We usually classify the first of these investments as a hedge fund and the rest as stock investments, but here we can bundle them together as stock investments. The first two are very successful while the second two are questionable.

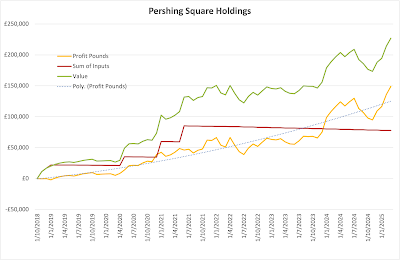

We start with our fifth biggest investment currently, Pershing Square Holdings (PSH.L) managed by Bill Ackman:

Scale: Pounds Sterling

We gradually ramped our investment up to 5,000 shares and then have let our net investment decline with dividend payouts. In the meantime, profit continued to increase. The fund trades 28% below NAV. So, part of our investment thesis is that the gap to NAV will reduce over time. Pershing Square went through a period of under-performance in the years before we invested. Since then they revised their strategy and have done very well. Our IRR is 24%. The question here is whether we should add to the investment. On the one hand, it is 7% of net worth already. On the other hand, it has performed well, is below NAV, and our net investment is only about 1/3 of the total value.

Our sixth largest investment (6.1% of net worth) is Defi Technologies (DEFI.NE and DEFTF):

Scale: US Dollars

This shows that a mature investment is not the same thing as an investment held for a long time if you get lucky! Our IRR is a crazy 378%. We invested roughly 2% of net worth in this company.

We first invested in Generation Global Share Fund, which is a Colonial First State offering, back in 2008 when it was called the Generation Global Sustainability Fund. The fund is closed to new investors, which is one reason why I never sold out of it, but also it has performed well historically returning an above average 13% IRR. However, at the previous review in 2021 it had an IRR of 16.5%. So what happened since then? I ramped up our investment in 2021. This was good timing as you can see profit soared. However, it round-tripped back to 2020 values in 2022. We have let our net investment decline since then as distributions were paid out. But profit has rebounded to new highs.

Scale: Australian Dollars

This is now the only remaining investment in the Colonial First State account I set up for Moominmama in 2008 soon after we moved to Australia. We now have 1.8% of net worth in this investment. So how is this fund doing now compared to benchmarks?

While it outperformed the benchmark over the last 10 years, it has underperformed in more recent periods. So, this isn't a clearcut decision. We need to compare this to our other international share funds. One reason to hold would be to maintain diversity of managers. Maybe this manager will increase performance in the future again while others will decrease... Because funds like this end up distributing most gains we don't need to worry about CGT.

Finally, we have Hearts and Minds (HM1.AX). This is an Australian listed investment company that invests globally using the highest conviction ideas of an array of fund managers. 35% of the holdings are based on stocks spruiked by fund managers at the annual Australian Sohn Investment Conference. The positions are then closed by the next conference. That is a good idea, but one year may be too short for all these investments to work out. And, sometimes, the conference has strayed off the path of sensible investments. Also, the management fees are donated to charity. I invested at the IPO.

Scale: Australian Dollars

I have been gradually reducing our exposure and moving the money to what I perceived as better opportunities. We have only 1.1% of net worth in this stock now. On the other hand, the fund has improved its performance in the last couple of years: Overall, our IRR has been 9%. Our net investment is now close to zero, so I am inclined to hold our position and see what happens. On the other hand, we could simplify things by eliminating this small position.

Overall, our IRR has been 9%. Our net investment is now close to zero, so I am inclined to hold our position and see what happens. On the other hand, we could simplify things by eliminating this small position.

.jpg)