I put together a dataset for the ASX 200 futures for the past 5 years - Barchart have this data. Every possible "Turtle" strategy I tested lost money. So, we're definitely not going to trade this! I tested breakouts from 1 to 40 day periods and they all have similar poor performance. Position sizing to always trade the same percentage risk made things much worse.

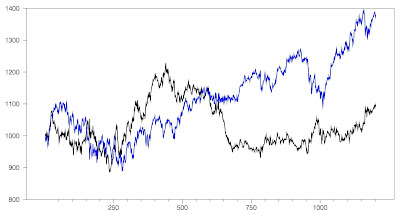

Here is a 2,2 strategy without position sizing assuming no slippage – The best case scenario:

The blue line is the continuous futures contract price I constructed and black is the equity line of the strategy. This actually makes a slight gain over the 1200 trading days. But including reasonable slippage, it will turn into a loss. A 2,2 strategy means that you buy or sell breakouts from the previous two days highs or lows and exit those positions on breakouts from the same number of trading days in the opposite direction.

I have now put on a small (10 ounce) Palladium trade using CFDs. I'll probably test trading oil next.

Saturday, September 28, 2019

Monday, September 23, 2019

Data Quality Matters

I did an analysis of the optimal trading strategy for Palladium futures using Barchart data. Previously, using free data, I had found that we should make trading decisions based on very short periods of past prices. For example we might go long (short) if prices broke out above (below) the previous day's high (low), or maybe the high or low of the previous two days. Now I find that the optimal strategies use periods of 7 to 18 days for breakouts. This shows that using good quality data really matters in trading, and not just a little bit. Using one day breakouts would actually lose money over the last five years of data that I tested. I lost money on all the Palladium trades I previously made... though four trades is not a large sample.

At the moment Palladium is in a winning long trade, but I am reluctant to go long at this point. So, I put in a short trade which will activate if the market reverses.

I also found out today that Barchart has past ASX 200 futures prices. I don't know if these are as high quality as their US futures data. I will download them next.

At the moment Palladium is in a winning long trade, but I am reluctant to go long at this point. So, I put in a short trade which will activate if the market reverses.

I also found out today that Barchart has past ASX 200 futures prices. I don't know if these are as high quality as their US futures data. I will download them next.

Sunday, September 15, 2019

Variable Position Size, Again

I signed up for the Barchart Premier subscription. Among other things, this gives access to daily open, high, low, close etc. data for all US based futures contracts back to 2000. The data seems to be much more accurate than the various free sources. To start with, I downloaded all Bitcoin futures contracts data. I constructed a continuous series of prices going back to the beginning of trading in Bitcoin futures. I use proportional splicing that preserves percentage changes rather than absolute dollar changes. I also saved the actual futures prices for computing trading costs.

When we include the very volatile period right after the all time high in Bitcoin, the optimal trading strategy changes:

This graph shows the drawdown for a simple strategy that always buys the same number of contracts (in red) with a strategy that always has the same initial risk in percentage terms (in green). The latter targets a constant maximum 5% potential loss of the face value of the Bitcoin contracts before stopping out. The simple strategy soon finds itself 40% down at the end of January 2018. On the other hand, it manages to claw back that loss by late March... The constant risk strategy only loses a maximum of 15% over this period. On the other hand it performed worse during the string of 11 losing trades in a row in late 2018. But the Sharpe ratio for the constant risk strategy (2.45) is quite a lot higher than for the constant position size strategy (2.21). So, I am going to start varying position size, targeting a maximum loss of USD 5,000.

I will also start to revisit other markets to see where there is potential.

Previously, I found that there was a positive relationship between the initial risk of a trade and its return. When volatility is low moves seem to be more noise than signal. Looking at the relationship between initial risk and return, there is now a negative correlation between them, though it isn't statistically significant:

On the other hand, the "lowest risk" trades here mostly had negative outcomes.

When we include the very volatile period right after the all time high in Bitcoin, the optimal trading strategy changes:

This graph shows the drawdown for a simple strategy that always buys the same number of contracts (in red) with a strategy that always has the same initial risk in percentage terms (in green). The latter targets a constant maximum 5% potential loss of the face value of the Bitcoin contracts before stopping out. The simple strategy soon finds itself 40% down at the end of January 2018. On the other hand, it manages to claw back that loss by late March... The constant risk strategy only loses a maximum of 15% over this period. On the other hand it performed worse during the string of 11 losing trades in a row in late 2018. But the Sharpe ratio for the constant risk strategy (2.45) is quite a lot higher than for the constant position size strategy (2.21). So, I am going to start varying position size, targeting a maximum loss of USD 5,000.

I will also start to revisit other markets to see where there is potential.

Previously, I found that there was a positive relationship between the initial risk of a trade and its return. When volatility is low moves seem to be more noise than signal. Looking at the relationship between initial risk and return, there is now a negative correlation between them, though it isn't statistically significant:

Wednesday, September 04, 2019

Individual Investment Returns, August 2019

Following up on the monthly report for August, here are the returns of each individual investment or trade. As usual, I have aggregated all the individual bonds (23 of them) we have into one number. As discussed in the monthly report, gold and the Winton Global Alpha Fund did exceptionally well, some hedge funds (Tribeca and Platinum Capital, in particular) did badly, and diversified funds like CFS Conservative, CREF Social Choice, and PSS(AP) weathered the month well. Real estate investments did OK. The CFS Developing Companies fund also bucked the trend for the month.

Tuesday, September 03, 2019

August 2019 Report

Stock markets fell in August but we did OK in Australian Dollar terms and not so bad in US Dollar terms. The Australian Dollar fell from USD 0.6879 to USD 0.6729. The MSCI World Index fell 2.33% and the S&P 500 1.58%. The ASX 200 fell 2.05%. All these are total returns including dividends. We gained 0.93% in Australian Dollar terms and lost 1.27% in US Dollar terms. The target portfolio is expected to have gained 1.82% in Australian Dollar terms and the HFRI hedge fund index is expected to have lost 0.70% in US Dollar terms. So, we had a relatively strongly performing month, beating all three stock indices but under-performing our target portfolio and the HFRI. Updating the monthly returns chart:

Here is a report on the performance of investments by asset class (futures includes managed futures and futures trading):Gold, futures, bonds, and Australian small cap had positive returns while other asset classes lost money. The largest positive contribution to the rate of return came from gold and the greatest detractor was hedge funds. The returns reported here are in currency neutral terms.

Things that worked well this month:

- Gold gained 7.8%.

- The Winton Global Alpha Fund also did very well gaining 5.6%...

- I was impressed by the PSS(AP) balanced fund, which actually gained this month. But generally, diversified investments did well as bond performance outweighed the fall in stocks.

- Trading. Not including gold we lost 2.48%. Including gold it was a 2.18% gain for the month. Near the beginning of the month we had a big winning trade in Bitcoin, gaining USD 16k. We then gave it back in losing trades as the cryptocurrency chopped around. I have now reduced my position size in case this chop continues. The treasuries steepening trade also lost as the yield curve inverted more.

- Tribeca Global Resources Fund (TGF.AX) did horribly in terms of its share price. It's trading at quite a large discount. Cadence Capital (CDM.AX) returned to its position of being my worst investment ever in dollar terms, down AUD 20.6k cumulatively (AUD 3.2k this month).

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- $25k of Scorpio Bulkers baby bonds matured slightly early, $25k of Hertz bonds were called, and $50k of Macquarie Bank bonds matured. I bought $50k of Energy Transfer bonds and $15k of Ford bonds. So, our direct bond holdings declined by $35k.

- We traded unsuccessfully, as discussed above.

- I opened a small position (10,000 shares) in URF, an Australian based REIT investing in US residential property, that was trading at a large discount to net asset value.

- I increased our holding of Domacom (DCL.AX) shares to 100k. It's still a very small position – 0.2% of net worth.

- I bought 1,000 more shares of the IAU gold ETF.

- I invested the inheritance of baby moomin. This reduced our cash and debt by the same amount as I was holding cash for this purpose but recording a loan from him in our accounts. Reported net worth does not include the net worth of our children, just my wife and I.

Subscribe to:

Comments (Atom)