World markets fell but the Australian market rose with the MSCI World Index (USD gross) falling by 2.55%, the S&P 500 by 2.99%, and the ASX 200 rising by 1.66%. All these are total returns including dividends. The Australian Dollar rose from USD 0.7063 to USD 0.7248 reducing Australian Dollar returns and increasing USD returns. We lost 1.10% in Australian Dollar terms but gained 1.49% in US Dollar terms. The target portfolio fell 2.38% in Australian Dollar terms and the HFRI hedge fund index is expected to fall 1.09% in US Dollar terms. So, we under-performed the ASX200, outperformed the other benchmarks.

It was a bit calmer month despite war breaking out in Ukraine at the end of the month. We continued to work on setting up a second brokerage account for the SMSF and transferring our holdings of listed investment trusts into it.

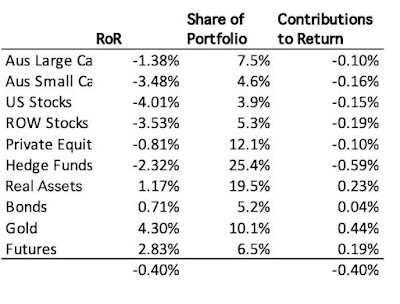

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

All the equity categories lost money, while all the others gained. Gold both performed best and added the most to returns. US stocks was the worst performer while hedge funds detracted most from performance.

- Gold gained AUD 26k. WAM Alternatives (WMA.AX) and URF.AX were the next two best performers, gaining AUD 10k and AUD 6k, respectively.

- Hearts and Minds (HM1.AX) and Cadence Opportunities (CDO.AX) were the two worst performers, losing AUD 13k and AUD 11k, respectively.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 but not so much against the other two benchmarks, which are measured in USD terms.

Our asset allocation did not change much. Private equity is still the most underweight asset class and real assets the most overweight. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month:

- As the gold price rose, the share of gold in gross assets went over 10% and following policy I sold 500 shares of PMGOLD.AX to bring it back to 10%.

- I sold 1,000 shares of Fortescue Metals (FMG,AX). Should have sold more...

- I opened a new position in WAM Leaders (WLE.AX), buying 20,000 shares so far.

- I bought 6k shares in Pengana Private Equity (PE1.AX) when the price was low.

- I sold 3k shares of Regal Funds (RF1.AX) to fund this.

- I heard that our investment in Doyle's farm through Domacom will be wound up and sold. The majority of holders voted to do this. This is my only active investment through Domacom, so a bit disappointing. Hopefully, we won't lose too much considering selling costs and that we have had very little upside so far in this investment. The management company, Domacom (DCL.AX), also doesn't look like relisting on the ASX any time soon.

- On the other hand, Masterworks sold their second painting, which turns out to be one I hold.

2 comments:

Any particular reason you are transferring the listed investment trust holdings into your SMSF rather than just selling them and making an non-concessioanl (or tax deductible, if you haven't maxed out the cap) contribution into the SMSF?

Transferring ownership of the listed investment trust from your names (individual or joint) into the SMSF is a CGT event, so you will have to pay the same personal CGT on transfer (if you have made a gain on those investments at the time of transfer) to the SMSF as you would if you simply sold the investments and realized a capital gain. You might save a fraction of a percent on buy/sell unit price spread by doing the transfer?

They are already in the SMSF in the Interactive Brokers account. We are just moving them to a new brokerage account also in the SMSF. The reason is to get them listed on an individual HIN and then get statements from the share registries. Interactive Brokers uses a custodian and so there is no HIN and no statements from the registry. The problem is that the information from Interactive Brokers on the distributions from these trusts is incorrect and/or not detailed enough.

Post a Comment