9:33am

I won't post hour by hour detail today. Have a big meeting from 12-2 anyway. Market is showing early strength. For the moment I will hold my positions until I am clear a bottom has been reached and then reverse course to the long side. Will report positions at the end of the day. Right now I am short 50 GOOG, 500 QQQQ, and 100 AAPL as at the close yesterday.

4:03pm

A mixed day - not much to report - ended down $50 overall in my Ameritrade accounts and with more short positions than I started. So the new plan still isn't implemented but my trading positions are not bigger than my risk management allows: 1000 QQQQ, 50 GOOG, 100 HANS, 100 AAPL all short (and 4 QQQQ puts and 150 GLD long in my Roth account). The GOOG and HANS positions are in the 5-6% of net worth range. QQQQ positions can be much bigger as this is a market index. My current position is conservative.

Tuesday, June 20, 2006

Monday, June 19, 2006

Trading Diary

Today I am trying to exit from my previous strategy and initiate the new one.

9:54am

I went into today short 100 GOOG and 500 QQQQ in my trading account (I also have 1 BRKB in this account. I added 500 QQQQ and 100 HANS to the short position in pre-market or the first few minutes of trade. Let's see how it goes. Barrons had a negative article on GOOG (as did the Economist) over the weekend. In Friday trading GOOG's share price got pinned down to the $390 strike at the option expiration. Maybe it can fall a little now that the options expiry is over. I see the market as a whole as needing to consolidate a little after last week's rally. HANS is very volatile and so sometimes is good for daytrading though often spreads are big and often it can't be shorted and because of the relatively low liquidity spikes in either direction can easily appear from nowhere. So not the ideal daytrading stock. But I don't have any other real ideas.

I have the market running on my laptop while working on other stuff on my desktop. Using the F9 key on my Mac I can get all the windows to be visible nicely spreadout across the screen and monitor various stocks for anything unusual out of the corner of my eye....

10:10am

Perfect reason not to trade individual stocks in large amounts - $5 spike up in GOOG came out of nowhere in 5 minutes. $2 of the spike happened in 1 minute. As I write the stock is falling back. No news out, nothing. I don't need this kind of stress. If I had half the number of shares I wouldn't worry.

10:23am

GOOG's back in the red for the day LOL

12:53pm

I am tracking the SP500 index. Tech stocks are showing relative strength today and it is hard to tell which way the market will go by just looking at the NASDAQ indices alone. The SP500 index though is much easier to read and if it goes down it is hardly likely the NASDAQ will go up. Looking at correlations across multiple indices and securities is one of the ways I try to work out what will happen next. Most individual traders and market commentators seem only able to focus on one thing in isolation.

1:40pm

With AAPL showing relative strength today and everything else near or at session lows. I add 100 AAPL to the bundle of shorts. Maybe this is getting too clever for my own good. But I figure the downside can't be too bad. Now I am using my full daytrade buying power.

2:47pm

With indices at session lows I bought to cover half my QQQQ and GOOG positions. The remaining positions are around 6% of net worth each and so much closer to my comfort zone. I am also well within the overnight margin requirements. So from now on if the market goes down more good, if it goes up a bit no big deal.

3:31pm

I covered the HANS position for about $500 profit. Actually I accidentally pressed the button :) I had the order set up and was looking for the price to fall back a bit and then accidentally leant on my laptop.... anyway the probability of more gain is too low now to make reshorting it worthwhile.

7:24pm

Well it was a good trading day, but we will need to wait till tomorrow to complete the transition plan. But at least I no longer have an outsized position in an individual stock.

9:54am

I went into today short 100 GOOG and 500 QQQQ in my trading account (I also have 1 BRKB in this account. I added 500 QQQQ and 100 HANS to the short position in pre-market or the first few minutes of trade. Let's see how it goes. Barrons had a negative article on GOOG (as did the Economist) over the weekend. In Friday trading GOOG's share price got pinned down to the $390 strike at the option expiration. Maybe it can fall a little now that the options expiry is over. I see the market as a whole as needing to consolidate a little after last week's rally. HANS is very volatile and so sometimes is good for daytrading though often spreads are big and often it can't be shorted and because of the relatively low liquidity spikes in either direction can easily appear from nowhere. So not the ideal daytrading stock. But I don't have any other real ideas.

I have the market running on my laptop while working on other stuff on my desktop. Using the F9 key on my Mac I can get all the windows to be visible nicely spreadout across the screen and monitor various stocks for anything unusual out of the corner of my eye....

10:10am

Perfect reason not to trade individual stocks in large amounts - $5 spike up in GOOG came out of nowhere in 5 minutes. $2 of the spike happened in 1 minute. As I write the stock is falling back. No news out, nothing. I don't need this kind of stress. If I had half the number of shares I wouldn't worry.

10:23am

GOOG's back in the red for the day LOL

12:53pm

I am tracking the SP500 index. Tech stocks are showing relative strength today and it is hard to tell which way the market will go by just looking at the NASDAQ indices alone. The SP500 index though is much easier to read and if it goes down it is hardly likely the NASDAQ will go up. Looking at correlations across multiple indices and securities is one of the ways I try to work out what will happen next. Most individual traders and market commentators seem only able to focus on one thing in isolation.

1:40pm

With AAPL showing relative strength today and everything else near or at session lows. I add 100 AAPL to the bundle of shorts. Maybe this is getting too clever for my own good. But I figure the downside can't be too bad. Now I am using my full daytrade buying power.

2:47pm

With indices at session lows I bought to cover half my QQQQ and GOOG positions. The remaining positions are around 6% of net worth each and so much closer to my comfort zone. I am also well within the overnight margin requirements. So from now on if the market goes down more good, if it goes up a bit no big deal.

3:31pm

I covered the HANS position for about $500 profit. Actually I accidentally pressed the button :) I had the order set up and was looking for the price to fall back a bit and then accidentally leant on my laptop.... anyway the probability of more gain is too low now to make reshorting it worthwhile.

7:24pm

Well it was a good trading day, but we will need to wait till tomorrow to complete the transition plan. But at least I no longer have an outsized position in an individual stock.

Sunday, June 18, 2006

Mid-Month Update

As of 16 June net worth has declined to $304k (down $14k) with an investment return for June so far of -4.56%. The MSCI global index (in USD terms and including dividends on a pre-tax basis) is down -3.41% for the month so far. So I am lagging the index. YTD my return is only 3.20% against the MSCI at 2.80%.

Saturday, June 17, 2006

New Short-Term Trading Plan

After my experiences over the last couple of months I have developed a new trading plan to try to implement a bit more discipline. This doesn't cover very long-term trades using mutual funds and changing currency exposure.

1. Only do short-term trades in my US accounts. This gives me a break rather than thinking I need to trade in both the US and Australia. Australia is only for long-term investment and long-term trades. The rationale is that it is more expensive and difficult to trade in Australia in every way (executing trades and getting real time information) and the market is less liquid.

2. Set up a position trade (i.e. for period of week, weeks, months) using options on QQQQ based on my own market timing model, E-Wave, and other technical analysis of daily and weekly data. The rationale for this is that options give some up and downside protection in the event of an unexpected market move (and stops won't really help outside the regular market day) and that option spreads (difference between bid and ask prices) are wider than individual stock spreads so that daytrading options can be difficult.

3. Set up a few position trades of small size in individual stocks. These should be less than 5% of net worth and probably smaller.

4. Do day and multi-day trades using stock in QQQQ and individual firms where appropriate. Use stops on these trades to weed out the losing trades fast. I don't have to day trade as I will have a position trade in place. Hopefully in a situation like yesterday I would have shorted the stock but kept a call options position. This would have mitigated the damage. Even better would have been not to go short at all till the end of the day :)

1. Only do short-term trades in my US accounts. This gives me a break rather than thinking I need to trade in both the US and Australia. Australia is only for long-term investment and long-term trades. The rationale is that it is more expensive and difficult to trade in Australia in every way (executing trades and getting real time information) and the market is less liquid.

2. Set up a position trade (i.e. for period of week, weeks, months) using options on QQQQ based on my own market timing model, E-Wave, and other technical analysis of daily and weekly data. The rationale for this is that options give some up and downside protection in the event of an unexpected market move (and stops won't really help outside the regular market day) and that option spreads (difference between bid and ask prices) are wider than individual stock spreads so that daytrading options can be difficult.

3. Set up a few position trades of small size in individual stocks. These should be less than 5% of net worth and probably smaller.

4. Do day and multi-day trades using stock in QQQQ and individual firms where appropriate. Use stops on these trades to weed out the losing trades fast. I don't have to day trade as I will have a position trade in place. Hopefully in a situation like yesterday I would have shorted the stock but kept a call options position. This would have mitigated the damage. Even better would have been not to go short at all till the end of the day :)

Comfortable Being Bearish

Went into today with my Ameritrade account short and added to the shorts and bought puts in my Roth IRA. So far it is working out. And I feel much more comfortable being bearish than trying to be bullish. It suits me much better :)

Friday, June 16, 2006

Trading and Emotions

I am now at the point where I know good money-making trades but the problem is actually executing them. Seems that all the recent volatility in the market has shaken me up and I am making bad decisions. Starting today I had good positions and ideas for good trades. I executed those trades and then midday reversed course and blew up most of the profits I had made. Don't really know why I did it. I guess there is the fear of losing the profits I had made. But why go short? Anyway the market kept rising through the day and I ended up giving back most of my profits by the end of the day. My trading account and Roth IRA ended up about $500 on the day but it could have been at least $2000 if I had played things right. Only consolation is that this is only 10% of my money. Another 10% is in my 403(b) and 80% in Australia in retirement and non-retirement accounts which I am not actively short-term trading.

Sunday, June 11, 2006

Net Worth Update

After last week's "trauma" I did a thorough update of the results so far this month. Investment return is -2.67% but the MSCI World gross index is down 2.82%. So still beating the benchmark :P I guess reversion to mean. Lot of luck in this business. I just hope that each debacle I suffer in the markets makes me a better investor and trader. The data so far say yes. But it is a very slow process. I updated my net worth profile and it is down almost $8000 or 2.5%.

Friday, June 09, 2006

Stressful Trading Day

Today is a day when everything went wrong. Here are just some of the things

1. I went into the day long even though I didn't really have any good case for it and vaguely thought I already should have sold.

2. I didn't manage to sleep last night. Not good for cool headed decisions.

3. I still didn't sell when the futures showed the market would open down or whent he market started falling - I was like a deer in the headlights.

4. Cramer said to sell HANS the night before.

5. I finally sold half my position after QQQQ had bounced 20 cents above the bottom. That was enough for me to stop panicking.

6. The market then rallied to end the day not far from where it started. I had to be in a meeting for part of that, but don't think I would have added to my position anyway at this stage.

The realised loss after tax is about 1/2 % of net worth. So in the big scheme of things not really such a big deal I guess. B ut I was feeling very scared while it was happening.

One of my problems is that when my trading starts going well I get cocky and arrogant and start breaking my rules. Then I blow up. Mostly I am upset at the time I wasted making those profits in the first place and why I was so dumb.

To make money trading you need emotions, but too much fear and panic will end up losing you money.

One good move: I sold my TLT call options just when bond prices were at the peak of the day.

1. I went into the day long even though I didn't really have any good case for it and vaguely thought I already should have sold.

2. I didn't manage to sleep last night. Not good for cool headed decisions.

3. I still didn't sell when the futures showed the market would open down or whent he market started falling - I was like a deer in the headlights.

4. Cramer said to sell HANS the night before.

5. I finally sold half my position after QQQQ had bounced 20 cents above the bottom. That was enough for me to stop panicking.

6. The market then rallied to end the day not far from where it started. I had to be in a meeting for part of that, but don't think I would have added to my position anyway at this stage.

The realised loss after tax is about 1/2 % of net worth. So in the big scheme of things not really such a big deal I guess. B ut I was feeling very scared while it was happening.

One of my problems is that when my trading starts going well I get cocky and arrogant and start breaking my rules. Then I blow up. Mostly I am upset at the time I wasted making those profits in the first place and why I was so dumb.

To make money trading you need emotions, but too much fear and panic will end up losing you money.

One good move: I sold my TLT call options just when bond prices were at the peak of the day.

Wednesday, June 07, 2006

Today's Report

I think there is still more downward movement coming in the stockmarkets in the next week or two, but today I sold most of my put options (kept Starbucks as it didn't seem worth trying to trade it) and covered my short positions and went long (QQQQ and HANS) for this bounce. The bounce might end tomorrow already but hard to tell at this point of course. I now have a small margin loan in my US account.

Tuesday, June 06, 2006

Net Worth in Australia

An interesting article about net worth levels in Australia. In the US median net worth is around $US93000. Recently I read in the New York Times that US mean net worth was just above $US400k. The mean net worth in Aus according to this article is similar ($US351k), while the median is more than twice as much ($US225k). However, the Australian study includes the value of cars and household contents in net worth which the US data does not - a comparable median figure is probably around $US175k. Official statistics typically place Australia with income per capita of around 80% US levels and around the same level of inequality in terms of income. These data indicate less inequality of wealth in Australia than in the US. I have seen median net worth statistics for Sweden and the UK which were much lower than the US median. Is the typical Australian the wealthiest citizen in the World? A comprehensive international comparison would be very interesting.

Sunday, June 04, 2006

Kondratieff Waves and Deflation

Michael Alexander has begun a new series of articles on SafeHaven. His analysis can look a little weird to mainstream economists like me but reading his articles in the past was the first time I really began to understand the Kondratieff Cycle. Of course I was familiar with this long cycle of more than 50 years in economic activity, but none of the previous discussions I had read seemed to be particularly well-informed and it was rather confusing to me. If the theory is valid then the current cycle is longer than previous ones. We are currently supposedly in the deflationary depression part of the cycle in the US - though Japan went through that in the previous decade. Yes, both Alexander and Mike Shedlock think that deflation, not inflation is the threat. I think they are probably right. My big bet on bonds in my portfolio (and my Mom's) wouldn't make sense if I thought we were facing inflation. In inflation interest rates rise and bond values fall. This is what happened from 1966 to 1982 in the US. Since then the reverse has been happening. We believe that the disinflationary cycle is not yet complete. Both these commentators have been marshalling the evidence in favor of this thesis. Everything I see reinforces the suspicion I already had that this is what will happen. Of course this is a hyper-contrarian belief. Most so-called contrarians believe that inflation is greater than government agencies state and that it will rise further. Wall Street orthdoxy is that the economy is strong, the Fed will stop both inflation and deflation etc. Actually, I don't think we will see any significant deflation in the prices of goods or services but little inflation either.

BTW, I finally got the second part of my Federal Tax Refund in my HSBC Online Savings Account. I now have over $11k piled up there exactly balancing my credit card debt. In July I will pay off all those debts before the zero percent offers terminate. I may get balance transfers in the future but will use a lower balance ratio so as not to affect my credit score.

BTW, I finally got the second part of my Federal Tax Refund in my HSBC Online Savings Account. I now have over $11k piled up there exactly balancing my credit card debt. In July I will pay off all those debts before the zero percent offers terminate. I may get balance transfers in the future but will use a lower balance ratio so as not to affect my credit score.

Saturday, June 03, 2006

Levels of Frugality and Wealth Creation

There is a lot of personal finance advice out there on the web and a lot of it is quite good, but of course little or none of it is tailored for people's specific financial situations. The things that are going to be important to focus on are going to change not only with people's life stages but also with their wealth and income relative to expenses. I've seen quite a few discussions in the blogosphere about whether paying attention to the latte factor makes a difference or whether PF bloggers are saving too much for retirement. And then there are people with negative net worth giving advice to supposed multimillionaires.

So here are some random thoughts:

1. If you are a student or on a low income the key is not to get into a level of debt which will be hard to stablize or pay down once you start working or get into a higher income job. Being very frugal is going to help. But it doesn't make sense to make undue sacrifices if you know your future income is likely to be much higher. My Dad told me I should be saving when I was a grad student rather than borrowing. I ignored his advice, to my mind that made no sense.

2. If you are earning roughly the average income for your city, country etc and can't make ends meet, then serious frugality intervention is required to get back into balance. This is where the stop buying crap, latte factor etc. are going to be important. Otherwise, I think even if you expand your income, your expenses probably will expand at the same rate. This has never been a problem for me or some others. We are just lucky to have had the frugalness meme instilled in us I guess. So I don't discuss this at all in my blog.

3. Once you have that under control then I think income expansion becomes the next focus whether increasing salary, or business and investment income. My focus in the blog is on the latter and how to manage the money. The key I think is to expand expenditures slowly and smoothly over time so that they always remain far behind income.

4. Once you have money to save then the natural focus is where to put it. When your monthly savings are still relatively large compared to your total wealth, managing the money is probably less important. For example, if the stock market goes down, the dollars you lose will not be very many and your new savings will buy more shares through dollar cost averaging. At this stage all the usual PF advice about building up emergency funds, index fund investing, different types of retirement accounts etc. is most relevant.

5. Soon enough you have more wealth than annual income or several times more wealth than annual income. The absolute dollar impact of each investment decision becomes greater. At this stage, searching for superior investment managers, seeking true diversification, thinking about market timing strategies etc. becomes much more relevant. That is the stage where I am at with financial wealth equal to more than four times annual income. So it's what I am mostly going to blog about. Buying real estate (or not) I think should come in at this stage. Most middle class people are house rich and financial asset poor. No surprise that I'm not a big believer in the usual advice about buying a house. To my mind it would usually be a good idea to get beyond stage 4 at least first, but this will differ with local conditions and personal preferences.

There are stages beyond here of course - when true wealth is reached and you can live off of business income, investment income, or retire. Or take an increasingly proactive role as an investor.

So here are some random thoughts:

1. If you are a student or on a low income the key is not to get into a level of debt which will be hard to stablize or pay down once you start working or get into a higher income job. Being very frugal is going to help. But it doesn't make sense to make undue sacrifices if you know your future income is likely to be much higher. My Dad told me I should be saving when I was a grad student rather than borrowing. I ignored his advice, to my mind that made no sense.

2. If you are earning roughly the average income for your city, country etc and can't make ends meet, then serious frugality intervention is required to get back into balance. This is where the stop buying crap, latte factor etc. are going to be important. Otherwise, I think even if you expand your income, your expenses probably will expand at the same rate. This has never been a problem for me or some others. We are just lucky to have had the frugalness meme instilled in us I guess. So I don't discuss this at all in my blog.

3. Once you have that under control then I think income expansion becomes the next focus whether increasing salary, or business and investment income. My focus in the blog is on the latter and how to manage the money. The key I think is to expand expenditures slowly and smoothly over time so that they always remain far behind income.

4. Once you have money to save then the natural focus is where to put it. When your monthly savings are still relatively large compared to your total wealth, managing the money is probably less important. For example, if the stock market goes down, the dollars you lose will not be very many and your new savings will buy more shares through dollar cost averaging. At this stage all the usual PF advice about building up emergency funds, index fund investing, different types of retirement accounts etc. is most relevant.

5. Soon enough you have more wealth than annual income or several times more wealth than annual income. The absolute dollar impact of each investment decision becomes greater. At this stage, searching for superior investment managers, seeking true diversification, thinking about market timing strategies etc. becomes much more relevant. That is the stage where I am at with financial wealth equal to more than four times annual income. So it's what I am mostly going to blog about. Buying real estate (or not) I think should come in at this stage. Most middle class people are house rich and financial asset poor. No surprise that I'm not a big believer in the usual advice about buying a house. To my mind it would usually be a good idea to get beyond stage 4 at least first, but this will differ with local conditions and personal preferences.

There are stages beyond here of course - when true wealth is reached and you can live off of business income, investment income, or retire. Or take an increasingly proactive role as an investor.

Friday, June 02, 2006

Monthly Report for May

I am happy with my financial performance this month and this year so far. Net worth increassed $6413 to $318482. It would have been stronger if there hadn't been a bit of a fall in the Australian Dollar. The gain in Australian Dollars was $A12740. I am almost halfway to my goal of adding $100,000 in net worth this year. At the beginning of this blog I said I would be happy with adding only $50,000 for the year, so I should be really happy now :) Investment performance for May was 0.59%. Doesn't seem much but the MSCI world index fell 3.33% and many stock indices and mutual funds fell by much more. I've noticed quite a few bloggers out there commenting on the decline in their portfolios in May. I am up 8.14% year to date (MSCI 6.35%) and 18.97% for the last 12 months (18.55%). Over the last three years I have gained more than twice the gain in the index. Beating the index is possible. But it takes both effort and skill and maybe luck :)

Other income is particularly high this month because my employer always pays June's salary on the last day of May. Spending was high this month because of the vacation trip and associated expenses. As you can see investment income on non-retirement accounts was halved by the change in exchange rate (I don't bother computing this for the retirement accounts). In order to increase net worth in June I am going to need to have a higher investment income than my spending (the retirement contributions for June will still occur in June though). That might be hard!

Other income is particularly high this month because my employer always pays June's salary on the last day of May. Spending was high this month because of the vacation trip and associated expenses. As you can see investment income on non-retirement accounts was halved by the change in exchange rate (I don't bother computing this for the retirement accounts). In order to increase net worth in June I am going to need to have a higher investment income than my spending (the retirement contributions for June will still occur in June though). That might be hard!

Thursday, June 01, 2006

Follow-Up on US Retirement Accounts

I've done a bit more research since posting on the retirement account puzzle. I now see that there are more options to get the money out of US retirement accounts without penalty before age 59 1/2 than I thought. The main one is if you convert the account into a lifetime annuity you can withdraw the money anytime without the 10% penalty (see comments for a better option suggested by Stealthbucks - coincidentally one of my local fiannce radio shows is talking about it right now...). For 401(k)s and 403(b)s it will be taxed at your marginal income tax rate rather than the lower investment (long-term CGT, qualified dividends) rates. You can get a variable annuity which varies with an underlying investment or a fixed annuity. A key issue here will be your tax rate when making contributions vs. withdrawing them. If you are happy with the annuity option and the tax rates work out in your favor then this could make sense. However, for a Roth IRA the distributions are taxable before age 59 1/2. So 401(k)s, 403(b)s, and traditional IRAs are clearly superior for this purpose and I think taxable accounts are too.

The other way money can be withdrawn before age 59 1/2 without penalty is if you are over 55 and leave your job or make a hardship withdrawal etc. (Roth's also allow a withdrawal for the first time purchase of a residence after the account has been open 5 years).

Australian retirement accounts are not as flexible in terms of withdrawing the money before age 60 (for those of us born in 1964 and later). It's not even a question of paying penalties.

Please only use my blog as a starting point to do your own research as I am not a qualified financial adviser of any sort.

The other way money can be withdrawn before age 59 1/2 without penalty is if you are over 55 and leave your job or make a hardship withdrawal etc. (Roth's also allow a withdrawal for the first time purchase of a residence after the account has been open 5 years).

Australian retirement accounts are not as flexible in terms of withdrawing the money before age 60 (for those of us born in 1964 and later). It's not even a question of paying penalties.

Please only use my blog as a starting point to do your own research as I am not a qualified financial adviser of any sort.

Tuesday, May 30, 2006

Hussmann and Svenlin on the Stockmarket

Here is the latest from Hussmann on the stockmarket. He seems to be one of the smarter guys around with regard to market analysis. Basically, he says hedge your stock portfolio against loss at this point. This is what I have been doing (after a rebound in the Aussie markets in the last two days my investment return for May seems to be 0% exactly :)).

Why hedge rather than just selling everything and going to cash? In taxable accounts there is the capital gains tax issue. If you sell you pay the tax with 100% certainty and you especially don't want to pay the short-term rates (as they are in the US and Aus) if you can avoid it. If you hedge and you are wrong you sell the hedging instrument (or buy back shorted shares) and take a capital gains loss. Another issue is mutual funds cannot be traded intraday. In reality there can be a day or two delay in getting the transaction done. If the market moves up suddenly you lose out. Hedging positions are normally much more liquid - I hedge with shares or options on ETFs or heavily traded stocks. For big investors, individual stocks are illiquid, they hedge in the futures market which is much more liquid.

Of course you can get more aggressive and overhedge until you are net short. I am slightly net short by standard measures. Again it is a risk if you are wrong - in the long-term stocks go up and based on the law of percentages up moves are bigger than down moves - a stock can only go to zero on the downside - but can go up infinitely in theory on the upside...

Carl Svenlin has posted an article on shorter term technical trends. I think that short term bounce is likely completed for now, but a larger rebound will happen in the first half of June.

Why hedge rather than just selling everything and going to cash? In taxable accounts there is the capital gains tax issue. If you sell you pay the tax with 100% certainty and you especially don't want to pay the short-term rates (as they are in the US and Aus) if you can avoid it. If you hedge and you are wrong you sell the hedging instrument (or buy back shorted shares) and take a capital gains loss. Another issue is mutual funds cannot be traded intraday. In reality there can be a day or two delay in getting the transaction done. If the market moves up suddenly you lose out. Hedging positions are normally much more liquid - I hedge with shares or options on ETFs or heavily traded stocks. For big investors, individual stocks are illiquid, they hedge in the futures market which is much more liquid.

Of course you can get more aggressive and overhedge until you are net short. I am slightly net short by standard measures. Again it is a risk if you are wrong - in the long-term stocks go up and based on the law of percentages up moves are bigger than down moves - a stock can only go to zero on the downside - but can go up infinitely in theory on the upside...

Carl Svenlin has posted an article on shorter term technical trends. I think that short term bounce is likely completed for now, but a larger rebound will happen in the first half of June.

Sunday, May 28, 2006

Portfolio Update

This is the first time I have provided a snapshot of the allocation spreadsheet I use to give myself a picture of my portfolio and calculate my NetWorthIQ numbers. It includes percentage allocations, summary allocations, performance figures, and total portfolio, saving etc. in US and Australian Dollars. It is based on a whole series of underlying spreadsheets. Each month I create a new worksheet like this from the previous one. That way I can compare this month to previous months. I was inspired by the worksheets George Soros provided in "The Alchemy of Finance".

I'll mainly focus on the current allocation in these comments. The main window shows the allocation of assets to securities and funds irrespective of whether they are in a retirement or taxable" account (Australian retirement accounts are taxable, but at a concessionary rate). The overall strategy which I ahve discussed is to invest 100% of assets in medium to long-term invests and then use leverage to trade. The market risk of the medium to long-term investments is adjusted slowly - preferably not more than once a year.

Main categories:

Mutual funds:

CFS (Australia), TIAA, CREF mutual funds - 78% of total. These are currently in a conservative mix - the largest amount is in the CFS Conservative Fund which is 70% bonds and cash, 30% equity related. When I think the stock-markets have bottomed I will become much more aggressive here.

Closed end/listed hedge funds/fund managers:

Everest Brown Babcock (fund of funds), Platinum Capital (listed hedge), Loftus Capital, Clime, Berkshire Hathaway - 12% of total - in the long-run I want to have much more in these kind of investments with the plan to only sell if the managers performance declines. Listed property/infrastructure adds another 3% in Challenger Infrastructure and IYS. Berkshire is really an insurance conglomerate but I think of it like a hedge fund/fund manager.

Individual stock investments:

Telecom NZ, Mayne Pharma, Symbion, Ansell, Croesus, Powertel - 11%. This is the extent of my "traditional stock picking". As I've posted, I don't do a lot of it. Mainly these are health or telecom firms. Croesus is a rather unsuccessful gold miner.

Trading:

A mix of short stock positions - Starbucks, Google, Apple, QQQQ, options - TLT, HHH, QQQQ, and gold. Any of these can be traded at any time, often intraday. Overall I end up with 46% more assets than equity. Less than half of that additional money is borrowed cash (19%) the rest is in borrowed stocks (26%). Short-selling requires holding lots of cash on deposit. That's the reason for my big cash holdings: 38% of assets. Cash outside my trading account is only 2% of assets. I have been withdrawing some profits from my trading account to my HSBC Savings Account in anticipation of paying off my credit card balances in the next couple of months (mostly zero percent). I missed out on playing this bounce in the markets in the last 3 days - I think there is another downwave to come before a more significant rally occurs. I will let you know when I get short-term bullish. However, I am not so bearish - If the stockmarket falls 10% I only stand to gain 1.6% (beta leverage) and so far I have lost money this month (0.43%) though less than the benchmark index has (2.64%).

Saturday, May 27, 2006

Two Interesting Articles from the Economist

One story about the world economy and state of the financial markets and another with the latest edition of the Big Mac Index. Seems to me that the Economist is a bit too optimistic about current earnings levels of firms being maintained going forward. Also I am surprised that the Yen and Hong Kong Dollar are undervalued by this measure.

Friday, May 26, 2006

Timing the Market

Today stock markets are rising around the world. The decline to this point hasn't received much attention outside the financial media. Some bloggers are beginning to notice though that their portfolios are taking a hit. I think that those who are selling out of stock mutual funds at this point are likely to feel better about their decision later in the year. I have been discussing the potential for a significant decline in the markets for a while now on this blog. And many others are coming to similar conclusions. As this article notes though, most individual small investors don't get market timing decisions right. And more sophisticated traders screw up too all the time :) The real solution is to invest in a portfolio of hedge funds of course and outsource that decision making. That can be hard for most individual investors. There are funds of hedge funds that take relatively small investments. The problem with many of these is that the funds willing to take investments from these funds of funds are not the superior hedge funds. Finding a good one takes some research. I know of one exception which is the Everest Brown Babcock fund of funds listed on the Australian Stock Market - sorry that isn't much use for US investors. The other alternative is a truly diversified portfolio with rebalancing and other techniques which I have discussed on this blog, here, here and probably other places.

Thursday, May 25, 2006

More Volatility

Today was another volatile day in the financial markets. Gold fell - obviously the wave 2 correction I disucssed yesterday is not over but with any luck this is the lowest point it will reach for now. If my new interpretation is right it would be a good trade to sell any short-term rally in gold. Stocks fell and rose and fell and ended up... Bonds rose and the yield curve by one measure is again inverted. The US Dollar strengthened again. But recent action in the dollar looks to me like a corrective wave or consolidation before the next fall (I think the same on stocks too).

And yes, my net worth is now down for the month. Investment performance is -0.5%, which is still much better than the the MSCI index's 4.5% loss (losses for other indices and stock mutual funds and similar or greater). Heavy spending on the trip didn't help either. My long positions in mutual funds and stocks are very conservative, but my short positions are not quite compensating. One short position (on News Corporation) went very wrong. The Australian Dollar has also been weak.

And yes, my net worth is now down for the month. Investment performance is -0.5%, which is still much better than the the MSCI index's 4.5% loss (losses for other indices and stock mutual funds and similar or greater). Heavy spending on the trip didn't help either. My long positions in mutual funds and stocks are very conservative, but my short positions are not quite compensating. One short position (on News Corporation) went very wrong. The Australian Dollar has also been weak.

Wednesday, May 24, 2006

Evening Market Update / Gold Chart

Like the US stockmarket today, Asian stockmarkets opened higher but have reversed at this point after Hong Kong opened at 10pm EDT. Though I am very bearish on stocks I am bullish on gold. Here is a chart the gold ETF GLD in the last two years with my educated guess of the simplest division of the move into Elliott Waves:

The count as posted means that the next move in gold is the third wave of the third wave up since mid 2005. That means that the move since then is less than half complete at this point. 3rd of 3rd waves are often very strong. Even if my exact count since mid 2005 is wrong the chart shows that using E-Wave principles we have to conclude that gold has not yet reached a final bull market peak - up waves must have 5 or 9 (or 13 etc.) subwaves and at the moment we only seem to have 8 at the most - the five subwaves of what I've labelled wave I and then II, 1, and 2. Elliott Wave theory is a very important tool in my technical analysis - both of long term trends and in intraday trading. It takes a lot of experience and skill in pattern recognition to use it properly. I find I get much better results by combining it with other forms of technical analysis and for the longer term analysis combining technical analysis with fundamental analysis and macroeconomics. Most E-Wave practioners think that the latter is tantamount to sacrilege. This doesn't make any sense to me. I also try to understand the relations in the patterns of different markets and securities. In general the more data point in the same direction the more reliable the result is likely to be.

The count as posted means that the next move in gold is the third wave of the third wave up since mid 2005. That means that the move since then is less than half complete at this point. 3rd of 3rd waves are often very strong. Even if my exact count since mid 2005 is wrong the chart shows that using E-Wave principles we have to conclude that gold has not yet reached a final bull market peak - up waves must have 5 or 9 (or 13 etc.) subwaves and at the moment we only seem to have 8 at the most - the five subwaves of what I've labelled wave I and then II, 1, and 2. Elliott Wave theory is a very important tool in my technical analysis - both of long term trends and in intraday trading. It takes a lot of experience and skill in pattern recognition to use it properly. I find I get much better results by combining it with other forms of technical analysis and for the longer term analysis combining technical analysis with fundamental analysis and macroeconomics. Most E-Wave practioners think that the latter is tantamount to sacrilege. This doesn't make any sense to me. I also try to understand the relations in the patterns of different markets and securities. In general the more data point in the same direction the more reliable the result is likely to be.

Another Crazy Day in US Markets

First the stockmarket was up strongly and then towards the close it slid heavily - a slide that continued after the official close. This wasn't at all unexpected to me, though Google rallied stronger than I expected and closed up. I reduced several short positions near the close ($40,000 of SBUX, AAPL, QQQQ) - not because I think we have yet reached the bottom but in order to get back within my margin requirements. Day trading buying power (on margin accounts with more than $25,000 in equity) lets you buy or short much more stock potentially than regular overnight margin requirements allow. If you hold the position overnight you will get a margin call, but the broker won't forcibly close the position that day as they have to allow you time to sell or deposit more cash etc. So this is what happened to me today. I get margin calls all the time because I tend to do extreme things with my account. But I haven't had a forced sale in years... All the trades I closed were profitable. My average profit on closed short-term trades in my taxable accounts is now 0.45% for the year again. This reflects some good and some bad trades. On the other hand Roth IRA is now up 40% since I opened it. I am amazed at how well those trades have gone - again there have been winning and losing trades but the winners have far outshone the losers. Currently I have 150 shares of GLD and 7 $40 June QQQQ puts in the account as well as a very little in a money market fund. I am increasingly thinking that individual stocks are most suited to long term investment and day trades, while short-term position trades are best handled using ETFs (or futures ultimately). The potentially high volatility of individual stocks can be useful intraday, when gapping is not possible and stops can be used. But it can be a real pain if it goes against you on position trades (held overnight, or for days, weeks etc.).

Tuesday, May 23, 2006

Stockmarket Slide Continues - Is Slowing Growth or Rising Inflation Responsible?

The slide in global stockmarkets continued today (and tonight in Asia). Not getting a lot of attention yet in the mainstream media (in the US at least) and in the financial media commentators are mostly remaining bullish. Bill Gross has posted his annual economic outlook. The bottom line is he still expects inflation to be low and bond yields in the US to remain in their recent range. He expects global growth to remain relatively strong. Others also think that the inflation outlook is benign but that global growth is likely to slow. This is on the whole my take, but I think the US stands a strong risk of outright recession in the coming year. Barclay's Bank warn that current conditions are very similar to those in 1987. I already made the same analogy with the big caveat that resource prices have been rising now, which wasn't the case in 1987. Others are similarly bearish but are looking for the main decline in the markets to occur in the Fall. There is no reason why we have to wait for the Fall for a crash to occur. On the other hand a slow slide across the midle of the year is entirely possible as are strong countertrend rallies on the way.

Something interesting is that bonds have begun to rebound from their recent lows. The sell-off in gold and other commodities may also have exhausted itself. I don't see us as being in a commodity price bubble. There is a genuine shortage of supply in many commodity areas. Perhaps the long-term trend of declining real resource prices (except for forest products) has begun to reverse? In the very short-term I am expecting a flight to safety to US government bonds and gold as stocks slide further. Regarding my own portfolio today, I rolled my QQQQ put options to a lower strike to free up some equity and buy gold with it. I also shorted more Google shares.

Something interesting is that bonds have begun to rebound from their recent lows. The sell-off in gold and other commodities may also have exhausted itself. I don't see us as being in a commodity price bubble. There is a genuine shortage of supply in many commodity areas. Perhaps the long-term trend of declining real resource prices (except for forest products) has begun to reverse? In the very short-term I am expecting a flight to safety to US government bonds and gold as stocks slide further. Regarding my own portfolio today, I rolled my QQQQ put options to a lower strike to free up some equity and buy gold with it. I also shorted more Google shares.

Monday, May 22, 2006

NetWorthIQ Top Ten List

I just entered the NetWorthIQ Top Ten List. Cool :) Probably it's because I am the top of the most active user list. Just got back from a roadtrip to Charlottesville, Virginia and back. Was a lot of fun and we had many memorable experiences. That included crashing the car into the grassy median of a highway resulting in $1000 in repairs which we did in various places en route. We also had to stay in New York City for an extra day and had to rejig the trip plan. Will soon get up to speed on the financial situation - there will be some goods (US tech stocks fell) and some bads (Aussie Dollar and gold fell, News Corporation shares rose). Seems that overall I am down several thousand from where I was before the trip. Investment performance for the month is a positive 0.45% gain versus a 3.45% loss for the MSCI index. Year to date I am up 7.94% vs. 6.22% for the MSCI. Over the last 12 months I am up about the same as the MSCI at 18.78% vs. 18.4%. Only a couple of weeks ago I was lagging seriously behind the MSCI over each of these time horizons. My assessment of sentiment from various sources is that on the whole investors remain mostly bullish. This probably means that the selling of stocks has not ended yet.

Thursday, May 11, 2006

More Good Tax News

More good tax news for investors on this side of the Pacific today. Interesting factoid in the article is that only 23% of people in the $50,000-$75,000 income bracket have any taxable investments. And even at the $1 million income level there are still 19% who don't.

Another Fed Day

Nothing unexpected for me in the announcement. After the announcement at 2:15pm, the dollar fell, bonds rose, gold rose, oil rose, and non-resource stocks fell. The "perfect storm" for my portfolio. Nice to have a little encouragement for my strategy. This evening at 5pm EST is the Google shareholders meeting.

Wednesday, May 10, 2006

Australia Simplifies its Retirement Accounts System

In the Federal Budget announced last night, treasurer Peter Costello, announced among other things a simplification of the superannuation system - Australia's retirement accounts system. Unlike the US there was already only one type of account but the tax regime was a little complex. It consisted of a 15% tax on contributions, a 15% tax on earnings, and above certain limits - additional taxes on payouts. Getting a payout as a pension annuity was tax-favored over taking a lump sum. So it was some mixture of tax concession and deferred tax regime.

The new system removed the complex regime of taxes on large payouts. Now it seems there is just a 15% tax on cointributions to and earnings of the funds and no taxes on payouts after age 60. This news is important for me because 40% of my net worth is in an Australian superannuation account. I estimate that I will save at least $A90,000 in tax that would have been paid in 2024-5.

For Americans and people from the many other countries that visit this blog it might be interesting to compare these moves in Australia with the system in your country. The announced changes makes this system simpler and lower tax than any of the US accounts - especially for people in higher tax brackets - as the only tax that will ever be applied is 15%. Also the maximum contributions allowed are much higher for people over 35 than those allowed in the US - equivalent to $US 40,000 per year. The downsides of the Australian system is that it is harder to withdraw your money before age 60 though it seems that now money can be left indefinitely in the Super system at the 15% earnings tax rate. In the US earnings on the Roth remain tax free and IRA/401(k)/403(b)'s etc. remain tax deferred until the money begins to be withdrawn (with compulsory withdrawals at age 70).

The new system removed the complex regime of taxes on large payouts. Now it seems there is just a 15% tax on cointributions to and earnings of the funds and no taxes on payouts after age 60. This news is important for me because 40% of my net worth is in an Australian superannuation account. I estimate that I will save at least $A90,000 in tax that would have been paid in 2024-5.

For Americans and people from the many other countries that visit this blog it might be interesting to compare these moves in Australia with the system in your country. The announced changes makes this system simpler and lower tax than any of the US accounts - especially for people in higher tax brackets - as the only tax that will ever be applied is 15%. Also the maximum contributions allowed are much higher for people over 35 than those allowed in the US - equivalent to $US 40,000 per year. The downsides of the Australian system is that it is harder to withdraw your money before age 60 though it seems that now money can be left indefinitely in the Super system at the 15% earnings tax rate. In the US earnings on the Roth remain tax free and IRA/401(k)/403(b)'s etc. remain tax deferred until the money begins to be withdrawn (with compulsory withdrawals at age 70).

Sunday, May 07, 2006

Sell Signal on the S&P 500 and Dow Industrials

The S&P 500 and Dow Industrials rallied strongly on Friday (punching through the 34 day Bollinger Bands indicator I like to use). This triggered the same sell signal on these two indices that occurred for the NASDAQ 100 index a few weeks ago. In 2000 the NASDAQ indices also started the big decline before the S&P 500 and Dow Industrials did. It could happen again.

Saturday, May 06, 2006

The Retirement Account Puzzle

One thing that puzzles me after my explorations in NetWorthIQ and PFBlog space is the obsession with retirement accounts. Many people write about getting financial freedom and are saving but they are stuffing the maximum into retirement accounts. In the US you generally can't touch these until age 59 1/2 and then the money withdrawn is taxed at your marginal rate of federal and state tax. If you touch the money before then you pay the marginal tax plus a 10% penalty (in Aus it is almost impossible to get the money out of a Superannuation account before age 60). Yes I know that a 401(k) defers tax to the future and the profits on a Roth IRA are tax free (if withdrawn after age 59 1/2 or in special cases - see below) and Roth contributions can be withdrawn at any time. But the federal long term capital gains tax rate is now 15% and the qualified dividend rate is also 15% (with 5% rates for lower income earners). And you can use the money to achieve financial freedom at any time....

If you are nearing 60 it certainly makes sense to stuff the maximum into a Roth as you will soon be able to get it out again (a 401(k) or traditional IRA will convert potential investment income though to ordinary income). But if you are in your 20s as many bloggers are - 60 is a long time off. Of course it makes sense to make contributions in order to get an employer match - even after paying a 10% penalty to withdraw the money that can usually be worthwhile.

I have about half my net worth in retirement accounts. Most is in an Australian Superannuation account. I had no choice on the level of contributions as a condition of my employment at a university in Australia. We put in 8% of our salary and the employer contributed 17%! That is the deal the unions had negotiated (I didn't join the union - but had to accept the same pay deal). All employers in Aus must contribute a minimum of 9%. There is no system like the US Social Security in Australia. Instead real savings must be made by employers and there is a flat rate welfare payment for poor retired people called the Age Pension. Here in the US I have to contribute 1% and my employer contributes 8% to a 403(b). I don't have any choice there either, but if I did I would do it - it is an excellent deal. However, we can make extra contributions, which I don't do.

I did open a Roth IRA recently with the sole purpose of creating $10,000 of tax free profits towards a first time purchase of a house, which is one of the special uses allowed. I will likely withdraw the contributions once that goal is achieved, though that is subject to review. The last thing I think I am going to need is more money at age 60.

If you are nearing 60 it certainly makes sense to stuff the maximum into a Roth as you will soon be able to get it out again (a 401(k) or traditional IRA will convert potential investment income though to ordinary income). But if you are in your 20s as many bloggers are - 60 is a long time off. Of course it makes sense to make contributions in order to get an employer match - even after paying a 10% penalty to withdraw the money that can usually be worthwhile.

I have about half my net worth in retirement accounts. Most is in an Australian Superannuation account. I had no choice on the level of contributions as a condition of my employment at a university in Australia. We put in 8% of our salary and the employer contributed 17%! That is the deal the unions had negotiated (I didn't join the union - but had to accept the same pay deal). All employers in Aus must contribute a minimum of 9%. There is no system like the US Social Security in Australia. Instead real savings must be made by employers and there is a flat rate welfare payment for poor retired people called the Age Pension. Here in the US I have to contribute 1% and my employer contributes 8% to a 403(b). I don't have any choice there either, but if I did I would do it - it is an excellent deal. However, we can make extra contributions, which I don't do.

I did open a Roth IRA recently with the sole purpose of creating $10,000 of tax free profits towards a first time purchase of a house, which is one of the special uses allowed. I will likely withdraw the contributions once that goal is achieved, though that is subject to review. The last thing I think I am going to need is more money at age 60.

Friday, May 05, 2006

Reflections on PF Bloggers

I've been reading plenty of these PF blogs as well as creating my own since discovering the NetWorthIQ website. It is very interesting to see how different people think and feel about money. Maybe I should get a new career as a financial adviser instead of as an economics professor :) As a professor, I just just get to tell people how to think about money (when teaching introductory courses) ...

Mainly I have discovered how different I am to the majority of bloggers out there. There are at least two very different universes in the financial internet. People interested in investing and trading on sites like Silicon Investor, which I've belonged to since 1998, have a very different mindset to those interested in personal finance. There are, though, some crossovers like Stealthbucks and Adventures in Money Making. Investor blogs look very different. Investors aren't interested in saving money but instead on making more of it (and protecting what they have). Some of them are naturally frugal and some not. Most, but not all, PF Bloggers seem more directed on saving money than making it. Maybe an exaggeration... but that is why I recently added the phrase "Absolutely no money saving tips!" to my profile.

I don't try to save money and don't need or want money saving tips. It seems I am just trained to be naturally frugal. I don't like buying things, or having things. What I do buy though has to be good quality and convenient. I do take advantage of any deal which is not inconvenient to do. It's not a question of trying to control expenditure or deny myself things. I just spend whatever I want and given current income it isn't too much. On the other hand, when I was a student or unemployed I had to think much more about what I was spending as my income was very low. Maybe all those years helped train me. I seem pretty lavish compared to my parents - perhaps more on that in future posts.

PF bloggers seem to fall into several categories that might overlap:

1. Young people just starting out in the financial world and dreaming of getting rich.

2. People who used to spend beyond their means and regret it and now try to save and invest (I used to spend beyond my means but don't regret it).

3. People whose parents and family are "financially irresponsible" or had little money and didn't know anything about it and are now trying to live a prudent lifestyle themselves.

There don't seem to be many who come from very financially prudent families, got a good financial education, and are themselves a bit more relaxed (that's me).

Mainly I have discovered how different I am to the majority of bloggers out there. There are at least two very different universes in the financial internet. People interested in investing and trading on sites like Silicon Investor, which I've belonged to since 1998, have a very different mindset to those interested in personal finance. There are, though, some crossovers like Stealthbucks and Adventures in Money Making. Investor blogs look very different. Investors aren't interested in saving money but instead on making more of it (and protecting what they have). Some of them are naturally frugal and some not. Most, but not all, PF Bloggers seem more directed on saving money than making it. Maybe an exaggeration... but that is why I recently added the phrase "Absolutely no money saving tips!" to my profile.

I don't try to save money and don't need or want money saving tips. It seems I am just trained to be naturally frugal. I don't like buying things, or having things. What I do buy though has to be good quality and convenient. I do take advantage of any deal which is not inconvenient to do. It's not a question of trying to control expenditure or deny myself things. I just spend whatever I want and given current income it isn't too much. On the other hand, when I was a student or unemployed I had to think much more about what I was spending as my income was very low. Maybe all those years helped train me. I seem pretty lavish compared to my parents - perhaps more on that in future posts.

PF bloggers seem to fall into several categories that might overlap:

1. Young people just starting out in the financial world and dreaming of getting rich.

2. People who used to spend beyond their means and regret it and now try to save and invest (I used to spend beyond my means but don't regret it).

3. People whose parents and family are "financially irresponsible" or had little money and didn't know anything about it and are now trying to live a prudent lifestyle themselves.

There don't seem to be many who come from very financially prudent families, got a good financial education, and are themselves a bit more relaxed (that's me).

Thursday, May 04, 2006

The Fed Isn't Printing Money

Despite the ravings of many goldbugs and other conspiracy theorists the Fed is not printing money. The chart of the M1 money supply has been flat for the past year. M1 money is the sum of bank notes, coins and checking deposits. It is in the direct control of the Fed. But that doesn't mean everything is just fine. If commodity prices are rising yet the money supply is not increasing to accommodate them we should get a recession instead of inflation. And that is my forecast which my investment strategy is based on. This morning I shorted more Starbucks - they release earnings tonight and the stock is looking very weak. Seems like there is little justification for the very high price/earnings ratio (around 50) of the stock given year on year earnings growth rates (around 10%). Yesterday I shorted more Apple Computer. That was a good move so far too. Each day we are seeing a pop-up in the markets in the morning and particularly in Google, only to see a sell-off in the afternoon. The myth is that morning price action reflects "dumb money" and afternoon price action "smart money". Could be some truth in that in recent days.

Wednesday, May 03, 2006

April Report

After a bit of a run around I bought a new firewire cable and got into the portable hard drive with my most uptodate accounts on it. Of course, I immediately backed up the disk. I use an Iomega hard drive which I switch between the various desktop and laptop computers I am use as my primary data store. The last cable only lasted 2 weeks! That cable was from our campus computer store where the same brand of cables are selling for less than half the price CompUSA are charging, but it's no good if they keep failing. Strange :o

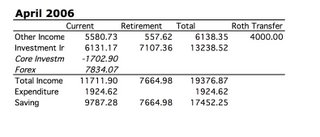

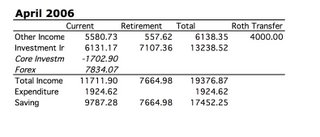

Anyway, my investment performance for April was a 4.49% gain in US Dollar terms. All of it and more is due to the gain in the Australian Dollar. The core rate of return at constant exchange rates was negative. Net worth increased by $17452 to $312,069. Net worth in Australian Dollars declined. Expenditure for the month was $1925. It's all detailed in this spreadsheet:

Investment return year todate is 7.45% and for the last 12 months 20.12%. The MSCI Gross World Index is up 3.09%, 10.01%, and 24.91% respectively. I am about a month ahead of my net worth goal for this point in the year.

Returns so far in May are already 2%.

Anyway, my investment performance for April was a 4.49% gain in US Dollar terms. All of it and more is due to the gain in the Australian Dollar. The core rate of return at constant exchange rates was negative. Net worth increased by $17452 to $312,069. Net worth in Australian Dollars declined. Expenditure for the month was $1925. It's all detailed in this spreadsheet:

Investment return year todate is 7.45% and for the last 12 months 20.12%. The MSCI Gross World Index is up 3.09%, 10.01%, and 24.91% respectively. I am about a month ahead of my net worth goal for this point in the year.

Returns so far in May are already 2%.

Tuesday, May 02, 2006

Global Markets Update

Here is Bill Gross' latest commentary. The last days and weeks have seen rapid movements in exchange rates, interest rates, stock prices, commodity prices etc. Volatility is increasing. Having some computer problems and so haven't yet produced final April numbers. Yesterday, the first day of May, though, was extremely good for me, especially in the US Markets. Stocks fell sharply, especially after Maria Bartiromo said that Ben Bernanke had told her he was misunderstood. Didn't do any good for my bonds of course (and the US Dollar reversed course and went up - though it's down again this morning). In the morning I covered 20 shares of my GOOG position and then in the afternoon started a short position in AAPL. Google went under 400 - Apple fell too - but would have been better to keep all 120 shares short of GOOG I had in the morning! Am also short (and have puts on) QQQQ. So that helped too.

Saturday, April 29, 2006

Weekend Links

John Mauldin's latest weekly letter is all about the weakening US Dollar and the Federal Reserve. Included is this great video! :) We've been watching Ben Bernanke in the Introductory Economics course I teach. We use the textbook the coauthored with Robert Frank and keep uptodate on his progress. And then this crazy real estate listing! That wild insider trading case again, and, finally, an article on renting vs. buying from the Economist.

End of the Month

Looks like I made about a 5% investment return for April. Most of the move was due to the strong rally in the Australian Dollar. The core investment gain - not counting exchange rate movements - was pretty small.

Last month, by contrast, the move in the Aussie was negative and wiped out most of my core investment gains.

Net worth increased by almost $20,000. One of my highest monthly gains, but not unprecedented. I am about $10,000 ahead of the target I set for April based on my goal of increasing net worth by $100,000 in 2006.

Moominmama also saw strong gains due to the fall in the US Dollar.

There doesn't seem to be much awareness of the collapse in the US Dollar in the media.

In the coming days I will post the final results for April.

Last month, by contrast, the move in the Aussie was negative and wiped out most of my core investment gains.

Net worth increased by almost $20,000. One of my highest monthly gains, but not unprecedented. I am about $10,000 ahead of the target I set for April based on my goal of increasing net worth by $100,000 in 2006.

Moominmama also saw strong gains due to the fall in the US Dollar.

There doesn't seem to be much awareness of the collapse in the US Dollar in the media.

In the coming days I will post the final results for April.

Wednesday, April 26, 2006

What Does the Rise in the Gold Price Mean?

Interesting article that looks at whether the rising price of gold is a signal of future inflation. Especially interesting is the comparison of the price of gold to that of other metals. Industrial metals make gold look cheap! No crash yet - but the stock market remains weak. Today I added I took a slightly more bearish stance by buying more QQQQ puts with the cash in my Roth IRA account - doubling the number of contracts. I like to buy in the money options and pay a minimum of time premium. Buying at the money or out of the money options really does seem like gambling. The options have no current "intrinsic value" and unless the stock price moves in your direction by the expiry date you lose all your money... Deep in the money options are closer to futures contracts or heavily leveraged stock positions and are definitely more my "cup of tea" :)

Thursday, April 20, 2006

Potential Crash Warning

One of the things that maybe gives me some trading edge is a technical analysis indicator I developed myself. It is very different to traditional indicators and is based on an autoregression model computed in a spreadsheet. I apply it to the main stocks I trade.

I just did some forward simulations on my NDX spreadsheet using my autoregressive indicator. There is the potential for a massive crash in coming days and weeks. I can't forecast a crash with the indicator, all I can do is plug in some values for the index and see whether the indicators they yield make any sense. Basically the model finds turning points. So if I plug in a number for tomorrow or next week or whenever and it yields a turning point value (greater than one) then I know that is a bottom or top. Very large declines are now possible before the bottom is reached. This wasn't possible even a couple of days ago, but the last couple of days' rally has loosened things up and the index has come to a potential top turning point on my weekly spreadsheet.

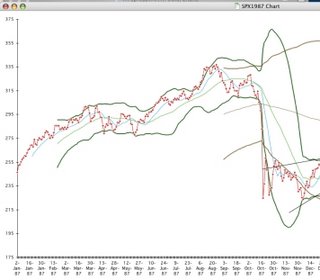

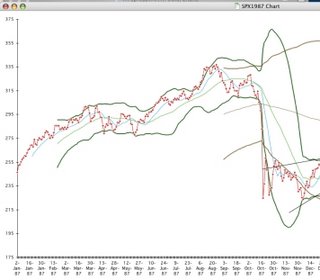

For those of you who remember, I reckon the current juncture has some of the feel of Fall 1987. Read the discussion of the crash in the Alchemy of Finance. Interest rates and the US Dollar played a key role in the crash. In fact the current NDX chart and the SPX chart from that period are uncannily similar in appearance:

Now check this.

Of course this isn't a forecast. Nothing may happen. Or perhaps it will.

I just did some forward simulations on my NDX spreadsheet using my autoregressive indicator. There is the potential for a massive crash in coming days and weeks. I can't forecast a crash with the indicator, all I can do is plug in some values for the index and see whether the indicators they yield make any sense. Basically the model finds turning points. So if I plug in a number for tomorrow or next week or whenever and it yields a turning point value (greater than one) then I know that is a bottom or top. Very large declines are now possible before the bottom is reached. This wasn't possible even a couple of days ago, but the last couple of days' rally has loosened things up and the index has come to a potential top turning point on my weekly spreadsheet.

For those of you who remember, I reckon the current juncture has some of the feel of Fall 1987. Read the discussion of the crash in the Alchemy of Finance. Interest rates and the US Dollar played a key role in the crash. In fact the current NDX chart and the SPX chart from that period are uncannily similar in appearance:

Now check this.

Of course this isn't a forecast. Nothing may happen. Or perhaps it will.

Sell in May and Go Away

Great article by Mark Hulbert on the "Sell in May and Go Away" saying. It is true that stocks perform worse in the summer and better in the winter. In the article he looks into the question of whether there is another asset class that performs better in summer and worse in winter. He finds that the Lehman US Bond Index does perform better in summer than winter. Therefore, an optimal strategy is to sell stocks and buy bonds for the summer. Of course this is just a statistical average over the long term and won't work every year. At the moment, though, I am net short stocks (including put options as shorts) and long bonds, which is a more extreme version of this strategy. I'm also 60% or so at least exposed to the Australian Dollar and only 20% to the US Dollar which is falling. In computing the latter I look at a firm's primary listing - for example, News Corp is a US Dollar asset even though I trade it in Australia. I'm now up to 2% allocated to gold (in my Roth IRA through GLD). Recent trades including buying TLT calls (today that doesn't look like such a great idea!) and this morning Yahoo puts. Yahoo's earnings report yesterday met expectations. So why the huge ramp in price? This is the kind of trade I do on news occasionally. When Fortune decides that finally it is time to get back into net stocks, it may actually be time to get out (or past time). This month the main news in my portfolio has been the rise in the Australian Dollar - each 1 US cent move up adds about $US3700 to my net worth.

Tuesday, April 18, 2006

Buying and Holding an Index Fund is so 20th Century

More Bond Bulls

These guys' Q1 report - highlighted in John Mauldin's latest letter - has an identical viewpoint to my own on inflation, bonds etc.

Monday, April 17, 2006

Savings vs. Profits

I was curious what fraction of my net worth accumulation had come from saving and how much from investment profits. I created this chart, which also breaks things down between retirement and non-retirement accounts. Profits on the retirement accounts now exceed contributions. Performance on the non-retirement accounts has not been as good. Cumulative profits in both categories were negative in January 2003 after substantial bear market losses. Non-retirement saving has not been much recently as I have fully funded a Roth IRA for 2005 and 2006.

Sunday, April 16, 2006

Clustermaps is Amazing

This Clustermaps application is so amazing! Every day I check the new red spots appear on the map. The latest entrants are for Bangkok, somewhere in southern Turkey, and Tokyo. Everyone I show it to is amazed also. I also installed one on my academic homepage.

Saturday, April 15, 2006

Is There a Housing Bubble?

There have been a couple of recent economic studies published that argue that there is no housing bubble. One paper by Himmelberg et al. and another by Hwang Smith and Smith.

Both studies value houses appropriately from the point of view of a potential homebuyer. I don't have any problems with their house pricing formula or data on existing prices, rents, and other variables. My problem is with their conclusion that their results indicate that there is no housing bubble.

The valuation formula takes into account rents for rental housing, interest rates, property tax, maintenance costs, federal and state tax deductions etc. and, crucially, potential capital appreciation. It makes sense to pay more for a house if you think its price will go up. So from the point of view of a potential buyer their formula for valuing a house is correct.

But this builds an expectations component into homeprices. If people think houseprices will rise they will pay more for houses. If houseprices continue to rise this will have turned out to be correct. But if houseprices in fact stop rising then the prices people are paying will turn out to be too high and prices will start to fall. Falling prices mean negative capital appreciation, which means prices should be even lower. There couldn't be a simpler and better bubble generating mechanism.

The two studies I cited assume house prices will continue to rise at historic rates. If you assume that, then people are not currently paying too much for housing in supposed bubble zones and hence the authors claim that there is no bubble - houses are not overvalued. But the instant prices stop rising - for example due to increasing interest rates - suddenly homes are overvalued and there is a bubble!

Similar mechanisms exist in the stock market - as discussed by Soros in The Alchemy of Finance. Stock prices partly depend on expectations of the growth rate of corporate profits. Soros pointed out that sometimes these contain a self-reflexive component where increasing stockmarket valuations feed back into increasing corporate profits. But in the housing market the growth component is even more self-reflexive. If everyone believes houseprices will rise then they will, until people no longer believe this.

In conclusion it is impossible to find whether a bubble exists by looking at whether house prices are currently overvalued based on historic capital appreciation rates. You have to be able to also model the future path of house prices and then ask: "Given this future path, are prices now too high". Yes the two depend on each other - the economics is dynamic and not as simple as the economics in these papers.

Both studies value houses appropriately from the point of view of a potential homebuyer. I don't have any problems with their house pricing formula or data on existing prices, rents, and other variables. My problem is with their conclusion that their results indicate that there is no housing bubble.

The valuation formula takes into account rents for rental housing, interest rates, property tax, maintenance costs, federal and state tax deductions etc. and, crucially, potential capital appreciation. It makes sense to pay more for a house if you think its price will go up. So from the point of view of a potential buyer their formula for valuing a house is correct.

But this builds an expectations component into homeprices. If people think houseprices will rise they will pay more for houses. If houseprices continue to rise this will have turned out to be correct. But if houseprices in fact stop rising then the prices people are paying will turn out to be too high and prices will start to fall. Falling prices mean negative capital appreciation, which means prices should be even lower. There couldn't be a simpler and better bubble generating mechanism.