The Australian Dollar rose a little this month to 93.43 US cents. The MSCI World Index rose 2.25%, the S&P 500 rose 4.00%, but the ASX200 rose only 0.62%. Our Australian Dollar performance was close to the latter gaining 0.58% (1.05% in US Dollar terms). All asset classes apart from private equity gained with Australian small cap and US stocks doing best. By the way, you can get an up to date asset allocation here.

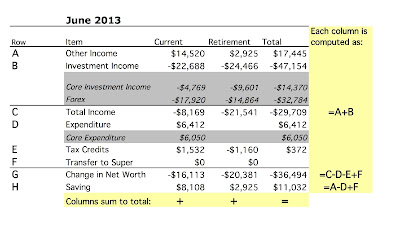

Net worth rose $A19k to $1.266 million or $US22k to $US1.183 million. The monthly accounts (in AUD) follow:

This month there is a new column and row to take into account housing investment activities separately from spending or other investing. So costs incurred in the housing hunt will be accounted for here. We seem to be out of the race for the house I bidded on this weekend, but the search continues.

Current non-investment income (salary etc.) was above normal at $15.7k due to some extra payments. Spending was $4.7k which is lower than average. We managed as a result to save $10.6k from non-investment income. We gained $6.9k on investments.

Net worth rose $A19k to $1.266 million or $US22k to $US1.183 million. The monthly accounts (in AUD) follow:

This month there is a new column and row to take into account housing investment activities separately from spending or other investing. So costs incurred in the housing hunt will be accounted for here. We seem to be out of the race for the house I bidded on this weekend, but the search continues.

Current non-investment income (salary etc.) was above normal at $15.7k due to some extra payments. Spending was $4.7k which is lower than average. We managed as a result to save $10.6k from non-investment income. We gained $6.9k on investments.