In September the Australian Dollar fell from USD 0.6729 to USD 0.6752. The MSCI World Index rose 2.15% and the S&P 500 1.87%. The ASX 200 rose 2.08%. All these are total returns including dividends. We gained 0.52% in Australian Dollar terms and 0.87% in US Dollar terms. The target portfolio lost 0.28% in Australian Dollar terms and the HFRI hedge fund index lost 0.27% in US Dollar terms. So, though we under-performed all three stock indices we out-performed our target portfolio and the HFRI. Updating the monthly returns chart:

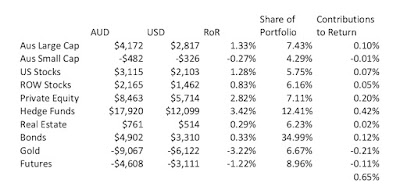

Here is a report on the performance of investments by asset class (futures includes managed futures and futures trading):Private equity and hedge funds did very well while gold and futures did poorly. The largest positive contribution to the rate of return came from hedge funds greatest detractor was gold, which was the exact reverse of the previous month. The returns reported here are in currency neutral terms.

Things that worked well this month:

- Hedge funds shined as Platinum Capital, Regal, and Cadence gained significantly but Tribeca lost more money.

- Pengana Private Equity gained.

- Gold and Winton Global Alpha lost significantly, partly reversing recent gains.

- Tribeca lost as noted above.

The picture is better using the broader definition.

We moved a further towards our new long-run asset allocation.* Cash increased most and private equity and bonds decreased most as we received the proceeds from the IPE.AX delisting:

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds, dividends, and interest. Other moves this month:

- We sold $50k of Tenet Health Care bonds when they were called and $50k of Discovery Bonds matured. We bought $50k of HSBC bonds So, our direct bond holdings declined by $50k.

- We traded with moderate success, as discussed above.

- I bought a small number of Platinum Capital shares as their price was a lot below net asset value.

- We started buying Australian Dollars again, buying AUD 20k this month.

- We received the proceeds from the delisting of Oceania Capital.

- As a result of all this our cash holdings increased by around AUD 120k.

No comments:

Post a Comment