5082 7637.43018 1.00000 0.00000 D buy. Stay long

5083 7490.00000 0.00000 0.00000 K sell. Go short

5084 7399.00977 0.00000 0.00000 K sell. Stay short

5085 7352.81982 0.00000 0.00000 K sell. Stay short

5086 7371.62012 0.00000 0.00000 K sell. Stay short

5087 7044.50000 0.00000 0.00000 D sell. Stay short

5088 6964.02978 0.00000 1.00000 R buy not confirmed by pdD D sell. Stay short

5089 7157.20996 1.00000 1.00000 R Buy outside BB confirmed by pdD

5090 7068.67041 1.00000 1.00000 R Buy outside BB confirmed by pdD

5091 NA 1.00000 1.00000 R Buy outside BB confirmed by pdD

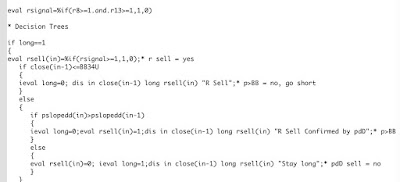

These are the most recent decisions, including today's decision to stay long. The "NA" indicates that we don't yet know the index value for today...

It also produces some performance statistics:

Alpha 1.76456 Beta -0.21425 ror 1.68344 Sharpe 5.47108

That means 176% p.a. of alpha... This is based on compounding the daily alpha over the year. Beta to the market is slightly negative and so compound rate of return for the year is a little less than alpha. I don't expect that high rates of return in other years. Conditions are ideal this year and probably the model is a bit overfitted. One of the reasons for doing this programming is to make it easier to test the model on larger samples.

Next I will add some refinements like using futures prices instead of index prices for performance results. Oh yes, and adding stops!

P.S.

When I ran the algorithm on the S&P 500, I found at least one bug which also needs ironing out.