Euro E-Mini E62,500

Australian Dollars $A100,000

Yen E-Mini Y6.25 million

$A100k is the minimum trade size. You can't trade only $A50k, for example.

To gain exposure to $A100,000, for example, you put down a margin of $US1000 and the value of your deposit then varies based on the underlying contract value. So if the Australian Dollar rises by 1 US cent your deposit becomes $US2000. If it moves the other way you have zero and must put up more margin (you actually need to do this as soon as the margin deposit falls below $US1000) or sell the contract. You can also short sell a contract to get negative exposure to the same amount. Short selling a contract means creating a new contract - the same as short-selling an option. But unlike selling an option you don't receive money up front for the contract - money flows into your account only if the value of the underlying asset falls. All these contracts are relative to the US Dollar. Shorting a contract converts an exposure to that currency into a USD exposure.

My net worth is $US350,000.$US87,000 or 25% is in US accounts - My 403(b) ($33k), Roth IRA ($8k), Ameritrade trading account ($26k), Interactive Brokers account ($10k), HSBC Online Savings Account ($9k), Checking Account etc. My Australian accounts have $US267k or $A349k.

Therefore, if I buy 1 AUD contract I convert $US77k of my USD exposure into Australian Dollars. I now have only $US10k of exposure to the US Dollar left. If I want to eliminate my Australian Dollar exposure I could short-sell 3 to 4 AUD contracts. Short selling 3 leaves me with $A49k exposure to the AUD. If I short-sell 4 contracts then my net US Dollar exposure is $US395k (4*77k+87k) and a net negative Australian Dollar exposure.

The preceding paragraph is one possible hedging strategy. If I am bullish on the USD I would short 3 AUD contracts and if I am bullish on the AUD I would buy one AUD contract. This will swing my exposure from almost all US Dollars to almost all Australian Dollars.

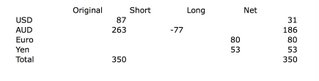

But, as I discussed in my previous post, that isn't a very diversified approach. To get a diversified currency exposure I could short sell 2 AUD contracts and buy 1 Euro and 2 Yen contracts. The resulting exposure is (here I resort to a spreadsheet!):

The net USD exposure is reduced because I converted $US154k of Australian Dollars into US Dollars but then bought $US186k of Euro and Yen. This results in an effective USD loan of $US32k (you don't actually borrow the money it is implicit in the contracts you are entering into). Borrowing money in a currency is just like shorting that currency. Because, my account is still relatively small, I can't avoid the lumpiness of the resulting exposure. Here is another example portfolio which is more bullish on the AUD (but still ends up shorting it!):

I short one AUD contract and buy 1 Yen and 1 Euro. It's possible to get net short in some of the currencies, but I think that is speculating rather than hedging and diversifying and not something I want to do. At least at the moment.

Right now I am long one AUD contract. My USD exposure is, therefore, 3% and my AUD exposure 97%. This hyperbullish stance on the Aussie probably doesn't make a lot of sense.