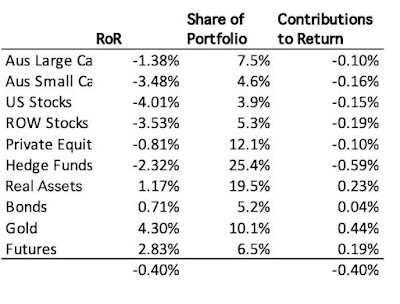

To better understand our investment underperformance in 2023 let's dive into the returns on each individual investment. If we'd managed to avoid all the losing investments in the table we would have roughly matched the return on the target portfolio. So, as usual it is the losers which hurt. In particular, the Cadence, Cadence Opportunities, and Tribeca listed hedge funds all did poorly. The worst of all though was the Aura VF2 venture capital fund. One of their companies - Lygon - went bankrupt and was then restructured. Once you are in a venture fund you can't really get out and I invested in this fund because VF1 has done well over time.

When I reviewed the hedge fund investments two years ago, these funds were all doing well. I did mention that I wanted to reduce exposure to Cadence Capital, which I failed to do. Tribeca has turned out to be a very volatile investment. Sometimes they have big wins and some times big losses. I failed to get out when it traded above NAV at about the time of the review. I thought then they had reformed, but apparently not.

The other two main losers are Domacom and the China Fund. I really should have gotten out of Domacom when it relisted on the ASX. Now it does look like they will turn things around, but dilution from new investors means we might never make any money. There's no real excuse for remaining in the China Fund, as I have been bearish on the long-term prospects of China under Xi Jinping. It is hard to explain.

On the other hand, I lost on the TIAA Real Estate Fund, but correctly reduced my exposure. Not by enough. My gains in the CREF Social Choice Fund just balanced my losses in the Real Estate Fund in 2023.

I have much less to say about the winners. 3i and Pershing Square Holdings have turned into big winners. I could have done even better on 3i if I had not sold 20% of the position. Half of the fund is in one company - Action - which made me a bit nervous. Gold did well and the other two big winners are our employer superannuation funds. With gold, these are our three biggest investments. Pershing Square is now our fourth biggest investment.