Given the continued underperformance of managed futures, I think I am going to again lower my allocation to this asset class to 5% from 10%. I've never gotten above 5% in managed futures funds anyway. In place of this, I could raise the allocation to real estate to 15% or raise both real estate and gold to 12.5%. Or is there something else I should allocate capital to?

Monday, August 17, 2020

Adjusting the Target Portfolio

Wednesday, August 12, 2020

Investing During the Pandemic

The table presents snapshots on 1 February, before the pandemic had effects in Western countries, and today. The number of shares held is self-explanatory. Investment is the net cash invested in that investment. So, making an investment increases the number and withdrawal reduces it, but dividends and distributions that aren't re-invested also reduce it. All the numbers are in Australian Dollars and so the numbers also declined for 3i, Boulder, China Fund, and Pershing as the Australian Dollar rose. Investment per share is the investment number divided by the number of shares.

In total, I added $334k to these investments over this period. Most of this money came from maturing bonds. There are a lot of different patterns though. I might have made a mistake in investing the most in funds that were trading at the biggest discount to net asset value rather than what turned out to be the strongest funds. I didn't invest anything in Hearts and Minds and not much in Regal. I got a lot of extra shares in Cadence and Tribeca, which is a bet that they'll do better in the future. I increased my Pengana investment mostly because I thought I needed to invest more in private equity and because the fund had been trading at a big premium to net asset value. It's partly a bet that the premium will come back.

In general though, I have been cautious investing during this period because I invested a lot in early 2008 after the initial fall in the market, only to lose big later in the year.

Wednesday, August 05, 2020

July 2020 Report

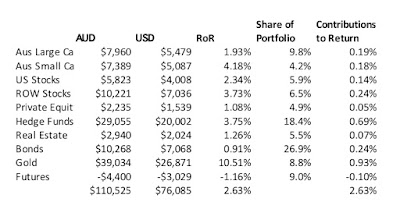

The returns reported here are in currency neutral terms. Gold performed best and futures worst. Gold contributed most to the total return.

Things that worked well this month:

- Gold gained AUD 39k as the metal hit a record high. It is now our fourth best investment ever in dollar terms. Only the CFS Geared Share Fund and the Unisuper and PSS(AP) superannuation funds have made us more money.

- Tribeca was the next best performer gaining AUD 15k.

- Pengana Private Equity lost AUD 4k.

- My Virgin Australia bonds lost AUD 3k. In the coming month we'll find out how much they are really worth.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- We participated in the Pengana Private Equity (PE1.AX) rights issue buying 18,000 shares.

- I bought AUD 50k of Australian Dollars and used 40k to reduce my margin loan at CommSec.

Sunday, July 05, 2020

2019-2020 Spending

Monthly spending increased from $10.7k to $12k (USD 8,250). This is more than my after-tax salary... Housing was again the largest spending category but supermarkets overtook health as the second largest. Spending on mail order and childcare and education are now both ahead of health. The shares of health and housing fell the most due to reduced mortgage interest and medical spending. Our second child was born 26 June 2019 and expenditure around that was mostly incurred in the previous financial year but we got some reimbursements in this financial year. Mortgage interest was down because we had a lot of money in our offset account leading up to the "mortgage inversion" and because the loan is just getting smaller and interest rates are falling.

I spent a lot more on taxis and Uber (I don't have a driving licence). A lot of this was because in the early months of Moominmama's maternity leave I took Moomin to daycare at her workplace before going on to my work. But also, I am getting less patient with the time it takes to get around on public transport when I have increased childcare duties. When it's convenient I get a bus, when it's not I get an Uber or taxi.

Childcare expenditure rose because we now have two children and because we got a lot less subsidy as our income rose. On the other hand, after the pandemic started we got free childcare, so this category will rise even more next year, probably. Mail order spending was up 86% on last year. This is partly because after Moominmama went on maternity leave she did a lot more mail order. But department store (all non-supermarket goods retail) and supermarket spending were also up. Across the three categories, spending was up 47%. Cash spending fell further to just $1,600, though some of the supermarket spending includes cash withdrawals by Moominmama.

I'm also tracking income, tax, and savings in the same spreadsheet. But these numbers are all still really uncertain until we are ready to submit our tax returns in a few months time. Very roughly, half our income goes to spending, a quarter to tax, and a quarter to saving.

Thursday, July 02, 2020

June 2020 Report

The Australian Dollar rose from USD 0.6647 to 0.6884. The MSCI World Index rose 3.24%, the S&P 500 1.99%, and the ASX 200 2.66%. All these are total returns including dividends. We lost 0.65% in Australian Dollar terms and gained 2.91% in US Dollar terms. The target portfolio is expected to have gained 0.59% in Australian Dollar terms and the HFRI hedge fund index 1.26% in US Dollar terms. So, we came close to the MSCI return and outperformed HFRI but underperformed the Australian Dolar benchmarks. Despite my attempts to diversify, returns during this crisis have closely matched the MSCI World Index:

Here is a report on the performance of investments by asset class:

Things that worked well this month:

- Regal Funds gained AUD 17k. We are now back in the black on this investment.

- Gold gained AUD 12k.

- Tribeca Global Resources lost AUD 20k, though it's still above the March low...

- Pengana Private Equity lost AUD 10k. It was at an unsustainable high level and then a rights issue at a much lower level was announced. So, this is actually OK I think.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- I sold USD 5k of Tupperware bonds. I probably acted too quickly on that one.

- I bought 12,000 shares of Tribeca Global Resources. Probably a mistake too.

- I bought AUD 35k of Australian Dollars.

- I sold 20,000 shares of Pengana Private Equity (PE1.AX) and then bought back 40,000 shares at lower prices. I also subscribed to the rights issue.

Monday, June 29, 2020

Some Updates

Before the Great Financial Crisis I invested in the ill-fated Everest Babcock and Brown fund of hedge funds. We finally got the final payout from this fund last week. In the end we lost AUD 12,348 from this and related investments.

Employees at my university narrowly voted in favor of freezing pay, which was scheduled to rise 2% next month. I won't be surprised if they soon try to get me to retire, though at this stage we don't have a good idea of what will happen to student demand going forward. Clearly, fewer people will want to study abroad for a long time. But one hypothesis is that Australia will rise in preference relative to the US and UK as a destination. Moominmama decided to not go back to work for another 3 months. On the spending side we decided to send Moomin to a private school. He has been going 2 days a week to their pre-school this year (and 2.5 days to the local public school). So, spending on childcare and education is only going to ramp up....

Friday, June 12, 2020

Aura Venture

Now, Aura are launching a second Australian venture capital fund. This fund is bigger and the minimum investment is bigger (AUD 250k). The initial investment is 25% of the committed capital. So, I am thinking to also invest in this fund. I think that the first fund will begin to make distributions during the time that the new fund is investing, so that my total invested capital wouldn't hit AUD 350k. All the same, it feels a bit risky investing so much with one manager, as my usual guideline would be to invest a maximum of 5% of net worth. We do have three funds with more than 7% of net worth but they are all quite diversified.

Tuesday, June 02, 2020

May 2020 Report

This month, our spending was again low relative to pre-COVID-19. We spent AUD 5.3k which is up on April's AUD 4.6k.

The Australian Dollar rose from USD 0.6524 to 0.6647. The MSCI World Index rose 4.41%, the S&P 500 4.76%, and the ASX 200 4.42%. All these are total returns including dividends. We gained 2.49% in Australian Dollar terms and 4.40% in US Dollar terms. The target portfolio is expected to have gained 1.53% in Australian Dollar terms and the HFRI hedge fund index 1.69% in US Dollar terms. So, we strongly out-performed these latter two benchmarks and matched the MSCI return.

Things that worked well this month:

- Regal Funds and Pershing Square Holdings were the top performing assets in dollar terms. Some other listed hedge funds (Cadence, Tribeca) also did well.

- Gold.

- CFS Developing Companies Fund.

- Pengana Private Equity.

- Domacom continued to rebound from the lows of March.

- Winton Global Alpha managed futures fund lost 4.6%. I now have lost money overall from investing in this. Is trend-following really dead?

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- Dish and Scorpio Tankers bonds matured, releasing USD 50k plus interest.

- I invested AUD 100k in the APSEC hedge fund.

- I bought 20,000 more shares of the Tribeca Global Resources Fund (TGF.AX).

- I sold 20,000 shares of Pengana Private Equity (PE1.AX) when the price rose a lot above net asset value.

Thursday, May 21, 2020

Margin Loan Limits

PS

Actually, I easily qualify as a wholesale investor based on net worth. Turns out, I have 3/4 of our joint household net worth. My immediate thoughts are that this isn't optimal tax-wise and whether it is worth paying an accountant to certify it? On the other hand, borrowing in my name is a good tax move.

Thursday, May 14, 2020

New Investment: Atlantic Pacific Australian Equity Fund

The fund is long-bias equity market hedge fund buys and short sells, Australian listed securities and derivatives. It has performed particularly well in the current crisis:

It didn't perform very well in the previous 5 years, though it has always been good at avoiding downside in the market and so is a potentially good diversifier.

Saturday, May 02, 2020

April 2020 Report

My main scenario is still that the stock market lows will be at least be retested. Only in 1987 really was there such a steep fall in the market that did develop into a longer bear market. And even then there was more bouncing along the bottom than there has been so far. This is probably like the March-May 2008 rally. The bullish case is that government's and central banks are pouring so much money into the financial markets and broader economy that this time it will be different. On the other hand, though people are comparing this period to the Great Depression, I think there is no chance that stock prices will fall as much as they did then because of all the government action.

I don't usually talk about monthly spending, but this month we only spent AUD 4,300. This doesn't include mortgage interest, which is now treated as an investment expense. Still, it is the lowest monthly spend in a long time. Including mortgage interest it would be AUD 5,800, which is the lowest since July 2017.

The Australian Dollar rose from USD 0.6115 to USD 0.6524. The MSCI World Index rose 10.76%, the S&P 500 12.82%, and the ASX 200 8.78%. All these are total returns including dividends. We gained 4.02% in Australian Dollar terms and 10.98% in US Dollar terms. The target portfolio is expected to have gained 2.93% in Australian Dollar terms and the HFRI hedge fund index gained 4.79% in US Dollar terms. So, we strongly out-performed these latter two benchmarks and beat the MSCI by a little. Updating the monthly AUD returns chart:

Here is a report on the performance of investments by asset class:

Things that worked well this month:

- Gold

- Hedge funds rebounded. In particular, Regal Funds and Tribeca Global Resources.

- Virgin Australia. The company went into voluntary administration and unfortunately I'm still holding USD 25k in face value of their bonds.

- Though it only lost AUD 142, I was surprised by the poor performance of the PSS(AP) superannuation fund (balanced option). This is the main public service superannuation fund for workers who joined the service in recent years. With stock markets and corporate bonds rebounding strongly and a roughly even balance between Australian and foreign assets it must have lost big in real estate or hedge funds to post this result. Unisuper (the universities superannuation fund) gained almost 7%.

- General Motors and Anglogold bonds matured, releasing USD 72k plus interest. I bought USD 15k of Woolworths (Australia) bonds, reducing net exposure by USD 57k.

- I shifted USD 16k from the TIAA Real Estate Fund to the TIAA Money Market Fund. I am concerned that the direct real estate investments the fund holds will be written down soon.

- I bought 4 September out of the money put options on the S&P 500 E-Mini futures as downside insurance in case the market lows are retested or worse.

- I bought AUD 25k by selling US Dollars.

Friday, April 03, 2020

March 2020 Report

I expect HSBC are now happy they didn't give us a mortgage. It's not worth chasing them any more I think. We are keeping our children out of daycare and school, though technically they are still open. There was some miscommunication about applying for the subsidy and only this weekend I completed the application. Now the government announced today that childcare will be free to parents during the pandemic. I was thinking about cancelling the service, but if it is free, of course I won't. It's not 100% clear yet whether it will be free.

I think I will keep paying for my 4 year old's private preschool as we are considering the school as a long term schooling option (it goes through to year 10). Also, we are receiving a government subsidy. It's unclear yet whether this pre-school qualifies for the free childcare deal. We want to have a school for him when this crisis hopefully ends later this year. He goes to that school 2 days a week and 2.5 days to the public preschool.

All stock markets fell sharply in response to the Coronavirus pandemic. The Australian Dollar fell from USD 0.6499 to USD 0.6115 and at one point reached USD 0.55. The MSCI World Index fell 13.44%, the S&P 500 12.35%, and the ASX 200 20.42%. All these are total returns including dividends. We lost 8.95% in Australian Dollar terms and 14.33% in US Dollar terms. This was the worst monthly investment return ever in terms of absolute Australian Dollars lost (AUD 319k). The target portfolio lost 5.05% in Australian Dollar terms and the HFRI hedge fund index is expected to lose 5.88% in US Dollar terms. So, we under-performed these benchmarks though did better than the ASX 200. The value of our house, which is not included in this investment return, increased. Well, the price of houses in our city went up. Updating the monthly AUD returns chart:

Here is a report on the performance of investments by asset class:

Things that worked well this month:

- Pershing Square Holdings - this hedge fund did perform as intended, with the share price rising. The manager Bill Ackman made a big bet on credit default swaps that hedged the losses in the stock portfolio. Subsequently, he has closed those positions and bought more stocks. I bought more shares in PSH, which are trading around 65% of NAV.

- Treasury futures - my bet on a steepening yield curve worked and I closed half the position. The remaining position has backtracked since then.

- China Fund - I bought back our position, which has since performed well.

- Regal Funds - this was our worst performing investment this month in dollar terms. It lost 45% for the month.

- The Unisuper and PSS(AP) superannuation funds were the next biggest losers in dollar terms. They lost 13% and 9%, respectively, which is about what would be expected given a 20% fall in the Australian stock market.

- Junkier bonds like Virgin Australia. The value of Virgin Australia bonds halved. It's not our only distressed bond at this point, but just the worst. I don't know what I was thinking, buying this in the first place.

- Domacom (DCL.AX) shares fell by 2/3.

- Washington Gaslight and Lexmark bonds matured, releasing USD 60k plus interest. We didn't buy any new corporate bonds, so our exposure fell.

- We bought AUD 104k by selling US Dollars.

- I bought 25k Pengana Private Equity (PE1.AX) shares after the rights issue was cancelled. My timing could have been better as the shares then dipped before rebounding.

- I bought back our position in the China Fund (CHN). I figured that China is now rebounding. So far, that was good timing.

- I bought 25k Cadence Capital shares (CDM.AX). This fund has been a disaster, but the shares were trading at the value of cash that the fund has per share. So far, a good move.

- I bought 10k Tribeca Global Resources (TGF.AX) shares. Another disastrous investment in the long run, but the new shares have risen since buying them.

- I bought 25k Bluesky Alternatives shares (BAF.AX). They were trading at about 50% of NAV. I expect some of the fund's investments will be written down, but not that much overall.

- I shifted USD 4k from the TIAA Real Estate Fund to the CREF Social Choice Fund.

- I shifted about AUD 36k from the CFS Conservative Fund to the CFS Diversified Fund that has a higher risk allocation.