So I met with the health insurance representative on Friday and she will send me quotes next week for various plans. With a basic plan we will save money compared to the Medicare surcharge. At our income level the Medicare surcharge is 1.25% of income which would be about $3,125 per year. The basic insurance package for our couple would be about $2,200 per year. But there are lots of "extras" you can add on. A complicated topic is the Lifetime Health Cover policy. This was introduced in 2000 by the Australian government and is meant to encourage people to take out private health insurance at a young age to avoid the adverse selection problem. It means that the cost of your insurance premium rises by 2 percentage points for each year you are over 30 years old after 2000.... For me this means that as I had my 30th birthday in 1994, the penalty only started accruing after 2000 (I think). But then I was in the US for many years. Those years don't count towards the penalty. So, I figure the penalty for me is 12%. For immigrants the penalty only starts to be incurred from after they become eligible for Medicare (and are older than 30). So for Snork Maiden I reckon her penalty is 6%. Therefore, our combined penalty is 9%. The government also offers a tax rebate for having private health insurance. At our income level this is 10%. So the penalty and the rebate should roughly cancel out and can be ignored when looking at the costs of the different policies.

Explanation for non-Australians - Australia has somewhat free public health care but their are tax incentives to get private health insurance. There is a surcharge which is 1-1.5% of your total income when your household income exceeds a certain level and you don't have insurance and there is a tax credit of 0-30% of the cost of health insurance, which is higher at lower income levels. There are also penalties for delaying getting health insurance after age 30 which are applied for the first ten years after you first buy private health insurance.

Saturday, July 27, 2013

Thursday, July 25, 2013

Excess Superannuation Contributions

I just saw this on the Colonial First State website:

"More generous rules for excess contributions:

In the past, if you went over your concessional contribution cap accidentally or otherwise, you’d be penalised effectively by having to pay the highest tax rate on the excess amount. But from

1 July 2013, you pay tax at your normal marginal tax rate on any excess concessional contributions, plus an interest charge. You'll also have the ability to withdraw up to 85% of any excess concessional contribution made. Note that this does not apply to contributions you have made in excess of the concessional cap before 1 July 2013."

I had heard there would be some change to the excess contributions regime but didn't know the details. But this is pretty unclear. Looking at the ATO website they don't have any clear information available yet on exactly how it would work. It looks like you can pay the extra tax at your own marginal rate and leave the money in the fund. The longer you wait to pay the excess tax, the more interest you will pay. But the ATO also says that "you will be liable for the excess concessional contributions charge." It doesn't say how much that will be - or perhaps that is the interest that the other articles I found mention.

I am stuck making excess contributions (more than $25k currently) because the universities' superannuation scheme has employers contributing 17% of your salary to the fund. And, no, you can't get them to reduce it or pay part of it as a "non-concessional contribution". At least the excess for me is less than $1000. In Snork Maiden's case I just realised that after the latest round of pay increases she will now be over the cap. We have been contributing $400 every two weeks as a "salary sacrifice" contribution on top of the employer contribution of 15.4%. We'll reduce this to $350.

"More generous rules for excess contributions:

In the past, if you went over your concessional contribution cap accidentally or otherwise, you’d be penalised effectively by having to pay the highest tax rate on the excess amount. But from

1 July 2013, you pay tax at your normal marginal tax rate on any excess concessional contributions, plus an interest charge. You'll also have the ability to withdraw up to 85% of any excess concessional contribution made. Note that this does not apply to contributions you have made in excess of the concessional cap before 1 July 2013."

I had heard there would be some change to the excess contributions regime but didn't know the details. But this is pretty unclear. Looking at the ATO website they don't have any clear information available yet on exactly how it would work. It looks like you can pay the extra tax at your own marginal rate and leave the money in the fund. The longer you wait to pay the excess tax, the more interest you will pay. But the ATO also says that "you will be liable for the excess concessional contributions charge." It doesn't say how much that will be - or perhaps that is the interest that the other articles I found mention.

I am stuck making excess contributions (more than $25k currently) because the universities' superannuation scheme has employers contributing 17% of your salary to the fund. And, no, you can't get them to reduce it or pay part of it as a "non-concessional contribution". At least the excess for me is less than $1000. In Snork Maiden's case I just realised that after the latest round of pay increases she will now be over the cap. We have been contributing $400 every two weeks as a "salary sacrifice" contribution on top of the employer contribution of 15.4%. We'll reduce this to $350.

Blog List

I finally upgrade Moomin Valley to a new Blogger template but in the process lost my previous blog list. A lot of the links were dead anyway. I've added a few back. If you would like your personal finance or investment blog added, let me know and if I like it, I'll add it. I'm more interested in the investing/business direction and less in frugality/getting out of debt.

Also, what's up with the NetWorthIQ badges? I re-added the code to the blog but nothing shows up :( If you know a hack, please let me know too.

Also, what's up with the NetWorthIQ badges? I re-added the code to the blog but nothing shows up :( If you know a hack, please let me know too.

Wednesday, July 24, 2013

Houses, Shares, Taxes Again

OK, so now we are not renting a house. We looked at four. Two were acceptable. But now Snork Maiden's mom says that she won't visit Australia till we buy a house and so we'll stay put for the moment. There aren't a lot of interesting houses on the market at the moment at this time of year.

I completed the four share purchases with shares in CAM.AX and IPE.AX.

Enoughwealth sent me a useable copy of the Australian tax form. It combines all three regular tax forms (the main form, the supplementary form, and the business items form) into one and unlike other Australian tax forms it isn't very colorful and instead of having separate boxes for each letter or number it has freeform entry boxes - compare to the sample individual tax return. But all the items and labels are exactly the same. It's weird, but I don't see why not to use it.

Monday, July 22, 2013

Houses, Shares, Taxes...

After looking at another couple of houses at the weekend and not agreeing on which we preferred we have changed direction and are now looking to rent a house or townhouse as a midway step to buying a house. Snork Maiden's mom is probably coming to visit for a while (months) and though we previously reorganized this apartment to accommodate her and her now deceased husband we aren't prepared to do that this time. We are much better off now and so have other alternatives. One option would be to rent her a furnished apartment nearby, but she's not keen on that... So we have four houses lined up to look at in the next three days. Rents range from $A570 to $A650 per week compared to $A490 in our current apartment. One ($A650) is actually nearer to the city centre, the others a little further out. One house is almost identical to another we looked at to buy a few doors down. Snork Maiden didn't like the small garden or lack of trees in the (new) neighborhood. But if we're not buying permanently...

I also just put in four orders to buy shares in listed funds here in Australia. Two have already executed (OCP.AX and AOD.AX). My margin loan was down to only $A15k. But if we are not likely to buy a house very soon then I don't need the extra borrowing capacity. We are still keeping a huge amount of cash on hand. You never know when the ideal property would show up. If we rent a house though it would be a 12 month lease. You can get out of that but it could be costly. With high occupancy rates still, it shouldn't be too hard to find someone else to rent in these locations.

The financial year here in Australia ends 30th of June so we are again in the run-up to filing tax returns (deadline 31 October). I've done a preliminary assessment and both of us probably owe more tax. For me it is over $1,000. This is going to mean that I will need to pay quarterly taxes in future :( The reason it is so high is that as we still don't have private health insurance I need to pay 1% of my income as the Medicare surcharge. On top of that my interest earnings are more than $3k due to our house-buying cash stockpile. On Friday I'm meeting a health insurance salesperson (sorry, consultant) who is offering a lower corporate health insurance rate. So, hopefully in future I can avoid the quarterly tax payments. It's also an incentive to increasing the margin loan again. I tried to do Snork Maiden's taxes using the ATO's E-Tax software now that they have a Mac version. It was a frustrating experience and I gave up. Crazily, you can't download a pdf of the main tax form! Only a sample copy. You have to get a hardcopy from the ATO in the mail or from their "shopfront". What I would really like is a web-based tax form that I can just fill numbers into without dealing with all the silly questions in E-Tax, or a typable pdf. I am going to get a hardcopy and again submit paper tax returns until they get the system more user friendly.

I also just put in four orders to buy shares in listed funds here in Australia. Two have already executed (OCP.AX and AOD.AX). My margin loan was down to only $A15k. But if we are not likely to buy a house very soon then I don't need the extra borrowing capacity. We are still keeping a huge amount of cash on hand. You never know when the ideal property would show up. If we rent a house though it would be a 12 month lease. You can get out of that but it could be costly. With high occupancy rates still, it shouldn't be too hard to find someone else to rent in these locations.

The financial year here in Australia ends 30th of June so we are again in the run-up to filing tax returns (deadline 31 October). I've done a preliminary assessment and both of us probably owe more tax. For me it is over $1,000. This is going to mean that I will need to pay quarterly taxes in future :( The reason it is so high is that as we still don't have private health insurance I need to pay 1% of my income as the Medicare surcharge. On top of that my interest earnings are more than $3k due to our house-buying cash stockpile. On Friday I'm meeting a health insurance salesperson (sorry, consultant) who is offering a lower corporate health insurance rate. So, hopefully in future I can avoid the quarterly tax payments. It's also an incentive to increasing the margin loan again. I tried to do Snork Maiden's taxes using the ATO's E-Tax software now that they have a Mac version. It was a frustrating experience and I gave up. Crazily, you can't download a pdf of the main tax form! Only a sample copy. You have to get a hardcopy from the ATO in the mail or from their "shopfront". What I would really like is a web-based tax form that I can just fill numbers into without dealing with all the silly questions in E-Tax, or a typable pdf. I am going to get a hardcopy and again submit paper tax returns until they get the system more user friendly.

Sunday, July 14, 2013

Moominvalley June 2013 Report

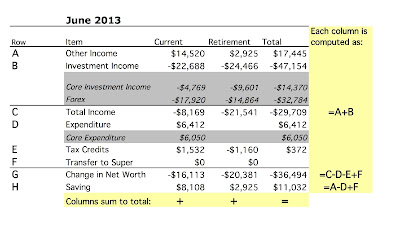

Finally back in Australia after another long trip to Europe, Asia, and Africa. This month's accounts in US Dollars, as usual:

Unlike last month we managed to save some money this month ($8,108 from current non-investment income) but still spent $6,412, which isn't too bad given all the travelling. There will probably be a similar level of spending in July too.

The Australian Dollar fell sharply this month resulting in investment returns in US Dollar terms of -5.46% but in Australian Dollar terms of -0.94%. As a result net worth fell $US36k but rose $3k in Australian Dollar terms to $A901k.

Unlike last month we managed to save some money this month ($8,108 from current non-investment income) but still spent $6,412, which isn't too bad given all the travelling. There will probably be a similar level of spending in July too.

The Australian Dollar fell sharply this month resulting in investment returns in US Dollar terms of -5.46% but in Australian Dollar terms of -0.94%. As a result net worth fell $US36k but rose $3k in Australian Dollar terms to $A901k.

Subscribe to:

Posts (Atom)