Wednesday, October 24, 2018

Hearts and Minds IPO Oversubscribed?

I just got an email with my allocation of shares in this IPO. It's 82% of what I requested and the settlement dates and first trading date have been brought forward. So looks like the IPO is oversubscribed and closing early.

Friday, October 19, 2018

Overfitted

When I started trying to backtest the model with my new program the performance was bad, worse than I expected and worse than backtests I'd done previously. Recent changes to the model seem to have overfit it to the recent data. Therefore, we can't rely on the model going forward. This will need thorough investigation and in the mean time I'll stop trading.

Wednesday, October 17, 2018

Hearts and Minds IPO

Another Australian IPO of a listed investment company (closed end fund). This one has a twist – there are no management fees and the directors have waived their fees too. Instead of receiving a fee, the managers will donate 1.5% of NAV each year to charity. The board of directors include local investing luminaries like Geoff Wilson and a long list of wealthy Australian families (such as the Lowy family) have agreed to make investments in the fund.

The fund is a long only fund investing in Australian and international stocks. Each year several Australian investment managers present at the Sohn Hearts and Minds conference their best investment picks for the coming year. 40% of the fund will be allocated to these picks. 60% will be allocated to "high conviction ideas" from a number of other "core" investment managers. In total the fund will invest in about 25 securities.

The picks from the last two conferences have done very well:

One of the core investment managers is Regal, whose hedge funds have done extremely well.

In summary, I think this looks like being another good investment opportunity.

The fund is a long only fund investing in Australian and international stocks. Each year several Australian investment managers present at the Sohn Hearts and Minds conference their best investment picks for the coming year. 40% of the fund will be allocated to these picks. 60% will be allocated to "high conviction ideas" from a number of other "core" investment managers. In total the fund will invest in about 25 securities.

The picks from the last two conferences have done very well:

One of the core investment managers is Regal, whose hedge funds have done extremely well.

In summary, I think this looks like being another good investment opportunity.

Results for the S&P 500

These are the results of the year to date for the S&P 500 model, again without stops. As volatility is lower than the NASDAQ index, returns are lower but are still very good:

Alpha 0.47948 Beta -0.22355 ror 0.46115 Sharpe 2.62376

Again these are annualized values. Annualized rate of return is 46% for this year.

P.S.

I've now written all the code including stops for NQ and ES. Stops only detract a little from performance for ES but quite a bit for NQ. This suggests that we should use wider initial stops, just to avoid catastrophe, rather than to get out of ordinary bad trades.

Alpha 0.47948 Beta -0.22355 ror 0.46115 Sharpe 2.62376

Again these are annualized values. Annualized rate of return is 46% for this year.

P.S.

I've now written all the code including stops for NQ and ES. Stops only detract a little from performance for ES but quite a bit for NQ. This suggests that we should use wider initial stops, just to avoid catastrophe, rather than to get out of ordinary bad trades.

Tuesday, October 16, 2018

More Progress on Programming the Trading Model

5082 7637.43018 1.00000 0.00000 D buy. Stay long

5083 7490.00000 0.00000 0.00000 K sell. Go short

5084 7399.00977 0.00000 0.00000 K sell. Stay short

5085 7352.81982 0.00000 0.00000 K sell. Stay short

5086 7371.62012 0.00000 0.00000 K sell. Stay short

5087 7044.50000 0.00000 0.00000 D sell. Stay short

5088 6964.02978 0.00000 1.00000 R buy not confirmed by pdD D sell. Stay short

5089 7157.20996 1.00000 1.00000 R Buy outside BB confirmed by pdD

5090 7068.67041 1.00000 1.00000 R Buy outside BB confirmed by pdD

5091 NA 1.00000 1.00000 R Buy outside BB confirmed by pdD

These are the most recent decisions, including today's decision to stay long. The "NA" indicates that we don't yet know the index value for today...

It also produces some performance statistics:

Alpha 1.76456 Beta -0.21425 ror 1.68344 Sharpe 5.47108

That means 176% p.a. of alpha... This is based on compounding the daily alpha over the year. Beta to the market is slightly negative and so compound rate of return for the year is a little less than alpha. I don't expect that high rates of return in other years. Conditions are ideal this year and probably the model is a bit overfitted. One of the reasons for doing this programming is to make it easier to test the model on larger samples.

Next I will add some refinements like using futures prices instead of index prices for performance results. Oh yes, and adding stops!

P.S.

When I ran the algorithm on the S&P 500, I found at least one bug which also needs ironing out.

Firetrail Cancels IPO

I looked at the prospectus but decided not to invest. Apparently they got more than the minimum funds raised but claim that there aren't enough different shareholders...

Dear Moom,

After careful consideration Firetrail Absolute Return Limited (Company) (in consultation with Firetrail Investments Pty Limited (Firetrail)) has made the decision, in the best interest of investors, to withdraw the initial public offering for ordinary shares in the Company (Offer) which was scheduled to close this Friday, 19 October 2018.

The Company made the decision to withdraw the Offer (in consultation with Firetrail) as it was in the best interests of investors to do so given liquidity concerns, in particular the concentration of the shareholder base. Listed Investment Companies (LICs) that do not have a well-diversified shareholder base are generally at a higher risk of the share price trading at a discount to the company’s net tangible assets. As such, we believe it was in the best interests of shareholders to withdraw the Offer, despite raising in excess of the minimum investment amount.

Investors that would like to gain access to the strategy are still able to do so through the Firetrail Absolute Return Fund which is still open to investors and has delivered strongly during the recent market volatility over the past week. Since Monday 8 October 2018, the share market has fallen over -4%1. The Firetrail Absolute Return Fund has delivered a positive return of approximately +1.3% over the same period, highlighting the benefit of the strategy which aims to deliver positive absolute returns above the RBA Cash Rate, independent of movements in the underlying share market.

Please contact us if you would like more information on investing in the Fund.

Kind regards,

Firetrail Investments

Firetrail Absolute Return Limited withdraws listed investment company IPO offer

Tuesday 16 October 2018Dear Moom,

After careful consideration Firetrail Absolute Return Limited (Company) (in consultation with Firetrail Investments Pty Limited (Firetrail)) has made the decision, in the best interest of investors, to withdraw the initial public offering for ordinary shares in the Company (Offer) which was scheduled to close this Friday, 19 October 2018.

The Company made the decision to withdraw the Offer (in consultation with Firetrail) as it was in the best interests of investors to do so given liquidity concerns, in particular the concentration of the shareholder base. Listed Investment Companies (LICs) that do not have a well-diversified shareholder base are generally at a higher risk of the share price trading at a discount to the company’s net tangible assets. As such, we believe it was in the best interests of shareholders to withdraw the Offer, despite raising in excess of the minimum investment amount.

Investors that would like to gain access to the strategy are still able to do so through the Firetrail Absolute Return Fund which is still open to investors and has delivered strongly during the recent market volatility over the past week. Since Monday 8 October 2018, the share market has fallen over -4%1. The Firetrail Absolute Return Fund has delivered a positive return of approximately +1.3% over the same period, highlighting the benefit of the strategy which aims to deliver positive absolute returns above the RBA Cash Rate, independent of movements in the underlying share market.

Please contact us if you would like more information on investing in the Fund.

Kind regards,

Firetrail Investments

Sunday, October 14, 2018

NQ Equity Curve

This is the equity curve trading NQ futures since the beginning of the trading experiment. It starts at about USD 4k because that was the cumulative profit for 2006-8. This isn't our total trading performance because I've also traded other things like ES futures and earned a little interest.

The little tick down at the end is the "bad trade", which wasn't so bad in the end, but that was mostly luck.

I've done a bit more programming and now the program produces a coherent list of trades, one for each day. But I've only written up part of the system yet, so you wouldn't want to actually trade them :) In fact, here is the fractional gain (i.e. 0.15 is 15% gain, not compounded) if you traded "the strategy" for this year:

In other words, it breaks even in the end, which is what you'd probably expect for a random set of trades. This kind of thing is now easy to produce, which is one of the main things this is all about.

To explain this curve, the model starts at long on 4th January and some of the code is written for what to do if you are long - it might tell you to switch to short, but not much code is written yet for what you should do if you are short. So there is little code to flip you back to long again. As a result the model is stuck on short for much of the time...

Saturday, October 13, 2018

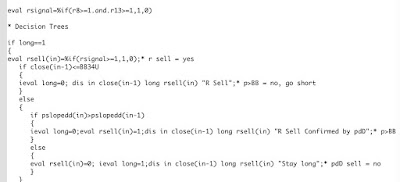

Started to Code the Decision Tree

After a couple of hours of coding and debugging I got the first little bit of the model decision tree to work and spit out buy and sell decisions. The output looks like this:

4895 6584.58008 1 0.00000 Stay long

4896 6653.29004 0 1.00000 R Sell Confirmed by pdD

4897 6676.62988 0 1.00000 Go long

4898 6677.93994 0 0.00000 Stay short

4899 6662.66016 0 0.00000 Stay short

4900 6708.49023 0 0.00000 Stay short

As the decision tree is far from complete, only the first two orders – long and then short – make any sense. The first number is a code for the date, the second is the closing value of the NASDAQ 100 index on the previous day (so that it's easier for me to work out where I am than the obscure date codes). Then there are codes for buy and sell and then a verbal description of the decision and why it was taken.

Luckily, writing computer code is a core practical skill for professional economists (or you should have these skills if you don't!) we took programming courses as part of our first year undergrad study.

Should Have Done the Long Trade

Market went up strongly. Model is still long for Monday. But I'm still not in. I needed to take a break from trading. This is why I need an automated system.

Friday, October 12, 2018

Rescued the Bad Trade

I stayed up and closed at 7119.75 the bad trade where I went long at NQ = 7145. So in the end I only lost USD 500 on that trade and am still up more than USD 6k for the month. If I exactly followed the model, though, I would be up USD 13k! The model is now switching to long for Friday, but this trade is based on the adjustment I made for the 1987 crash (picture below from 1987) and doesn't have a lot of statistical support. So, this is a high risk trade and I think I will wait it out. Yeah, I'm not doing what the model says to do but at least I am not trading against it!

In other news, the Tribeca fund (TGF) starts trading on the ASX today . They only sold 63 million shares in the IPO out of a maximum of 120 million, which is a bit disappointing. Maybe, my thesis that it would trade above NAV will take a while to work out. My entry point into Pershing Square was really bad - lost around 4% already on it. I also did a trade yesterday to switch back AUD 20k from CFS Conservative Fund to CFS Geared Share Fund. ASX SPI futures are off 47 points but CME NQ futures bounced after the New York close and the model is switching to long, so hopefully my timing wasn't too bad.

In other news, the Tribeca fund (TGF) starts trading on the ASX today . They only sold 63 million shares in the IPO out of a maximum of 120 million, which is a bit disappointing. Maybe, my thesis that it would trade above NAV will take a while to work out. My entry point into Pershing Square was really bad - lost around 4% already on it. I also did a trade yesterday to switch back AUD 20k from CFS Conservative Fund to CFS Geared Share Fund. ASX SPI futures are off 47 points but CME NQ futures bounced after the New York close and the model is switching to long, so hopefully my timing wasn't too bad.

Thursday, October 11, 2018

Great at Analysis No Good at Trading

I'm great at analysis and no good at trading. Just like this guy. This is why I need a computer to trade for me. That will now be the top priority.

Subscribe to:

Posts (Atom)