Volatility in financial markets continued this month but I hardly traded at all and for us it was a fairly quiet month financially with mostly background prep work. The Australian Dollar rose from USD

0.7083 to USD 0.7302 The MSCI World Index rose 1.51% and the S&P 500 2.04%. The ASX 200 fell 1.96%. All these are total returns including dividends. We lost 1.88% in Australian Dollar terms and gained 1.15% in US Dollar terms. So, we outperformed the Australian market and underperformed international markets. Our Australian Dollar returns are now strongly driven by changes in the exchange rate as cash in US Dollars and other currencies are a large part of our portfolio. Our currency neutral rate of return was -0.14%.Here again is a detailed report on the performance of all investments:

- Bluesky Alternatives rose sharply after Geoff Wilson engineered the firing of most of the board and Pinnacle Investment withdrew their proposal to manage the fund. It now looks like Wilson Asset Management will end up managing the fund. Most Wilson LICs (closed end funds) trade above net asset value.

- The Hearts and Minds IPO started trading and performed well.

- International hedge funds: Tribeca and Pershing each did well in relative terms as did Winton.

- The China Fund had a decent bounce and Boulder Income Fund bounced back very nicely to almost return to it's September value.

- Cadence Capital, again fell sharply. It's performance in the last three months has been very disappointing.

- Perhaps relatedly, small cap Australian funds also performed badly.

- Medibank Private fell sharply after the Australian Defence Department didn't renew its contract with them.

- UK private equity firm, 3i, fell further, though it bounced from its lows.

We also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- As mentioned above, Hearts and Minds began to trade and I increased my holding up to the amount I originally requested in the IPO.

- I sold some Platinum Capital (PMC.AX) and bought the equivalent actively managed ETF PIXX.AX instead. The idea was that PMC was overvalued. So far this trade hasn't worked out.

- I bought more Pershing Holdings (PSH.L) and 3i (III.L). Though I increased each position by 50%, each is still only around 0.8% of net worth.

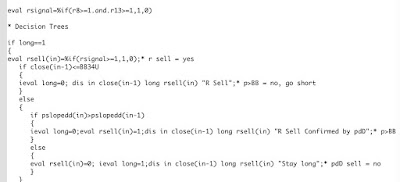

- I did a couple of trades in futures options and futures.