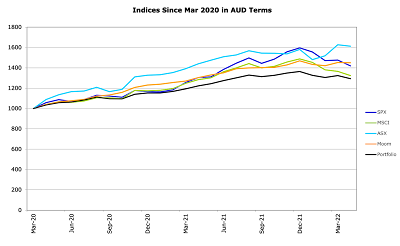

World markets fell sharply with the MSCI World Index (USD gross) falling by 7.97%, the S&P 500 falling 8.72%, and the ASX 200 falling 0.85%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7494 to USD 0.7114 increasing Australian Dollar returns and reducing USD returns. We lost only 0.16% in Australian Dollar terms but lost 5.23% in US Dollar terms. The target portfolio lost by 2.34% in Australian Dollar terms and the HFRI hedge fund index is lost 0.93% in US Dollar terms. So, we out-performed all benchmarks apart from the HFRI index. I felt like I was losing a lot of money, but in Australian Dollar terms it wasn't that bad.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

In a reversal of last month real assets, gold, and futures gained money, while other asset classes lost. Real assets were negatively affected by the URF debacle. Rest of the world stocks were negatively affected by the China Fund. Gold rose in Australian Dollar terms, though the USD price fell. US stocks performed worst and detracted from performance most, while gold performed best and contributed most to performance.

Things that worked well this month:

- Gold gained AUD 21k, Winton Global Alpha 10k, Tribeca Global Resources (TGF.AX) 11k, and Aspect Diversified Futures 8k.

What really didn't work:

- Pershing Square Holdings (-22k), Australian Dollar Futures (-17k), and Hearts and Minds (HM1.AX, -11k) all lost more than AUD 10k.

Our SMSF continues to perform quite well compared to our employer superannuation funds:

They're all indexed to 1000 in April 2021.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We are basically performing a bit worse than the average hedge fund levered 1.67 times. Hedge funds have been doing well recently.

I adjusted the leverage on the URF.AX investment to roughly 3:1 in our gross asset allocation as there still seems some possibility that the wind-up deal will be voted down by the shareholders.

We moved a little bit nearer to our target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month. It was a busy month.

- I invested in the Unpopular Ventures rolling fund on the AngelList platform. The initial investment is USD 10k and then the same amount each quarter for eight quarters.

- Our listed investments trusts are now all in a CommSec account within

the SMSF, which means I get accurate tax reporting and can subscribe to

dividend reinvestment, which I did.

- I sold 10k shares in Pengana Private Equity (PE1.AX). These were shares in my name that I held to get accurate tax reporting, which I don't need any more. I sold at AUD 1.69 and the price is now AUD 1.49. So, that was a good move.

- I sold AUD 30k for USD and bought one more AUD futures contract, increasing AUD exposure by about 100k, which was a mistake.

- I withdrew AUD 25k from Domacom Investments after two crowdfunding campaigns just vaporized.

- But I started accumulating units in another property at

Domacom. It is a market garden property near the planned Badgery's Creek

Airport. 60 Devonshire Road, Rossmore.

- I bought 12.5k WAM Leaders shares (WLE.AX).

- I invested AUD 10k in the Winton Global Alpha Fund, which has been doing well recently, for a change as I predicted. Seems futures work well in inflationary environments but not in low inflation environments. I based this opinion on this research.

- I invested AUD 10k in the Australian Unity Diversified Property Fund.

- I bought AUD 7k shares in Pendal as a merger arbitrage play.

- I invested in a new painting at Masterworks: "No Hopeless". I felt this might be over-valued but took the plunge anyway.