I put together a dataset for the ASX 200 futures for the past 5 years - Barchart have this data. Every possible "Turtle" strategy I tested lost money. So, we're definitely not going to trade this! I tested breakouts from 1 to 40 day periods and they all have similar poor performance. Position sizing to always trade the same percentage risk made things much worse.

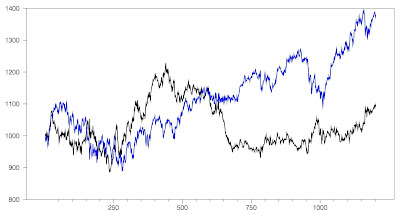

Here is a 2,2 strategy without position sizing assuming no slippage – The best case scenario:

The blue line is the continuous futures contract price I constructed and black is the equity line of the strategy. This actually makes a slight gain over the 1200 trading days. But including reasonable slippage, it will turn into a loss. A 2,2 strategy means that you buy or sell breakouts from the previous two days highs or lows and exit those positions on breakouts from the same number of trading days in the opposite direction.

I have now put on a small (10 ounce) Palladium trade using CFDs. I'll probably test trading oil next.

Saturday, September 28, 2019

Monday, September 23, 2019

Data Quality Matters

I did an analysis of the optimal trading strategy for Palladium futures using Barchart data. Previously, using free data, I had found that we should make trading decisions based on very short periods of past prices. For example we might go long (short) if prices broke out above (below) the previous day's high (low), or maybe the high or low of the previous two days. Now I find that the optimal strategies use periods of 7 to 18 days for breakouts. This shows that using good quality data really matters in trading, and not just a little bit. Using one day breakouts would actually lose money over the last five years of data that I tested. I lost money on all the Palladium trades I previously made... though four trades is not a large sample.

At the moment Palladium is in a winning long trade, but I am reluctant to go long at this point. So, I put in a short trade which will activate if the market reverses.

I also found out today that Barchart has past ASX 200 futures prices. I don't know if these are as high quality as their US futures data. I will download them next.

At the moment Palladium is in a winning long trade, but I am reluctant to go long at this point. So, I put in a short trade which will activate if the market reverses.

I also found out today that Barchart has past ASX 200 futures prices. I don't know if these are as high quality as their US futures data. I will download them next.

Sunday, September 15, 2019

Variable Position Size, Again

I signed up for the Barchart Premier subscription. Among other things, this gives access to daily open, high, low, close etc. data for all US based futures contracts back to 2000. The data seems to be much more accurate than the various free sources. To start with, I downloaded all Bitcoin futures contracts data. I constructed a continuous series of prices going back to the beginning of trading in Bitcoin futures. I use proportional splicing that preserves percentage changes rather than absolute dollar changes. I also saved the actual futures prices for computing trading costs.

When we include the very volatile period right after the all time high in Bitcoin, the optimal trading strategy changes:

This graph shows the drawdown for a simple strategy that always buys the same number of contracts (in red) with a strategy that always has the same initial risk in percentage terms (in green). The latter targets a constant maximum 5% potential loss of the face value of the Bitcoin contracts before stopping out. The simple strategy soon finds itself 40% down at the end of January 2018. On the other hand, it manages to claw back that loss by late March... The constant risk strategy only loses a maximum of 15% over this period. On the other hand it performed worse during the string of 11 losing trades in a row in late 2018. But the Sharpe ratio for the constant risk strategy (2.45) is quite a lot higher than for the constant position size strategy (2.21). So, I am going to start varying position size, targeting a maximum loss of USD 5,000.

I will also start to revisit other markets to see where there is potential.

Previously, I found that there was a positive relationship between the initial risk of a trade and its return. When volatility is low moves seem to be more noise than signal. Looking at the relationship between initial risk and return, there is now a negative correlation between them, though it isn't statistically significant:

On the other hand, the "lowest risk" trades here mostly had negative outcomes.

When we include the very volatile period right after the all time high in Bitcoin, the optimal trading strategy changes:

This graph shows the drawdown for a simple strategy that always buys the same number of contracts (in red) with a strategy that always has the same initial risk in percentage terms (in green). The latter targets a constant maximum 5% potential loss of the face value of the Bitcoin contracts before stopping out. The simple strategy soon finds itself 40% down at the end of January 2018. On the other hand, it manages to claw back that loss by late March... The constant risk strategy only loses a maximum of 15% over this period. On the other hand it performed worse during the string of 11 losing trades in a row in late 2018. But the Sharpe ratio for the constant risk strategy (2.45) is quite a lot higher than for the constant position size strategy (2.21). So, I am going to start varying position size, targeting a maximum loss of USD 5,000.

I will also start to revisit other markets to see where there is potential.

Previously, I found that there was a positive relationship between the initial risk of a trade and its return. When volatility is low moves seem to be more noise than signal. Looking at the relationship between initial risk and return, there is now a negative correlation between them, though it isn't statistically significant:

Wednesday, September 04, 2019

Individual Investment Returns, August 2019

Following up on the monthly report for August, here are the returns of each individual investment or trade. As usual, I have aggregated all the individual bonds (23 of them) we have into one number. As discussed in the monthly report, gold and the Winton Global Alpha Fund did exceptionally well, some hedge funds (Tribeca and Platinum Capital, in particular) did badly, and diversified funds like CFS Conservative, CREF Social Choice, and PSS(AP) weathered the month well. Real estate investments did OK. The CFS Developing Companies fund also bucked the trend for the month.

Tuesday, September 03, 2019

August 2019 Report

Stock markets fell in August but we did OK in Australian Dollar terms and not so bad in US Dollar terms. The Australian Dollar fell from USD 0.6879 to USD 0.6729. The MSCI World Index fell 2.33% and the S&P 500 1.58%. The ASX 200 fell 2.05%. All these are total returns including dividends. We gained 0.93% in Australian Dollar terms and lost 1.27% in US Dollar terms. The target portfolio is expected to have gained 1.82% in Australian Dollar terms and the HFRI hedge fund index is expected to have lost 0.70% in US Dollar terms. So, we had a relatively strongly performing month, beating all three stock indices but under-performing our target portfolio and the HFRI. Updating the monthly returns chart:

Here is a report on the performance of investments by asset class (futures includes managed futures and futures trading):Gold, futures, bonds, and Australian small cap had positive returns while other asset classes lost money. The largest positive contribution to the rate of return came from gold and the greatest detractor was hedge funds. The returns reported here are in currency neutral terms.

Things that worked well this month:

- Gold gained 7.8%.

- The Winton Global Alpha Fund also did very well gaining 5.6%...

- I was impressed by the PSS(AP) balanced fund, which actually gained this month. But generally, diversified investments did well as bond performance outweighed the fall in stocks.

- Trading. Not including gold we lost 2.48%. Including gold it was a 2.18% gain for the month. Near the beginning of the month we had a big winning trade in Bitcoin, gaining USD 16k. We then gave it back in losing trades as the cryptocurrency chopped around. I have now reduced my position size in case this chop continues. The treasuries steepening trade also lost as the yield curve inverted more.

- Tribeca Global Resources Fund (TGF.AX) did horribly in terms of its share price. It's trading at quite a large discount. Cadence Capital (CDM.AX) returned to its position of being my worst investment ever in dollar terms, down AUD 20.6k cumulatively (AUD 3.2k this month).

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- $25k of Scorpio Bulkers baby bonds matured slightly early, $25k of Hertz bonds were called, and $50k of Macquarie Bank bonds matured. I bought $50k of Energy Transfer bonds and $15k of Ford bonds. So, our direct bond holdings declined by $35k.

- We traded unsuccessfully, as discussed above.

- I opened a small position (10,000 shares) in URF, an Australian based REIT investing in US residential property, that was trading at a large discount to net asset value.

- I increased our holding of Domacom (DCL.AX) shares to 100k. It's still a very small position – 0.2% of net worth.

- I bought 1,000 more shares of the IAU gold ETF.

- I invested the inheritance of baby moomin. This reduced our cash and debt by the same amount as I was holding cash for this purpose but recording a loan from him in our accounts. Reported net worth does not include the net worth of our children, just my wife and I.

Sunday, August 25, 2019

Understanding Wills and Estate Planning

As we don't yet have a will, I have been reading this book, which is a simple guide to this topic with plenty of examples. I now see that there is more to estate planning in Australia than I thought. There are no inheritance taxes in Australia, so I thought that "estate planning" wasn't a big deal here. But after reading the book I now see that you might want to design things to prevent various scenarios occurring, and yes there are some tax issues, and then there are all the issues of making sure your wishes are carried out.

For example, in the case of my mother, after she lost the ability to make decisions, we ended up being dictated to by the government about how we managed her money etc. We had to sell all her financial assets and reinvest them in an approved way. We had a power of attorney to act on her behalf, but crazily this became invalid when she most needed us to act on her behalf! This was because prior to 2017 apparently you couldn't have an enduring power of attorney in her country. So, it is important to set up an enduring power of attorney.

I aspire that my children will inherit in real terms at least as much as I inherited from my parents. Of course, we can't guarantee this as who knows what might happen to the economy etc. But we can try to prevent some adverse events happening. An example is if one of us dies and the other gets a new partner. Then they die and the partner inherits everything and decides to give none of the money in their will to our children. Maybe because they have existing children and rewrite their will to include only them.... This kind of case is mentioned in the book but the solution isn't provided. On p58 it says that the survivor should see a lawyer before remarrying...

I am thinking the solution is to set up a testamentary trust on the death of the first spouse incorporating their share of the total assets. The beneficiaries would be the surviving spouse and the children. The surviving spouse will earn income from the trust during the remainder of their life after which the children will be the sole beneficiaries of the trust. So, clearly, we are going to need to discuss with a lawyer all of this.

Currently, if our nuclear family all died, it would be my mother-in-law who would inherit everything according to Australian law. I can't imagine she would handle that very well and given the large inheritance component from my parents, that hardly seems fair. So, we also need to have contingent inheritors to result in a more reasonable distribution of assets in that extreme case.

We also will need to think about who would be a guardian for our children if we both died. I can't really think of someone here in Australia that we would want to do this and who would agree to it as neither of us have relatives here. But it is something we are going to have to determine.

There are probably lots of things I still haven't considered but I think we are going to need to have rough ideas about all of these before meeting a lawyer. By the way, if anyone can recommend a lawyer that they have used, that would be great!

Sunday, August 18, 2019

Individual Investment Performance, July 2019

In July, generally alternative investments and small cap stocks did well and gold and our trading did poorly. Some things were just bouncing back from previous poor performance like Tribeca Global Natural Resources (TGF.AX) or Domacom (DCL.AX).

Monday, August 12, 2019

Trading Back on Track

After suffering some losses, it looks like I've got our trading back on track for the moment:

We were stopped out of Bitcoin this morning for a USD 16k gain at $11595 and $11600 in the August futures (3 contracts in total). As we are only doing long trades in Bitcoin, we don't have a Bitcoin position. This should be the impetus for subscribing to a data service and doing some backtesting of other markets...

We are also net positive in trading since 1996. However, the month is still not half-way over, so anything could happen by the end of the month.

We were stopped out of Bitcoin this morning for a USD 16k gain at $11595 and $11600 in the August futures (3 contracts in total). As we are only doing long trades in Bitcoin, we don't have a Bitcoin position. This should be the impetus for subscribing to a data service and doing some backtesting of other markets...

We are also net positive in trading since 1996. However, the month is still not half-way over, so anything could happen by the end of the month.

Sunday, August 04, 2019

Designing a Portfolio for Baby Moomin

I decided that the best provider of investment bonds is Generation Life. This is mainly because they seem to be scandal free, not about to be sold off to an overseas manager, and have lower fees than other providers. Next I needed to pick an investment portfolio from their investment options. I decided on the following rules and criteria:

50% Dimensional World Allocation 50/50 Trust. Here I compared a Vanguard balanced fund with this fund. In the long run, DFA have done much better than Vanguard:

Here, Portfolio 1 is a DFA stock fund and Portfolio 3 the Vanguard equivalent. The equity curves are for someone withdrawing 5% per year in retirement. Portfolio 2 is a DFA 60/40 stock/bond portfolio. The difference is stunning. Recently, DFA hasn't done as well as value stocks are out of favor. I am betting on them coming back. If there is a major market correction we might shift this core holding to a more aggressively equity focused fund.

10% Ellerston Australian Market Neutral Fund. Ellerston has done horribly in the past year, but prior to that it did very well for a market neutral fund. It now seems to be rebounding. This fund manager originally managed James Packer's money and then branched out.

10% Magellan Global Fund. This has been one of the best Australia based international equity funds. It did particularly well during the GFC.

10% Magellan Infrastructure Fund. This fund seems better than the other real estate options. It didn't do very well during the GFC, but all the others were worse.

10% Generation Life Tax Effective Australian Share Fund. This fund is managed by Redpoint Investments. The idea is to tilt a bit towards tax effective Australian shares given the high taxes on this investment bond overall. The manager is pretty much an index hugger, but the other options for actively managed Australian shares seem worse.

5% PIMCO Global Bond Fund. PIMCO is the gold standard for actively managed bonds. I decided to split my allocation to PIMCO between international bonds and

5% PIMCO Australian Bond Fund, as Australian bonds have actually done very well recently.

- 50/50 equities/fixed income and alternatives

- 50/50 passive and active management

- 50/50 Australian and international assets

- Pick the best fund from alternatives in each of these niches - focusing on long-term "alpha" and in particular their performance during the Global Financial Crisis and the recent December 2018 mini-crash.

50% Dimensional World Allocation 50/50 Trust. Here I compared a Vanguard balanced fund with this fund. In the long run, DFA have done much better than Vanguard:

Here, Portfolio 1 is a DFA stock fund and Portfolio 3 the Vanguard equivalent. The equity curves are for someone withdrawing 5% per year in retirement. Portfolio 2 is a DFA 60/40 stock/bond portfolio. The difference is stunning. Recently, DFA hasn't done as well as value stocks are out of favor. I am betting on them coming back. If there is a major market correction we might shift this core holding to a more aggressively equity focused fund.

10% Ellerston Australian Market Neutral Fund. Ellerston has done horribly in the past year, but prior to that it did very well for a market neutral fund. It now seems to be rebounding. This fund manager originally managed James Packer's money and then branched out.

10% Magellan Global Fund. This has been one of the best Australia based international equity funds. It did particularly well during the GFC.

10% Magellan Infrastructure Fund. This fund seems better than the other real estate options. It didn't do very well during the GFC, but all the others were worse.

10% Generation Life Tax Effective Australian Share Fund. This fund is managed by Redpoint Investments. The idea is to tilt a bit towards tax effective Australian shares given the high taxes on this investment bond overall. The manager is pretty much an index hugger, but the other options for actively managed Australian shares seem worse.

5% PIMCO Global Bond Fund. PIMCO is the gold standard for actively managed bonds. I decided to split my allocation to PIMCO between international bonds and

5% PIMCO Australian Bond Fund, as Australian bonds have actually done very well recently.

Friday, August 02, 2019

July 2019 Report

July was another positive month for long term investments, but we lost money trading.

In July the Australian Dollar fell from USD 0.7012 to USD 0.6879. The MSCI World Index rose 0.33% and the S&P 500 1.44%. The ASX 200 rose 2.94%. All these are total returns including dividends. We gained 2.25% in Australian Dollar terms and 0.31% in US Dollar terms. The target portfolio is expected to have gained 2.38% in Australian Dollar terms and the HFRI hedge fund index is expected to have gained only 0.10% in US Dollar terms. So, we had a relatively strongly performing month, almost a bit below the ASX200 and more or less matching our target portfolio and the MSCI and beating HFRI. Updating the monthly returns chart I posted last month :

Here is a report on the performance of investments by asset class (futures includes managed futures and futures trading):Things that worked very well this month:

- Hedge funds, private equity, and Australian small cap all did well. I think this could be because many of these investments were not doing well and were probably sold to crystallize tax losses last month before the end of the Australian financial year and then rebought this month. The CFS Developing Companies Fund gained 5.86%.

- I marked Oceania Capital to $2.30 at the end of the month, which was the record date for the buyback associated with the delisting that was approved at the extra-ordinary meeting. The buyback price is $2.30 a share. This translated to a 7% gain for the month.

- The Winton Global Alpha Fund also did well gaining 2.46%. A big contrast to my own trading...

- We had major losses trading Bitcoin, though, so far, it is just a "correction". I closed short positions early which would have been winners. The Bitcoin "model" also suffered its worst percentage loss to date on a long trade. As I have been trading double the size long as short this just compounded the loss. Going forward I will only take long Bitcoin trades for the moment.

We moved a little more towards our new long-run asset allocation.* Gold and cash increased most and bonds decreased most:

- We tendered USD 40k of Avon Products bonds into an early redemption and sold USD 21k of Deutsche Bank bonds. Also, USD 50k of Citibank bonds matured. I bought USD 10k of Lexmark bonds, USD 25k of Kraft-Heinz bonds, and USD 25k of Dish bonds. So, our direct bond allocation fell by USD 51k.

- We traded unsuccessfully, as discussed above.

- I bought 1,000 more shares of the IAU gold ETF.

- I bought another 450 shares of Oceania Capital.

Wednesday, July 31, 2019

Australian Investment/Insurance Bonds

Investment/insurance bonds are an Australian investment vehicle, which is a bit like a superannuation fund but actually is formally a type of life insurance. You make an investment like in a super fund, but instead of earnings being taxed at 15% they are taxed at the corporate income tax rate, which is 30% currently. If you withdraw the money after 10 years, no additional tax is payable. This can be a good idea in two cases:

1. If you are in a high tax bracket so that additional investments are taxed at up to a 47% marginal tax rate and you either have maximized your superannuation contributions or want the flexibility to get the money out before you retire.*

2. You want to invest in your children's name. Investments for children in their name are subject to very high penalty rates of tax in Australia to prevent income-splitting tax dodges. You can invest in a "trust account" in the child's name and avoid these penalty rates but you are liable to pay tax on the earnings.** You can specify a vesting age when the investment bond will be transferred to the child.

My mother's will specifies that each of her grandchildren will get £25k when they are 23 y.o. My brother and I are interpreting that as investing £25k now. We set up trust accounts for his children below 23 and my son in Falafeland where he lives and my mother lived. But then on 26 June this year our second child was born. It seems I haven't mentioned this on this blog before! My brother and I agreed to also invest £25k for him.

I began to explore setting up an Australian trust for him. An Australian will can set up a "testamentary trust" in the name of a child or grandchild etc. The income on that inherited money won't be subject to the penalty rates. The twist is that the money for our newborn son is my hands now. If I just set up a trust for him I will have a battle with the ATO to claim that the penalty rates don't apply. I talked to a lawyer on the phone and she said she needs to do research on whether we can set up a testamentary trust now. This would be a lot of upfront expense and then there is the hassle of running the trust and investing on its behalf and submitting annual tax returns etc. So, I am skeptical that this is going to work and if it does it would be a lot of hassle, I think. Also a trust must pay out all its earnings every year. So our son will need a bank account to receive them and this will be an income stream that his brother won't be getting.

An investment bond seems like a simpler option and is very similar to our first child's trust account In Falafeland, which doesn't pay distributions and is taxed at 25%. The 30% tax rate seems high, but there is a trick. If you make an additional investment that is greater than 125% of the previous year's investment then the bond resets to year 1 of the 10 year period. As the previous year's additional investment could be zero this is not hard. When that happens if the child withdraws money from the bond the money is taxable at their tax rate but they get a 30% non-refundable tax offset somewhat like a franking credit. But this will only reduce your tax if currently you earned less than AUD37k per year, which is below the full time minimum wage.*** But a 23 year old might earn that little if they were doing graduate study, for example.

There are six providers according to Macquarie:

- Comminsure (Commonwealth Bank)

- AMP

- IOOF

- Australian Unity

- Centuria

- Generation Life

* Investment bonds don't get a long-term capital gains tax discount. So, they aren't as effective if your not in the top bracket.

** Income children earn from labor/their own entrepreneurship isn't subject to the penalty rates and neither is inherited money in a testamentary trust. Trust accounts don't work for us as the children must get the money from them at age 18.

*** It's crazy that the minimum wage is already taxed at a marginal 32.5% + Medicare Levy.

Tuesday, July 30, 2019

Stopping Daytrading

Well, that didn't last long. I think it is definitely possible to make money using this daytrading method, but it is definitely not for me. The problem is that though entry to positions is "automated" the exit is discretionary. If you say it is the end of the session, then you can't do it exactly at the end -say at 4:30pm for the ASX200 futures. So, do you do it at 4:00 pm? 4:10pm? 4:30pm?, 5:10pm? or what? There is a temptation to hang on for the price to improve. And I seem to have a strong self-destructive tendency, which I need to control with rules based trading.

Monday, July 29, 2019

Long Only Bitcoin Trading

I continue to struggle psychologically with shorting Bitcoin futures and as a result make mistakes and lose money. So, I investigated how taking only the long trades would perform. If the "model" says to short Bitcoin, we close the long and stay out of the market. This is equivalent to being always long 1 unit of Bitcoin and going long or short one unit in addition.

Statistics since March 2018 for long trades only are very similar to the statistics for all trades. But because you are in the market only half the time, total returns will be lower. Since the beginning of 2019 total returns have been the same - short trades have added nothing to returns. Winning long trades outnumber losing long trades 10 to 6. Losing short trades outnumbered winning short trades 10 to 5.

So, I think that in the interim I will only take long trades in Bitcoin.

Note that in the last 10 months of 2018, long only trades gained a total of 18% while Bitcoin lost 65%. So, taking long only trades doesn't mean losing if Bitcoin returns to a bear market.

Statistics since March 2018 for long trades only are very similar to the statistics for all trades. But because you are in the market only half the time, total returns will be lower. Since the beginning of 2019 total returns have been the same - short trades have added nothing to returns. Winning long trades outnumber losing long trades 10 to 6. Losing short trades outnumbered winning short trades 10 to 5.

So, I think that in the interim I will only take long trades in Bitcoin.

Note that in the last 10 months of 2018, long only trades gained a total of 18% while Bitcoin lost 65%. So, taking long only trades doesn't mean losing if Bitcoin returns to a bear market.

Saturday, July 27, 2019

Trading Account Equity Curves

Thought I'd just post the "equity curves" from our three trading accounts. Moominpapa:

There is trading in the first half of last year and then in this year. In between, I didn't trade in this account for tax reasons and then because I wasn't trading over the Australian summer.

Here is Moominmama's account (which I trade too):

There is trading in the second half of last year instead. Most of the recent moves in this account and Bitcoin long trades. The short trades are in Moominpapa's account.

Plus 500 CFD account:

This is mostly long Bitcoin trades. As it is expensive to trade in this account I use it for hedging Bitcoin positions over the weekend and for experimental trades at a smaller scale than I can do with futures contracts.

Generally, the curves show a two steps forward one step back pattern. Hopefully, we can recover from the recent drawdown soon.

There is trading in the first half of last year and then in this year. In between, I didn't trade in this account for tax reasons and then because I wasn't trading over the Australian summer.

Here is Moominmama's account (which I trade too):

There is trading in the second half of last year instead. Most of the recent moves in this account and Bitcoin long trades. The short trades are in Moominpapa's account.

Plus 500 CFD account:

This is mostly long Bitcoin trades. As it is expensive to trade in this account I use it for hedging Bitcoin positions over the weekend and for experimental trades at a smaller scale than I can do with futures contracts.

Generally, the curves show a two steps forward one step back pattern. Hopefully, we can recover from the recent drawdown soon.

Trading the SPI

The graph compares idealized trading of the ASX200 futures contract, known as the "SPI" (share price index) vs. buy and hold. The trading uses my new day-trading approach. I actually transcribed by hand all the opening, high, low, and close values off a chart of the past month with 8 hour bars to get the data. The ticks are each of the five daily 8 hour bars. Yes, they're not all actually 8 hours long. 9:50-10:00am is one of them! Each index point is worth AUD 25 per contract and this tracks trading one contract.

The good news is that trading would have made money over the past month. On the other hand, buy and hold would have done just as well. But trading is less volatile. Hopefully, trading also does better in down markets. As I started near the end of this chart, so far I have lost money. But I have been making money in daytrading the Australian Dollar and the S&P 500 index in the last week. I also did a rough backtest on the NASDAQ 100 Index. But as I don't have access to bulk hourly data I can't do very extensive backtesting. Either I need to get that data or I need to just trade at a small scale until the results are statistically significant.

Tuesday, July 23, 2019

Worst Loss on Bitcoin

Just got stopped out for a 7.06% loss on Bitcoin trading. That is the worst loss that the Bitcoin model has suffered so far. So, most losses won't be as bad as that. Back to short...

This position was never in the money. The position was entered on a spike in price, which just triggered the stop. But I exactly followed my approach.

This is our equity curve (USD) so far in trading Bitcoin futures:

We also had some profits trading Bitcoin CFDs.

This position was never in the money. The position was entered on a spike in price, which just triggered the stop. But I exactly followed my approach.

This is our equity curve (USD) so far in trading Bitcoin futures:

We also had some profits trading Bitcoin CFDs.

Monday, July 22, 2019

New Macro Trade

I've started another long-term macro trade by buying a treasury note futures spread. The spread is short one ten year treasury note futures contract and long two two year treasury futures contracts. You can execute this with one trade using the TUT ticker. The face value of a two year contract is $200,000 and for a ten year contract, $100,000, so actually the trade is long four times as many two year notes as it is short ten year notes. The idea is that this spread will gain value as the yield curve steepens, which following a yield curve inversion, it already seems to be doing. The curve would steepen mainly because the Federal Reserve would cut short term interest rates. So, if they don't cut much the trade will lose. The more they cut the more likely it is to make money.

My other macro trade is gold. Though that is also a bit more like an investment as we plan to allocate to gold in the long term and I am using the IAU ETF for tax and psychological reasons. I've increased my position at this point to 4.89% of assets. The net treasuries position is nominally $302k, which is much bigger than that.

I've also been thinking about how to improve my new day-trading strategy. I think that I will add exit stops to each order I place. This means, for example, if we go long initially in a "headfake"and then the market falls and the sell stop order is triggered, rather than getting out of the market it will initiate a short position. That would have been a profitable trade in the S&P 500 futures on 16th and 19th of July. The resulting short gained more than the stopped out long lost. Also, I am thinking to keep half of the position as a turtle style trend following position rather than an actual daytrade. The difference to the medium term turtle trading is that the stop is moved each day based on action in the first part of the day rather than action over the last few days.

So I now have three time frames of trades. I am hoping that this diversification, while requiring entering more orders, actually results in me being less anxious about the trades and so actually spending less time looking at the market. We will see.

Thursday, July 18, 2019

Systematic Day Trading

I figured out a way to adapt the turtle trading method to systematic day-trading. I plan to apply it to markets which tend to move strongly after the release of US economic news at 8:30am Eastern Time on many days and which have elevated volume when US cash markets are open. The idea is to put buy and sell orders in for these markets at around 8:00am (currently 10pm here in Australia) based on the movement of the futures markets over the day up to that point. If there is a breakout of that range you go long or short automatically. Then you close the positions at the end of the trading day. This is a day trading method where you don't look at the market all day.

I don't have access to historic hourly data at the moment but I have backtested the idea for a couple of months by looking at charts for the NASDAQ 100 futures. It seems that the approach wins more times than it loses, though average wins and losses are about equal in size. Once the market starts moving in a given direction intraday it tends to keep moving in that direction. It looks like it would work well for stocks, bonds, gold, Australian Dollars... It doesn't look like it would work for oil, soybeans etc. These commodities typically expand their trading range in both directions when the market gets more active. As a result trades would tend to get stopped out.

I'll start trading it using the new micro-futures that are a 10th of the size of the e-mini NASDAQ and S&P contracts as well as with CFDs for gold (trading 10 ounces say) and Australian Dollars (starting with AUD 10k) and see how we go.

Monday, July 15, 2019

Trading Bitcoin Futures over the Weekend or Not

Because recently Bitcoin rallied strongly over weekends, I decided to close any Bitcoin futures short position at the end of trading on Friday. That means that this weekend I closed my short on Friday at the worst possible point and missed a more than 1000 points decline over the weekend. However, I've resolved not to get into this trade now and just wait for the next long trade.

Not including this weekend's action the average return over the weekend in the last 15 months when my model was short was -0.2%, i.e. a loss. But this is a small loss and is statistically insignificant. The t-statistic to test that this mean is different to zero is -0.31 (p = 0.74). On the other hand, the average return over the weekend when long was 1.5%. And this return is highly statistically significant. The t-statistic is 2.33 (p = 0.026).

This explains why I was reluctant to be short over the weekend but not to be long over the weekend. On the other hand, the expected loss isn't much, so avoiding trading over the weekend when short is due to risk aversion. Especially as I can place an effective stop in our Plus 500 CFD account. If we go long there and are short futures we are effectively out of the market. But it's expensive to do so due to their spread and overnight financing charges, and they only allow me to trade a maximum of 6 Bitcoin. On the other hand, I am only shorting one futures contract (5 Bitcoin) at a time at the moment.

So, how did this weekend affect these results? The gain to being short over the weekend was 9.5%. The mean weekend short return is now 0.07% with a t-statistic of 0.11 (p = 0.91). So, that is even closer to zero. Someone who is risk averse would still stay out of the market as the expected return is insignificantly different to zero.

To deal with the frustration, I am just telling myself that there will be a better opportunity to go long the further the price falls :) In the longer term, I think I would be less concerned about this if I diversify trading to multiple markets.

Not including this weekend's action the average return over the weekend in the last 15 months when my model was short was -0.2%, i.e. a loss. But this is a small loss and is statistically insignificant. The t-statistic to test that this mean is different to zero is -0.31 (p = 0.74). On the other hand, the average return over the weekend when long was 1.5%. And this return is highly statistically significant. The t-statistic is 2.33 (p = 0.026).

This explains why I was reluctant to be short over the weekend but not to be long over the weekend. On the other hand, the expected loss isn't much, so avoiding trading over the weekend when short is due to risk aversion. Especially as I can place an effective stop in our Plus 500 CFD account. If we go long there and are short futures we are effectively out of the market. But it's expensive to do so due to their spread and overnight financing charges, and they only allow me to trade a maximum of 6 Bitcoin. On the other hand, I am only shorting one futures contract (5 Bitcoin) at a time at the moment.

So, how did this weekend affect these results? The gain to being short over the weekend was 9.5%. The mean weekend short return is now 0.07% with a t-statistic of 0.11 (p = 0.91). So, that is even closer to zero. Someone who is risk averse would still stay out of the market as the expected return is insignificantly different to zero.

To deal with the frustration, I am just telling myself that there will be a better opportunity to go long the further the price falls :) In the longer term, I think I would be less concerned about this if I diversify trading to multiple markets.

Sunday, July 14, 2019

Individual Investment Returns for June 2019

I finally got around to doing this analysis for June:

It's not as straightforward as my other reporting and probably takes 20 minutes or so to prepare. International stocks, gold, and Australian real estate did really well. Australian small cap did really badly. The Unisuper superannuation fund also performed very well. Bitcoin trading was the real star though. It's not looking good this month so far... USD corporate bond performance continues to improve as the portfolio matures.

It's not as straightforward as my other reporting and probably takes 20 minutes or so to prepare. International stocks, gold, and Australian real estate did really well. Australian small cap did really badly. The Unisuper superannuation fund also performed very well. Bitcoin trading was the real star though. It's not looking good this month so far... USD corporate bond performance continues to improve as the portfolio matures.

Friday, July 12, 2019

Distribution of Income and Wealth in Australia in 2017-18

The latest survey results have been released by ABS. To be in the top 1% in Australia you need to have a household net worth of about AUD 7.5 million (USD 5.25 million). We're in the top 4% according to the data. The mean household has a net worth of AUD 1.022 million and the median AUD 559k.

We're also in roughly the top 4% by household income if we'd earned 2018-19 income in 2017-18... Median household earns AUD 1,700 per week (AUD 88k per year) and mean 2,242 (AUD 117k). Of course, households with children average a lot more than this as the data include pensioners, students, singles etc. These data don't let you compute the income of the top 1% directly.

Wednesday, July 03, 2019

June 2019 Report

Because the financial year has just ended in Australia, this report has more estimated figures than normal. June was another positive month with big wins in Bitcoin and gold.

In June the Australian Dollar rose from USD 0.6930 to USD 0.7012. The MSCI World Index rose 6.59% and the S&P 500 7.05%. The ASX 200 rose 3.80%. All these are total returns including dividends. We gained 1.39% in Australian Dollar terms and 2.59% in US Dollar terms. The target portfolio gained 2.36% in Australian Dollar terms and the HFRI hedge fund index gained 2.60% in US Dollar terms. So, we under-performed all benchmarks apart from HFRI. On the other hand, all months since the end of November have had positive returns in Australian Dollar terms:

Here is a report on the performance of investments by asset class (futures includes managed futures and trading):

Things that worked very well this month:

- Trading Bitcoin. Trading profits for this month were greater than for all of 2018.

- Gold.

- Tribeca Global Resources and Cadence Capital. These are now two of my three worst investments in dollar terms. Both of these are trading a lot below NAV. Tribeca is actually doing fine but investors have sold it perhaps because of a misleading report from Morningstar.

We moved towards our new long-run asset allocation * as we began to shift out of bonds and moved the first money that orginally came from Chocolateland into our Australian bank account. Gold futures, and cash all increased. As predicted, last month was "peak bonds".

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- USD 130k of corporate bonds matured (Cigna) or we sold them after early redemptions were announced (CNO, HCA) and we bought USD 103k of USD bonds (Genworth, Goodyear, Xerox, and Avon Products). We also sold 2,000 CBAPH Commonwealth Bank hybrid securities.

- We traded successfully, as discussed above.

- I bought 5,000 shares of the IAU gold ETF.

- We bought 66,126 shares in Domacom (DCL.AX), a startup company that is enabling fractional ownership of residential property.

- I bought another 4,734 shares in Oceania Capital.

Wednesday, June 26, 2019

Adding Individual Stock Trading

My last post looked at my trading profit and loss from futures, ETFs, CFDs etc. But it didn't include individual stocks, which I traded a lot in the early years. So, I went into my data and tried to identify, which individual stocks were trades and which investments. It's not so easy to tell in some cases. However, anything I was generally short was clearly a trade as well as stocks I held for less than a month typically. So, the result is quite rough.

But the picture is clear. Adding individual stocks makes my trading history look much worse up to 2006:

I have now almost recouped all my previous trading losses in the last two years of trading. There are still a few days left to go and anything can happen, but this month is looking to be a record trading gain.

But the picture is clear. Adding individual stocks makes my trading history look much worse up to 2006:

I have now almost recouped all my previous trading losses in the last two years of trading. There are still a few days left to go and anything can happen, but this month is looking to be a record trading gain.

Sunday, June 23, 2019

Trading History

I was wondering how my trading performance looked over the long haul and put together this chart which is cumulative profits from trading futures, ETFs, options etc. Mostly, I haven't included individual company stocks. Up to 2002 I just lost money really. Then from 2006 to 2008 I started systematic trading and had ups and downs and mainly went sideways. But then as the financial crisis deepened things went off a cliff. After that, I didn't trade for a decade until last year. After and initial dip, I made money every month till October last year and then took a break from trading. This year, I came back with a new approach and so far are doing even better. I am now better than breakeven in the long run from trading. I would say that I am optimistic now rather than confident that this can be a long-run source of profits.

Tuesday, June 11, 2019

Only 40 Active Accounts Trading Bitcoin Futures?

According to this article, there are only 40 active accounts trading CME bitcoin futures. I can't read the whole article without paying for an expensive subscription, so I don't know their methodology. I am surprised by this as I have two accounts regularly trading bitcoin futures. I wonder if all accounts at a broker like Interactive Brokers are bundled into a single virtual account?

Thursday, May 30, 2019

Cancelled my Income Protection Insurance

Unisuper are raising the cost of income protection insurance by 43%. I can't see why I am paying for this insurance any more, and, so, I cancelled it. That's AUD 2,400 more a year that will be going into my superannuation account. I kept the death and disablement insurance as it costs much less, though I'm not 100% sure that I should be paying for that either. The death insurance pays out AUD 1/4 million and costs about AUD 50 a month.

Friday, May 24, 2019

May 2019 Report

In May the Australian Dollar fell from USD 0.7047 to USD 0.6930. The MSCI World Index fell 5.85% and the S&P 500 6.35%. The ASX 200 rose 1.96%. All these are total returns including dividends. We gained 0.37% in Australian Dollar terms and lost 1.30% in US Dollar terms. Our currency neutral rate of return was -0.53%. I estimate that the target portfolio gained 0.01% in Australian Dollar terms and the HFRI hedge fund index lost 1.75% in US Dollar terms. So, we under-performed the Australian stock market but outperformed our other benchmarks.

Here again is a detailed report on the performance of all investments:

The table also shows the shares of these investments in net worth. At the bottom of the table I also include the Australian Dollars return from foreign currency movements, other net investment gains and losses - net interest and fees, and futures trading. At the asset class level, private equity was the best performing asset class gaining 1.56%. The worst asset class was rest of the world stocks.

Things that worked very well this month:

We moved further away from our new long-run asset allocation * as we continued to accumulate bonds. But this is probably "peak bonds" in terms of their share in our portfolio, as we have finished moving money from my US bank account to Interactive Brokers:

Buying Australian Dollars is also on hold for a while as we bought a lot last month.

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

Here again is a detailed report on the performance of all investments:

Things that worked very well this month:

- Trading Bitcoin. The beginning of the month we made big profits and then towards the end of the month started losing.

- Medibank Private. We sold out of it in the post-election rally.

- Oceania Capital. They announced a buyback at a premium to the last share price prior to planned delisting. See below...

- Hearts and Minds. Continued to outperform the markets.

- Our corporate bond portfolio began to have net positive returns.

- Bluesky Alternatives. The parent company of the fund manager went bankrupt... See below...

- China Fund. Got hit by the trade war.

We moved further away from our new long-run asset allocation * as we continued to accumulate bonds. But this is probably "peak bonds" in terms of their share in our portfolio, as we have finished moving money from my US bank account to Interactive Brokers:

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- USD 50k of corporate bonds matured (General Motors) and I bought USD 147k of USD bonds (Tenet Health, Anglogold, Deutsche Bank, and Yum Brands).

- We traded successfully, as discussed above.

- We sold 3521 Medibank Private shares when the price spiked after the election. We now have no individual company stocks.

- I bought 25,000 BAF.AX shares following the manager BLA.AX being put into administration. The board of the LIC is trying to engage Wilson Asset Management as the new manager and I think the chances of that are now better. The discount to NAV is about 36%, so even if assets managed by BLA are liquidated, I think there is a margin of safety.

- I bought 8000 OCP.AX shares after the manager announced that they would delist and buy out minority shareholders. The announced buy out price of AUD 2.30 is much less than NAV of AUD 2.83 though higher than NTA of 1.50. So, I am still hoping that they will raise the buyout price. On the other hand, the largest shareholder owns 60% of the shares and so it seems that they can do anything they like. Only around 25% are held by non-insiders/managers. Even if they don't raise the price, it is about a 12% p.a. rate of return from my entry price to redemption.

- I bought 2000 shares of the IAU gold ETF.

- We applied for the Regal Funds IPO.

Tuesday, May 21, 2019

Asset Allocation at "Peak Bonds"

We don't include our house in the breakdown and there are also debts, particularly a margin loan and our mortgage. This is just the assets side of the picture.

Sunday, May 19, 2019

Weekend Trading

Bitcoin is again rising over this weekend, so far. I set a stop buy order in my CFD trading account, which allows me to trade Bitcoin 24/7 for 7700 and it has triggered. Bitcoin is around 8000 at the moment. This long position hedges my short futures position. It allows me to have a stop on my position over the weekend when the futures market is closed. I would have been better off and less anxious if instead I had closed the futures position at the close of trading on Saturday morning Australian time. I think that is what I will do in future.

Friday, May 17, 2019

Monday's Move in Bitcoin was a Huge Outlier

The weekend move in Bitcoin extended into Monday's trading and Bitcoin ended up rising 25%. You can see how much of an outlier that was on my daily trading return vs. volatility graph:

Since then, Bitcoin has gone into another consolidation range. This morning it looked like we might get stopped out of the long trade at the open, but the market bounced and we are still long from 5285.

P.S. 12:55pm

We just closed the long position and went short at 7715. Profit on the trade was USD 12.1k Of course, all this was done automatically via stop orders. 20 minutes later the short is up USD 5k. This is crazy price action.

Sunday, May 12, 2019

Bitcoin Going Completely Nuts Over the Weekend

I've noticed that in recent days Bitcoin has gone up starting at around 6pm US Eastern time when all stock markets in the World apart from New Zealand are closed. Of course, this is the afternoon and evening on the US West Coast. So, I figured that it was driven by retail investors in the U.S. Now this weekend, that trend has continued in dramatic fashion:

Bitcoin is up almost $700 on Friday's close. Luckily, I am long Bitcoin futures. It certainly makes me wary of ever being short Bitcoin over the weekend. Bitcoin has now popped up to be my 22nd best investment in dollar terms ever - I've been investing since 1996... Just about to overtake Pendal Property Investments. Anyway, anything could happen by 10am Monday Eastern Australia time when the futures market re-opens...

P.S.

Obvious solution to going short over the weekend is to have an account with a cash Bitcoin exchange that is open over the weekend and buy Bitcoin if the stop loss level is reached. What such exchanges allow stop orders?

P.P.S.

Bitcoin now up $1000 since Friday. If this persists till Monday it will be the biggest daily move in percentage terms in my dataset, possibly since the futures market open at the end of 2017. Plus 500 allows CFD trading 24/7. There are huge buy-sell spreads, so this would only be used as insurance. You can place conditional orders, such as buy only when the price reaches a certain level.

P.P.P.S.

I tried the demo platforms at Plus500 and eToro. eToro appears to be very limited and geared to novice traders. There were strong restrictions on the levels of orders that could be placed. So, Plus 500 seems to be the only real option that offers Bitcoin CFD trading 24/7.

Bitcoin is up almost $700 on Friday's close. Luckily, I am long Bitcoin futures. It certainly makes me wary of ever being short Bitcoin over the weekend. Bitcoin has now popped up to be my 22nd best investment in dollar terms ever - I've been investing since 1996... Just about to overtake Pendal Property Investments. Anyway, anything could happen by 10am Monday Eastern Australia time when the futures market re-opens...

P.S.

Obvious solution to going short over the weekend is to have an account with a cash Bitcoin exchange that is open over the weekend and buy Bitcoin if the stop loss level is reached. What such exchanges allow stop orders?

P.P.S.

Bitcoin now up $1000 since Friday. If this persists till Monday it will be the biggest daily move in percentage terms in my dataset, possibly since the futures market open at the end of 2017. Plus 500 allows CFD trading 24/7. There are huge buy-sell spreads, so this would only be used as insurance. You can place conditional orders, such as buy only when the price reaches a certain level.

P.P.P.S.

I tried the demo platforms at Plus500 and eToro. eToro appears to be very limited and geared to novice traders. There were strong restrictions on the levels of orders that could be placed. So, Plus 500 seems to be the only real option that offers Bitcoin CFD trading 24/7.

Wednesday, May 08, 2019

More Asymmetry

A couple of days ago I posted about the asymmetry of market returns capture by the target portfolio. The portfolio captured less than 100% of the upside in the markets but almost none of the downside. The chart below, inspired by a recent paper from AQR, shows the Bitcoin trading model's daily returns compared to the absolute percentage change in the price of Bitcoin futures for that day:

The rising diagonal line are all the days when the model was properly aligned with market direction. The descending diagonal line are all the days where it was incorrectly aligned with market direction. The remaining cloud of points is where the model changed direction. Some of those days were winners and some very bad losers when the model ended up incorrectly with the market in both directions that day. For example, it was stopped out of a long position and entered a short and then the market rose for the rest of the day...

The fitted quadratic curve shows that for low absolute price changes up or down in the price of Bitcoin, the model tends to lose money. This is because of "whipsaw". There is a strong asymmetry in the response for large moves and so the fitted curve shows that the model captures increasingly more of the return the larger the move.

The results do conform to AQR's argument that returns to trend-following have been poor recently because markets haven't been moving enough.

The rising diagonal line are all the days when the model was properly aligned with market direction. The descending diagonal line are all the days where it was incorrectly aligned with market direction. The remaining cloud of points is where the model changed direction. Some of those days were winners and some very bad losers when the model ended up incorrectly with the market in both directions that day. For example, it was stopped out of a long position and entered a short and then the market rose for the rest of the day...

The fitted quadratic curve shows that for low absolute price changes up or down in the price of Bitcoin, the model tends to lose money. This is because of "whipsaw". There is a strong asymmetry in the response for large moves and so the fitted curve shows that the model captures increasingly more of the return the larger the move.

The results do conform to AQR's argument that returns to trend-following have been poor recently because markets haven't been moving enough.

Tuesday, May 07, 2019

Varying Position Size Still Doesn't Make Sense

Last year, I posted that increasing trading position size when volatility is lower didn't make sense for my trading system. When the volatility was low trades tended to lose more and win less. So, trading bigger because risk was supposedly lower didn't pay off.

Now I am using a more traditional trading system that wins by letting winners run and cutting losses short, without pretending to predict the direction of the market. Here, I have found that there is no correlation between the profit from trades and the maximum loss possible given the initial stop loss:

The chart shows all the trades in Bitcoin futures my system would have made in the last year The x-axis shows the maximum loss on the trade of one contract (assuming we can exit at the stop loss, i.e. no Black Swans). The y-axis shows the profit for the trade. There is a slightly positive correlation, though it is not statistically significant. On the other hand, you can see that realized losses do increase with increased initial risk. The system won 46% of the time with the average win 4.1 times bigger than the average loss. The average trade lasted 5 days.

If you adjust position size so that the initial risk of each trade is the same, returns do increase, but so does the maximum drawdown. If you scale back the average size of trades so that the maximum drawdown in percentage terms is the same as for trading with the same number of contracts each time, then returns turn out to be very similar for both strategies.

Bottom line is that varying position size increases returns but also drawdowns by a similar amount. If you care about drawdowns it doesn't help. So, I think I will focus on controlling drawdowns when choosing position size rather than equalizing initial risk.

Now I am using a more traditional trading system that wins by letting winners run and cutting losses short, without pretending to predict the direction of the market. Here, I have found that there is no correlation between the profit from trades and the maximum loss possible given the initial stop loss:

The chart shows all the trades in Bitcoin futures my system would have made in the last year The x-axis shows the maximum loss on the trade of one contract (assuming we can exit at the stop loss, i.e. no Black Swans). The y-axis shows the profit for the trade. There is a slightly positive correlation, though it is not statistically significant. On the other hand, you can see that realized losses do increase with increased initial risk. The system won 46% of the time with the average win 4.1 times bigger than the average loss. The average trade lasted 5 days.

If you adjust position size so that the initial risk of each trade is the same, returns do increase, but so does the maximum drawdown. If you scale back the average size of trades so that the maximum drawdown in percentage terms is the same as for trading with the same number of contracts each time, then returns turn out to be very similar for both strategies.

Bottom line is that varying position size increases returns but also drawdowns by a similar amount. If you care about drawdowns it doesn't help. So, I think I will focus on controlling drawdowns when choosing position size rather than equalizing initial risk.

Sunday, May 05, 2019

Target Portfolio vs. the MSCI World Index

The graph shows monthly returns for the target portfolio vs. the MSCI World Index in Australian Dollar terms. The linear fit shows a beta of about 0.3 – if the market rises 1% more , the portfolio tends to rise 0.3%. Alpha is at around 8% per year. The orange line is a quadratic fit. This suggests that beta increases, the more the market rises, while for large down moves beta is zero. This is the kind of asymmetric relationship you want to get.

Margin Requirements for Bitcoin Futures Trading

I just discovered that while going long a Bitcoin futures contract requires margin of about USD 16843.75

per contract, going short requires initial margin of USD 200k at Interactive Brokers. Do they really think that Bitcoin could rise by a factor of 7-8x when the market is closed?* This makes it much harder for people to go short and contributes to the inefficiency of this market. Importantly there are no options on these futures, so you can't hedge against large adverse movements. I can't see anything about this asymmetry in margin on the CME site, so I assume that it is set by the broker.

* Stops will only work when the market is open. The Globex futures market is open 23/5 - closed one hour each day and over the weekend.

* Stops will only work when the market is open. The Globex futures market is open 23/5 - closed one hour each day and over the weekend.

Friday, May 03, 2019

April 2019 Report

In April the Australian Dollar fell from USD 0.7096 to USD 0.7047. The MSCI World Index rose 3.18% and the S&P 500 3.72%. The ASX 200 rose 3.36%. All these are total returns including dividends. We gained 0.95% in Australian Dollar terms and 0.26% in US Dollar terms. Our currency neutral rate of return was 0.91%. The target portfolio gained 2.37% in Australian Dollar terms and the HFRI hedge fund index 1.57% in US Dollar terms. So, we under-performed our benchmarks.

Here again is a detailed report on the performance of all investments:

The table also shows the shares of these investments in net worth. At the bottom of the table I also include the Australian Dollars return from foreign currency movements, other net investment gains and losses - net interest and fees, and trading Bitcoin futures. Trading income was USD 733 for the month, which at an annualized rate was roughly a 7.3% rate of return on capital. At the asset class level, only real estate lost money this month. Australian small cap stocks were the best performing asset class.

Things that worked very well this month:

The main driver is continued movement of cash from my US bank account to Interactive Brokers where I am buying bonds before eventually transferring some of the money to our Australian bank accounts when the broker allows..... At the end of the month we bought 1/4 million Australian Dollars by transferring money from Falafeland. This means that we will buy new US bonds for a few months as the current ones mature rather than changing the proceeds into AUD immediately as the plan is to buy about AUD 50k per month. After the month end, I immediately made an AUD 90k non-concessional (after tax) contribution to superannuation. As I plan to roll over my retail super fund into a self-managed super fund after the start of the new financial year in July, I invested the money in the CFS Wholesale Conservative Fund.

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

Here again is a detailed report on the performance of all investments:

Things that worked very well this month:

- 3i, the UK private equity firm, and Generation Global shined. A few other funds beat the index. Tribeca bounced back from underperformance.

- Cadence and Bluesky sucked. Cadence went ex dividend and I couldn't be bothered to account for this properly in my accounts, so it will do better next month when I receive the dividend. However, it fell by more than the dividend and falling in an up-market is not good. I'm still willing to give them the benefit of the doubt that they will come back again. Bluesky was probably affected by troubles at the manager, also known as Bluesky, and lack of certainty about Wilson Asset Management taking over as the new manager.

- I continue to be impressed by PSS(AP), where we are now in the balanced fund.

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- USD 69k of corporate bonds matured (Royal Bank of Canada) or were called (Goldman Sachs) and I bought USD 275k of USD bonds (Tokio Marine, Anglogold, General Motors, CNO, Scorpio Tankers, Woolworths, Safeway, and Hertz). There is still more than USD 100k to convert into bonds. I also bought 245 more shares (net) of CBAPH - Commonwealth Bank hybrid securities.

- I did some unsuccessful trading of gold futures and then bought 1000 more (net) shares of IAU - a gold ETF.

- I did some successful trading of Bitcoin futures.

- I sold my remaining shares in PIXX.AX and bought a small amount of OCP.AX at $1.98 a share.

Subscribe to:

Posts (Atom)