The rallies in the Australian Dollar and the stock markets continued this month. The Australian Dollar rose from USD 0.7361 to USD 0.7725. The MSCI World Index rose 4.68%, the S&P 500 by 3.84%, and the ASX 200 rose 1.27%. All these are total returns including dividends. We gained 2.16% in Australian Dollar terms or 7.21% in US Dollar terms. The target portfolio is expected to have gained 0.07% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 2.03% in US Dollar terms. So, we outperformed all benchmarks. In recent months, we have been tracking the target portfolio quite closely but with a positive alpha:

The target portfolio is a mix of indices (ASX200, MSCI World, HFRI, price of gold, Australian Dollar, private equity indices) and actual funds (TIAA Real Estate, TIAA Bond Market, Winton Global Alpha). If I was more industrious, I would use indices for the latter too... Hopefully, we can continue to beat the target portfolio by selecting better than average hedge funds etc.

Increasingly our assets are in more illiquid investments that report with a lag. I am now using estimates for all of these:

- Our house - we might change the value based on local sales up to a year after the month end! We will stick with last year's value until there is another local sale. Our house isn't included in the calculation of the rate of return, though, only in our net worth calculation.

- Aura VF1 - reports every 2 months and more than a month after the end of the month, I am using the IRR so far to project the return.

- Aura VF2- reports every 2 months and more than a month after the end of the month. For the moment we will stick with the IPO price.

- Winton Global Alpha - lag is only 2-3 days.

- Cadence Opportunities - not sure how long the lag will be. I am using the historic alpha and beta to compute an expected return.

- APSEC - seems to be 2-3 weeks after month end. I am using the expected HFRI return to project the return.

- Masterworks - none of my paintings is yet tradable in the secondary market, so we are just using the IPO price.

Some of our other investments are listed on the market or quoted daily, but their NAV adjusts with a lag, such as Wilson Alternative Assets (WMA.AX) and TIAA Real Estate.

Here is a report on the performance of investments by asset class (currency neutral terms):

Hedge funds added the most to performance followed by gold.

Things that worked well this month:

- Pretty much everything! But gold was the strongest performer in dollar terms, gaining AUD 28k.

What really didn't work:

- URF.AX which invests in residential property in New York and New Jersey lost most – AUD 3.5k. Hearts and Minds (HM1.AX) had its first decline since March, losing AUD 1.3k. That's after gaining AUD 95k since the March low!

The

investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices. We have the desired asymmetric capture for all three indices now and positive alpha compared to two of them.

We moved fu

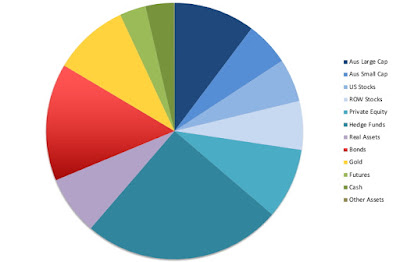

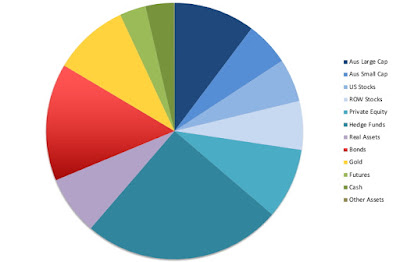

rther towards our long-run asset allocation. Real assets (real estate and art) are the asset class that is furthest from their target allocation (7.6% of total assets too little) followed by bonds (4.8% too much):

We are now over-allocated to hedge funds, so will look to trim some positions over time. On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also

retirement contributions. Other moves this month:

- I rebalanced my US 403b retirement account to 50% in the TIAA Real Estate Fund (direct real estate) and 50% in the CREF Social Choice Fund (balanced fund). I eliminated an allocation to the Money Market Fund and reduced the allocation to the Social Choice Fund.

- I bought 5,000 Treasury Wine Estates shares.

- I sold 1,000 CBAPI.AX Commonwealth Bank hybrid securities (convertible bonds).

- I bought 3,000 shares of the IAU gold ETF, taking our position to 20,000 shares and finally around 10% of gross assets.

- I bought AUD 160k by selling US Dollars to get our currency exposure to 50% Australian Dollars and I bought GBP 25k by selling AUD.

- I bought 1,000 Pershing Square Holdings (PSH.L) shares. This took me more overweight hedge funds, but I self-justified it by the fact that the shares are still trading at a big discount to NAV but the gap is narrowing. And anyway, the target portfolio weights are arbitrary, aren't they? I will look to trim the lower performing listed hedge funds once prices are nearer NAVs again.