Here is the latest from Hussmann on the stockmarket. He seems to be one of the smarter guys around with regard to market analysis. Basically, he says hedge your stock portfolio against loss at this point. This is what I have been doing (after a rebound in the Aussie markets in the last two days my investment return for May seems to be 0% exactly :)).

Why hedge rather than just selling everything and going to cash? In taxable accounts there is the capital gains tax issue. If you sell you pay the tax with 100% certainty and you especially don't want to pay the short-term rates (as they are in the US and Aus) if you can avoid it. If you hedge and you are wrong you sell the hedging instrument (or buy back shorted shares) and take a capital gains loss. Another issue is mutual funds cannot be traded intraday. In reality there can be a day or two delay in getting the transaction done. If the market moves up suddenly you lose out. Hedging positions are normally much more liquid - I hedge with shares or options on ETFs or heavily traded stocks. For big investors, individual stocks are illiquid, they hedge in the futures market which is much more liquid.

Of course you can get more aggressive and overhedge until you are net short. I am slightly net short by standard measures. Again it is a risk if you are wrong - in the long-term stocks go up and based on the law of percentages up moves are bigger than down moves - a stock can only go to zero on the downside - but can go up infinitely in theory on the upside...

Carl Svenlin has posted an article on shorter term technical trends. I think that short term bounce is likely completed for now, but a larger rebound will happen in the first half of June.

Tuesday, May 30, 2006

Sunday, May 28, 2006

Portfolio Update

This is the first time I have provided a snapshot of the allocation spreadsheet I use to give myself a picture of my portfolio and calculate my NetWorthIQ numbers. It includes percentage allocations, summary allocations, performance figures, and total portfolio, saving etc. in US and Australian Dollars. It is based on a whole series of underlying spreadsheets. Each month I create a new worksheet like this from the previous one. That way I can compare this month to previous months. I was inspired by the worksheets George Soros provided in "The Alchemy of Finance".

I'll mainly focus on the current allocation in these comments. The main window shows the allocation of assets to securities and funds irrespective of whether they are in a retirement or taxable" account (Australian retirement accounts are taxable, but at a concessionary rate). The overall strategy which I ahve discussed is to invest 100% of assets in medium to long-term invests and then use leverage to trade. The market risk of the medium to long-term investments is adjusted slowly - preferably not more than once a year.

Main categories:

Mutual funds:

CFS (Australia), TIAA, CREF mutual funds - 78% of total. These are currently in a conservative mix - the largest amount is in the CFS Conservative Fund which is 70% bonds and cash, 30% equity related. When I think the stock-markets have bottomed I will become much more aggressive here.

Closed end/listed hedge funds/fund managers:

Everest Brown Babcock (fund of funds), Platinum Capital (listed hedge), Loftus Capital, Clime, Berkshire Hathaway - 12% of total - in the long-run I want to have much more in these kind of investments with the plan to only sell if the managers performance declines. Listed property/infrastructure adds another 3% in Challenger Infrastructure and IYS. Berkshire is really an insurance conglomerate but I think of it like a hedge fund/fund manager.

Individual stock investments:

Telecom NZ, Mayne Pharma, Symbion, Ansell, Croesus, Powertel - 11%. This is the extent of my "traditional stock picking". As I've posted, I don't do a lot of it. Mainly these are health or telecom firms. Croesus is a rather unsuccessful gold miner.

Trading:

A mix of short stock positions - Starbucks, Google, Apple, QQQQ, options - TLT, HHH, QQQQ, and gold. Any of these can be traded at any time, often intraday. Overall I end up with 46% more assets than equity. Less than half of that additional money is borrowed cash (19%) the rest is in borrowed stocks (26%). Short-selling requires holding lots of cash on deposit. That's the reason for my big cash holdings: 38% of assets. Cash outside my trading account is only 2% of assets. I have been withdrawing some profits from my trading account to my HSBC Savings Account in anticipation of paying off my credit card balances in the next couple of months (mostly zero percent). I missed out on playing this bounce in the markets in the last 3 days - I think there is another downwave to come before a more significant rally occurs. I will let you know when I get short-term bullish. However, I am not so bearish - If the stockmarket falls 10% I only stand to gain 1.6% (beta leverage) and so far I have lost money this month (0.43%) though less than the benchmark index has (2.64%).

Saturday, May 27, 2006

Two Interesting Articles from the Economist

One story about the world economy and state of the financial markets and another with the latest edition of the Big Mac Index. Seems to me that the Economist is a bit too optimistic about current earnings levels of firms being maintained going forward. Also I am surprised that the Yen and Hong Kong Dollar are undervalued by this measure.

Friday, May 26, 2006

Timing the Market

Today stock markets are rising around the world. The decline to this point hasn't received much attention outside the financial media. Some bloggers are beginning to notice though that their portfolios are taking a hit. I think that those who are selling out of stock mutual funds at this point are likely to feel better about their decision later in the year. I have been discussing the potential for a significant decline in the markets for a while now on this blog. And many others are coming to similar conclusions. As this article notes though, most individual small investors don't get market timing decisions right. And more sophisticated traders screw up too all the time :) The real solution is to invest in a portfolio of hedge funds of course and outsource that decision making. That can be hard for most individual investors. There are funds of hedge funds that take relatively small investments. The problem with many of these is that the funds willing to take investments from these funds of funds are not the superior hedge funds. Finding a good one takes some research. I know of one exception which is the Everest Brown Babcock fund of funds listed on the Australian Stock Market - sorry that isn't much use for US investors. The other alternative is a truly diversified portfolio with rebalancing and other techniques which I have discussed on this blog, here, here and probably other places.

Thursday, May 25, 2006

More Volatility

Today was another volatile day in the financial markets. Gold fell - obviously the wave 2 correction I disucssed yesterday is not over but with any luck this is the lowest point it will reach for now. If my new interpretation is right it would be a good trade to sell any short-term rally in gold. Stocks fell and rose and fell and ended up... Bonds rose and the yield curve by one measure is again inverted. The US Dollar strengthened again. But recent action in the dollar looks to me like a corrective wave or consolidation before the next fall (I think the same on stocks too).

And yes, my net worth is now down for the month. Investment performance is -0.5%, which is still much better than the the MSCI index's 4.5% loss (losses for other indices and stock mutual funds and similar or greater). Heavy spending on the trip didn't help either. My long positions in mutual funds and stocks are very conservative, but my short positions are not quite compensating. One short position (on News Corporation) went very wrong. The Australian Dollar has also been weak.

And yes, my net worth is now down for the month. Investment performance is -0.5%, which is still much better than the the MSCI index's 4.5% loss (losses for other indices and stock mutual funds and similar or greater). Heavy spending on the trip didn't help either. My long positions in mutual funds and stocks are very conservative, but my short positions are not quite compensating. One short position (on News Corporation) went very wrong. The Australian Dollar has also been weak.

Wednesday, May 24, 2006

Evening Market Update / Gold Chart

Like the US stockmarket today, Asian stockmarkets opened higher but have reversed at this point after Hong Kong opened at 10pm EDT. Though I am very bearish on stocks I am bullish on gold. Here is a chart the gold ETF GLD in the last two years with my educated guess of the simplest division of the move into Elliott Waves:

The count as posted means that the next move in gold is the third wave of the third wave up since mid 2005. That means that the move since then is less than half complete at this point. 3rd of 3rd waves are often very strong. Even if my exact count since mid 2005 is wrong the chart shows that using E-Wave principles we have to conclude that gold has not yet reached a final bull market peak - up waves must have 5 or 9 (or 13 etc.) subwaves and at the moment we only seem to have 8 at the most - the five subwaves of what I've labelled wave I and then II, 1, and 2. Elliott Wave theory is a very important tool in my technical analysis - both of long term trends and in intraday trading. It takes a lot of experience and skill in pattern recognition to use it properly. I find I get much better results by combining it with other forms of technical analysis and for the longer term analysis combining technical analysis with fundamental analysis and macroeconomics. Most E-Wave practioners think that the latter is tantamount to sacrilege. This doesn't make any sense to me. I also try to understand the relations in the patterns of different markets and securities. In general the more data point in the same direction the more reliable the result is likely to be.

The count as posted means that the next move in gold is the third wave of the third wave up since mid 2005. That means that the move since then is less than half complete at this point. 3rd of 3rd waves are often very strong. Even if my exact count since mid 2005 is wrong the chart shows that using E-Wave principles we have to conclude that gold has not yet reached a final bull market peak - up waves must have 5 or 9 (or 13 etc.) subwaves and at the moment we only seem to have 8 at the most - the five subwaves of what I've labelled wave I and then II, 1, and 2. Elliott Wave theory is a very important tool in my technical analysis - both of long term trends and in intraday trading. It takes a lot of experience and skill in pattern recognition to use it properly. I find I get much better results by combining it with other forms of technical analysis and for the longer term analysis combining technical analysis with fundamental analysis and macroeconomics. Most E-Wave practioners think that the latter is tantamount to sacrilege. This doesn't make any sense to me. I also try to understand the relations in the patterns of different markets and securities. In general the more data point in the same direction the more reliable the result is likely to be.

Another Crazy Day in US Markets

First the stockmarket was up strongly and then towards the close it slid heavily - a slide that continued after the official close. This wasn't at all unexpected to me, though Google rallied stronger than I expected and closed up. I reduced several short positions near the close ($40,000 of SBUX, AAPL, QQQQ) - not because I think we have yet reached the bottom but in order to get back within my margin requirements. Day trading buying power (on margin accounts with more than $25,000 in equity) lets you buy or short much more stock potentially than regular overnight margin requirements allow. If you hold the position overnight you will get a margin call, but the broker won't forcibly close the position that day as they have to allow you time to sell or deposit more cash etc. So this is what happened to me today. I get margin calls all the time because I tend to do extreme things with my account. But I haven't had a forced sale in years... All the trades I closed were profitable. My average profit on closed short-term trades in my taxable accounts is now 0.45% for the year again. This reflects some good and some bad trades. On the other hand Roth IRA is now up 40% since I opened it. I am amazed at how well those trades have gone - again there have been winning and losing trades but the winners have far outshone the losers. Currently I have 150 shares of GLD and 7 $40 June QQQQ puts in the account as well as a very little in a money market fund. I am increasingly thinking that individual stocks are most suited to long term investment and day trades, while short-term position trades are best handled using ETFs (or futures ultimately). The potentially high volatility of individual stocks can be useful intraday, when gapping is not possible and stops can be used. But it can be a real pain if it goes against you on position trades (held overnight, or for days, weeks etc.).

Tuesday, May 23, 2006

Stockmarket Slide Continues - Is Slowing Growth or Rising Inflation Responsible?

The slide in global stockmarkets continued today (and tonight in Asia). Not getting a lot of attention yet in the mainstream media (in the US at least) and in the financial media commentators are mostly remaining bullish. Bill Gross has posted his annual economic outlook. The bottom line is he still expects inflation to be low and bond yields in the US to remain in their recent range. He expects global growth to remain relatively strong. Others also think that the inflation outlook is benign but that global growth is likely to slow. This is on the whole my take, but I think the US stands a strong risk of outright recession in the coming year. Barclay's Bank warn that current conditions are very similar to those in 1987. I already made the same analogy with the big caveat that resource prices have been rising now, which wasn't the case in 1987. Others are similarly bearish but are looking for the main decline in the markets to occur in the Fall. There is no reason why we have to wait for the Fall for a crash to occur. On the other hand a slow slide across the midle of the year is entirely possible as are strong countertrend rallies on the way.

Something interesting is that bonds have begun to rebound from their recent lows. The sell-off in gold and other commodities may also have exhausted itself. I don't see us as being in a commodity price bubble. There is a genuine shortage of supply in many commodity areas. Perhaps the long-term trend of declining real resource prices (except for forest products) has begun to reverse? In the very short-term I am expecting a flight to safety to US government bonds and gold as stocks slide further. Regarding my own portfolio today, I rolled my QQQQ put options to a lower strike to free up some equity and buy gold with it. I also shorted more Google shares.

Something interesting is that bonds have begun to rebound from their recent lows. The sell-off in gold and other commodities may also have exhausted itself. I don't see us as being in a commodity price bubble. There is a genuine shortage of supply in many commodity areas. Perhaps the long-term trend of declining real resource prices (except for forest products) has begun to reverse? In the very short-term I am expecting a flight to safety to US government bonds and gold as stocks slide further. Regarding my own portfolio today, I rolled my QQQQ put options to a lower strike to free up some equity and buy gold with it. I also shorted more Google shares.

Monday, May 22, 2006

NetWorthIQ Top Ten List

I just entered the NetWorthIQ Top Ten List. Cool :) Probably it's because I am the top of the most active user list. Just got back from a roadtrip to Charlottesville, Virginia and back. Was a lot of fun and we had many memorable experiences. That included crashing the car into the grassy median of a highway resulting in $1000 in repairs which we did in various places en route. We also had to stay in New York City for an extra day and had to rejig the trip plan. Will soon get up to speed on the financial situation - there will be some goods (US tech stocks fell) and some bads (Aussie Dollar and gold fell, News Corporation shares rose). Seems that overall I am down several thousand from where I was before the trip. Investment performance for the month is a positive 0.45% gain versus a 3.45% loss for the MSCI index. Year to date I am up 7.94% vs. 6.22% for the MSCI. Over the last 12 months I am up about the same as the MSCI at 18.78% vs. 18.4%. Only a couple of weeks ago I was lagging seriously behind the MSCI over each of these time horizons. My assessment of sentiment from various sources is that on the whole investors remain mostly bullish. This probably means that the selling of stocks has not ended yet.

Thursday, May 11, 2006

More Good Tax News

More good tax news for investors on this side of the Pacific today. Interesting factoid in the article is that only 23% of people in the $50,000-$75,000 income bracket have any taxable investments. And even at the $1 million income level there are still 19% who don't.

Another Fed Day

Nothing unexpected for me in the announcement. After the announcement at 2:15pm, the dollar fell, bonds rose, gold rose, oil rose, and non-resource stocks fell. The "perfect storm" for my portfolio. Nice to have a little encouragement for my strategy. This evening at 5pm EST is the Google shareholders meeting.

Wednesday, May 10, 2006

Australia Simplifies its Retirement Accounts System

In the Federal Budget announced last night, treasurer Peter Costello, announced among other things a simplification of the superannuation system - Australia's retirement accounts system. Unlike the US there was already only one type of account but the tax regime was a little complex. It consisted of a 15% tax on contributions, a 15% tax on earnings, and above certain limits - additional taxes on payouts. Getting a payout as a pension annuity was tax-favored over taking a lump sum. So it was some mixture of tax concession and deferred tax regime.

The new system removed the complex regime of taxes on large payouts. Now it seems there is just a 15% tax on cointributions to and earnings of the funds and no taxes on payouts after age 60. This news is important for me because 40% of my net worth is in an Australian superannuation account. I estimate that I will save at least $A90,000 in tax that would have been paid in 2024-5.

For Americans and people from the many other countries that visit this blog it might be interesting to compare these moves in Australia with the system in your country. The announced changes makes this system simpler and lower tax than any of the US accounts - especially for people in higher tax brackets - as the only tax that will ever be applied is 15%. Also the maximum contributions allowed are much higher for people over 35 than those allowed in the US - equivalent to $US 40,000 per year. The downsides of the Australian system is that it is harder to withdraw your money before age 60 though it seems that now money can be left indefinitely in the Super system at the 15% earnings tax rate. In the US earnings on the Roth remain tax free and IRA/401(k)/403(b)'s etc. remain tax deferred until the money begins to be withdrawn (with compulsory withdrawals at age 70).

The new system removed the complex regime of taxes on large payouts. Now it seems there is just a 15% tax on cointributions to and earnings of the funds and no taxes on payouts after age 60. This news is important for me because 40% of my net worth is in an Australian superannuation account. I estimate that I will save at least $A90,000 in tax that would have been paid in 2024-5.

For Americans and people from the many other countries that visit this blog it might be interesting to compare these moves in Australia with the system in your country. The announced changes makes this system simpler and lower tax than any of the US accounts - especially for people in higher tax brackets - as the only tax that will ever be applied is 15%. Also the maximum contributions allowed are much higher for people over 35 than those allowed in the US - equivalent to $US 40,000 per year. The downsides of the Australian system is that it is harder to withdraw your money before age 60 though it seems that now money can be left indefinitely in the Super system at the 15% earnings tax rate. In the US earnings on the Roth remain tax free and IRA/401(k)/403(b)'s etc. remain tax deferred until the money begins to be withdrawn (with compulsory withdrawals at age 70).

Sunday, May 07, 2006

Sell Signal on the S&P 500 and Dow Industrials

The S&P 500 and Dow Industrials rallied strongly on Friday (punching through the 34 day Bollinger Bands indicator I like to use). This triggered the same sell signal on these two indices that occurred for the NASDAQ 100 index a few weeks ago. In 2000 the NASDAQ indices also started the big decline before the S&P 500 and Dow Industrials did. It could happen again.

Saturday, May 06, 2006

The Retirement Account Puzzle

One thing that puzzles me after my explorations in NetWorthIQ and PFBlog space is the obsession with retirement accounts. Many people write about getting financial freedom and are saving but they are stuffing the maximum into retirement accounts. In the US you generally can't touch these until age 59 1/2 and then the money withdrawn is taxed at your marginal rate of federal and state tax. If you touch the money before then you pay the marginal tax plus a 10% penalty (in Aus it is almost impossible to get the money out of a Superannuation account before age 60). Yes I know that a 401(k) defers tax to the future and the profits on a Roth IRA are tax free (if withdrawn after age 59 1/2 or in special cases - see below) and Roth contributions can be withdrawn at any time. But the federal long term capital gains tax rate is now 15% and the qualified dividend rate is also 15% (with 5% rates for lower income earners). And you can use the money to achieve financial freedom at any time....

If you are nearing 60 it certainly makes sense to stuff the maximum into a Roth as you will soon be able to get it out again (a 401(k) or traditional IRA will convert potential investment income though to ordinary income). But if you are in your 20s as many bloggers are - 60 is a long time off. Of course it makes sense to make contributions in order to get an employer match - even after paying a 10% penalty to withdraw the money that can usually be worthwhile.

I have about half my net worth in retirement accounts. Most is in an Australian Superannuation account. I had no choice on the level of contributions as a condition of my employment at a university in Australia. We put in 8% of our salary and the employer contributed 17%! That is the deal the unions had negotiated (I didn't join the union - but had to accept the same pay deal). All employers in Aus must contribute a minimum of 9%. There is no system like the US Social Security in Australia. Instead real savings must be made by employers and there is a flat rate welfare payment for poor retired people called the Age Pension. Here in the US I have to contribute 1% and my employer contributes 8% to a 403(b). I don't have any choice there either, but if I did I would do it - it is an excellent deal. However, we can make extra contributions, which I don't do.

I did open a Roth IRA recently with the sole purpose of creating $10,000 of tax free profits towards a first time purchase of a house, which is one of the special uses allowed. I will likely withdraw the contributions once that goal is achieved, though that is subject to review. The last thing I think I am going to need is more money at age 60.

If you are nearing 60 it certainly makes sense to stuff the maximum into a Roth as you will soon be able to get it out again (a 401(k) or traditional IRA will convert potential investment income though to ordinary income). But if you are in your 20s as many bloggers are - 60 is a long time off. Of course it makes sense to make contributions in order to get an employer match - even after paying a 10% penalty to withdraw the money that can usually be worthwhile.

I have about half my net worth in retirement accounts. Most is in an Australian Superannuation account. I had no choice on the level of contributions as a condition of my employment at a university in Australia. We put in 8% of our salary and the employer contributed 17%! That is the deal the unions had negotiated (I didn't join the union - but had to accept the same pay deal). All employers in Aus must contribute a minimum of 9%. There is no system like the US Social Security in Australia. Instead real savings must be made by employers and there is a flat rate welfare payment for poor retired people called the Age Pension. Here in the US I have to contribute 1% and my employer contributes 8% to a 403(b). I don't have any choice there either, but if I did I would do it - it is an excellent deal. However, we can make extra contributions, which I don't do.

I did open a Roth IRA recently with the sole purpose of creating $10,000 of tax free profits towards a first time purchase of a house, which is one of the special uses allowed. I will likely withdraw the contributions once that goal is achieved, though that is subject to review. The last thing I think I am going to need is more money at age 60.

Friday, May 05, 2006

Reflections on PF Bloggers

I've been reading plenty of these PF blogs as well as creating my own since discovering the NetWorthIQ website. It is very interesting to see how different people think and feel about money. Maybe I should get a new career as a financial adviser instead of as an economics professor :) As a professor, I just just get to tell people how to think about money (when teaching introductory courses) ...

Mainly I have discovered how different I am to the majority of bloggers out there. There are at least two very different universes in the financial internet. People interested in investing and trading on sites like Silicon Investor, which I've belonged to since 1998, have a very different mindset to those interested in personal finance. There are, though, some crossovers like Stealthbucks and Adventures in Money Making. Investor blogs look very different. Investors aren't interested in saving money but instead on making more of it (and protecting what they have). Some of them are naturally frugal and some not. Most, but not all, PF Bloggers seem more directed on saving money than making it. Maybe an exaggeration... but that is why I recently added the phrase "Absolutely no money saving tips!" to my profile.

I don't try to save money and don't need or want money saving tips. It seems I am just trained to be naturally frugal. I don't like buying things, or having things. What I do buy though has to be good quality and convenient. I do take advantage of any deal which is not inconvenient to do. It's not a question of trying to control expenditure or deny myself things. I just spend whatever I want and given current income it isn't too much. On the other hand, when I was a student or unemployed I had to think much more about what I was spending as my income was very low. Maybe all those years helped train me. I seem pretty lavish compared to my parents - perhaps more on that in future posts.

PF bloggers seem to fall into several categories that might overlap:

1. Young people just starting out in the financial world and dreaming of getting rich.

2. People who used to spend beyond their means and regret it and now try to save and invest (I used to spend beyond my means but don't regret it).

3. People whose parents and family are "financially irresponsible" or had little money and didn't know anything about it and are now trying to live a prudent lifestyle themselves.

There don't seem to be many who come from very financially prudent families, got a good financial education, and are themselves a bit more relaxed (that's me).

Mainly I have discovered how different I am to the majority of bloggers out there. There are at least two very different universes in the financial internet. People interested in investing and trading on sites like Silicon Investor, which I've belonged to since 1998, have a very different mindset to those interested in personal finance. There are, though, some crossovers like Stealthbucks and Adventures in Money Making. Investor blogs look very different. Investors aren't interested in saving money but instead on making more of it (and protecting what they have). Some of them are naturally frugal and some not. Most, but not all, PF Bloggers seem more directed on saving money than making it. Maybe an exaggeration... but that is why I recently added the phrase "Absolutely no money saving tips!" to my profile.

I don't try to save money and don't need or want money saving tips. It seems I am just trained to be naturally frugal. I don't like buying things, or having things. What I do buy though has to be good quality and convenient. I do take advantage of any deal which is not inconvenient to do. It's not a question of trying to control expenditure or deny myself things. I just spend whatever I want and given current income it isn't too much. On the other hand, when I was a student or unemployed I had to think much more about what I was spending as my income was very low. Maybe all those years helped train me. I seem pretty lavish compared to my parents - perhaps more on that in future posts.

PF bloggers seem to fall into several categories that might overlap:

1. Young people just starting out in the financial world and dreaming of getting rich.

2. People who used to spend beyond their means and regret it and now try to save and invest (I used to spend beyond my means but don't regret it).

3. People whose parents and family are "financially irresponsible" or had little money and didn't know anything about it and are now trying to live a prudent lifestyle themselves.

There don't seem to be many who come from very financially prudent families, got a good financial education, and are themselves a bit more relaxed (that's me).

Thursday, May 04, 2006

The Fed Isn't Printing Money

Despite the ravings of many goldbugs and other conspiracy theorists the Fed is not printing money. The chart of the M1 money supply has been flat for the past year. M1 money is the sum of bank notes, coins and checking deposits. It is in the direct control of the Fed. But that doesn't mean everything is just fine. If commodity prices are rising yet the money supply is not increasing to accommodate them we should get a recession instead of inflation. And that is my forecast which my investment strategy is based on. This morning I shorted more Starbucks - they release earnings tonight and the stock is looking very weak. Seems like there is little justification for the very high price/earnings ratio (around 50) of the stock given year on year earnings growth rates (around 10%). Yesterday I shorted more Apple Computer. That was a good move so far too. Each day we are seeing a pop-up in the markets in the morning and particularly in Google, only to see a sell-off in the afternoon. The myth is that morning price action reflects "dumb money" and afternoon price action "smart money". Could be some truth in that in recent days.

Wednesday, May 03, 2006

April Report

After a bit of a run around I bought a new firewire cable and got into the portable hard drive with my most uptodate accounts on it. Of course, I immediately backed up the disk. I use an Iomega hard drive which I switch between the various desktop and laptop computers I am use as my primary data store. The last cable only lasted 2 weeks! That cable was from our campus computer store where the same brand of cables are selling for less than half the price CompUSA are charging, but it's no good if they keep failing. Strange :o

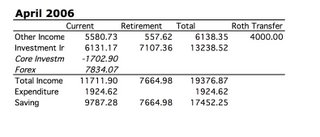

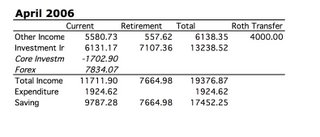

Anyway, my investment performance for April was a 4.49% gain in US Dollar terms. All of it and more is due to the gain in the Australian Dollar. The core rate of return at constant exchange rates was negative. Net worth increased by $17452 to $312,069. Net worth in Australian Dollars declined. Expenditure for the month was $1925. It's all detailed in this spreadsheet:

Investment return year todate is 7.45% and for the last 12 months 20.12%. The MSCI Gross World Index is up 3.09%, 10.01%, and 24.91% respectively. I am about a month ahead of my net worth goal for this point in the year.

Returns so far in May are already 2%.

Anyway, my investment performance for April was a 4.49% gain in US Dollar terms. All of it and more is due to the gain in the Australian Dollar. The core rate of return at constant exchange rates was negative. Net worth increased by $17452 to $312,069. Net worth in Australian Dollars declined. Expenditure for the month was $1925. It's all detailed in this spreadsheet:

Investment return year todate is 7.45% and for the last 12 months 20.12%. The MSCI Gross World Index is up 3.09%, 10.01%, and 24.91% respectively. I am about a month ahead of my net worth goal for this point in the year.

Returns so far in May are already 2%.

Tuesday, May 02, 2006

Global Markets Update

Here is Bill Gross' latest commentary. The last days and weeks have seen rapid movements in exchange rates, interest rates, stock prices, commodity prices etc. Volatility is increasing. Having some computer problems and so haven't yet produced final April numbers. Yesterday, the first day of May, though, was extremely good for me, especially in the US Markets. Stocks fell sharply, especially after Maria Bartiromo said that Ben Bernanke had told her he was misunderstood. Didn't do any good for my bonds of course (and the US Dollar reversed course and went up - though it's down again this morning). In the morning I covered 20 shares of my GOOG position and then in the afternoon started a short position in AAPL. Google went under 400 - Apple fell too - but would have been better to keep all 120 shares short of GOOG I had in the morning! Am also short (and have puts on) QQQQ. So that helped too.

Subscribe to:

Posts (Atom)