Bill Ackman posted a link to this presentation on Twitter. I have 3,000 shares or a 2% of net worth position. We also have 5,000 shares of PSH.L, Ackman's hedge fund that will be buying $1.5 billion of UMG shares by buying PSTH shares. Vivendi shareholders vote on Tuesday to approve the listing of UMG (hopefully) and presentations take place on Wednesday morning US time.

Monday, June 21, 2021

Update on PSTH

Sunday, July 10, 2022

Portfolio Planning

I won't post June accounts for quite a while. There

doesn't seem much point until we have all valuations for private assets

for the end of the financial year and that won't happen till some time

in August probably.

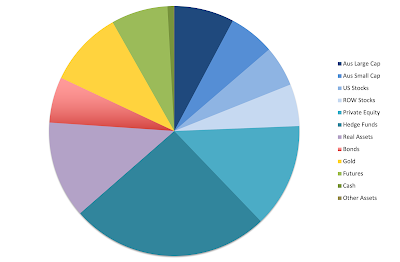

I did a bit of a portfolio planning exercise again with some moves planned. I tweaked the portfolio allocation a little as a result to meet the various constraints. Target allocation to Australian large cap is down from 8% to 7%, hedge fund allocation down from 25% to 24% and bonds and futures both up from 5% to 6%. Other allocations remain unchanged (real assets 15%, private equity 15%, international shares 11%, gold 10%, and cash 1%). Back in 2017, our Australian large cap allocation was 35-36%!

In theory, the new allocation does increase the historical portfolio Sharpe ratio.

So here is the current allocation where I break down by asset class and type of holding:

You are going to need to click on this to see any detail. The names at the bottom are most of the relevant investments in that category. Employer super includes my US retirement account as well. I originally developed this spreadsheet when we were planning the SMSF. Then the future allocation tries to move more towards the long run allocation while taking into account the amount of money in each pot and what the employer super is invested in etc.

It also reflects that we are probably going to get the cash back from our investment in PSTH, which is then reinvested in the SMSF. I want to move my holding of Aspect Diversified Futures into the SMSF I will sell and buy again rather than actually move it as I plan to buy a class with lower fees. With the proceeds from selling Aspect we invest in Australian small cap and international shares. We then use the proceeds from PSTH to buy Aspect in the super fund. Plus a $20k concessional contribution for Moominmama I just made. Otherwise, the allocation says we need to increase holdings of real assets outside of super a lot. I don't know what those investments would be...

Monday, June 14, 2021

Investments Review: Part 5, Private Equity

The private equity category includes both venture capital, buyout funds, and SPACs, which acquire private companies to take them public.

WAM Alternatives (WMA.AX). Share of net worth: 4.32%. IRR: 16.9%. About a quarter of this fund is allocated to venture capital (one quarter is in real estate and half in real assets, mainly water rights). This fund was started by the failed Bluesky group and has now been taken over by Wilson Asset Management. The fund has traded deep below NAV. It has closed some of the gap but is still below NAV. I'm holding the fund mainly in the hope that eventually it trades at a premium to NAV and for exposure to real assets like water rights. The underlying performance is not that good. In 2020 it lost 3 cents per share in NAV to $1.08 per share while paying out 4 cents in dividends. This year, so far it's gained 6 cents per share, which I guess is OK.

Aura Venture Fund I. Share of net worth: 3.05%. IRR: 20.0%. This is an early stage venture capital fund run by Australian/Singaporean company Aura. It invests in Australian start ups. This fund actually has a negative tax rate – fund earnings are tax free and you get a 10% tax offset on your investment contributions. This is part of the Australian government's policy to encourage start-up companies. None of its investees has failed, though some are now valued below the fund's initial investment price. Some have done really well. Shippit is the star. Some investees have already been exited or are on the way there. The latest is Superestate, which is a residential real estate super fund acquired by Raiz. Superestate has been struggling due to the incompetence of the ATO. The fund is receiving shares in Raiz, which is listed on the ASX, which value the company below the carrying value. Hopefully, Raiz will do well and the shares will gain in value.

Pengana Private Equity (PE1.AX). Share of net worth: 2.40%. IRR: 15.3%. This fund invests in mostly North American private equity (but also in Europe) via funds managed by its partner Grosvenor Capital Management. There are a LOT of fees in this structure, but when I attended the pre-IPO presentation I was persuaded that there was still upside for investors. Initially the share price performed very well and I made money trading the stock. But then the firm issued more shares and the price has settled at NAV. It has struggled to make headway due to the rise in the Australian Dollar negating the gains on the underlying funds. So, the IRR mostly reflects my earlier trading.

3i (III.L). Share of net worth: 2.06%. IRR: 13.8%. This is my oldest private equity investment. I first invested in 2008, during the GFC. By investing in this company, you invest in the business itself, but also in its investments. The firm invests its own capital as well as managing outside funds. When I first invested, the firm invested in venture and buyout. It has pivoted to invest in buyout and infrastructure. It also manages far less outside money than it did. I haven't really been following the company in detail recently until I had to write this report. The proprietary capital is mostly invested in private equity. The fund invests mostly in Europe (but also in North America).

Aura Venture Fund II. Share of net worth: 1.40%. IRR: n.a. Based on the success of Aura VF I, I invested 2.5 times as much money in their next fund. It has not yet made any investments. The initial investment is 25% of the total. So, this would be about 5% of our current net worth when fully invested (not counting any returns on top of that).

Pershing Square Tontine Holdings (PSTH). Share of net worth: 1.35%. IRR: n.a. My newest investment. Pershing announced that they are going to acquire a 10% stake in Universal Music (UMG), which Vivendi is taking public in the next couple of months. But that will leave cash in PSTH and Ackman has a convoluted plan for keeping the company going as a private equity company, acquiring private companies and taking them public. Investors didn't like the UMG deal, but I think it is worth being in on the potential upside of future deals.

Sunday, February 16, 2025

Investments Review 1: Unprofitable Investments

We have six unprofitable investments:

- Tribeca Global Resources Fund (TGF.AX)

- Unpopular Ventures

- Aura VF2

- Dash Technologies/IPS

- Domacom (DCL.AX)

- Pershing Square Tontine Holdings (PSTH)

We can only sell the first of these... You are going to see a lot of graphs like this during this investment review:

The red line is the net cash we have invested, the green line is the current value of the investment, and the golden line is profit. I bought this investment at the IPO (a mistake). I reviewed TGF in the previous investments review here. The investment was marketed on the basis of the high returns the team got with this strategy prior to launch. But unfortunately that performance has not been replicable. Instead, their performance has been erratic to the up and down side. I ramped up my investment by "buying the dip" until 2021 but then missed the chance to cash out at the top. Since then, net investment has declined as dividends have been paid out. But net profit has also drifted down. I guess I am hoping the managers have another bout of erratic out-performance allowing me to cash out at a profit, but I seriously wonder if I should just sell instead. Our internal rate of return (IRR) is -0.5% and the investment is 2.8% of net worth

What's up with all the other unprofitable investments that we can't do anything about?

Unpopular Ventures is a venture fund on Angellist. We contribute USD 10k per quarter to their "rolling fund" and occasionally invest in some of their syndicates. The investments have so far generated a little net profit. But the fund is managed on a 2 and 20 basis and you pay ten years of 2% annual management fees up front! So, each investment in the Rolling Fund is immediately marked down by 20% or so.

Our internal rate of return is -7% indicating the underlying profitability. And their funds from the years immediately prior to our initial investment have done very well. So, we could stop making new contributions here, but I think we can continue until the fund is at 5% of net worth say. We are now at 3.5%.

Aura VF2 is a conventional Australian venture fund that is still making capital calls. One of their early investments, Lygon, went bust but has been restructured. This is the main reason the investment is down. Some of their other investments are doing well. The IRR is -3% and the investment is 2.6% of net worth.

Dash Technologies took over Integrated Portfolio Solutions, which was an Aura Venture investment. Unfortunately, IPS didn't manage to make the breakthrough they hoped for when we invested in the syndicate. The takeover was for a mix of cash and shares in Dash. Half the cash has been distributed, the rest is coming later this year. The remaining investment is 0.6% of net worth. The IRR has been -5%.

Domacom provides fractionalised investments in real estate in Australia. It is currently suspended from the ASX. My investment thesis was that the company was likely to be acquired by a larger financial institution that could leverage the investment through its distribution network. But that never happened and I missed the opportunity to get out during the previous period when the company was relisted on the exchange. It has gone through a lot of recapitalizations and things are again looking up. It is only 0.1% of net worth with a -36% IRR!

Finally, PSTH was a SPAC vehicle set up by Pershing Square Holdings. It tried to acquire Universal Music Group but was blocked. Ackman has restructured the company and claims to be still looking for targets. So, it has zero carrying value and it is a case of wait and see. The IRR has been -13%.

Thursday, August 05, 2021

July 2021 Report

It was another month of increases in world stock markets. The MSCI World Index rose 0.72%, the S&P 500 by 2.38%, and the ASX 200 rose 1.11%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7500 to USD 0.7350. We gained 2.96% in Australian Dollar terms or 0.90% in US Dollar terms. The target portfolio is expected to have gained 2.31% in Australian Dollar terms and the HFRI hedge fund index is expected to lose 0.33% in US Dollar terms. So, we outperformed all benchmarks. Here is a report on the performance of investments by asset class (currency neutral returns):

Gold contributed the most to performance followed by real assets, Australian large cap, and private equity.Things that worked well this month:

- Gold gained AUD 32k followed by WAM Alternative Assets (15k), US Masters Residential Property Fund (URF.AX, 14k). The latter gained 23% for the month.

- The worst performers, not surprisingly, were the two Pershing Square Funds: PSH.L (-AUD 12k) and PSTH (- 10k). The SEC stopped Bill Ackman's planned purchase of shares in Universal Music. Now the hedge fund, PSH.L, will have to buy more than planned and the SPAC, PSTH, will have to look for another deal. Third worst was, also not surprisingly, the China Fund (CHN, -7k).

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices. We show the desired asymmetric capture and positive alpha against the ASX200 index. We are doing about the same as the median hedge fund levered 1.6 times.

We maintained roughly the same distance from our desired long-run asset allocation. Hedge funds is the asset class that is now furthest from its target allocation (4.7% of total assets too little). Our actual allocation now looks like this:

Roughly two thirds of our portfolio is in what some consider to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month, which was a relatively quiet month:

- I bought 10,000 shares of Pengana Private Equity (PE1.AX) around its announcement of a good gain in NAV.

- I bought 1,000 shares of Scorpio Tankers baby bonds (SBBA).

- I closed a losing soybeans trade.

- I bought shares in another painting.

- I transferred my shares in the Macquarie Winton Global Alpha Fund to our SMSF.

Wednesday, August 03, 2022

July 2022 Report

July was a reversal of June. The S&P500 gained more than it lost in the previous month and gold fell more than it rose in the previous month. Investors seem to think that the Federal Reserve will raise interest rates by less than originally expected. The MSCI World Index (USD gross) rose by 7.02%, the S&P 500 by 9.22%, and the ASX 200 by 5.77%. All these are total returns including dividends. The Australian Dollar rose from USD 0.6900 to USD 0.6968 increasing Australian Dollar returns and reducing USD returns. We gained 4.11% in Australian Dollar terms or 5.13% in US Dollar terms. The target portfolio gained 3.75% in Australian Dollar terms and the HFRI hedge fund index was up only 1.65% in US Dollar terms. So, we out-performed the latter two benchmarks but under-performed the stock indices. The AUD return for the month is more than what would be expected historically given the ASX 200 performance for the month.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have for the first time added in the contributions of leverage and the Australian Dollar to the AUD net worth return.

Hedge funds were the biggest contributor to performance while Australian small cap had the best return. Gold was the worst performer and a significant detractor. Rest of the World stocks had a relatively poor performance because of our weighting to the China Fund.

Things that worked well this month:

- Regal Funds was the best performer (AUD 25k) followed by Pershing Square Holdings (18k), Tribeca Global Resources (18k), and another seven investments that gained more than AUD 10k.

What really didn't work:

- Gold was the worst performer (-24k) followed by the China Fund (-9k) and Winton Global Alpha (-5k). Only six investments lost money while 29 gained.

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. This month, I have added another three rows to report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the hedge fund index and not really against the MSCI. Compared to the ASX200 our rate of return has only been 0.6% lower but our volatility has been 5% lower.

We are performing 2% per annum worse than the average hedge fund levered 1.7 times. I'm not sure why this alpha has deteriorated sharply recently. July 2017, which was dropped from the estimation this month, was a good month for hedge funds but both June and July 2017 were particularly good months for us in USD terms as the Australian Dollar rose sharply.

We moved a bit away from our target allocation. This was mainly because of the redemption of Pershing Square Tontine Holdings that reduced our private equity allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I sold 4,000 shares of WAM Leaders to get some cash.

- I made an AUD 20k concessional superannuation contribution for Moominmama.

- We combined these to start an account at Colonial First State for the SMSF investing in Aspect Diversified Futures with an initial AUD 25k (the minimum investment for Class A shares).

- As mentioned above, PSTH returned the cash to shareholders. There is a placeholder position still in our account which might turn into SPAR warrants at some point.

- I bought a net AUD 75k, mainly with the US Dollars from PSTH.

- I invested around AUD 10k in 64 Devonshire Road, Rossmore, NSW.

- I bought 1,250 PMGOLD shares (12.5 ounces of gold).

- I bought 3,000 more shares in Pendal (PDL.AX), when it was announced that merger talks were back on.

Tuesday, June 08, 2021

Investments Review: Part 4, Hedge Funds

Regal Funds (RF1.AX). Share of net worth: 5.63%. IRR: 45.7%. This is a multi-strategy hedge fund listed on the ASX that has performed very well since the COVID crash:

It has a beta of one to the stock market but has added a lot of alpha. The downside is that it has a trust structure and, therefore, pays out all profits in the form that they were earned in. So, it is not very tax-effective. We have now moved our holding to our SMSF. The stated focus is on Australian stocks, but they hold a lot of foreign stocks too.

Tribeca Global Natural Resources (TGF.AX). Share of net worth: 5.57%. IRR: 19.2%. This a global resource sector focused hedge fund listed on the ASX. From launch the price collapsed from $2.50 to under $1. They also lost a lot of money on a large loan to a US based coal mining company. They now have revised the investment guidelines to prevent a recurrence. The NAV is now above the IPO price and the stock price is almost there. We have gained a lot by buying when the price was depressed as well as in after-tax terms by selling when the price was depressed to take a tax loss.

Pershing Square Holdings (PSH.L). Share of net worth: 5.33%. IRR: 39.8%. This fund is listed on the London stock exchange but managed by Bill Ackman, a famous US hedge fund manager. The fund is very focused. They invest in around 10 large cap mostly US stocks at any one time. It is mostly a long fund. But they gained during the COVID crash by putting on a credit -ased hedge. Almost perfect market timing. The history of Pershing Square Holdings has been a bit erratic but since we invested it has been very good. The fund is still trading a lot below net asset value. Pershing Square Tontine Holdings has been in the news recently following its deal to buy 10% of Universal Music. I'm still not clear what will be the pay-off for PSH.L holders from this deal. Both PSTH and PSH fell on the news.

Cadence Capital (CDM.AX). Share of net worth: 3.80%. IRR: 10.2%. This is a long-biased long-short fund that mostly invests in Australian stocks. I invested in this fund when it had been performing well. Then, soon enough, it started to perform badly. Since the COVID crash it has done well. They also invested in a private investment in DeepGreen Minerals, which will be taken public by a SPAC for a huge gain on Cadence's investment price. I am thinking to trim my exposure to this fund once the price has built in the value of the DeepGreen Investment. There is no reason to hold both this and the Cadence Opportunities Fund, and this is also the worst performing of the hedge funds that I have held for at least a few years.

Cadence Opportunities Fund. Share of net worth: 2.76%. IRR: 41.6%. This fund was launched recently by the managers of Cadence Capital. This fund has performed extremely well. It is a long-biased long-short fund that trades more actively than CDM.AX. It was supposed to be listed on the ASX but the IPO failed and it became a private company. At the time I didn't invest. That was a bad decision. When a second opportunity to invest came up, I took it. Our IRR so far shows that was a good move.

Platinum Capital (PMC.AX). Share of net worth: 2.67%. IRR: 13.0%. I first invested in Platinum Capital back in 2001. Over time, we also held various unlisted versions of the fund. I have gained by trading the fund depending on whether the share price was above or below NAV. The fund's best performance was during the dot.com crash when I first invested in it. Most of the time since then it has underperformed the market but has also had lower volatility. In the last year, value investing has come back into favor and the fund has again been outperforming the market.

APSEC. Share of net worth: 2.07%. IRR: -7.5%. This is an unlisted Australian stocks focused hedge fund. They did very well in the COVID crash:

Contango Income Generator (CIE.AX). Share of net worth: 1.41%. IRR: -11.9%. This is a very new investment, so the IRR likely is pretty meaningless. This listed fund recently changed strategy to a global equity long short portfolio managed by WCM Investment Management. This is supposed to be their track record:

This was the result of an activist campaign by Wilson Asset Management. It is supposed to be hedged into the Australian Dollar.

In summary, a bit more than half of our hedge fund exposure is to the Australian Dollar but there is definitely quite a lot more international than Australian equity exposure.

Monday, October 02, 2023

Good News from Pershing Square

The SEC finally approved the registration of Pershing Square SPARC Holdings. I bought Pershing Square Tontine Holdings (PSTH) around $23. We got $20 back when the SPAC was wound up. It's great to see that it will now be resurrected. Hopefully some good deal will come out of this. I wasn't that inspired by the Universal Music deal, which fell through, anyway. We ended up being invested in that all the same through PSH.L.

Saturday, August 14, 2021

Top Baggers

Meb Faber refers to the total gain on an investment over time in terms of "baggers". If you invested $1,000 and made $9,000 then that is a 10-bagger.

I was wondering what my best investment measured this way was. I previously calculated this using internal rate of return. But it is easier to get a high IRR on an investment held for a short time than one held for the long term. Which of my investments gained the most over time?

If you invest $1,000 and now have $1,000 of profit it is easy to see that this is a 2-bagger. This is the way venture capital firms typical report the value relative to what they put in. But what if you added more to the investment over time? What if you sold out for a while and then bought back? Or traded in other ways?

I realized we could get an approximation in these cases using the following pseudo-formula in Excel:

Bags = (1+IRR)^(COUNT(X:Y)/12)

IRR is the internal rate of return I already have. The count formula counts how many cells have an entry in them. I created a column with the following formula in it:

=IF(Z=0,"",1)

where Z are cells with the number of shares held each month. It returns a blank if the number is zero. We then apply the previous formula to this column (i.e. the range X:Y).

I've now applied this to all my currently held investments. The median investment is 1.42 (gold). The worst is 0.80 (PSTH) and the best is CFS Developing Companies at 9.69. I think my best ever investment is Colonial/Commonwealth Bank which scores 13.01. I bought Colonial shares at the demutualization. I haven't computed this for all past investments yet. Gold is also my current median investment by IRR (12.4%).

So here are the top ten current investments using "bags", IRR, and total AUD gain :

There is some overlap between the columns. Regal Funds and Pershing Square show up in all three. The IRR column though highlights several recent investments that have done well like WCM Global Long-Short (WLS.AX) and WAM Strategic Value (WAR.AX). The top two in the last column are our two superannuation funds that also appear in the bags column and have a lot invested in them.

Monday, July 05, 2021

June 2021 Report

This month I completed the review of all our investments.

The Australian Dollar fell from USD 0.7738 to USD 0.7500. It was another month of increases in world stock markets. The MSCI World Index rose 1.35%, the S&P 500 by 2.33%, and the ASX 200 rose 2.32%. All these are total returns including dividends. We gained 1.16% in Australian Dollar terms or lost 1.95% in US Dollar terms. The target portfolio is expected to have gained 2.32% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 0.68% in US Dollar terms. So, we underperformed all benchmarks. Here is a report on the performance of investments by asset class (currency neutral terms):

Gold detracted the most from performance followed by private equity and futures. Hedge funds contributed the most followed by large cap Australian shares. The reason we under-performed the target portfolio were mainly that we had a negative private equity return rather than a strongly positive private equity return and our international stocks didn't perform as well as the index.

Things that worked well this month:

- Regal Funds (RF1.AX) gained a lot (AUD 28k) before going ex-dividend on the last day of the month. I sold into the rally. Hearts and Minds also did well (14k).

- Gold lost 30k followed by Cadence Capital losing 8k. Aspect Diversified Futures debuted with a $4k loss though Winton and soybean trading both made gains. 3i, Pengana Private Equity, and Pershing Square Tontine Holdings all lost money in the private equity category.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices. We show the desired asymmetric capture and positive alpha against the ASX200 index. We are doing a little worse than the median hedge fund levered 1.6 times.

We moved a little away from our desired long-run asset allocation. Hedge funds is the asset class that is now furthest from its target allocation (4.25% of total assets too little) following selling most of our Regal Funds shares.

On a regular basis there are retirement contributions. I have stopped making regular contributions to investments outside of superannuation. This was a again a very busy month:

- I sold most of our Regal Funds (RF1.AX) shares as the price soared above NAV.

- I bought shares in my tenth painting at Masterworks for USD 10k.

- Following the investments review, I closed our holding of CFS Future Leaders and CFS Diversified Fund and increased our holdings of CFS Imputation Fund, CFS Developing Companies, and opened a position in Aspect Diversified Futures.

- I sold our holdings of two baby bonds: SBBA and SBKLZ.

- USD 15k of our Ford bonds were subject to an early call.

- I bought 8,000 more shares of Ruffer Investment Company (RICA.L) doubling our position.

- I opened a position (3,000 shares) in Pershing Square Tontine Holdings (PSTH).

- There was a net increase in our holding of MCP Income Opportunities (MOT.AX).

- I increased and rolled our position in the soybeans future calendar spread. I bought a put option as well which was a losing trade.

- I added 1,000 shares to our PMGOLD.AX position.

- We received 83,320 shares in the WAM Strategic Value (WAR.AX) IPO.

- There were a lot of foreign currency transactions, but I'm not going to try to summarize them.