Saturday, April 29, 2006

Weekend Links

John Mauldin's latest weekly letter is all about the weakening US Dollar and the Federal Reserve. Included is this great video! :) We've been watching Ben Bernanke in the Introductory Economics course I teach. We use the textbook the coauthored with Robert Frank and keep uptodate on his progress. And then this crazy real estate listing! That wild insider trading case again, and, finally, an article on renting vs. buying from the Economist.

End of the Month

Looks like I made about a 5% investment return for April. Most of the move was due to the strong rally in the Australian Dollar. The core investment gain - not counting exchange rate movements - was pretty small.

Last month, by contrast, the move in the Aussie was negative and wiped out most of my core investment gains.

Net worth increased by almost $20,000. One of my highest monthly gains, but not unprecedented. I am about $10,000 ahead of the target I set for April based on my goal of increasing net worth by $100,000 in 2006.

Moominmama also saw strong gains due to the fall in the US Dollar.

There doesn't seem to be much awareness of the collapse in the US Dollar in the media.

In the coming days I will post the final results for April.

Last month, by contrast, the move in the Aussie was negative and wiped out most of my core investment gains.

Net worth increased by almost $20,000. One of my highest monthly gains, but not unprecedented. I am about $10,000 ahead of the target I set for April based on my goal of increasing net worth by $100,000 in 2006.

Moominmama also saw strong gains due to the fall in the US Dollar.

There doesn't seem to be much awareness of the collapse in the US Dollar in the media.

In the coming days I will post the final results for April.

Wednesday, April 26, 2006

What Does the Rise in the Gold Price Mean?

Interesting article that looks at whether the rising price of gold is a signal of future inflation. Especially interesting is the comparison of the price of gold to that of other metals. Industrial metals make gold look cheap! No crash yet - but the stock market remains weak. Today I added I took a slightly more bearish stance by buying more QQQQ puts with the cash in my Roth IRA account - doubling the number of contracts. I like to buy in the money options and pay a minimum of time premium. Buying at the money or out of the money options really does seem like gambling. The options have no current "intrinsic value" and unless the stock price moves in your direction by the expiry date you lose all your money... Deep in the money options are closer to futures contracts or heavily leveraged stock positions and are definitely more my "cup of tea" :)

Thursday, April 20, 2006

Potential Crash Warning

One of the things that maybe gives me some trading edge is a technical analysis indicator I developed myself. It is very different to traditional indicators and is based on an autoregression model computed in a spreadsheet. I apply it to the main stocks I trade.

I just did some forward simulations on my NDX spreadsheet using my autoregressive indicator. There is the potential for a massive crash in coming days and weeks. I can't forecast a crash with the indicator, all I can do is plug in some values for the index and see whether the indicators they yield make any sense. Basically the model finds turning points. So if I plug in a number for tomorrow or next week or whenever and it yields a turning point value (greater than one) then I know that is a bottom or top. Very large declines are now possible before the bottom is reached. This wasn't possible even a couple of days ago, but the last couple of days' rally has loosened things up and the index has come to a potential top turning point on my weekly spreadsheet.

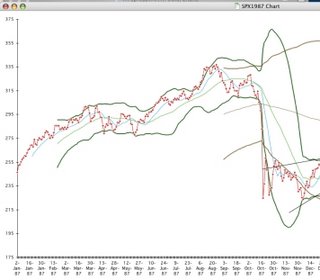

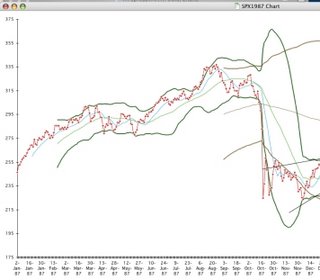

For those of you who remember, I reckon the current juncture has some of the feel of Fall 1987. Read the discussion of the crash in the Alchemy of Finance. Interest rates and the US Dollar played a key role in the crash. In fact the current NDX chart and the SPX chart from that period are uncannily similar in appearance:

Now check this.

Of course this isn't a forecast. Nothing may happen. Or perhaps it will.

I just did some forward simulations on my NDX spreadsheet using my autoregressive indicator. There is the potential for a massive crash in coming days and weeks. I can't forecast a crash with the indicator, all I can do is plug in some values for the index and see whether the indicators they yield make any sense. Basically the model finds turning points. So if I plug in a number for tomorrow or next week or whenever and it yields a turning point value (greater than one) then I know that is a bottom or top. Very large declines are now possible before the bottom is reached. This wasn't possible even a couple of days ago, but the last couple of days' rally has loosened things up and the index has come to a potential top turning point on my weekly spreadsheet.

For those of you who remember, I reckon the current juncture has some of the feel of Fall 1987. Read the discussion of the crash in the Alchemy of Finance. Interest rates and the US Dollar played a key role in the crash. In fact the current NDX chart and the SPX chart from that period are uncannily similar in appearance:

Now check this.

Of course this isn't a forecast. Nothing may happen. Or perhaps it will.

Sell in May and Go Away

Great article by Mark Hulbert on the "Sell in May and Go Away" saying. It is true that stocks perform worse in the summer and better in the winter. In the article he looks into the question of whether there is another asset class that performs better in summer and worse in winter. He finds that the Lehman US Bond Index does perform better in summer than winter. Therefore, an optimal strategy is to sell stocks and buy bonds for the summer. Of course this is just a statistical average over the long term and won't work every year. At the moment, though, I am net short stocks (including put options as shorts) and long bonds, which is a more extreme version of this strategy. I'm also 60% or so at least exposed to the Australian Dollar and only 20% to the US Dollar which is falling. In computing the latter I look at a firm's primary listing - for example, News Corp is a US Dollar asset even though I trade it in Australia. I'm now up to 2% allocated to gold (in my Roth IRA through GLD). Recent trades including buying TLT calls (today that doesn't look like such a great idea!) and this morning Yahoo puts. Yahoo's earnings report yesterday met expectations. So why the huge ramp in price? This is the kind of trade I do on news occasionally. When Fortune decides that finally it is time to get back into net stocks, it may actually be time to get out (or past time). This month the main news in my portfolio has been the rise in the Australian Dollar - each 1 US cent move up adds about $US3700 to my net worth.

Tuesday, April 18, 2006

Buying and Holding an Index Fund is so 20th Century

More Bond Bulls

These guys' Q1 report - highlighted in John Mauldin's latest letter - has an identical viewpoint to my own on inflation, bonds etc.

Monday, April 17, 2006

Savings vs. Profits

I was curious what fraction of my net worth accumulation had come from saving and how much from investment profits. I created this chart, which also breaks things down between retirement and non-retirement accounts. Profits on the retirement accounts now exceed contributions. Performance on the non-retirement accounts has not been as good. Cumulative profits in both categories were negative in January 2003 after substantial bear market losses. Non-retirement saving has not been much recently as I have fully funded a Roth IRA for 2005 and 2006.

Sunday, April 16, 2006

Clustermaps is Amazing

This Clustermaps application is so amazing! Every day I check the new red spots appear on the map. The latest entrants are for Bangkok, somewhere in southern Turkey, and Tokyo. Everyone I show it to is amazed also. I also installed one on my academic homepage.

Saturday, April 15, 2006

Is There a Housing Bubble?

There have been a couple of recent economic studies published that argue that there is no housing bubble. One paper by Himmelberg et al. and another by Hwang Smith and Smith.

Both studies value houses appropriately from the point of view of a potential homebuyer. I don't have any problems with their house pricing formula or data on existing prices, rents, and other variables. My problem is with their conclusion that their results indicate that there is no housing bubble.

The valuation formula takes into account rents for rental housing, interest rates, property tax, maintenance costs, federal and state tax deductions etc. and, crucially, potential capital appreciation. It makes sense to pay more for a house if you think its price will go up. So from the point of view of a potential buyer their formula for valuing a house is correct.

But this builds an expectations component into homeprices. If people think houseprices will rise they will pay more for houses. If houseprices continue to rise this will have turned out to be correct. But if houseprices in fact stop rising then the prices people are paying will turn out to be too high and prices will start to fall. Falling prices mean negative capital appreciation, which means prices should be even lower. There couldn't be a simpler and better bubble generating mechanism.

The two studies I cited assume house prices will continue to rise at historic rates. If you assume that, then people are not currently paying too much for housing in supposed bubble zones and hence the authors claim that there is no bubble - houses are not overvalued. But the instant prices stop rising - for example due to increasing interest rates - suddenly homes are overvalued and there is a bubble!

Similar mechanisms exist in the stock market - as discussed by Soros in The Alchemy of Finance. Stock prices partly depend on expectations of the growth rate of corporate profits. Soros pointed out that sometimes these contain a self-reflexive component where increasing stockmarket valuations feed back into increasing corporate profits. But in the housing market the growth component is even more self-reflexive. If everyone believes houseprices will rise then they will, until people no longer believe this.

In conclusion it is impossible to find whether a bubble exists by looking at whether house prices are currently overvalued based on historic capital appreciation rates. You have to be able to also model the future path of house prices and then ask: "Given this future path, are prices now too high". Yes the two depend on each other - the economics is dynamic and not as simple as the economics in these papers.

Both studies value houses appropriately from the point of view of a potential homebuyer. I don't have any problems with their house pricing formula or data on existing prices, rents, and other variables. My problem is with their conclusion that their results indicate that there is no housing bubble.

The valuation formula takes into account rents for rental housing, interest rates, property tax, maintenance costs, federal and state tax deductions etc. and, crucially, potential capital appreciation. It makes sense to pay more for a house if you think its price will go up. So from the point of view of a potential buyer their formula for valuing a house is correct.

But this builds an expectations component into homeprices. If people think houseprices will rise they will pay more for houses. If houseprices continue to rise this will have turned out to be correct. But if houseprices in fact stop rising then the prices people are paying will turn out to be too high and prices will start to fall. Falling prices mean negative capital appreciation, which means prices should be even lower. There couldn't be a simpler and better bubble generating mechanism.

The two studies I cited assume house prices will continue to rise at historic rates. If you assume that, then people are not currently paying too much for housing in supposed bubble zones and hence the authors claim that there is no bubble - houses are not overvalued. But the instant prices stop rising - for example due to increasing interest rates - suddenly homes are overvalued and there is a bubble!

Similar mechanisms exist in the stock market - as discussed by Soros in The Alchemy of Finance. Stock prices partly depend on expectations of the growth rate of corporate profits. Soros pointed out that sometimes these contain a self-reflexive component where increasing stockmarket valuations feed back into increasing corporate profits. But in the housing market the growth component is even more self-reflexive. If everyone believes houseprices will rise then they will, until people no longer believe this.

In conclusion it is impossible to find whether a bubble exists by looking at whether house prices are currently overvalued based on historic capital appreciation rates. You have to be able to also model the future path of house prices and then ask: "Given this future path, are prices now too high". Yes the two depend on each other - the economics is dynamic and not as simple as the economics in these papers.

Friday, April 14, 2006

Wealth Distribution

There has been some discussion on NetWorthIQ about what fraction of the US and world population are millionaires. It is surprisingly hard to get that information and there are various definitions including both total net worth, net worth excluding primary residence, and financial net worth. An expert on the topic is Edward Wolff, his paper on the topic of changes in the net worth of US households in the 1980s and 1990s includes official data from 2001. It doesn't quite give the answer but has lots of interesting data. Based on this, I estimate that in current dollars using a broad definition of net worth there are around 10 million millionaire households in the US. This is far above the Merrill Lynch estimate but close to the TNS estimate. Also my net worth is about average for someone of my age and income, though its composition is rather unusually biased to financial securities.

Update (20 April): Another survey on wealthy households in the US

Update (20 April): Another survey on wealthy households in the US

Wednesday, April 12, 2006

$300,000

Today I exceeded $300,000 in net worth for the first time. This is based on an update of all values yesterday and the change in exchange rates and my Ameritrade account today. The rise in the Australian Dollar and fall in the stockmarket pushed me over the line. A falling stockmarket has a positive effect on my short positions and put options. The beta of my portfolio is currently -0.35, which means that a 1% fall in the stock-market increases my net worth by 0.35% on average.

It took till November 2001 to reach the first $100,000. My net worth declined after that, though, to a low of $56,000 in September 2002 shortly after I moved back to the US. I again reached $100,000 in August 2003 and $200,000 in October 2004.

Let's see if I can stay in the new wealth bracket permanently!

It took till November 2001 to reach the first $100,000. My net worth declined after that, though, to a low of $56,000 in September 2002 shortly after I moved back to the US. I again reached $100,000 in August 2003 and $200,000 in October 2004.

Let's see if I can stay in the new wealth bracket permanently!

Sunday, April 09, 2006

Check that Tax Return!

Today I got my tax assessment letter from the IRS. Now I know why the refund they paid me was $1250.00 less than I expected. I forgot to fill in line 23 of my Schedule A! Line 23 asks you to add together lines 20 through 22. I did, but forgot to fill in the box. I used the number I calculated in computing line 26 which is where you deduct line 25 from line 23. As my line 23 had zero on it their computer told them my line 26 should have zero too. Instead I had $4981.04. As a result they raised my taxable income by that amount and taxed me $1250.00 more. I will phone the IRS and explain it to them. So, those of you out there who haven't yet filed - check all the relevant boxes are filled in and if the IRS changes your refund, don't assume they are right! I will recognize the extra $1250.00 in my net worth immediately.

Picking Stocks is Hard

Looks like Croesus Mining will survive though I have no idea what the shares will trade at on 28 April when the suspension ends. One reason I originally bought shares in this company was because I had read they were not doing much hedging of the gold price. And looking at the accounts over the years this seemed to be the case until suddenly their hedgebook exploded. Gold miners hedge by agreeing to sell their gold at a predetermined price using futures (or forward) contracts. This means that they miss out on any upside or downside in the gold price. It gives them more certainty. Any extra gold they produce could be sold at the spot price. A problem happens, I now understand when production falls short and the gold price is rising steeply. Then they need to buy gold at the spot price and sell it at their lower contract price. I knew also that Croesus was having some difficulties in operations, but it seemed like they were addressing these - for example selling a large part of their mineral concessions at a nominal profit. And the company kept putting out announcements on promising exploration results. Seemed that reserves while never big were being replenished. A warning sign I should have noted was when last year they appointed a new CEO who resigned within months. I thought I understood fairly well what was going on with this firm, but now I see I didn't. This is a reason that I don't try to pick many individual stocks in "industrial companies" for long term holdings (as opposed to closed end funds, and other financial operations). I have very few. It is hard for an individual investor to have any edge in this, unless they are knowledgable about a particular industry or there is a very clear undervaluation phenomenon.

Friday, April 07, 2006

Turning Point in the Bond Market?

Great article from Bill Gross explaining why the bear market in bonds (equals rising long term bond rates) should be almost over. It's a bet I have been making through holdings in bond and majority bond mutual funds, so far with neither good or bad results (apart from missing out on stock market gains I could have made. Colonial First State's Conservative Fund has however performed nicely over this period.

Today the gold price touched $600 per ounce in the futures market and a little less in the spot market. The Australian Dollar has been rally ever since I did that transfer to Australia - so good timing for once. On the other hand the stock market has been resilient but the McClellan Oscillator has been pretty weak the last three days.

Today the gold price touched $600 per ounce in the futures market and a little less in the spot market. The Australian Dollar has been rally ever since I did that transfer to Australia - so good timing for once. On the other hand the stock market has been resilient but the McClellan Oscillator has been pretty weak the last three days.

Tuesday, April 04, 2006

Salary Increase and March Report

Got the letter today. 1.5%. Inflation is 3.6% p.a. currently. The pool for all salary increases was 2.5%. The rest of the letter went on about how we should think of our department's performance measures as an opportunity for next year and beyond. My chairman ranked me as strong on two measures and outstanding on one of the three. Not much incentive is it.

In the end I got a -0.47% return on investment for March in US Dollar terms. In Australian Dollar terms I made 2.87%. The fall in the Australian Dollar more than wiped out all my positive performance when measured in USD. The MSCI world index returned 2.24%. As a result, net worth increased by only $US1,474 but by $A16,653 to $A411k ($US295k). Still that means I am up $25k so far this year which is exactly on track to add $100k to net worth by the end of the year.

In the end I got a -0.47% return on investment for March in US Dollar terms. In Australian Dollar terms I made 2.87%. The fall in the Australian Dollar more than wiped out all my positive performance when measured in USD. The MSCI world index returned 2.24%. As a result, net worth increased by only $US1,474 but by $A16,653 to $A411k ($US295k). Still that means I am up $25k so far this year which is exactly on track to add $100k to net worth by the end of the year.

Sunday, April 02, 2006

Federal Tax Refund

Received my refund and it is more than $1200 less than expected :( Will have to wait to get a statement to see why there is such a large discrepancy. Whether they disallowed something or I miscalculated something. Something very curious is that the number of cents after the decimal is exactly the same as what I calculated. In fact, the two figures are different by exactly $1250.00. Very weird. Am restating my February accounts and net worth.

PS: Sunday - decided to transfer $3000.00 - my refund + $500 to my Roth IRA. Enough to buy another 5 ounces of gold :)

PS: Sunday - decided to transfer $3000.00 - my refund + $500 to my Roth IRA. Enough to buy another 5 ounces of gold :)

Saturday, April 01, 2006

Google Enters the S&P 500 Index

Crazy action at the end of the trading day and after hours as GOOG entered the S&P 500 Index and Google's 5.3 million secondary share offering was priced. Huge volume. I would interpret the downward pressure towards the end as players who bought shares in the last week in the hope to sell them to mutual funds dumping their surplus. They should have a surplus if they didn't expect this 5.3 million share offering. We can't really know this unless we are actually inside these institutions, but it is a picture that makes sense. I stayed short GOOG at the end. Tried to play HANS. There was a rumor that they are in talks with Anheuser-Busch, which pushed the stock up in pre-market trading. I shorted but missed my opportunity to buy back before the news wires reported the story and pushed the stock up again. Covered after hours for a small loss. Trading has been harder recently, no big wins since WLS jumped $20 on the offer by William Lyon to buy out the company. My average return on a trade so far this year is now about 0.45%. The experiment will continue :)

In the next several days will calculate and report results for March.

In the next several days will calculate and report results for March.

Subscribe to:

Posts (Atom)