Treasury (TWE.AX) rose sharply today with no announcement from the company or news in the media. At one point it was up 9%. This was on a day when the market was sharply down. It closed up 5.92%. I added to my position on the basis that my thesis was working out and that this spike would be continued.

Thursday, January 28, 2021

Monday, January 25, 2021

Incentives for Charitable Giving in Australia

As there is no estate or inheritance tax in Australia, I think it makes much more sense to give money to charity while you are alive rather than in your will. If I give money in my will, my children will have less but no tax benefit from giving money. If I give while I am alive then I can claim a tax deduction. Or am I wrong?

P.S. 6 February

I thought of an alternative approach. You can write in your will that your children need to make contributions to charity from the money they receive. That way they can take tax deductions instead. The advantage of this is that if you are unsure if you will run out of money in retirement you can direct your children to make donations if you didn't run out of money. The downside is that they may not follow your directions. Maybe there is some trust structure that enforces this. Also, you don't get to see the benefits of your donations.

Saturday, January 23, 2021

Started SMSF Process

I made it my new year resolution to finally set up an SMSF. This is the next step in our financial restructuring process. The final step will be estate planning. The idea is to put relatively high tax investments into the SMSF. Also, we will put direct holdings of US stocks into the fund, so that they aren't part of our estate. Yes, there is a tax treaty between Australia and the US, which would mean that we wouldn't pay any tax at the moment. But it is likely that the threshold for inheritance tax in the US will be reduced under the Democrats and there is still paperwork to do.

I have now started the process with SuperGuardian who seem to provide a lot of service with a lot of flexibility and have very good recommendations. All I've done so far is send in the client engagement form. The decisions I made so far are to use a corporate trustee and to use a Macquarie CMA as the fund's bank account. Apparently, one third of SMSFs use a Macquarie CMA and SuperGuardian's representative said a lot of their clients do too. A corporate trustee is a little more complicated and expensive in the short run, but seems more sensible in the long run. An SMSF with only individual trustees must have at least two trustees, while the corporate trustee can have a single director. As I am 11 years older than Moominmama, it's likely that she will end up being the only trustee/director unless we bring our children into the fund, or she involves at outside person as an additional trustee. She would also have to deal with all that and she currently isn't at all interested in any of this financial stuff.

Thursday, January 21, 2021

January 2021 Report

The

rallies in the Australian Dollar and the stock markets continued this

month. The Australian Dollar fell from USD 0.7725 to USD 0.7663. The

MSCI World Index fell 0.43% and the S&P 500 by 1.01%, but the ASX 200

rose 0.93%. All these are total returns including dividends. We gained 0.59% in Australian Dollar terms or -0.22% in US Dollar terms.

The target portfolio is expected to have lost 0.09% in Australian

Dollar terms and the HFRI hedge fund index is expected to lose 0.24% in

US Dollar terms. So, we outperformed all benchmarks apart from the ASX 200.

- Tribeca was the best performer in dollar terms. Treasury Wine was maybe the best in percentage terms.

- Pershing Square Holdings was the worst performer, giving back AUD 11k of gains. Gold was second worst, losing AUD 9k.

- I invested USD 10k in another painting with Masterworks.

- USD 50k of HSBC bonds matured.

- The remaining USD 3.75k of General Finance baby bonds were called.

- I sold 2000 shares of the Boulder Income Fund (BIF) closing our position and buying 100 shares of Berkshire Hathaway (BRK/B) instead.

- I also closed our position in Pendal Property Securities and switched the funds to Generation Global. Both are funds offered by Colonial First State.

- To then rebalance a bit towards real estate I bought 50,000 shares of URF.AX.

- As part of a long term plan to not hold US stocks directly, I reorganized my holdings in my Interactive Brokers and CommSec brokerage accounts. In the end, the CommSec account ended up holding gold (PMGOLD), unlisted funds from Colonial First State and Macquarie, and small positions in each of our listed Australian funds. The latter are so we get the correct tax information from the share registries as IB isn't strong on this. My main holdings of these funds are now at IB, which has a much lower borrowing rate. IB has all my other stock positions in Australian, UK, and US markets. The latter will eventually move to the new SMSF. There are also some bond positions there which we will hold to maturity.

Wednesday, January 20, 2021

Berkshire Hathaway

I sold 2000 shares of the Boulder Income Fund (BIF) closing our position and bought 100 shares of Berkshire Hathaway (BRK/B) instead. Berkshire is BIF's largest holding and seems to recently be outperforming BIF. Additionally, it doesn't pay dividends and so is more tax effective. Berkshire has a relatively low valuation by several metrics compared to the US stock market in general. I think the company could become much more valuable after Buffett steps down as CEO as I expect the future managers will break it up. The position is quite small (less than 1%) as our whole target US stock allocation is only 5% of net worth.

I have held Berkshire in the past, a long time ago.

Saturday, January 09, 2021

Hedge Funds Beat the S&P 500 in December

It's rare to see hedge funds beating the major stock indices to the upside these days, but that's what happened in December when the HFRI returned 4.47% and the S&P 500 3.84%. The MSCI World Index gained 4.68%. As a result our target portfolio actually returned 6.13% in US Dollar terms, though we still beat it, gaining 7.21%. In Australian Dollar terms it gained 1.26% rather than just breaking even as I reported a few days ago.

Contributions of Individual Investments 2020

As promised, here are the contributions of each of 62 investments to our annual investment return. Of course, these numbers (in Australian Dollars) depend on the size of each investment and I don't make any attempt to work out or compile the annual rate of return on all these investments (I do compute it for some).

Compared to last year, gold again is a top contributor and Hearts and Minds and Pershing Square Holdings are gain near the top. Cadence Capital had a turn around this year for the positive and Platinum Capital for the negative. The large super funds did OK but last year they were the two top contributors.

There were two big disasters this year. Winton Global ALpha had a terrible performance losing 18% and Virgin Australia bonds were almost totally wiped out in the airline's bankruptcy.

The total number of investments was smaller this year as we gradually ran off our individual bond holdings and traded much less.

Tuesday, January 05, 2021

Annual Report 2020

The main financial themes of this year for us was continuing to invest the money we inherited in late 2018 and surprisingly strong investment returns for the year after the sharp fall in markets in March due to the COVID-19 pandemic. In my academic career I was also surprisingly productive in the second half of the year following the struggle of dealing with closed schools and our move to online teaching in the first half of the year. We spent less for the year overall because of a reduction in spending during the lockdown and no travel. Our house fell in value, which was against the trend in the Australian housing market.

Investment Returns

In Australian Dollar terms we gained 11.9% for the year and in USD terms we gained 23.2% because the Australian Dollar gained 10%. The MSCI gained 16.8% in USD terms and the ASX 200 only 2.6% in AUD terms. The HFRI hedge fund index gained 8.9% in USD terms. Our target portfolio is expected to gain 6.8%. So, we beat all benchmarks this year.

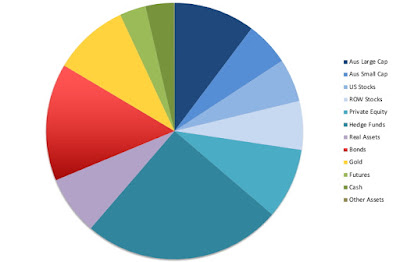

The main changes in allocation over the year was that we ran down our bonds allocation while increasing hedge funds, private equity, and gold mostly:

Accounts

Here are our annual accounts in Australian Dollars:

We earned $128k after tax in salary, business related refunds, medical payment refunds, tax refunds etc. This was down 13% on 2019 because Moominmama worked less and we had large tax bills due to investment income (investment income is reported pre-tax). We earned (pre-tax including unrealized capital gains) $370k on non-retirement account investments. The latter number was up on from last year. The former number continued its decline. The investment numbers suffered from the rise in the Australian Dollar ($67k in "forex" loss). Total current income was $498k. Not including mortgage interest we spent $121k. Total spending was down 18% on 2019 due to reclassifying mortgage interest as an investment cost since we paid off and redrew the mortgage and reduced spending due to the pandemic. Not counting mortgage interest, spending was down 9%.

$10k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. We transferred $45k into retirement accounts from existing savings in "non-concessional (after tax) contributions. I list $2.4k of "inheritance". This is mostly due to adding the value of a painting I inherited, which I already had but hadn't included in net worth. The only other "things" included in our net worth are our car, a gold coin, and our house.

The change in current net worth, was therefore $324k. Looking at just saving from non-investment income, we dissaved $37k. So, before the transfer to retirement accounts we saved about $8k from salaries etc.

The retirement account is a bit simpler. We made $44k in pre-tax contributions (after the 15% contribution tax) and made an estimated $65k in pre-tax returns, which was strongly down on 2019. $8k in "tax credits" is an adjustment needed to get from the number I calculate as a pre-tax return to the after tax number. Taxes on returns are just estimated because all we get to see are the after tax returns. I do this exercise to make retirement and non-retirement returns comparable. Net worth of retirement accounts increased by $146k.

Finally, the housing account. I estimate that our house lost $34k in value. As our mortgage is now included in the current investment account there are no other entries in the housing account now.

Total net worth increased by $436k, which was up 12% on last year. $51k of this was from saving from non-investment sources, up 7% on last year. Thanks to employer superannuation contributions this was 30% of our total after tax non-investment income. Including investment gains our savings rate was 78% of our comprehensive after-tax income.

How Does This Compare to My Projection for This Year?

At the beginning of the year, I projected a gain in net worth of $425k, which turned out to be almost exactly correct. The baseline projection in my spreadsheet for 2021 is for a very high 19% rate of return, a 6% increase in spending, and flat other income, leading to an $800k increase in net worth to around $5.7 million. A more sensible projection would be for another $400k increase to around $5.3 million. Of course, anything could happen.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then the other two are fairly self-explanatory. However, property taxes etc. are included in the current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells that might again be used in the future.

Closing Plus 500 Account

I opened a CFD trading account with Plus 500 in Moominmama's name in order to hedge Bitcoin trades over the weekend and do other trading experiments with small position sizes. I no longer need the account and they are charging monthly inactivity fees. So, I tried to withdraw the cash in the account. But they wouldn't transfer the money to our joint Commonwealth Bank account. They also refused to transfer the money to Moominmama's Interactive Brokers account, even though it has a BSB and bank account number. So, I opened a new bank account in her name at HSBC. But now we have to wait a month to get a statement that would be acceptable to Plus 500... To be continued

Aura Venture Fund II Still Accepting New Investors

Recently, I invested in the Aura Venture Fund II. There was a "first close" but the fund is still accepting new investors before a final close. From my experience with Aura Venture Fund I, these later investors will need to pay interest together with their initial investment to account for possibly benefiting from the funds initial investments that were made before they joined. You can get more information about the fund here. Usually, you will need to be qualified as a wholesale investor and the minimum investment is likely AUD 250k. Note that you will only need to invest a fraction of that at first with capital calls then spread over the life of the fund. My initial investment was AUD 62.5k.

My IRR on VF I is 27% so far, but of course there is no guarantee that the new fund will perform as well or that the final IRR will be that high for VF I when all investments are wound up. A big advantage is that the tax rate for Australian investors on early stage venture capital investments is negative. There is a 10% offset on your investments and zero capital gains or income tax. Also, investment in the fund may make a foreign investor eligible for an investor visa to immigrate to Australia.

Monday, January 04, 2021

December 2020 Report

- Our house - we might change the value based on local sales up to a year after the month end! We will stick with last year's value until there is another local sale. Our house isn't included in the calculation of the rate of return, though, only in our net worth calculation.

- Aura VF1 - reports every 2 months and more than a month after the end of the month, I am using the IRR so far to project the return.

- Aura VF2- reports every 2 months and more than a month after the end of the month. For the moment we will stick with the IPO price.

- Winton Global Alpha - lag is only 2-3 days.

- Cadence Opportunities - not sure how long the lag will be. I am using the historic alpha and beta to compute an expected return.

- APSEC - seems to be 2-3 weeks after month end. I am using the expected HFRI return to project the return.

- Masterworks - none of my paintings is yet tradable in the secondary market, so we are just using the IPO price.

- Pretty much everything! But gold was the strongest performer in dollar terms, gaining AUD 28k.

- URF.AX which invests in residential property in New York and New Jersey lost most – AUD 3.5k. Hearts and Minds (HM1.AX) had its first decline since March, losing AUD 1.3k. That's after gaining AUD 95k since the March low!

- I rebalanced my US 403b retirement account to 50% in the TIAA Real Estate Fund (direct real estate) and 50% in the CREF Social Choice Fund (balanced fund). I eliminated an allocation to the Money Market Fund and reduced the allocation to the Social Choice Fund.

- I bought 5,000 Treasury Wine Estates shares.

- I sold 1,000 CBAPI.AX Commonwealth Bank hybrid securities (convertible bonds).

- I bought 3,000 shares of the IAU gold ETF, taking our position to 20,000 shares and finally around 10% of gross assets.

- I bought AUD 160k by selling US Dollars to get our currency exposure to 50% Australian Dollars and I bought GBP 25k by selling AUD.

- I bought 1,000 Pershing Square Holdings (PSH.L) shares. This took me more overweight hedge funds, but I self-justified it by the fact that the shares are still trading at a big discount to NAV but the gap is narrowing. And anyway, the target portfolio weights are arbitrary, aren't they? I will look to trim the lower performing listed hedge funds once prices are nearer NAVs again.

Saturday, January 02, 2021

Restructuring Baby Moomin's Portfolio

About one and a half years ago I opened an account for baby Moomin with Generation Life to invest the money he inherited from my mother. For this calendar year, the account made about 6.6% on a pre-tax basis.*

This wasn't as good as our portfolio, which returned about 12% in Australian Dollar terms. So, I felt that it was time to make some changes. I decided to switch out of the Dimensional World Allocation 50/50 Fund and the PIMCO Australian and Global Bond Funds. I am switching into the Dimensional World Allocation 70/30 and Vanguard Growth Funds, 50% in each. This is my first time investing in a Vanguard fund! The Vanguard fund is better tax optimized, while Dimensional has more of a tilt to value stocks, which are maybe back in favor. This will result in a total portfolio that is 60% stocks, 20% bonds, 10% infrastructure, and 10% hedge funds.

* This assumes that 30% tax was deducted. Actually, the tax was lower due to franking credits and offsets for foreign taxes. The post-tax return was 4.65%.

Friday, January 01, 2021

2020 Performance of Interactive Brokers Accounts

Inspired by Financial Samurai's post, here are the track records of our two Interactive Brokers accounts over 2020.

Moominpapa (in USD and compared to the S&P500):

This is the kind of result we are trying to achieve with our investment strategy and why we don't just invest in index funds. The only ETF we invest in is IAU - a gold ETF.

Moominmama (in AUD):

On the IB platform, I can only compare this inappropriately to US Dollar indices. By comparison, the ASX200 gained only 1.27% for the year. At the end of March it was down 23% for the year and so probably fell about as much as this portfolio did at the worst point a few days earlier. This is a pleasing result, though less downside would be nice, but then this is just a relatively small part of our total portfolio.