Little My (our second child) had a good year investment-wise:

Monday, January 12, 2026

Little My 2025 Investment Performance

Sunday, July 13, 2025

Spending 2024-25

Each year, I report on income and spending for the Australian financial year, which runs from 1 July to 30 June. This makes it easy to do a break down of gross income including taxes that's comparable to many you'll see online, though all our numbers are in Australian Dollars. Here is last year's report. At the top level we can break down total gross income (as reported in our tax returns plus employer superannuation contributions that are paid on top of nominal salary) into the following categories of spending (click on the image to read more easily):

The gross income for this year (bottom line) is just an estimate. It is based on the gross income we expect to report in our tax returns (before investment expenses etc.) plus employer superannuation contributions. Gross income is forecast to rise by 9% this year after falling for three years. Of course, adjusted for inflation it is still below the 2020-21 peak.

Tax includes local property tax as well as income tax (projected) and tax on superannuation contributions. Income tax is expected to rise by 19%! This is because we have run out of capital losses to offset capital gains. Investing costs include margin interest. Mortgage interest is included in spending, while mortgage principal payments are considered as saving. Spending also includes the insurance premia paid through our superannuation. Current saving is then what is left over. This is much bigger than saving out of salaries because gross income includes investment returns reported in our tax returns. The latter number depends on capital gains reported for tax purposes, so is fairly arbitrary. Spending fell for the first time since I started this spreadsheet, by 4%. Mortgage principal saving doubled, because we are keeping more money in our offset account, reducing mortgage interest payments. Graphically, the breakdown above looks like this:

We break down spending into quite detailed categories. Some of these are then aggregated up into broader categories as shown here:

Here, I include mortgage interest in housing spending. In the accounts I report at the end of the calendar year I include it in investment costs. The idea of including interest in housing costs here is to make this spending report more similar to others on the web.

Our biggest spending category, if we don't count tax, is now childcare and education, which continues to trend upwards. As mentioned above, the income and tax numbers are all estimates. Commentary on each category follows:

Employer superannuation contributions: These include employer contributions (we don't do any salary sacrifice contributions) but not concessional contributions we paid to the SMSF this year.

Superannuation contributions tax: The 15% tax on concessional superannuation contributions. This includes tax on our concessional contributions to the SMSF.

Franking credits: Income reported on our tax returns includes franking credits (tax paid by companies we invest in). We need to deduct this money which we don't receive as cash but is included in gross income. Foreign tax paid is the same story.

Income tax is one category that has fallen since 2017-18! But it has been offset by increasing franking credits, which inflate top line income, and superannuation contributions tax.

Life and disability insurance: I have been trying to bring this under control and the amount paid has also fallen since 2017-18 a result.

Health: Includes health insurance and direct spending. Spending peaked with the birth of our second child.

Housing: Includes mortgage interest, maintenance, and body corporate fees (condo association). It is down this year because we parked more cash in our offset account reducing the mortgage interest we need to pay.

Transport: About 60% is spending on our car and 40% is my spending on Uber, e-scooters, buses etc.

Utilities: This includes water, gas, electricity, telephone, internet, and online storage etc.

Subscriptions: Includes all payments for online electronic services that aren't basic infrastructure. It's has levelled out after increasing sharply during the pandemic.

Supermarkets: Includes convenience stores, liquor stores etc as well as supermarkets. It has been constant for the last four years.

Restaurants: This was low in 2017-18 because we spent a lot of cash at restaurants and during the pandemic for obvious reasons. It has now levelled out. In fact we spent quite a bit on restaurants while travelling in China and Thailand that either came out of Chinese accounts that aren't included here or in cash.

Cash spending: This is up strongly this year due to spending in cash in Thailand.

Department stores: All other stores selling goods that aren't supermarkets. No real trend here.

Mail order: This has come down over the last four years. We now get mail order direct from China, which is paid for from China and doesn't enter these accounts.

Childcare and education: We are paying for private school for both children now, plus music classes, swimming classes...

Travel: This includes flights, hotels etc. It was very high in 2017-18 when we went to Europe and Japan. In 2020-21 it was down to zero due to the pandemic and having a small child. It again rose this year as we travelled to Queensland in July 2024 and China and Thailand in 2024-25.

Charity: Not much trend.

Other: This is mostly other services. It includes everything from haircuts to professional photography.

This year's reduced spending was mainly driven by reduced interest and education costs.

Saturday, February 01, 2025

Performance of Individual Investments 2024

This post breaks down the investment returns for 2024 at a very granular level. Other costs and benefits like interest and fees and exchange rate gains and losses are not included here. I also don't go down to the level of the very small individual investments inside the Masterworks and Unpopular Ventures boxes. All numbers are in Australian Dollars.

The grey shaded investments are ones we no longer hold (some were short term trades or investments). The numbers in yellow are total wins and losses and in green the total investments return. Last year's results are here. Some of the same investments were again major winners this year: 3i (III.L), gold, Unisuper, and PSSAP. Pershing Square Holdings (PSH.L) moved down the league table a bit this year. There are two newcomers in the top three: Defi Technologies (DEFI.NE) and Bitcoin. Gold also returned nearly three times the amount it did in 2023. These pushed 3i down from the top spot to fourth place.

Some of the same investments were again losers this year. On the other hand, the Cadence funds, Regal Partners, Aura VF2, and APSEC moved from losing last year to gaining more than $10k this year.

The top investments are mostly our biggest. 3i is relatively small though at 4% of the portfolio and our Pershing Square position is slightly bigger than our Defi Technologies position but did not perform as well this year.

Friday, January 31, 2025

Updated Annual Performance

I said that I would update the annual performance numbers after receiving all private investment returns for the year. The final number for 2024 in AUD terms was 23.30% up from 23.18%. Aura Venture Fund II made a nice gain in the final quarter but Aura Venture Fund I was marked down a little due to ongoing management costs probably.

Monday, January 20, 2025

The Australian Reports on Superannuation Fund Performance for the 2024 Calendar Year

The Australian reports on the best performing super funds for 2024. They focus on lifecycle, balanced, and sustainable options. I am sure there is some retail super option invested in international shares that did better than these. How did we do? I compute our SMSF returns pre-tax, while super funds report post-tax results. But anyway, our SMSF gained 34.1%! Estimated pre-tax numbers for Unisuper and PSS(AP) balanced options were 14.3% and 13.4%, respectively.

Sunday, January 19, 2025

Annual Report 2024

We are still waiting for the Aura venture funds to report, but I am guessing their values will be unchanged. So, now we can compute reasonably accurate annual accounts. All $ signs in this report indicate Australian Dollars. I'll do a separate report on individual investments. I do a report breaking down spending after the end of the financial year. I'll probably do another report on our SMSF performance then.

Overview

Investment returns were positive and net worth again increased. We did a lot better than in 2023. This was a direct result of my dis-satisfaction with the 2023 result and my determination to do better. We came in way ahead of the best case net worth projection I made in the 2023 report of $6.7 million with an end of year total of $7.4 million. We took a vacation in Maroochydore, Queensland in July and in December we travelled overseas for the first time since before the pandemic to China and Thailand. I did some short business trips to Sydney during the year as well. My 60th birthday was in December and I started a transition to retirement pension in that month.

Investment Return

In Australian Dollar terms we gained 23.1% for the year while in USD terms we gained 12.1%. The big gap is because the Australian Dollar fell. The MSCI gained 18.0% and the S&P 500 25.0% in USD terms while the ASX 200 gained 13.2% in AUD terms. The HFRI hedge fund index gained 9.6% in USD terms. Our target portfolio gained 19.2% in AUD terms. The new Vanguard 60/40 AUD benchmark only returned 12.4%. So, we under-performed the US Dollar stock indices but outperformed the other benchmarks.Investment Allocation

There were significant changes in asset allocation over the year:

Accounts

Here are our annual accounts in Australian Dollars:

We earned $208k after tax in salary etc. Total non-investment earnings including retirement contributions were $240k, up 14% on 2022. I'm quite surprised by that increase! Part of it seems to be from timing of payments as well as larger tax refunds.

Taxes on superannuation returns are just estimated because, though we know the tax paid by the SMSF, our employer superannuation funds only report after tax returns. I estimate this tax to make retirement and non-retirement investment returns comparable. The total estimated tax on superannuation was $20k. Net worth of retirement accounts increased by $600k after the transfer from current savings. With the gain in the value of our house, total net worth increased by $1.228M.

Projections

Last year my best case scenario for 2024 was for an increase in net worth of $500k to $6.7 million. We actually reached $7.4 million. For this year, my base case scenario is simply a 10% increase in net worth to $8.2 million. The bear case is for a 10% decline to $6.7 million. In 2022, our net worth only fell by 0.7%, so this is very bearish. What about the best case scenario? This is going to seem crazy but I project double the percentage increase of 2024 for a net worth of $10 million. Told you it was crazy.Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then the other two are fairly self-explanatory. However, property taxes etc. are included in the current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells in the spreadsheet that might again be used in the future.Wednesday, January 08, 2025

Big Moomin's and Little Moomin's Investment Returns for 2024

A year ago, we reconfigured Big Moomin's portfolio, which is managed by my brother, to provide better investment returns. This really paid off this year with a return of 34.4% in Australian Dollar terms. He now has AUD 73,230 in his account overtaking Little Moomin, who was ahead but now has only AUD 63,650. Little Moomin's pre-tax return is estimated at 15.0%, which at least beat the ASX200. But you have to take off the 30% investment bond tax to find out what he actually received, which is nearer 10%.* I am wondering if my balanced investment strategy is too conservative for Little Moomin.

* Actually, I take the reported 10.3% after-tax return and add back the 30% tax to get an estimated pre-tax return. The latter is definitely exaggerated because franking credits on some funds reduce the tax paid.

Tuesday, July 09, 2024

Superannuation Returns for the 2023-24 Financial Year

The Australian reports on the performance of superannuation funds for the just completed financial year. This year, retail funds tended to perform better than industry funds because of their higher allocation to public stock markets rather than private assets. How did our SMSF do by comparison? I don't actually compute comparable after-tax performance figures, which are how superannuation returns are reported.* Public offer funds make an allowance for future tax payable, which includes capital gains tax if the assets are sold. This means that members who withdraw funds don't push tax liabilities onto those that stay. This is unlike a regular unlisted managed fund where tax is at the investor level and attached to distributions...

So, instead I estimate what the performance of our employer funds might be pre-tax. This probably over-estimates the performance of the employer funds, but reconciling tax expected with tax actually paid on our SMSF would be hard work. On that basis, the SMSF returned 9.54%. Unisuper returned 10.89% and PSS(AP) 10.55%. Both the latter are balanced funds. Even though we underperformed for the year, we are still ahead overall since inception:

PSS(AP) has, however, inched ahead in risk-adjusted performance. It now has an information ratio (Sharpe ratio with zero risk free rate) of 1.02, versus 0.96 for the SMSF. Unisuper is on 0.83.

Since inception, the SMSF has returned an annualized 7.9% pre-tax versus 6.44% for Unisuper and 6.63% for PSS(AP).

* Reported performance does deduct administration, audit, ASIC fees etc. As an example, for the year to 31 December 2023, Unisuper report a return of 10.3%, while I estimate a pretax return of 11.15% for the fund.

Saturday, July 06, 2024

Spending 2023-24

For the last seven years I've been putting together reports on our spending over the Australian financial year, which runs from 1 July to 30 June. This makes it easy to do a break down of gross income including taxes that's comparable to many spending reports you'll see online, though all our numbers are in Australian Dollars. At the top level, we can break down total income (as reported in our tax returns plus employer superannuation contributions) into the following expenditure categories:

The gross income for this year (bottom line), and so also "Other Saving", is just an estimate. It is based on the gross income we expect to report in our tax returns (before investment expenses etc.) plus employer superannuation contributions. Tax includes local property tax as well as income tax and tax on superannuation contributions. Investing costs include margin interest. Mortgage interest is included in spending here (though usually I consider them to be an investment cost), while mortgage principal payments are considered as saving. Spending also includes the insurance premia paid through our superannuation. Other saving is then what is left over. This is much bigger than our saving out of salaries because gross income includes investment returns reported in our tax returns. Spending increased by 4% this year in line with inflation. Gross income, especially in real terms, has been slowly declining since the peak in 2020-21. This is partly because I moved high-tax investments into superannuation. Expected other saving is the lowest it has been. The latter includes the AUD 20k concessional contribution we made for Moominmama to our SMSF in each of the last three years. Graphically, it looks like this:

We break down spending into quite detailed categories. Some of these are then aggregated up into broader categories:

Our biggest spending category, if we don't count tax, continues to be childcare and education, which declined slightly this year as the youngest moved out of daycare and the older one changed schools. Both are now in the same private school since the beginning of this calendar year. As mentioned above, the income, tax, and other savings numbers for this year are all estimates. Commentary on each category follows:

Employer superannuation contributions: These include employer contributions (we don't do any salary sacrifice contributions) but not the concessional contributions we paid into the SMSF.

Superannuation contributions tax: The 15% tax on concessional superannuation contributions. This includes tax on our concessional contributions to the SMSF. It does not include taxes on SMSF earnings as the superannuation earnings are not included in income here.

Franking credits: Income reported on our tax returns includes franking credits (tax paid by companies we invest in). We need to deduct this money which we don't receive as cash but is included in gross income in order to get the numbers to add up.* Foreign tax paid is the same story.

Income tax paid is one category that has fallen since 2017-18! Franking credits rose fourfold.

Life and disability insurance: I have been trying to bring this under control and the amount paid has also fallen since 2017-18 as a result.

Health: Includes health insurance and direct spending. Spending peaked with the birth of our second child.

Housing: Includes mortgage interest, maintenance, and body corporate fees (condo association). Rising interest rates have pushed up spending this year again as has replacement of our central air-conditioner, which will cost more than AUD 11k.

Transport: About half is spending on our car and half is my spending on Uber, e-scooters, buses etc. I tried to spend less on Uber this year. I reduced my transport spending by 22% as a result. Also, the value of our car rose, contributing AUD 1,700.

Utilities: This includes water, gas, electricity, telephone, internet, and online storage etc.

Subscriptions: This is spending on all online services that aren't basic infrastructure. After rising strongly during the pandemic we brought it back under control this year with an 8% reduction.

Supermarkets: Includes convenience stores, liquor stores etc as well as supermarkets. Spending has been stable in nominal terms for the last three years.

Restaurants: This was low in 2017-18 because we spent a lot of cash at restaurants. It was low in 2020-22 because of the pandemic. It then jumped as life got more back to normal and rose 11% as prices are climbing I feel particularly in this area. I just paid more than AUD 7 for a large coffee this morning in Queensland, which is a record for me.

Cash spending: This has collapsed to almost zero. I try not to use cash so that I can track spending. Moominmama also gets some cash out at supermarkets that is included in that category.

Department stores: All other stores selling goods that aren't supermarkets. Has been falling since 2019-20.

Mail order: This continued to decline since the pandemic peak in 2020-21. Down another 15% this year.

Childcare and education: We are now paying for private school for both children plus music classes, swimming classes...

Travel: This includes flights, hotels, car rental etc. It was very high in 2017-18 when we went to Europe and Japan. In 2020-21 it was down to zero due to the pandemic and having a small child. This year it almost reached the nominal level of 2017-18. We paid to rent a house in Bondi Beach in Sydney because my brother and his wife were supposed to visit. That was very expensive. In the end, they couldn't visit because of the war in the Middle East. And now we took a second vacation in Winter in Queensland.

Charity: Continues to fluctuate around my goal of AUD 1k. When I think I am really financially independent and my children are grown up I'd plan to increase it.

Other: This is mostly other services. It includes everything from haircuts to fees for tourist attractions. I don't include the latter in travel because we might also pay to go to a museum or paid play place when we are home.

This year's increased spending was mainly driven by increased housing and travel costs, while most other categories declined despite inflation. Both housing and travel included one-off costs. I paid the second half of the air-conditioner bill a few days ago in the new financial year, so I expect housing costs will remain similar in 2024-25. Travel is hard to predict, but I expect that spending will remain high as we begin to spend more on airfares again. We were still paying for daycare in the first half of the financial year, so I expect education costs to fall a little in 2024-25.

* Moominmama has negative income tax and gets some of her franking credits paid out as cash. This is accounted for here as a reduction in the net income tax category.

Sunday, February 04, 2024

Individual Investment Performance 2023

To better understand our investment underperformance in 2023 let's dive into the returns on each individual investment. If we'd managed to avoid all the losing investments in the table we would have roughly matched the return on the target portfolio. So, as usual it is the losers which hurt. In particular, the Cadence, Cadence Opportunities, and Tribeca listed hedge funds all did poorly. The worst of all though was the Aura VF2 venture capital fund. One of their companies - Lygon - went bankrupt and was then restructured. Once you are in a venture fund you can't really get out and I invested in this fund because VF1 has done well over time.

When I reviewed the hedge fund investments two years ago, these funds were all doing well. I did mention that I wanted to reduce exposure to Cadence Capital, which I failed to do. Tribeca has turned out to be a very volatile investment. Sometimes they have big wins and some times big losses. I failed to get out when it traded above NAV at about the time of the review. I thought then they had reformed, but apparently not.

The other two main losers are Domacom and the China Fund. I really should have gotten out of Domacom when it relisted on the ASX. Now it does look like they will turn things around, but dilution from new investors means we might never make any money. There's no real excuse for remaining in the China Fund, as I have been bearish on the long-term prospects of China under Xi Jinping. It is hard to explain.

On the other hand, I lost on the TIAA Real Estate Fund, but correctly reduced my exposure. Not by enough. My gains in the CREF Social Choice Fund just balanced my losses in the Real Estate Fund in 2023.

I have much less to say about the winners. 3i and Pershing Square Holdings have turned into big winners. I could have done even better on 3i if I had not sold 20% of the position. Half of the fund is in one company - Action - which made me a bit nervous. Gold did well and the other two big winners are our employer superannuation funds. With gold, these are our three biggest investments. Pershing Square is now our fourth biggest investment.

Saturday, February 03, 2024

Annual Report 2023

In the second half of 2023 I stopped writing monthly reports on this blog because each month's accounts had large errors.* But now I have got the errors down to not more than $500 in any one month and 0.01% of the portfolio for the year as a whole. Our private investments have all also reported their results for the year. So, now we can compute reasonably accurate annual and monthly accounts for the year.

Overview

Investment returns were positive and net worth again increased. But I was disappointed that we underperformed the target portfolio and were far behind the gains in stock indices. So, we also fell short of the net worth projection I made in the 2022 report. In the first half of the year, I spent quite a lot of time on my new hobby of researching my family tree. In the second half of the year I was working hard on teaching. I do all my teaching in the second semester now. In the second half of the year I also took on a new editorial role that will keep me busy over the next three years. We took a vacation at Coogee Beach in Sydney in January and I made a couple of short business trips to Melbourne in March and the end of November. Maybe in 2024 we will finally travel overseas again...

All $ signs in this report indicate Australian Dollars. I'll do a separate report on individual investments. I do a report breaking down spending after the end of the financial year.

Investment Return

In Australian Dollar terms we gained 5.6% for the year while in USD terms we gained 5.9%. The Australian Dollar didn't move much over the year. The MSCI gained 22.8% and the S&P 500 26.3% in USD terms while the ASX 200 gained 14.4% in AUD terms. The HFRI hedge fund index gained 7.3% in USD terms. Our target portfolio gained 10.8% in AUD terms. So, we under-performed all benchmarks.

Accounts

Here are our annual accounts in Australian Dollars:

We earned $178k after tax in salary etc. Total non-investment earnings including retirement contributions were $210k, up 14% on 2022. The result is likely driven by lower net tax. We gained (pre-tax including unrealized capital gains) $154k on non-retirement account investments. A small amount of the gains were due to the fall in the Australian Dollar (forex). We gained $130k on retirement accounts with $31k in employer retirement contributions. The value of our house is estimated to have risen by $33k. As a result, the investment gains totaled $317k and total income $527k.

$31k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. Taxes on superannuation returns are just estimated because, apart from tax paid by the SMSF, all we get to see are the after tax returns. I estimate this tax to make retirement and non-retirement returns comparable. The total estimated tax on superannuation was $40k. Net worth of retirement accounts increased by $141k after the transfer from current savings. With the gain in the value of our house, total net worth increased by $306k.

Projections

Last year my baseline projection for 2023 (best case scenario) was for an 11.2% investment rate of return in AUD terms, an 11% nominal increase in spending, and about a 3% increase in other income, leading to an $550k increase in net worth to around $6.5 million or a 9% increase. Net worth only increased by just over half of this due to much lower than predicted investment returns. On the other hand, spending actually fell despite high inflation and non-investment income rose.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then the other two are fairly self-explanatory. However, property taxes etc. are included in the current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells in the spreadsheet that might again be used in the future.

Monday, January 08, 2024

Contributions to Annual Return

I haven't formally finalized the accounts for 2023 yet. I will need to wait to get investment returns on illiquid investments that report with a long time lag. But I do have a preliminary estimate of 6.38% in AUD terms (6.64% in USD terms). This is rather disappointing as the MSCI returned 22.81%, the S&P 500 26.27%, and the ASX 200 14.45%. Our target portfolio returned 10.84%. So, why did we underperform the target by so much? The following tables analyze the returns of each portfolio:

RoR is the rate of return of the asset class and contribution is the rate of return multiplied by the share of the portfolio. The sum of contributions gives the portfolio return. The returns for the Moom portfolio are in currency neutral and unlevered terms and, so, differ slightly from the Australian Dollar return for the portfolio. The asset classes don't quite match, but it's close enough.

The target portfolio got 2.48% returns from international stocks. The return I got from US stocks at 15.8% was less than the MSCI index at 22.5% but more importantly, my allocation to other countries resulted in a negative return and so the total contribution from international stocks was only 0.89%.

The target portfolio got 1.73% returns from Australian stocks. Again, my return from Australian large caps was a bit lower than that of the ASX 200 but my allocation to small cap stocks had a negative return and so the overall contribution was only 0.49%.

The target portfolio represents managed futures using the Winton Global Alpha Fund. This gave a contribution of 0.59%. I also allocated to the Aspect Diversified Futures Fund and Australian Dollar futures. These dragged down returns resulting in a contribution of only 0.18%.

The target portfolio obtained a 1.61% contribution from hedge funds (based on the HFRI index), while I only got 0.25%. Though some funds like Pershing Square did very well, other Australian hedge funds under-performed.

Real Assets is the area where I outperformed. I represent this in the target portfolio using the TIAA Real Estate Fund. My allocations to other real assets resulted here in a small gain rather than a large loss.

Bonds and gold made a similar contribution to each portfolio. Finally, venture capital made an outsized contribution to the target portfolio of 4.38%. My venture capital investments lost money overall in 2023. I did much better than the target portfolio in buyout investments like 3i. But this wasn't sufficient to match the target portfolio's overall private equity contribution.

I think there is some luck here. In a different year, non-US stocks or Australian small caps might perform well. On the other hand, I also need to eventually reduce some of my allocations to Australian hedge funds that have under-delivered.

Update on the Children's Portfolios

I was calling our children Moomin and Baby Moomin on this blog. But the latter is no longer a baby, so let's call them Big and Little Moomin :) My brother reported to me that Big Moomin's portfolio only returned 4% in USD terms in 2023. He put that down to not trading enough because the bank has made it harder to trade on this trust account... Obviously it's down to being in the wrong things. I have tried to get him to stick with a diversified portfolio. He manages this one and the accounts for two of his children who all inherited money from our mother. The will stated that they couldn't access the money till they were 23 years old. I manage Little Moomin's portfolio, because he was born after my mother died and so wasn't included in the will. My brother and I each contributed from our inheritances to his account. I invested his money in an investment bond with Generation Life. His account returned an estimated pre-tax 14% in AUD terms in 2023.* The target portfolio benchmark made about 10.8% for the year. So, finally, this portfolio outperformed the benchmark after under-performing so far:

The graph also shows how the target portfolio has matched the ASX 200 while experiencing lower volatility over this period.

Anyway, my brother says that he is going to try to transfer the money to me. Initially, he was advised that the money had to stay in his country, where my mother lived, but now apparently he has reason to think otherwise.

* It is estimated, as 30% tax is deducted inside the investment bond. You can reduce this tax eventually if the child "breaks the bond" by adding an additional investment and they are in a lower tax bracket when withdrawing the money.

Sunday, July 09, 2023

Spending 2022-23

For the last six years I've been putting together reports on our spending over the Australian financial year, which runs from 1 July to 30 June. This makes it easy to do a break down of gross income including taxes that's comparable to many you'll see online, though all our numbers are in Australian Dollars. At the top level we can break down total income (as reported in our tax returns plus superannuation contributions) into the following categories of spending:

The gross income for this year (bottom line) is just an estimate. It is based on the gross income we expect to report in our tax returns (before investment expenses etc) plus employer superannuation contributions. Tax includes local property tax as well as income tax and tax on superannuation contributions. Investing costs include margin interest. Mortgage interest is included in spending, while mortgage principal payments are considered as saving. Spending also includes the insurance premia paid through our superannuation. Current saving is then what is left over. This is much bigger than saving out of salaries because gross income includes investment returns reported in our tax returns. The latter number depends on capital gains reported for tax purposes, so is fairly arbitrary. Spending increased substantially, though we also expect income to hit a high though it's been fairly constant over the last five years. Graphically, it looks like this:

We break down spending into quite detailed categories. Some of these are then aggregated up into broader categories:

Our biggest spending category, if we don't count tax, is now childcare and education, which has now fallen for two years in a row. Shifting from daycare, to private per-K, to private junior school actually reduces costs! We also include things like swimming and piano lessons in this category. Commentary on other categories follows:

Employer superannuation contributions: These include employer contributions (we don't do any salary sacrifice contributions) but not contributions we paid to the SMSF this year.

Franking credits: Income reported on our tax returns includes franking credits (tax paid by companies we invest in). We need to deduct this money which we don't receive as cash but is included in gross income. Effectively, this is tax paid on our behalf by corporations that we are shareholders of. Foreign tax paid is the same story.

Superannuation contributions tax: The 15% tax on concessional superannuation contributions. This includes tax on our concessional contributions to the SMSF.

Life and disability insurance: This is paid out of our contributions to our employr superannuation funds. I have been trying to bring this under control and the amount paid has also fallen since 2017-18 a result.

Health: Includes health insurance and direct spending. These increased by 12% and 10%, respectively. Spending peaked with the birth of our second child.

Housing: Includes mortgage interest, maintenance, and body corporate fees (condo association). This category fell by 27% this year, due to us paying less in mortgage interest. This is the reason that our total spending is down this year.

Transport: About two thirds is spending on our car and one third is my spending on Uber, e-scooters, buses etc.

Utilities: This includes water, gas, electricity, telephone, internet, and online storage etc.

Subscriptions: This is a new category this year, split out from utilities. Spending has been stable in the last three years after rising during the pandemic.

Supermarkets: Includes convenience stores, liquor stores etc as well as supermarkets. This has now been stable for the last four years.

Restaurants: This was low in 2017-18 because we spent a lot of cash at restaurants. It was low during the pandemic for obvious reasons but has been back to pre-pandemic levels in the last three years. We also spent a lot on restaurants in cash while on vacation in China and Thailand.

Cash spending: I try not to use cash so that I can track spending. Moominmama also gets some cash out at supermarkets that is included in that category. Spending jumped 20-fold this year due to spending in cash while traveling in Asia.

Department stores: All other stores selling goods that aren't supermarkets. No real trend here.

Mail order: This has continued to fall. Moominmama now gets mail order direct from China that doesn't enter into our accounting system. When we were in China we deposited RMB cash in her mother's bank account. I treated this in our accounts as a repayment of a loan from her mother. Evidently the money is being used to buy stuff in China...

Travel: This includes flights, hotels etc. It has now been back at pre-pandemic levels for the last two years.

Charity: Increased a little bit. We pay one charity on a regular basis but otherwise I just respond to requests I get.

Professional: These are work expenses that were not paid for directly by our employers. So, we got reimbursement for some of these, but that reimbursement is not in our income number. Really, our savings were larger by the value of that reimbursement (about $2k this year).

Other: This is mostly other services. It includes everything from haircuts to professional photography.

In summary, our spending fell due to reduced mortgage interest payments. In the accounts I post at the end of the calendar year, that interest is accounted for as an investment expense. Spending apart from mortgage interest was up a little.

Saturday, January 14, 2023

Annual Report 2022

This was the first year that our net worth fell since 2008. Investment returns were negative but the value of our house increased a bit and we did save some money.* We were far short of the best case projection I made at the beginning of the year of a net worth of AUD 6.7 million. In my academic career, I spent a lot of time this year working on preparing and then teaching a new course, though I did get at least one newish research project completed. I was supposedly on long service leave for the first three months of the year but didn't really get to take any time off. This year, I plan on taking it a bit easier in the first half of the year before focusing on teaching in the second half of the year. Teaching was more in person this year and so a bit more enjoyable. I didn't leave the Canberra region all year since getting back from the coast right after New Year's Day.

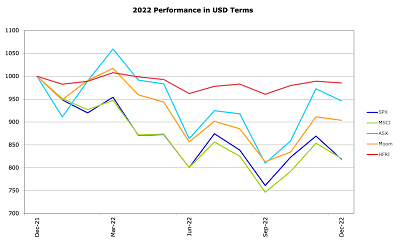

In Australian Dollar terms we lost 3.7% for the year but in USD terms we lost 9.6% because of the fall in the Australian Dollar over the year. The MSCI lost 18.0% in USD terms but the ASX 200 gained 0.9% in AUD terms. The HFRI hedge fund index lost 1.5% in USD terms. Our target portfolio lost 4.2% in AUD terms. So, we beat the MSCI and the target portfolio benchmarks this year but not the ASX 200 or HFRI Index.

Benchmark returns have now mostly decreased over time. We have similar performance to the ASX 200 over ten years but much worse over twenty. We beat the HFRI over all the longer time horizons. We had particularly good relative performance over the three year horizon. Whether you think our performance is good or bad depends on what you think the default alternative investment is. If it is an ASX 200 index fund, then we are doing in the last ten years. If it is a global stock index fund then not so good over horizons longer than three years. If you think it is our target portfolio then we are doing well.

Accounts

Here are our annual accounts in Australian Dollars:

Percentage changes are for the total numbers. There are lots of quirks in the way I compute the accounts, which have gradually evolved over time. There is an explanation at the end of this post.

We earned $153k after tax in salary etc. Total non-investment earnings including retirement contributions were $183k, down 9% on 2021. This was due to increased tax payments, fewer non-salary earnings, and fewer employee contributions to Moominmama's employer superannuation fund. We lost (pre-tax including unrealized capital gains) $166k on non-retirement account investments. A small amount of the gains were due to the fall in the Australian Dollar (forex). We lost $15k on retirement accounts with $30k in employer retirement contributions. The value of our house is estimated to have risen by $133k. As a result, the investment loss totaled -$45k and total income $139k.

$25k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. We transferred $120k into retirement accounts the SMSF from existing savings. This included $20k as a concessional contribution for Moominmama. Therefore, looking at just saving from non-investment income, we dissaved $120k. The change in current net worth, was therefore -$306k.

Taxes on superannuation returns are just estimated because apart from tax paid by the SMSF all we get to see are the after tax returns. I estimate this tax to make retirement and non-retirement returns comparable. The total implicit tax on supernnuation was a negative $1k because we lost money. Net worth of retirement accounts increased by $136k after the transfer from current savings.

Projections

Last year my baseline projection for 2022 was for a 16% rate of return, no increase in the value of our home, flat other income, and 6% growth in spending. This resulted in projected net worth increasing by $800k to around $6.7 million. Obviously, we came nowhere near this projection.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then the other two are fairly self-explanatory. However, property taxes etc. are included in the current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells in the spreadsheet that might again be used in the future.

Saturday, August 27, 2022

Moominmama's 2021-22 Taxes

I also did Moominmama's taxes for this financial year. The post about last year's taxes is here. Here is a summary of her tax return for this year:

Her salary was up steeply this year, as last year large superannuation contributions were deducted from it. This year, we redirected those to our new SMSF. Australian dividends were up dramatically as I tried to get more investments in her name. Gross income fell by 15% though because of reduced capital gains.

Total deductions rose by 66%, mainly because of the $20k in contributions to the SMSF. As a result, net income fell 32% mainly I think because of the reduced capital gains this year.

Gross tax applies the tax bracket rates to taxable income. Most of this nominal tax was eliminated by the 208% increase in franking credits. As a result, she should be assessed for only $1.4k in tax. As this is much less than the tax withheld from her salary, I expect she will get a refund of around $4k.