At this point the NDX futures are up 5. If this holds or even if the index were to fall 12 points or so today the model is calling for a change of trend from Thursday. If we fall more than 12 points today then Thursday would open with oversold conditions if the index was unchanged from today's close. So that's the roadmap. Cover short positions today unless there is a huge selloff. Everything will depend on the economic data and Fed Beige Book published today.

Update: 10:47am

I did some NQ daytrading and am now holding the short positions with stops in around the day's highs. One theory is that the high today is the top of the B-Wave (in Elliott Wave Theory) of the correction that started on Friday. The big decline on Monday looks impulsive rather than a complete correction and the wave since then looks like an ABC formation. On the other hand, unless things reverse sharply here and the market ends down (which at the moment looks unlikely unless they totally hate the Fed Beige Book at 2pm) the model is saying to get long at today's close. So wait and see for the moment.

Update: 11:49am

The stops were hit while I was commuting and now I am flat. Though the market is off from the level of the stops (always annoying) I will remain flat till nearer 2pm. Have a meeting coming shortly for the next 1 hour or so. NDX could be making an ending diagonal formation intraday and if so it isn't complete.

Update: 2:34pm

Tha market doesn't hate the beige book, but so far it doesn't seem to like it either. I got long - waiting to see if that is the right stance.

Update: 8:29pm

In retrospect I would have been much better off without the stops.... I always have mixed feelings about stops. Sometimes I wish I had them and other times wish I didn't. I sold out of both long positions (QQQQ and NQ) by the end of the day. Will re-establish in the morning.

Wednesday, November 29, 2006

Tuesday Update

The market rebounded a little today. Friday remains the likely timing for a more substantial upswing. That is unless we get to oversold conditions (stochastic less than 20) before that. For that to happen we need to get another serious selloff in the next couple of days. The Aussie Dollar rallied against me. My futures position is partially hedging the underlying exposure to the AUD so actually my USD net worth rose still due to this rally in the AUD, but much less than it could have. The "autoregressive model" is now giving a more emphatic sell signal today for the Aussie. Bonds rose too, which is good for me. So all in all today was probably a wash. I did a couple of NDX daytrades the losing one lost a little less than the winning one made so I guess that is OK too :)

Tomorrow we get a bunch more macro news including preliminary GDP, new home sales and the Fed's Beige Book. Today existing home sales were up, but as expected there was a year on year price decline again.

Tomorrow we get a bunch more macro news including preliminary GDP, new home sales and the Fed's Beige Book. Today existing home sales were up, but as expected there was a year on year price decline again.

Tuesday, November 28, 2006

Trading Update

I've been short NDX for a while and losing money. In strongly overbought situations it is hard to use "the model". Each time it seems to show that the overbought situation is ending there has been a quick reversal back to overbought conditions. A nimble trader could have played these intraday "buy the dip" situations we have been having. Today's down move brings me to about breakeven on the month. The model is now clearly short. Expect more downside. Friday though could be the beginning of a new uptrend. It could get going on Thursday already. Overall though my portfolio is up about 2% so far this month and now beating the market. I fully expect to lose money in Australia in the next few days, though.

Monday, November 27, 2006

Forex Update

I've been successful so far trading the Aussie Dollar on the long side - making $US814 so far (this is just futures contracts not gains on my actual Australian investments due to the rise in the AUD) - and now I have switched to the short side. I was long one contract and am now short one contract. So I have gone from almost 100% in Australian Dollars portfolio wide to about 50/50 Aussies and Greenbacks. The reason is because my "autoregressive model" gave a sell signal on the Friday close. I don't know how far the down move will go. It seems reasonable that the sharp fall in the US Dollar last week will correct somewhat even if the USD is headed down further after that. And the Aussie does look relatively weak. I've also relabeled my posts about currency trading as "Forex" instead of "Trading" so that they will be easier to find.

P.S. Noon Monday

I sold another AUD contract, taking my AUD exposure down to 23% and USD up to 67% (the rest is in funds exposed to other currencies).

P.S. Noon Monday

I sold another AUD contract, taking my AUD exposure down to 23% and USD up to 67% (the rest is in funds exposed to other currencies).

Saturday, November 25, 2006

Thanksgiving Conversation

As many other bloggers mention, we often find ourselves having conversations about finances with people we don't usually talk to about finances at occasions like Thanksgiving. And it is always amazing what people don't know. We were talking about looking for other jobs and relocating and someone mentioned: "It's a pity that retirement accounts are set up in America so that it makes it difficult to move jobs". With a bit of prodding it sounds like the guy has a 403(b) defined contribution account with TIAA-CREF just like I do. I told him that it probably isn't a barrier to moving but he should check with his HR people if he is thinking of moving so he knows what to do. I said anyway he could roll it over into an IRA even if he couldn't keep the account or transfer it to his new employer and then he could just start a new account with his new employer. Our host (early 50s, actually with a PhD in economics) then said: "how do you know if you have a defined benefit or defined contribution?" I explained, looks like she has defined benefit with state government and that could be an impediment to moving. If you stay with the state more than 20 years they up the benefit level and she's only been 16 years. That's what she said anyway. Then everyone commented that they hate thinking about this stuff and dealing with money... I didn't investigate why.

The first guy though did know how much was in his 403(b), how much he contributed each month, and had shifted some of the money to more aggressive options in the previous year. The host had an FSA (something I don't do because I think it's too much hassle) and knew all these things came out pre-tax. We also discussed the percentages my employer and I put into my 403(b).

The first guy though did know how much was in his 403(b), how much he contributed each month, and had shifted some of the money to more aggressive options in the previous year. The host had an FSA (something I don't do because I think it's too much hassle) and knew all these things came out pre-tax. We also discussed the percentages my employer and I put into my 403(b).

Tuesday, November 21, 2006

Investment Decisions

I have made the three investment decisions I've been discussing recently:

1. I am investing $7000 in the Hussman Strategic Growth Fund in my Roth IRA.

2. After my discussion with one of the portfolio managers, and reading up on their funds and approach to investing, I have decided to make an initial investment of $5000 (the minimum) in the TFS Market Neutral Fund. Currently, this fund is the top performer in Morningstar's long-short category. The fund's track record is short but over this time it shows strong upward movement, but short-term movements tend to be against the market. This indicates the fund has a low beta and high alpha which are desirable for a market neutral fund. This chart shows the fund's performance relative to the S&P 500:

The fund was particularly strong during the mid-year market meltdown and has beaten the market for the last 12 months and year to date. Other factors that I like are that the managers invest in the fund and also manage hedge funds through the same firm and that they have a particularly interesting compensation structure on a new fund they have launched, which includes an incentive fee, but could result in them receiving no compensation for the year. This suggests they are very confident of beating the market of course. Finally, they focus on quantitative investment and trading strategies.

3. I will max out my 403(b) contributions to my TIAA-CREF account, starting on December 1st.

The reason behind these moves is I don't want to add money to my U.S. trading accounts until they breakeven. I also don't want to devote more money to short-term trading until I can prove I can make profits consistently.

The Hussman and TFS Funds essentially give you a hedge fund without high hedge fund fees, high minimum investments, high net worth requirements, or low liquidity. These and other such funds are well worth considering as an alternative to traditional long-only mutual funds. I already invest in two hedge fund vehicles in Australia - one a fund of funds, and one a closed end fund that is similar to these two funds.

The two new funds add to my existing core investments. These are intended to be investments that do not need adjustment over the stock or business cycle. Eventually, I'd like to have around 50% of net worth in investments of this type I think.

1. I am investing $7000 in the Hussman Strategic Growth Fund in my Roth IRA.

2. After my discussion with one of the portfolio managers, and reading up on their funds and approach to investing, I have decided to make an initial investment of $5000 (the minimum) in the TFS Market Neutral Fund. Currently, this fund is the top performer in Morningstar's long-short category. The fund's track record is short but over this time it shows strong upward movement, but short-term movements tend to be against the market. This indicates the fund has a low beta and high alpha which are desirable for a market neutral fund. This chart shows the fund's performance relative to the S&P 500:

The fund was particularly strong during the mid-year market meltdown and has beaten the market for the last 12 months and year to date. Other factors that I like are that the managers invest in the fund and also manage hedge funds through the same firm and that they have a particularly interesting compensation structure on a new fund they have launched, which includes an incentive fee, but could result in them receiving no compensation for the year. This suggests they are very confident of beating the market of course. Finally, they focus on quantitative investment and trading strategies.

3. I will max out my 403(b) contributions to my TIAA-CREF account, starting on December 1st.

The reason behind these moves is I don't want to add money to my U.S. trading accounts until they breakeven. I also don't want to devote more money to short-term trading until I can prove I can make profits consistently.

The Hussman and TFS Funds essentially give you a hedge fund without high hedge fund fees, high minimum investments, high net worth requirements, or low liquidity. These and other such funds are well worth considering as an alternative to traditional long-only mutual funds. I already invest in two hedge fund vehicles in Australia - one a fund of funds, and one a closed end fund that is similar to these two funds.

The two new funds add to my existing core investments. These are intended to be investments that do not need adjustment over the stock or business cycle. Eventually, I'd like to have around 50% of net worth in investments of this type I think.

Sunday, November 19, 2006

Benefits Fair

I went to my employer's annual benefits fair on Friday. The fair is on the first day of the open enrollment period that runs till December 1st. Like a trade convention/fair on two floors, with tables for all the vendors. Full of people talking with the vendors' representatives and eating the free snacks. The only one I was really interested in was the TIAA-CREF rep. I asked him about supplemental retirement accounts (we are required to contribute 1% of salary and receive an 8% employer contribution - to contribute more than 1% you need to apply for a supplementary account). He was out of forms and told me to go visit HR's office. Back at my own office I downloaded the form from HR's website. Turns out that you can start a supplemental account and change your contribution every month! No need to wait for "open enrollment". I still need to make a final decision on this, but now I know I can reverse this any time and stop making additional contributions it feels a bit easier. I figure that going from a 1% employee contribution to the maximum allowed contribution ($1250 per month) will reduce each half-monthly take home pay check by only $380. That's not too bad.

Tuesday, November 14, 2006

Letter from the Australian Tax Office

Today, I received a letter from the Australian Tax Office regarding my past holding of IYS. This investment sold by Deutsche Bank is in the process of being wound up, though I have already sold. The ATO has disallowed some deductions and other features of the scheme , which apparently it regarded as being too aggressive in reducing tax. So they want to know what I reported on my 2001-2 tax Australian tax return regarding this investment (I moved to the US in July 2002). Luckily, I have all my old tax returns here and the spreadsheets I used in preparing them, so it took hardly any time to dig out the information. Now I know why I save all this stuff :) After mid-2002 I reported all income, deductions, and capital gains and losses on this investment to the US IRS. I hope I don't owe too much tax if any in Australia for that year.

Sunday, November 12, 2006

Inheritance

Claire is blogging again about money from family. I'm the first commenter on this post.

After reading some of the other comments on Claire's post I think there are some things that I should or could add. Somebody mentioned telling their parents what to spend. I certainly don't do that, except as I said in the post to tell my mother she is rich and can and should spend more money. I only advise on choosing other financial advisers and then work with them to make decisions on investments. My father asked my advice too while he was alive but never gave me any clue about how much money there was in total.

In the posts there is a strong emphasis on the merits of being self-made and self-reliant. I agree that these are very desirable. If I have children (I'm 41 now, but my father was 48 when I was born :)) it is probably something I am going to have to think about regarding them too. I know of cases where people who inherited money young were demotivated. The good cases seem mostly to share the trait that the children worked in the family business alongside the parents and eventually took it over. In my case I had no idea there was as much money as there is till I was 37 years old when my father died. We grew up very much at the lower end of the middle class. My father came from a formerly wealthy family - the main thing we inherited though then was attitudes to investment, risk, debt etc. I sometimes say he was nouveau pauvre - the newly poor and the exact opposite of the nouveau riche - the newly rich. His mother died in 1970 and legal battles among family took up many years after that. What he inherited was art and antiques. His father's family were in the art/antique dealing business. What he received was mainly inventory from his father's business. His father died in 1922 when my father was just 5-6 years old.

Over time he sold most of it. The final sale in 1996 was the biggest. These art works realised far more than the valuation. He was shocked how much he received. At the time he just told me it was much more than the valuation.

The point of this story is that people don't want their parents to sacrifice to leave them money. I fully agree with this. Our case is different in that the core of the wealth was handed down from the previous generation (the little we have salvaged actually - maybe this makes us more upper class than middle class however ludicrous that notion is), though my father saved plenty during his life time too. I think my mother should spend the income on what she has inherited. But she's not.

After reading some of the other comments on Claire's post I think there are some things that I should or could add. Somebody mentioned telling their parents what to spend. I certainly don't do that, except as I said in the post to tell my mother she is rich and can and should spend more money. I only advise on choosing other financial advisers and then work with them to make decisions on investments. My father asked my advice too while he was alive but never gave me any clue about how much money there was in total.

In the posts there is a strong emphasis on the merits of being self-made and self-reliant. I agree that these are very desirable. If I have children (I'm 41 now, but my father was 48 when I was born :)) it is probably something I am going to have to think about regarding them too. I know of cases where people who inherited money young were demotivated. The good cases seem mostly to share the trait that the children worked in the family business alongside the parents and eventually took it over. In my case I had no idea there was as much money as there is till I was 37 years old when my father died. We grew up very much at the lower end of the middle class. My father came from a formerly wealthy family - the main thing we inherited though then was attitudes to investment, risk, debt etc. I sometimes say he was nouveau pauvre - the newly poor and the exact opposite of the nouveau riche - the newly rich. His mother died in 1970 and legal battles among family took up many years after that. What he inherited was art and antiques. His father's family were in the art/antique dealing business. What he received was mainly inventory from his father's business. His father died in 1922 when my father was just 5-6 years old.

Over time he sold most of it. The final sale in 1996 was the biggest. These art works realised far more than the valuation. He was shocked how much he received. At the time he just told me it was much more than the valuation.

The point of this story is that people don't want their parents to sacrifice to leave them money. I fully agree with this. Our case is different in that the core of the wealth was handed down from the previous generation (the little we have salvaged actually - maybe this makes us more upper class than middle class however ludicrous that notion is), though my father saved plenty during his life time too. I think my mother should spend the income on what she has inherited. But she's not.

A Pair Trade?

Pair trades are one of the strategies commonly used by hedge funds. The idea is to buy a stock that is expected to perform well and short another stock in the same industry which is expected to underperform. A similar idea is to buy a portfolio of stocks that the investor expects to perform well and short index futures or ETFs etc. to remove the general market risk from the portfolio. The latter is the Hussman Strategic Growth Fund's strategy in perceived poor market conditions. I have been thinking for a while of shorting an ETF that attempts to replicate the Dow Jones REITs index - IYR. Many REITs have very high P/E ratios and high price to book ratios. Even if there were no decline in the property market it seems possible that their share prices should correct towards more historical price earnings and price book ratios. The rapid rise of IYR's share price is rather scary though for shorts.

On Friday I was reading about the upcoming IPO of hedge fund manager Fortress Investment Group. I noticed that they manage one NYSE listed REIT - Newcastle. This REIT invests in mortgages rather than actual property - largely commercial mortages. Its dividend yield is very high, its P/E is low and management is buying shares. What I don't understand is how it is managing to significantly increase earnings and dividends when it pays out 90% plus of earnings. Of course it seems strange to buy shares in a REIT when I expect a downturn in the property market.... I also have shares in my 403(b) in the TIAA Real Estate Fund. It invests directly in property and the value of the fund is based directly on the appraised value of the properties it owns. The share price cannot deviate from the fund's book value.

A solution to my reluctance to short IYR and concern about how NCT could increase earnings is to buy NCT and short IYR. It seems to me that IYR is overvalued relative to NCT. I am thinking to buy just 100 shares of NCT initially (less than 1% of net worth), but to short 100 shares of IYR (a little more than 2% of net worth). The additional short exposure to IYR will be partially hedging my TIAA Real Estate and Hudson City Bank Corp investments. For a complete hedge I'd need to short around 200 shares of IYR.

I am gradually moving short-term trading from my Ameritrade account to my Interactive Brokers account due to the tax advantages of futures trading and cheaper commissions at IB. So I am gradually turning my Ameritrade account into an investment account. I want to keep $25k of equity in the account in order to allow me to daytrade if I want to. So I want to have around $50k in investments in this account eventually (50% margin ratio). So far I have a little less than $8k (BRK/B and HCBK).

On Friday I was reading about the upcoming IPO of hedge fund manager Fortress Investment Group. I noticed that they manage one NYSE listed REIT - Newcastle. This REIT invests in mortgages rather than actual property - largely commercial mortages. Its dividend yield is very high, its P/E is low and management is buying shares. What I don't understand is how it is managing to significantly increase earnings and dividends when it pays out 90% plus of earnings. Of course it seems strange to buy shares in a REIT when I expect a downturn in the property market.... I also have shares in my 403(b) in the TIAA Real Estate Fund. It invests directly in property and the value of the fund is based directly on the appraised value of the properties it owns. The share price cannot deviate from the fund's book value.

A solution to my reluctance to short IYR and concern about how NCT could increase earnings is to buy NCT and short IYR. It seems to me that IYR is overvalued relative to NCT. I am thinking to buy just 100 shares of NCT initially (less than 1% of net worth), but to short 100 shares of IYR (a little more than 2% of net worth). The additional short exposure to IYR will be partially hedging my TIAA Real Estate and Hudson City Bank Corp investments. For a complete hedge I'd need to short around 200 shares of IYR.

I am gradually moving short-term trading from my Ameritrade account to my Interactive Brokers account due to the tax advantages of futures trading and cheaper commissions at IB. So I am gradually turning my Ameritrade account into an investment account. I want to keep $25k of equity in the account in order to allow me to daytrade if I want to. So I want to have around $50k in investments in this account eventually (50% margin ratio). So far I have a little less than $8k (BRK/B and HCBK).

Saturday, November 11, 2006

Currency Hedging and Exposure: Part III

Finally, I get to actual practical hedging strategies. But, first, I'll explain something about forex futures contracts. These are the contract sizes of the smallest futures contracts available in a few different currencies:

Euro E-Mini E62,500

Australian Dollars $A100,000

Yen E-Mini Y6.25 million

$A100k is the minimum trade size. You can't trade only $A50k, for example.

To gain exposure to $A100,000, for example, you put down a margin of $US1000 and the value of your deposit then varies based on the underlying contract value. So if the Australian Dollar rises by 1 US cent your deposit becomes $US2000. If it moves the other way you have zero and must put up more margin (you actually need to do this as soon as the margin deposit falls below $US1000) or sell the contract. You can also short sell a contract to get negative exposure to the same amount. Short selling a contract means creating a new contract - the same as short-selling an option. But unlike selling an option you don't receive money up front for the contract - money flows into your account only if the value of the underlying asset falls. All these contracts are relative to the US Dollar. Shorting a contract converts an exposure to that currency into a USD exposure.

My net worth is $US350,000.$US87,000 or 25% is in US accounts - My 403(b) ($33k), Roth IRA ($8k), Ameritrade trading account ($26k), Interactive Brokers account ($10k), HSBC Online Savings Account ($9k), Checking Account etc. My Australian accounts have $US267k or $A349k.

Therefore, if I buy 1 AUD contract I convert $US77k of my USD exposure into Australian Dollars. I now have only $US10k of exposure to the US Dollar left. If I want to eliminate my Australian Dollar exposure I could short-sell 3 to 4 AUD contracts. Short selling 3 leaves me with $A49k exposure to the AUD. If I short-sell 4 contracts then my net US Dollar exposure is $US395k (4*77k+87k) and a net negative Australian Dollar exposure.

The preceding paragraph is one possible hedging strategy. If I am bullish on the USD I would short 3 AUD contracts and if I am bullish on the AUD I would buy one AUD contract. This will swing my exposure from almost all US Dollars to almost all Australian Dollars.

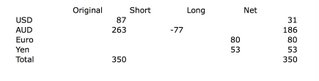

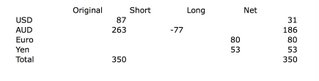

But, as I discussed in my previous post, that isn't a very diversified approach. To get a diversified currency exposure I could short sell 2 AUD contracts and buy 1 Euro and 2 Yen contracts. The resulting exposure is (here I resort to a spreadsheet!):

The net USD exposure is reduced because I converted $US154k of Australian Dollars into US Dollars but then bought $US186k of Euro and Yen. This results in an effective USD loan of $US32k (you don't actually borrow the money it is implicit in the contracts you are entering into). Borrowing money in a currency is just like shorting that currency. Because, my account is still relatively small, I can't avoid the lumpiness of the resulting exposure. Here is another example portfolio which is more bullish on the AUD (but still ends up shorting it!):

I short one AUD contract and buy 1 Yen and 1 Euro. It's possible to get net short in some of the currencies, but I think that is speculating rather than hedging and diversifying and not something I want to do. At least at the moment.

Right now I am long one AUD contract. My USD exposure is, therefore, 3% and my AUD exposure 97%. This hyperbullish stance on the Aussie probably doesn't make a lot of sense.

Euro E-Mini E62,500

Australian Dollars $A100,000

Yen E-Mini Y6.25 million

$A100k is the minimum trade size. You can't trade only $A50k, for example.

To gain exposure to $A100,000, for example, you put down a margin of $US1000 and the value of your deposit then varies based on the underlying contract value. So if the Australian Dollar rises by 1 US cent your deposit becomes $US2000. If it moves the other way you have zero and must put up more margin (you actually need to do this as soon as the margin deposit falls below $US1000) or sell the contract. You can also short sell a contract to get negative exposure to the same amount. Short selling a contract means creating a new contract - the same as short-selling an option. But unlike selling an option you don't receive money up front for the contract - money flows into your account only if the value of the underlying asset falls. All these contracts are relative to the US Dollar. Shorting a contract converts an exposure to that currency into a USD exposure.

My net worth is $US350,000.$US87,000 or 25% is in US accounts - My 403(b) ($33k), Roth IRA ($8k), Ameritrade trading account ($26k), Interactive Brokers account ($10k), HSBC Online Savings Account ($9k), Checking Account etc. My Australian accounts have $US267k or $A349k.

Therefore, if I buy 1 AUD contract I convert $US77k of my USD exposure into Australian Dollars. I now have only $US10k of exposure to the US Dollar left. If I want to eliminate my Australian Dollar exposure I could short-sell 3 to 4 AUD contracts. Short selling 3 leaves me with $A49k exposure to the AUD. If I short-sell 4 contracts then my net US Dollar exposure is $US395k (4*77k+87k) and a net negative Australian Dollar exposure.

The preceding paragraph is one possible hedging strategy. If I am bullish on the USD I would short 3 AUD contracts and if I am bullish on the AUD I would buy one AUD contract. This will swing my exposure from almost all US Dollars to almost all Australian Dollars.

But, as I discussed in my previous post, that isn't a very diversified approach. To get a diversified currency exposure I could short sell 2 AUD contracts and buy 1 Euro and 2 Yen contracts. The resulting exposure is (here I resort to a spreadsheet!):

The net USD exposure is reduced because I converted $US154k of Australian Dollars into US Dollars but then bought $US186k of Euro and Yen. This results in an effective USD loan of $US32k (you don't actually borrow the money it is implicit in the contracts you are entering into). Borrowing money in a currency is just like shorting that currency. Because, my account is still relatively small, I can't avoid the lumpiness of the resulting exposure. Here is another example portfolio which is more bullish on the AUD (but still ends up shorting it!):

I short one AUD contract and buy 1 Yen and 1 Euro. It's possible to get net short in some of the currencies, but I think that is speculating rather than hedging and diversifying and not something I want to do. At least at the moment.

Right now I am long one AUD contract. My USD exposure is, therefore, 3% and my AUD exposure 97%. This hyperbullish stance on the Aussie probably doesn't make a lot of sense.

Friday, November 10, 2006

Currency Exposure and Hedging: Part II

Diversifcation makes sense in currency trading in the same way it makes sense in stock trading and investing. For example, in the last couple of days I thought the US Dollar would fall. Turned out I was right but the Australian Dollar also turned out to be weak. So just buying Australian Dollars did not turn out to be the way to profit from the move in the USD. In retrospect the Euro would have been the best choice. One couldn't have known that upfront but being diversified away from the US Dollar - holding say AUD, Euro, and Yen would have been a better strategy than just buying the Aussie. Don't put all your eggs in one basket.

Currency Exposure and Hedging: Part I

Most investors don't think about currency exposure and leave their portfolio in the currency of their home country. When they invest in foreign assets they may consider their currency exposure and either try to take advantage of changes in the value of the foreign currency relative to their own currency or hedge it away. For small investors this usually means buying a fund that hedges the foreign currency exposure back into the domestic currency. But currency exposure is a choice even if it is a default choice. If you don't do anything about it you do not have a neutral exposure but probably a big exposure to your home currency. Now, if you are for example a US investor it may make sense to have a portfolio denominated in US Dollars as when you get to actually spend some of the money you will be spending in US Dollars if you are still living in the United States. Diversifying runs the risk that if the US Dollar gains value against foreign currencies over time your portfolio will lose value in US Dollar terms. But if the US Dollar loses relative value over time diversifying would result in gains.

For an international investor like myself with 75% of my net worth in Australian accounts and 25% in US accounts, who isn't sure what country he or she will be living in in the future, currency strategy becomes much more important. From a low in 2001 of less than 50 U.S. Cents the Aussie rose to around 80 cents in 2004-5 and is now trading around 77 U.S. Cents. As most of my assets were still in Australia when I moved to the US in 2002 I gained tremendously from the rise in the Australian currency. Since moving to the US I have sent considerable savings back to Australia when the AUD was at a level that I perceived as attractive.

I don't know if the Aussie Dollar will keep rising. It is no longer undervalued like it was at the beginning of the decade and 80 U.S. Cents has provided resistance during the last decade. On the other hand, I don't see any compelling reasons to cause it to fall. So now we are in more of a trading environment.

As my net worth has grown the absolute dollar value of changes in the exchange rate have of course increased. My Australian Dollar exposure is $A341k. Therefore, a 1 cent move up or down in the Aussie changes my net worth in USD terms by $US3410. That's very nice when the Aussie is rising but not good news when it is falling. The changes in my net worth measured in Australian Dollars are much less of course.

I'll discuss different hedging strategies in upcoming posts.

For an international investor like myself with 75% of my net worth in Australian accounts and 25% in US accounts, who isn't sure what country he or she will be living in in the future, currency strategy becomes much more important. From a low in 2001 of less than 50 U.S. Cents the Aussie rose to around 80 cents in 2004-5 and is now trading around 77 U.S. Cents. As most of my assets were still in Australia when I moved to the US in 2002 I gained tremendously from the rise in the Australian currency. Since moving to the US I have sent considerable savings back to Australia when the AUD was at a level that I perceived as attractive.

I don't know if the Aussie Dollar will keep rising. It is no longer undervalued like it was at the beginning of the decade and 80 U.S. Cents has provided resistance during the last decade. On the other hand, I don't see any compelling reasons to cause it to fall. So now we are in more of a trading environment.

As my net worth has grown the absolute dollar value of changes in the exchange rate have of course increased. My Australian Dollar exposure is $A341k. Therefore, a 1 cent move up or down in the Aussie changes my net worth in USD terms by $US3410. That's very nice when the Aussie is rising but not good news when it is falling. The changes in my net worth measured in Australian Dollars are much less of course.

I'll discuss different hedging strategies in upcoming posts.

Thursday, November 09, 2006

Hussman Strategic Growth Fund

I am considering investing in the Hussman Strategic Growth Fund. This is effectively a long-short equity hedge fund in mutual fund format and without the hedge fund fees. As the chart shows the fund performed excellently in the last bear market from 2000 to 2002. It hasn't performed so well recently due to using hedging due to the view that stocks are overvalued and the market shows little momentum. It's annual return since inception in 2000 is 12.71%. In the last 5 years my return has been 12.68% p.a. while the MSCI World Index has returned 10.30% and the S&P 500 5.71%. For the 5 years ending June 30 the HSGFX returned 11.55% vs. 2.49% for the S&P 500, while I returned 9.74% and the MSCI returned 6.92%.

The reason why I am now considering this fund, is that since opening a futures account I can separate the country I am investing in from the currency I am investing in. Up till now I have transferred most of my after tax savings to Australia, buying Australian Dollars in the process. Now I can in theory invest in the US and buy Australian Dollar futures if I want to be exposed to that currency.

Looks like the fund is available via Ameritrade though they don't list "Hussman" as a fund family. But they want a $49.99 fee to buy a mutual fund! This might just about make sense for my Roth IRA account if I am buying say a $7000 chunk, but otherwise it would make sense to apply to the fund directly and avoid the fee. Any thoughts?

Wednesday, November 08, 2006

Reinstating My Previous Goal for the Year

Seems I was too hasty in lowering my goal for the year to $350,000 from $370,000. I have passed a net worth of $US350k and $A450k. So I am reinstating the old goal and seeing how close I can get. Finally I am on the right side of the stock market and the Aussie Dollar has been performing very nicely too. If I was more confident I would have benefited even more from the latter. Made three quick trades so far on the Aussie, all profitable.

Tuesday, November 07, 2006

The 24 Hour Forex Market

The chart shows the last day's trading in Globex Australian Dollar Futures. I sold my position on Sunday evening when the market seemed like it might be beginning to trade down. It's good that I did because around 2am EST the price collapsed and my stop would have been hit. Just before 5am though the market began to rally. Note that these times are 7am and 10am in London, the world's biggest foreign exchange market. Currently the price is above my sale price...

This shows why this market is best for either hedging or a very small level of speculation for overnight trades, or for daytrading, though often the big moves are happening in the middle of the night for US traders. Globex futures allow 80:1 leverage in Australian Dollars and some spot currency brokers allow larger levels still. This is where naive traders can quickly lose large amounts of money by being tempted to leverage too large positions on a seemingly small margin deposit. I'm definitely going to continue to step very gingerly in this market.

Monday, November 06, 2006

Powertel

I bought into this Aussie telecom firm where the green arrow is on the chart. This was based on a tip from a Hong Kong based investor I know online and the research from investment banks he sent to me. My purchase price was $A1.20. It's been pretty volatile since I bought, but as I write it is now at $A1.35. Is it finally breaking out of the multiyear triangle I outlined on the chart? It recently declared its first ever profit (as predicted in the research) and then signed a wholesale access agreement on Friday with Telecom NZ's AAPT subsidiary. AAPT was my second individual shareholding, which I bought at the IPO in November 1997 (the first was Colonial - also an IPO buy). AAPT was acquired by Telecom NZ yielding me an eventual $A8600 in profit. I still hold Telecom NZ and it has yielded me an additional net $A100 in profit in the last six years! Sounds terrible, but on second thoughts that's about what the S&P 500 has made including dividends in the same time frame.

Closed My First Australian Dollar Futures Trade

Made $US64.30. Got in @ 0.7683 and out @ 0.7690. Each 0.0001 is worth $US10 on a single contract trade. Hopefully this won't follow the pattern of the NASDAQ 100 futures (NQ) where my first trade made money and the second trade was a losing trade. I entered this trade Friday after the steep rise in the US Dollar and fall in the Australian Dollar after the unemployment report came out on Friday morning. I did some technical analysis over the weekend, which showed that there was a significant chance that we were now in at least a short term downtrend. So I got out this evening with a small profit. I had a stop in anyway but if the chances seem stronger that the pullback will continue why take the risk of ending up losing money? But I don't feel certain enough about that to short the Aussie and right now have too little equity in my account to do both that and buy an NQ contract. I put some more money in my account but it is on hold till Wednesday :( I bought one NQ contract @ 1714 as the model is long. The model is predicting the Republicans will retain control of congress or if the Democrats gain control Bush will veto any moves they make to raise taxes on stocks. That has to be the implication of expecting the market to rise through the end of the coming week?

Friday, November 03, 2006

Want to Be a Millionaire? Pick Your Currency :)

I forgot to mention this, but October saw me exceed 1/3 million Dollars for the first time. US Dollars that is. I reached 1/3 million Australian Dollars in July 2005. In many currencies I am already a millionaire. All you need to do is pick your currency and you too can be a millionaire. The Pacific Exchange Rate Service Website has lots of nice resources about exchange rates that I often refer to. Most recently I became a Zloty (Polish) millionaire :) Everyone with positive net worth can be an Indonesian or Vietnamese millionaire...

Thursday, November 02, 2006

Closed my First Futures Trade and Opened Another

I closed my first futures trade (short NQ (NASDAQ 100 E-Mini)) and went long (and long QQQQ and QQQQ calls too). Made 10 points on that first trade ($200 - $4.80 in commissions) which is nice. Yes the model is forecasting tomorrow as an upday...

October Report

Investment Performance

Investment return in US Dollars was 2.70% vs. a 3.27% gain in the MSCI World Index, which I use as my overall benchmark and a 4.74% gain in the NDX which I use as a trading benchmark. The trading accounts lost 14.3% - a disastrous performance. Total returns in terms of Australian Dollars was a loss of 0.31%. The best performer of the month was the CFS Conservative Fund, my biggest single investment and the worst performer was QQQQ trading.

Asset Allocation

At the end of the month the portfolio had a beta of -0.14 (a 1% rise in the market would result in a 0.14% decline in the portfolio). Assets were allocated as follows:

Asset Class:

Stocks Long 41.58%

Stocks Short -18.67% (QQQQ)

Futures 0.00% (NQ)

Put Options 0.29% (QQQQ)

Bonds 46.02%

Real Estate 4.92%

Hedge Funds 2.62%

Cash 31.49%

Loans -8.44%

Asset Loans 0.18%

Much of the cash is used as margin for the short position. Bonds are held via the CREF Bond Market Fund and the CFS Conservative Fund. 65% of net assets are deemed to be AUD related and 24% USD related with the remainder in global funds.

Net Worth Performance

Net worth rose by $US12,003 to $US342,135 but in Australian Dollars lost $A614 to $A441920. This is the reverse of last month's pattern as the Australian Dollar rose strongly this month.

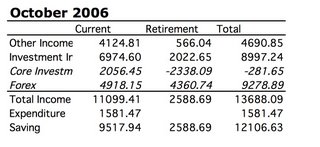

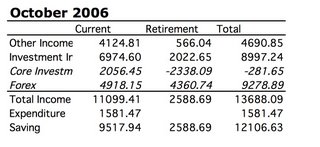

Income and Expenditure

Core investment income is total investment gains before taking into account the change in exchange rates. Other income is salary and retirement contributions.

As you can see total investment income was -$US282 before taking into account foreign currency fluctuations which resulted in a net investment gain of $US8997. But retirement accounts suffered a loss of $US2338 before taking into account the change in the exchange rate. This is due to the disastrous loss I suffered in QQQQ trading in my Roth IRA. Expenditure was $US1581 - this is about my base level of spending if I don't travel anywhere or make large purchases.

Investment return in US Dollars was 2.70% vs. a 3.27% gain in the MSCI World Index, which I use as my overall benchmark and a 4.74% gain in the NDX which I use as a trading benchmark. The trading accounts lost 14.3% - a disastrous performance. Total returns in terms of Australian Dollars was a loss of 0.31%. The best performer of the month was the CFS Conservative Fund, my biggest single investment and the worst performer was QQQQ trading.

Asset Allocation

At the end of the month the portfolio had a beta of -0.14 (a 1% rise in the market would result in a 0.14% decline in the portfolio). Assets were allocated as follows:

Asset Class:

Stocks Long 41.58%

Stocks Short -18.67% (QQQQ)

Futures 0.00% (NQ)

Put Options 0.29% (QQQQ)

Bonds 46.02%

Real Estate 4.92%

Hedge Funds 2.62%

Cash 31.49%

Loans -8.44%

Asset Loans 0.18%

Much of the cash is used as margin for the short position. Bonds are held via the CREF Bond Market Fund and the CFS Conservative Fund. 65% of net assets are deemed to be AUD related and 24% USD related with the remainder in global funds.

Net Worth Performance

Net worth rose by $US12,003 to $US342,135 but in Australian Dollars lost $A614 to $A441920. This is the reverse of last month's pattern as the Australian Dollar rose strongly this month.

Income and Expenditure

Core investment income is total investment gains before taking into account the change in exchange rates. Other income is salary and retirement contributions.

As you can see total investment income was -$US282 before taking into account foreign currency fluctuations which resulted in a net investment gain of $US8997. But retirement accounts suffered a loss of $US2338 before taking into account the change in the exchange rate. This is due to the disastrous loss I suffered in QQQQ trading in my Roth IRA. Expenditure was $US1581 - this is about my base level of spending if I don't travel anywhere or make large purchases.

Subscribe to:

Posts (Atom)