Australian Unity and Cromwell announce that their fund merger plan is cancelled. I wasn't very enthusiastic about the merger and so am happy it has been called off. Cromwell's fund only included offices, so while the deal was diversifying for Cromwell unitholders it was not so for Australian Unity unitholders. I invested in the fund to get diversified property exposure, not just offices.

Friday, October 27, 2023

Second Australian Unity Merger Plan Scuttled

Saturday, October 21, 2023

Moominmama's Taxes 2022-23

I also did Moominmama's taxes for this financial year. The post about last year's taxes is here. Here is a summary of her tax return for this year:

Her salary was up only 3% this year. Gross income was down 2%, though there were some big fluctuations across categories. Australian dividends rose quite strongly, which is something of a trend...Total deductions rose by 46%, mainly because of increased interest costs. As a result, net income fell 27%.

Gross tax applies the tax bracket rates to taxable income. This was more than offset by franking credits. So, she gets the franking credits refunded as cash and has a negative tax rate. As a result, she should get a large refund.

Moominpapa's 2022-23 Taxes

This year, I've prepared our tax returns just before the deadline. Here is a summary of my taxes. Last year's taxes are here. To make things clearer, I reclassify a few items compared to the actual tax form. Of course, everything is in Australian Dollars.

Overall, gross income and deductions barely changed from last year, falling by 1% each.

On the income side, Australian dividends and franked distributions from managed funds are again up strongly. My salary still dominates my income sources but again only increased by 3%.

Other income sources are down strongly, partly because I shifted the assets, which produced these returns into the SMSF. Net capital gain is zero due mainly to some strategic sales to generate losses. I am carrying forward $93k in capital losses.

Deductions fell 47% because last year they included the loss on Virgin Australia bonds. I redistributed deductions a bit to match the size of different holdings. This resulted in some big changes in the individual categories. Didn't plan on charity falling that much...

Gross tax is computed by applying the rates in the tax table to the net income. In Australia, you don't enter the tax due in your tax return, but I like to compute it so that I know how big or small my refund will be.

Franking credits (from Australian dividends), foreign tax paid, and the

Early Stage Venture Capital (ESVCLP) offset are all deducted from gross

tax to arrive at the tax assessment.

Estimated assessed tax fell because of the larger offsets this year.

I estimate that I will pay 25% of net income in tax. Tax was withheld on my salary at an average rate of 32%. I already paid $7,782 in tax installments and so estimate that I should get a refund of $8,701.

Monday, October 02, 2023

Good News from Pershing Square

The SEC finally approved the registration of Pershing Square SPARC Holdings. I bought Pershing Square Tontine Holdings (PSTH) around $23. We got $20 back when the SPAC was wound up. It's great to see that it will now be resurrected. Hopefully some good deal will come out of this. I wasn't that inspired by the Universal Music deal, which fell through, anyway. We ended up being invested in that all the same through PSH.L.

Saturday, September 09, 2023

Why I Haven't Posted a Monthly Report Recently

I haven't posted monthly reports for July or August. The reason is that the July accounts have an error of more than AUD 12k and I don't have the time or inclination to try to reconcile them at the moment. Probably this will have to wait till later in the year when my teaching is over. I focus all my teaching in the second semester so I am really busy. And I am also working on my new hobby of genealogy research, since December last year. Probably I will eventually make a post for the second half of the year as a whole with monthly investment performance figures. There is also an error of more than AUD 8k that cropped up now in the December 2022 accounts, which wasn't there before. Possibly they are related...

Anyway, in AUD terms July is currently at 2.18% (compared to our target portfolio of 1.77%. ASX200 = 2.89%) or 3.18% in USD terms (HFRI = 1.75%, MSCI = 3.45%). So not bad.

August is at 0.05% (ASX = -0.44%, target = 0.90%). In USD terms though it was a fall of 3.62%. Stock markets were down but not that bad...

P.S.

After writing this post I realised what might be wrong with December 2022 and fixed that and June 2023. But July 2023 still has a 12,000 dollar error...

Tuesday, August 29, 2023

Nischa: Great Personal Finance Videos

I just found these great personal finance videos. I know most of this stuff, but lots (most?) of people could learn a lot from this!

Saturday, August 26, 2023

Paypal

Closed my Paypal account. Only time it ever comes up is when someone is trying to scam me. Just had someone try to charge USD 599 to me.

Tuesday, August 15, 2023

Lifetime Health Cover Loading

In Australia, if you don't get private health care when you are younger, if you finally do get it you have to pay an extra "loading". I had to pay 36% more and Moominmama 14%. But apparently that is only for ten years. The ten years is up and our premium has been reduced!

Saturday, August 12, 2023

June 2023 Report

We finally have all the investment statements and reports for the 2022-23 financial year, which means I can put together a report on our investment performance in June. In June, The MSCI World Index (USD gross) rose 5.85%, the S&P 500 rose 6.61%, and the HFRI hedge fund index gained 2.20% in USD terms. The ASX 200 rose 1.74% and the target portfolio 1.09% in AUD terms. All these are total returns including dividends. The Australian Dollar rose from USD 0.6479 to USD 0.6657. We lost 0.27% in Australian Dollar terms or gained 2.40% in US Dollar terms. So, we under-performed all benchmarks apart from the HFRI. Our hedge fund and private equity investments underperformed their benchmarks, dragging down performance relative to the target benchmark, which has a 38% weighting on these two asset classes.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I then add in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return. Gold was the biggest detractor, while futures contributed the most.Things that worked well this month:

- Pershing Square Holdings and Australian Dollar Futures did well.

What really didn't work:

- Gold and Tribeca Global Resources did badly.

The investment performance statistics for the last five years are not looking good and I don't feel like reporting them. 😕

We are now very close to our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. It was another quiet month. The only additional investment moves I made were:

- I bought 500 PMGOLD.AX and 1778 CDO.AX (Cadence Opportunities Fund) shares.

Sunday, August 06, 2023

Superannuation Returns in the Long-Run

Following up from my post on how our SMSF is performing compared to our managed superannuation funds, here is how our superannuation in general has done over time:

Note that the y-axis is a log scale! Our superannuation has outperformed the MSCI index in AUD terms in the long-run. The big win was in the couple of years after 2002 when I rolled over my Unisuper fund to Colonial First State and invested in geared funds. Then I got too conservative leading up to the GFC - the flat top you can see on the red line. Superannuation returns crashed in the GFC because I got aggressive again too early. After that, we have followed the market more closely until after 2018 when we have gone into a bit more of a capital preservation mode again. This reduced the volatility in 2022 but returns in 2023 are a bit disappointing so far.

On the other hand, our non-superannuation assets had catastrophic performance up to 2009. After that, I got my act together, which eventually gave me the confidence to set up an SMSF. But you can see the value of handing control to an external manager early on.

Superannuation returns are pre-tax but after fees. My method of imputing tax paid for public superannuation funds probably exaggerates their performance a bit. These time based returns are quite different from dollar based returns. All the early volatility wasn't that important because total assets were small. Performing well now is much more important.

Enough Wealth followed up on my original post by comparing his SMSF over a longer period to a basket of industry funds.

Saturday, August 05, 2023

Superannuation Performance Update July 2023

Inspired by this article in the AFR, here is an update on how well our SMSF is doing compared to Unisuper and PSS(AP). after underperforming for a few months, it outperformed in June and July:

Looking at the longer term, it is still ahead of the two super funds:

It rode out the 2022 downturn with less "volatility". PSS(AP) actually has a slightly lower standard deviation of monthly returns but also a lower mean. As a result, the SMSF has an information ratio (Sharpe ratio with a zero return hurdle) of 1.1, while Unisuper is at 0.61 and PSS(AP) at 0.73. Relative to Unisuper, the SMSF has an annual alpha of 5.36% and a beta of 0.44 (Relative to PSS(AP): 4.61% and 0.61).

I compute all these returns pre-tax. This probably overestimates the taxes paid by Unisuper and PSS(AP), giving them a bit of an advantage. OTOH, I don't charge for my time in managing the investments.

Wednesday, July 26, 2023

Got a Call from Australian Unity

I blogged recently about the proposed merger between the Australian Unity Diversified Property Fund and a Cromwell office fund. Today, I was called by a representative who told me about the plan and timeline and asked if I had questions and whether I would support the proposal So, I told him that I understood the reasons for seeking a merger and that I thought this merger was better than previous proposal but also that I invested in the fund to get exposure to a diversified portfolio and now it was going to be a office dominated fund, a sector that's not doing too well. So, I wasn't really sure which way to vote. He sounded disappointed and said he understood my thinking...

Thursday, July 13, 2023

New Australian Unity Merger Proposal

Australian Unity Diversified Property Fun has a new merger proposal on the table following the failed merger in 2021-22. This is a merger with the unlisted Cromwell Direct Property Fund. This seems like a fair deal unlike the previous one. It has various advantages. The only downside is that the merged fund will have 70% of its assets in offices. The attraction of AUDPF was that it was truly diversified and not dominated by offices.

I expect I will stay in the fund (there is only a limited near term opportunity to withdraw) and think about withdrawing in 2025 when a full liquidity event is promised. The main risk is that office properties are downvalued in 2024 and 2025 after the merger happens. I am seeing a decline in value in the TIAA Real Estate Fund even though only a quarter of their assets are in offices. I reduced my holdings near peak value, should have reduced them more. So, maybe I should try to withdraw some of our investment when allowed later this year...

Sunday, July 09, 2023

Spending 2022-23

For the last six years I've been putting together reports on our spending over the Australian financial year, which runs from 1 July to 30 June. This makes it easy to do a break down of gross income including taxes that's comparable to many you'll see online, though all our numbers are in Australian Dollars. At the top level we can break down total income (as reported in our tax returns plus superannuation contributions) into the following categories of spending:

The gross income for this year (bottom line) is just an estimate. It is based on the gross income we expect to report in our tax returns (before investment expenses etc) plus employer superannuation contributions. Tax includes local property tax as well as income tax and tax on superannuation contributions. Investing costs include margin interest. Mortgage interest is included in spending, while mortgage principal payments are considered as saving. Spending also includes the insurance premia paid through our superannuation. Current saving is then what is left over. This is much bigger than saving out of salaries because gross income includes investment returns reported in our tax returns. The latter number depends on capital gains reported for tax purposes, so is fairly arbitrary. Spending increased substantially, though we also expect income to hit a high though it's been fairly constant over the last five years. Graphically, it looks like this:

We break down spending into quite detailed categories. Some of these are then aggregated up into broader categories:

Our biggest spending category, if we don't count tax, is now childcare and education, which has now fallen for two years in a row. Shifting from daycare, to private per-K, to private junior school actually reduces costs! We also include things like swimming and piano lessons in this category. Commentary on other categories follows:

Employer superannuation contributions: These include employer contributions (we don't do any salary sacrifice contributions) but not contributions we paid to the SMSF this year.

Franking credits: Income reported on our tax returns includes franking credits (tax paid by companies we invest in). We need to deduct this money which we don't receive as cash but is included in gross income. Effectively, this is tax paid on our behalf by corporations that we are shareholders of. Foreign tax paid is the same story.

Superannuation contributions tax: The 15% tax on concessional superannuation contributions. This includes tax on our concessional contributions to the SMSF.

Life and disability insurance: This is paid out of our contributions to our employr superannuation funds. I have been trying to bring this under control and the amount paid has also fallen since 2017-18 a result.

Health: Includes health insurance and direct spending. These increased by 12% and 10%, respectively. Spending peaked with the birth of our second child.

Housing: Includes mortgage interest, maintenance, and body corporate fees (condo association). This category fell by 27% this year, due to us paying less in mortgage interest. This is the reason that our total spending is down this year.

Transport: About two thirds is spending on our car and one third is my spending on Uber, e-scooters, buses etc.

Utilities: This includes water, gas, electricity, telephone, internet, and online storage etc.

Subscriptions: This is a new category this year, split out from utilities. Spending has been stable in the last three years after rising during the pandemic.

Supermarkets: Includes convenience stores, liquor stores etc as well as supermarkets. This has now been stable for the last four years.

Restaurants: This was low in 2017-18 because we spent a lot of cash at restaurants. It was low during the pandemic for obvious reasons but has been back to pre-pandemic levels in the last three years. We also spent a lot on restaurants in cash while on vacation in China and Thailand.

Cash spending: I try not to use cash so that I can track spending. Moominmama also gets some cash out at supermarkets that is included in that category. Spending jumped 20-fold this year due to spending in cash while traveling in Asia.

Department stores: All other stores selling goods that aren't supermarkets. No real trend here.

Mail order: This has continued to fall. Moominmama now gets mail order direct from China that doesn't enter into our accounting system. When we were in China we deposited RMB cash in her mother's bank account. I treated this in our accounts as a repayment of a loan from her mother. Evidently the money is being used to buy stuff in China...

Travel: This includes flights, hotels etc. It has now been back at pre-pandemic levels for the last two years.

Charity: Increased a little bit. We pay one charity on a regular basis but otherwise I just respond to requests I get.

Professional: These are work expenses that were not paid for directly by our employers. So, we got reimbursement for some of these, but that reimbursement is not in our income number. Really, our savings were larger by the value of that reimbursement (about $2k this year).

Other: This is mostly other services. It includes everything from haircuts to professional photography.

In summary, our spending fell due to reduced mortgage interest payments. In the accounts I post at the end of the calendar year, that interest is accounted for as an investment expense. Spending apart from mortgage interest was up a little.

Monday, June 12, 2023

What I Get Out of Tracking Spending Categories

Ramit Sethi advocates only tracking about four categories of spending and is critical of couples who do more fine-grained tracking. For the last few years I have been tracking 15 top level spending categories and 27 more detailed spending categories. So, what do I get out of this. I think the following:

- I can track which items have grown fast and maybe we should cut back on. This has resulted in saving money on car insurance, health insurance, and mortgage interest.

- Some things that I think we are spending a lot on, and should cut back on are actually not that big. For example, our current spending on restaurants is AUD 3k per year or 1.7%. My spending on bus, Uber, taxis etc. is AUD 4.5k per year or 2.5%, which is less than half our spending on transport. These are two of my three areas of "luxury" or personal spending. The other is spending money on subscriptions online etc So, being able to see these numbers makes me feel more comfortable about my spending in these areas.

- Perhaps some things seem small and we can consider raising them, like our spending on charity at only 0.4%.

- Well, yes it's neat to see what we are spending money on and comparing to other people :)

Sunday, June 11, 2023

May 2023 Report

In May, markets were mixed. The MSCI World Index (USD gross) fell 1.00% while the S&P 500 rose 0.43% in USD terms. The ASX 200 fell 2.30% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6605 to USD 0.6479. We lost 1.07% in Australian Dollar terms or lost 3.09% in US Dollar terms. The target portfolio lost 0.06% in Australian Dollar terms and the HFRI hedge fund index is expected to lose 0.12% in US Dollar terms. So, we under-performed all benchmarks apart from the ASX 200.

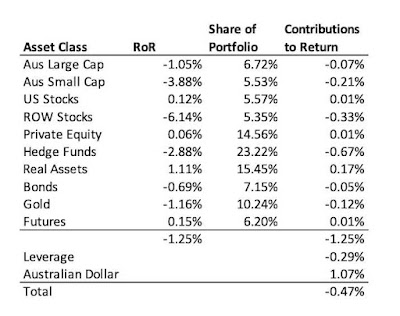

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I then add in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return. We underperformed the target portfolio benchmark mainly because of negative returns on hedge funds in particular. Private equity had the most positive returns and contributed most to the return for the month, while gold and futures also performed positively. Australian small caps were the worst performers.

Things that worked well this month:

- 3i (III.L) gained the most (AUD 18k) followed by Cordish Dixon PE Fund 3 (CD3, 8k), and Winton Global Alpha (7k).

What really didn't work:

- Cadence Capital (CDM.AX), Regal Funds (RF1.AX), and Cadence Opportunities (CDO.AX) lost the most: AUD 18k, 13k, and 11k respectively.

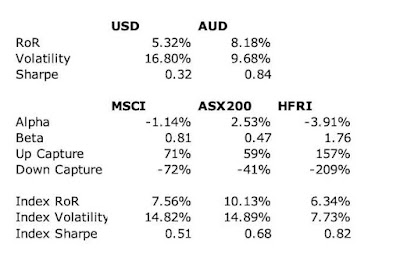

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture, positive alpha, and higher Sharpe Ratio against the ASX200 but not the USD benchmarks. We are performing about 4.4% per annum worse than the average hedge fund levered 1.77 times. Hedge funds have been doing well in recently.We are now very close to our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. It was a very quiet month. The only additional investment move I made was:

- I bought a net 250 shares of PMGOLD.AX.

Friday, June 09, 2023

Fixed My Margin Loan Interest Rate

I fixed my margin loan interest rate for the next year at 7.69% instead of a variable rate 9.15%. I am paying the interest in arrears. At the moment I can't see the RBA really cutting interest rates by an average of 1.5% over the next year. It's the first time I have done this. One reason for that is that my balance is relatively low at the moment and I expect it will increase, so I won't have the problem of early termination. I am withdrawing AUD 15k every quarter to invest in the Unpopular Ventures Rolling Fund.

Saturday, May 06, 2023

April 2023 Report

In April, stock markets continued to rise. The MSCI World Index (USD gross) rose 1.48% and the S&P 500 1.56% in USD terms, while the ASX 200 gained 2.03% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6695 to USD 0.6605. We gained 1.09% in Australian Dollar terms but lost 0.45% in US Dollar terms. The target portfolio gained 1.98% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 1.19% in US Dollar terms. So, we under-performed all benchmarks :(

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I then add in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return. We underperformed the target portfolio benchmark because of negative returns on international stocks and hedge funds, in particular. Our US stocks actually outperformed the S&P 500 this month.Several asset classes made moderate positive contributions with private equity leading, while ROW stocks and hedge funds had negative returns

Things that worked well this month:

- Gold was the greatest gainer at AUD 9k, but several other investments gained between AUD 6-9k including Unisuper, 3i (III.L), Hearts and Minds (HM1.AX), Regal Funds (RF1.AX), Winton Global Alpha, WAM Alternatives (WMA.AX), and PSS(AP).

What really didn't work:

- Tribeca Global Resources (TGF.AX) was again the biggest loser with a loss of AUD 14k. Followers up were: The China Fund (CHN, -8k) and Pershing Square Holdings (PSH.L, -6k).

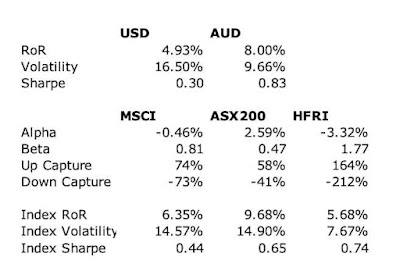

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture, positive alpha, and higher Sharpe Ratio against the ASX200 but not the USD benchmarks. We are performing about 3.9% per annum worse than the average hedge fund levered 1.76 times. Hedge funds have been doing well in recently.We are now very close to our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I invested USD 2,500 in a Latin-American start-up company through the Unpopular Venture Syndicate.

- I bought 5,000 more Cordish-Dixon 3 (CD3.AX) shares.

Thursday, May 04, 2023

Moominmama's Manager Made the Whole Thing Up!

So, Moominmama talked to HR about the "voluntary redundancy". They said that there was no restructuring in progress and she would only be considered for voluntary redundancy if she literally volunteered and that basically her manager just made the whole thing up! This sounds like real incompetence or professional malpractice on his part.

Thursday, April 27, 2023

Redundancy Package

Moominmama was offered a redundancy package. Seems a bit like an offer you can't refuse. When she asked if she would be fired anyway if she rejected it, her boss told her he couldn't tell her that... We don't know the details of the package yet. Her lower level manager said that as she is only working two days a week it's hard to involve her in projects or for them to take on projects that need her skills because she doesn't work enough. But she wants to take the package and doesn't want to work more days.

She plans to reduce the daycare days of our almost 4 year old for the second half of this year. After that he should be in full time pre-school.

I ran a simulation and through the end of 2024 the effect is a reduction in net worth of about AUD35k before considering the value of the package and after considering the likely value of the package it is about even. After that the effect gets progressively larger, but, surprisingly, in the long run (2029 and 2044) net worth is around 2% lower than in the base case. This is in contrast to the scary numbers that we are currently spending AUD 177k per year and my after tax salary is AUD 130k.

I feel like I must have done something wrong in the simulation.

Sunday, April 09, 2023

March 2023 Report

In March, stock markets rebounded. The MSCI World Index (USD gross) rose 3.15% and the S&P 500 3.67% in USD terms, while the ASX 200 only gained 0.25% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6740 to USD 0.6695. We gained 0.55% in Australian Dollar terms but lost 0.15% in US Dollar terms. The target portfolio gained 1.84% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 1.47% in US Dollar terms. So, we only out-performed the ASX200.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I then add in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return. We underperformed the target portfolio benchmark because of negative returns on international stocks and hedge funds as well as negative returns on Australian small caps. We lost on US stocks because of a very negative return from Hearts and Minds (HM1.AX) offsetting positive returns on other US holdings.Gold was the main positive contributor to returns and the highest returning asset class while futures were the largest detractor and worst performing asset class. The trend-following managed futures funds got caught in the sudden movement in US bonds during the month associated with the banking crisis.

Things that worked well this month:

- Gold gained AUD 54k - the biggest monthly gain in a single investment since I started investing.

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost AUD 11k. Followers up were: Pershing Square Holdings (PSH.L, -10k), Aspect Diversified Futures (-9k), Hearts and Minds (HM1.AX, -9k), and Winton Global Alpha (-8k).

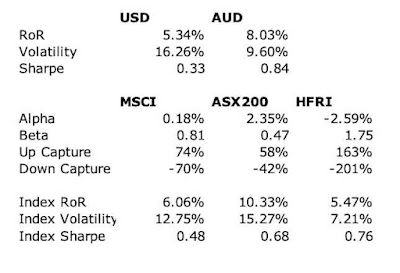

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture, positive alpha, and higher Sharpe Ratio against the ASX200 but not the USD benchmarks. We are performing about 3.6% per annum worse than the average hedge fund levered 1.76 times. Hedge funds have been doing well in recently.We are now very close to our target allocation but we mived away from it quite sharply during the month. In particular, real assets increased as we added to URF.AX and it rose, while private equity fell as we took profits in PE1.AX. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I sold 100 China Fund (CHN) shares.

- I sold 3,500 WAM Leaders (WLE.AX) shares.

- I sold 10k MCP Income Opportunities (MOT.AX) when the price spiked back up to AUD 2.10.

- I bought 12k shares net of Cordish-Dixon Private Equity Fund 3 (CD3.AX).

- I did a losing trade in bond futures.

Friday, March 31, 2023

Comments Stuck in Moderation

I just found that a lot of comments people made in the past were stuck in moderation. I didn't know "sometimes moderation" was on. I approved all the substantive comments and turned moderation off. I apologize to everyone who commented but whose comment wasn't published up till now. I really appreciate all the comments. They made me feel less lonely on this journey.

Monday, March 27, 2023

Yield Curve Trade

I entered a new yield curve trade - betting on a reduction in the inversion:

This executed by buying a spread that is long two year treasuries futures and short ten year treasuries futures. If we have a repeat of the late 1970s and early 1980s it will lose but inflation was much higher than now then. Last time I tried this in late 2019 to early 2020 I lost about USD 1,500. I was right but too early.

31 March

The trade went badly right from the start and it started making me more and more anxious. I didn't sleep last night and couldn't get to sleep tonight, so I closed the trade. But I still can't sleep yet. So, thought writing this update might help. I would have thought that I had learnt my lesson that I can't cope with overnight futures trades where I could decide to change the trade. It's just not something I can do. I had planned to do some more work on trading in the next few months, but now think I shouldn't do it.

Sunday, March 05, 2023

February 2022 Report

In February, stock markets fell again. The MSCI World Index (USD gross) fell 2.83% and the S&P 500 2.44% in USD terms, while the ASX 200 lost 2.25% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.7113 to USD 0.6740. We also lost money: 0.47% in Australian Dollar terms or 5.69% in US Dollar terms. The target portfolio gained 0.72% in Australian Dollar terms and the HFRI hedge fund index is expected to lose about 0.83% in US Dollar terms. So, we out-performed the ASX200 but under-performed all the other benchmarks.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I then add in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return. One reason that we underperformed the target portfolio benchmark is the very negative returns we got for rest of world stocks and to a lesser degree hedge funds. The Australian Dollar cash price of gold was breakeven for the month, so I also don't understand why PMGOLD.AX lost value, especially as I bought some extra shares during the month at a price that was lower than the end of month price...Real assets were the main positive contributor to returns and the highest returning asset class while hedge funds were the largest detractor.

Things that worked well this month:

- URF.AX (US residential real estate) was the biggest gainer adding AUD 11k, followed by two managed futures funds: Winton Global Alpha (9k) and Aspect Diversified Futures (6k).

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost AUD 30k. The next worse were the China Fund (CHN, -19k) and Australian Dollar Futures (-15k).

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture, positive alpha, and higher Sharpe Ratio against the ASX200 but not the USD benchmarks. We are performing about 3.3% per annum worse than the average hedge fund levered 1.77 times. Hedge funds have been doing well in recently.We are now very close to our target allocation but we mived away from it quite sharply during the month. In particular, real assets increased as we added to URF.AX and it rose, while private equity fell as we took profits in PE1.AX. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I bought 1,000 shares of the gold ETF, PMGOLD.AX.

- I sold 4,000 shares of WAM Leaders (WLE.AX).

- I sold 59,976 shares of Pengana Private Equity (PE1.AX).

- I bought 29,638 shares of the Cordish-Dixon private equity fund CD3.AX.

- I bought 25,000 shares of MCP Income Opportunities private credit fund (MOT.AX).

- I bought 65,000 shares of URF.AX (US residential real estate).

Wednesday, March 01, 2023

January 2022 Report

In January, stock markets rebounded. The MSCI World Index (USD gross) gained 7.19% and the S&P 500 6.28% in USD terms, and the ASX 200 gained 6.23% in AUD terms. All these are total returns including dividends. The Australian Dollar rose from USD 0.6816 to USD 0.7113. We gained 2.21% in Australian Dollar terms or 6.66% in US Dollar terms. The target portfolio rose 1.45% in Australian Dollar terms and the HFRI hedge fund index around 2.8% in US Dollar terms. So, we out-performed the S&P 500, the HFRI, and our target portfolio and under-performed the others.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have added in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return.

All asset classes had positive returns. Private equity was the largest contributor to returns Followed by hedge funds, while RoW stocks had the highest return.

Things that worked well this month:

- 3i (III.L) rose strongly, gaining AUD 22k. Tribeca (TGF.AX 18k), Unisuper (15k), PSSAP (14k), China Fund (CHN, 13k), and Hearts and Minds (HM1, 10k) all contributed more than AUD 10k.

What really didn't work:

- Three managed futures funds all lost money, with Winton Global Alpha losing the most (AUD 4k).

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We have a higher Sharpe Index than the ASX200 but lower than the MSCI in USD terms. We are performing about 2.6% per annum worse than the average hedge fund levered 1.75 times. Hedge funds have been doing well in recently.

We are now very close to our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I bought 1,000 shares of the China Fund, CHN.

- I bought 3,000 shares of Ruffer Investment Company, RICA.L.