I just found that a lot of comments people made in the past were stuck in moderation. I didn't know "sometimes moderation" was on. I approved all the substantive comments and turned moderation off. I apologize to everyone who commented but whose comment wasn't published up till now. I really appreciate all the comments. They made me feel less lonely on this journey.

Friday, March 31, 2023

Comments Stuck in Moderation

Monday, March 27, 2023

Yield Curve Trade

I entered a new yield curve trade - betting on a reduction in the inversion:

This executed by buying a spread that is long two year treasuries futures and short ten year treasuries futures. If we have a repeat of the late 1970s and early 1980s it will lose but inflation was much higher than now then. Last time I tried this in late 2019 to early 2020 I lost about USD 1,500. I was right but too early.

31 March

The trade went badly right from the start and it started making me more and more anxious. I didn't sleep last night and couldn't get to sleep tonight, so I closed the trade. But I still can't sleep yet. So, thought writing this update might help. I would have thought that I had learnt my lesson that I can't cope with overnight futures trades where I could decide to change the trade. It's just not something I can do. I had planned to do some more work on trading in the next few months, but now think I shouldn't do it.

Sunday, March 05, 2023

February 2022 Report

In February, stock markets fell again. The MSCI World Index (USD gross) fell 2.83% and the S&P 500 2.44% in USD terms, while the ASX 200 lost 2.25% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.7113 to USD 0.6740. We also lost money: 0.47% in Australian Dollar terms or 5.69% in US Dollar terms. The target portfolio gained 0.72% in Australian Dollar terms and the HFRI hedge fund index is expected to lose about 0.83% in US Dollar terms. So, we out-performed the ASX200 but under-performed all the other benchmarks.

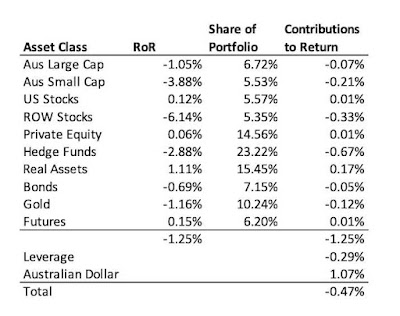

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I then add in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return. One reason that we underperformed the target portfolio benchmark is the very negative returns we got for rest of world stocks and to a lesser degree hedge funds. The Australian Dollar cash price of gold was breakeven for the month, so I also don't understand why PMGOLD.AX lost value, especially as I bought some extra shares during the month at a price that was lower than the end of month price...Real assets were the main positive contributor to returns and the highest returning asset class while hedge funds were the largest detractor.

Things that worked well this month:

- URF.AX (US residential real estate) was the biggest gainer adding AUD 11k, followed by two managed futures funds: Winton Global Alpha (9k) and Aspect Diversified Futures (6k).

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost AUD 30k. The next worse were the China Fund (CHN, -19k) and Australian Dollar Futures (-15k).

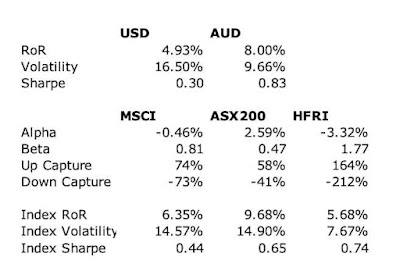

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture, positive alpha, and higher Sharpe Ratio against the ASX200 but not the USD benchmarks. We are performing about 3.3% per annum worse than the average hedge fund levered 1.77 times. Hedge funds have been doing well in recently.We are now very close to our target allocation but we mived away from it quite sharply during the month. In particular, real assets increased as we added to URF.AX and it rose, while private equity fell as we took profits in PE1.AX. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I bought 1,000 shares of the gold ETF, PMGOLD.AX.

- I sold 4,000 shares of WAM Leaders (WLE.AX).

- I sold 59,976 shares of Pengana Private Equity (PE1.AX).

- I bought 29,638 shares of the Cordish-Dixon private equity fund CD3.AX.

- I bought 25,000 shares of MCP Income Opportunities private credit fund (MOT.AX).

- I bought 65,000 shares of URF.AX (US residential real estate).

Wednesday, March 01, 2023

January 2022 Report

In January, stock markets rebounded. The MSCI World Index (USD gross) gained 7.19% and the S&P 500 6.28% in USD terms, and the ASX 200 gained 6.23% in AUD terms. All these are total returns including dividends. The Australian Dollar rose from USD 0.6816 to USD 0.7113. We gained 2.21% in Australian Dollar terms or 6.66% in US Dollar terms. The target portfolio rose 1.45% in Australian Dollar terms and the HFRI hedge fund index around 2.8% in US Dollar terms. So, we out-performed the S&P 500, the HFRI, and our target portfolio and under-performed the others.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have added in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return.

All asset classes had positive returns. Private equity was the largest contributor to returns Followed by hedge funds, while RoW stocks had the highest return.

Things that worked well this month:

- 3i (III.L) rose strongly, gaining AUD 22k. Tribeca (TGF.AX 18k), Unisuper (15k), PSSAP (14k), China Fund (CHN, 13k), and Hearts and Minds (HM1, 10k) all contributed more than AUD 10k.

What really didn't work:

- Three managed futures funds all lost money, with Winton Global Alpha losing the most (AUD 4k).

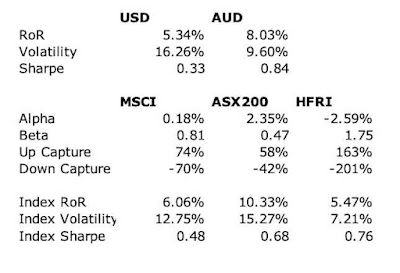

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We have a higher Sharpe Index than the ASX200 but lower than the MSCI in USD terms. We are performing about 2.6% per annum worse than the average hedge fund levered 1.75 times. Hedge funds have been doing well in recently.

We are now very close to our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I bought 1,000 shares of the China Fund, CHN.

- I bought 3,000 shares of Ruffer Investment Company, RICA.L.