In October, the Australian Dollar fell from USD 0.6613 to USD 0.6542 meaning that USD investment returns are worse than AUD investment returns. Stock markets continued to rise (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 2.26%

S&P 500: 2.34%

HFRI Hedge Fund Index: 0.55% (forecast)

Australian Dollar Benchmarks

ASX 200: 0.39%

Target Portfolio: 1.36% (forecast - depends on HFRI result)

Australian 60/40 benchmark: 1.55%

We gained 1.78% in Australian Dollar terms or 0.69% in US Dollar terms. So we beat three of the benchmarks.

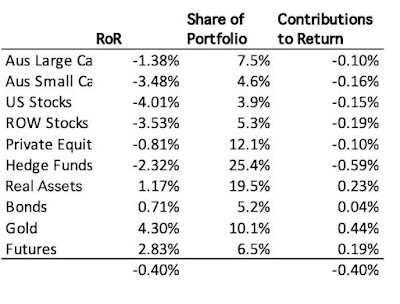

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and do not include investment expenses such as margin interest, and so the total differs from the Australian Dollar returns on net assets mentioned above. Hedge funds had the highest rate of return and the greatest contribution to total return.

Things that worked well this month:

- Seven investments gained more than AUD 10k: Gold (32k), 3i (24k), Tribeca Global Resources (24k), Pershing Square Holdings (23k), Platinum Capital (12k), PSS(AP) (11k), and Domacom (10k). Domacom has not been relisted on the ASX but has issued shares in private placements at 14 cents per share.

What really didn't work:

- No investment lost more than AUD 10k.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give the same statistics for four benchmarks. The middle block gives our performance relative to the indices.

Our alpha relative to the ASX200 is 3.0% with a beta of only 0.48. We have much lower volatility, resulting in a information ratio of 1.47 vs. 1.17. We capture much less of the downside moves than the upside moves in the market. We also have very good performance relative to the Vanguard 60/40 portfolio with the same volatility but 3.5% p.a. more return. We captured 102% of the upside of this portfolio but only 62% of the downside. But as we optimize for Australian Dollar performance, our USD statistics are much worse. We do beat the HFRI hedge fund index in terms of return, but at the expense of far higher volatility. Our USD volatility is at least less than that of the MSCI index, but our return is more than five percentage points lower!

We moved a bit away our target allocation due to investments and investment performance. Our actual allocation currently looks like this:

About 65% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily liquidity, so our portfolio is not as illiquid as you might think.

We receive employer superannuation contributions every two weeks. We make monthly concessional contributions to Moominmama's superannuation to reach the annual cap on contributions. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. I am now receiving TTR pension payments from both Unisuper and our SMSF and contributing more than the total of these back to my superannuation accounts. During the month I worked on finalizing my redundancy and renewing my wholesale investor certification.

I was quite busy making the following additional moves this month:

- I made a AUD 75k investment in Aura Group.

- I bought 900 IBTC.AX bitcoin ETF shares.

- I bought 100 QETH.AX ether ETF shares.

- I sold 6,000 WAM Capital (WAM.AX) shares.

- I bought 9,312 MCP Income Opportunities private credit shares (MOT.AX).

- I bought 5,000 Regal Investment Fund (RF1.AX) shares.

- I sold 19,174 Pengana Private Equity (PE1.AX) shares.

- I sold 5,000 Regal Partners (RPL.AX) shares.

- I bought 5,445 Cadence Opportunities (CDO.AX) shares.

- I bought 20,000 WAM Alternative Assets (WMA.AX) shares.

- I sold 250 gold ETF (PMGOLD.AX) shares.

- I sold 2,000 Tribeca Global Resources (TGF.AX) shares.

- I sold 1,000 WCM Quality (WCMQ.AX) shares.