Wednesday, March 12, 2025

Market Update

Wednesday, March 05, 2025

February 2025 Report

February was the first down month after positive months. In dollar terms it was our third worst investment result after June 2022 and March 2020. The Australian Dollar fell from USD 0.6237 to USD 0.6208 meaning that USD investment returns are slightly worse than AUD investment returns. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): -0.57%

S&P 500: -1.30%

HFRI Hedge Fund Index: 0.77% (forecast)

Australian Dollar Indices

ASX 200: -3.60%

Target Portfolio: -0.97% (forecast)

Australian 60/40 benchmark: -0.68%

We lost -4.11% in Australian Dollar terms or -4.40% in US Dollar terms. So we underperformed all benchmarks.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and do not include investment expenses such as margin interest, and so the total differs from the Australian Dollar returns on net assets mentioned above. Gold gained most while RoW stocks, futures (including bitcoin), and Australian Small Cap all had terrible performances.

Things that worked well this month:

- Gold was the only investment to gain more than AUD 10k. Domacom Investments also did well with a property in Perth being radically up-valued to 57% above the IPO. I bought post-IPO after the price had already declined. There have also been large distributions. Profit is now AUD 9k on an initial AUD 7k investment.

What really didn't work:

- Bitcoin, Defi Technologies, and Regal Partners were all terrible. The latter was surprising as I felt their earnings report was good and it only slightly missed forecast earnings. Unisuper also lost more than AUD 10k.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give the same statistics for three indices. The middle block gives our performance relative to the indices. Our rate of return remained higher than the ASX200 despite such a disastrous month and we have much lower volatility, resulting in a Sharpe ratio of 0.99 vs. 0.58. Our alpha relative to the ASX200 fell to 4.46% (from 4.94%) with a beta of only 0.47. We capture much less of the downside moves than the upside moves in the market. But as we optimize for Australian Dollar performance, our USD statistics are much worse. We do beat the HFRI hedge fund index in terms of return, but at the expense of much higher volatility. Our USD volatility is at least less than that of the MSCI index, but our return is more than three percentage points lower.

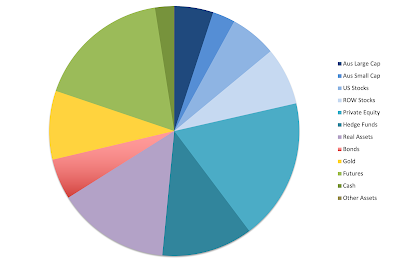

We moved towards our target allocation due to the poor performance of the overweighted asset classes, which previously had performed well. Our actual allocation currently looks like this:

We receive employer superannuation contributions every two weeks. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. I am now receiving TTR pension payments from both Unisuper and our SMSF and contributing more than the total of these to the SMSF (around AUD 4k net contribution per month). I made the following additional moves this month:

- I sold 10k shares of Hearts and Minds (HM1.AX) as it neared the after tax NAV.

- With the proceeds I bought 3k shares of WCM Global (WCMQ.AX), which is a global stock actively managed ETF.

- I also bought another 100 shares of FBTC, Fidelity's bitcoin ETF.

- I did a follow on investment of USD 2,500 in Chowdeck, a Nigerian food delivery app. This is their Series A investment round. Previously, I invested in the seed round at a lower valuation.

Sunday, March 02, 2025

Where We Are at With the VSS

The latest episode. I met the director on Thursday. They didn't try to discourage me from doing it (I didn't expect they would). They even noted that they have at least a couple of other people who teach and research in my exact field. We are the top place for this in Australia. We also discussed other options included a transition to retirement plan, where you work part-time till a set retirement date at a maximum 3 years in the future. The director saw this plan as tied to a specific "project", which isn't something in the plan as described by the university. The key aspect in the university description is that the university keeps paying employer contributions to Unisuper at the full time rate even though the worker is now working part time. This is critical for people on the defined benefit scheme who otherwise lose a lot of money if they switch to part-time work.

The other option we discussed is simply working part-time. The director wouldn't commit to a specific reduction in salary that I need to take in order to reduce my teaching load. Instead, they said I should talk to my department head (HoD).* But they did say that all expectations needed to be adjusted and not just the teaching expectation. What does this mean? Academic staff are allocated a nominal percentage workload. In my case it is 40% teaching, 40% research, and 20% service. So, the director is saying that each of those percentages need to go down, not just the teaching one. This is totally expected. Having been a HoD myself, I knew that they couldn't make this decision by themselves. But what they can do is look at their teaching plans and see how it would work.

So, on Friday I talked to the HoD on the phone, who was very positive about the part-time plan and said there are two people who would be interested in teaching one of my courses. The HoD will now go back to the director to negotiate the percentage cut in FTE. The HoD is going to argue for a 30% cut. I think the director wants 50% but wouldn't say so. Maybe I'll end up at a 40% cut?

On Tuesday, there is an information session on the VSS, which I'll attend.

I have discussed this a lot with Moominmama. At one extreme we talked about taking the VSS and moving somewhere cheaper and doing homeschooling. In Australia, the lower the cost of living the worse the quality of public schools and there might not be a suitable private option.** At the other extreme we are looking at doing the part-time option.

I've debugged my simulations more and the VSS is equivalent financially to working part time to the end of 2028. After that, one year of part-time work adds 1.1% to net worth. Full time work adds 0.8% per year on top of the part-time option. The differential is because of progressive taxation.

So, why not just take the VSS? The main reason comes down to going cold turkey from an AUD 200k plus salary to depending entirely on investment returns.*** This month has been our worst in investment returns since June 2022. I have been very stressed out by the combination of that and the need to make this career decision. Moominmama thinks I will be very stressed out and maybe make bad decisions if I take the VSS. So, the lowest stress path is to ease into retirement gradually. In theory, the VSS gives you a pile of cash, so that you don't need to depend on investment returns for more than a year. But the temptation is to chase yield on that too...

* The director heads a "school" that comprises 4 academic departments.

** In particular, coastal areas outside the big cities are notoriously areas of low socio-economic status and high unemployment. Here are the socio-economic profiles of our nearest public high school in Canberra:

and Bateman's Bay High School, on the coast near Canberra:

These numbers are relative to Australia as a whole. The main private school tbere only has 28% of its students from the top quartile and its performance is similar to the average school in Australia. At our children's school 80% of students are from the top-quartile! I think that is likely too far in the opposite direction 😀*** Around AUD 245k pre-tax including employer superannuation contributions.

Wednesday, February 26, 2025

VSS Update

I now have a meeting lined up with my boss and discussed the whole thing with a colleague who took a similar package in 2020. He said that there weren't anything to know really that isn't on the website and the main thing are the psychological issues involved in retirement in general but also the sudden and fast pace of retiring under a scheme like this. I have been debugging and improving my simulation. Now there is no financial difference between taking the package and working half time from the middle of this year till the end of 2027. After that, each additional year of half-time work adds 1% to net worth!

The university has an existing "transition to retirement scheme" as well. Under this you commit to retire at a date not more than 3 years out and then step down your hours while the university pays your superannuation contributions at the full time rate. That wouldn't be much different to taking the package. Maybe 0.5% extra net worth and a lot of work....

The website mentions that there might also be an early retirement scheme but that the ATO needs to approve of it still. So, I sent an email to HR asking what that would be like.

Tuesday, February 25, 2025

VSS

VSS stands for "Voluntary Separation Scheme". The details were announced this afternoon. There are three weeks to apply for it from today. They are offering 3 weeks pay per year of service as a severance payment. That means I'd get about 3/4 a year's pay in a tax advantaged way. So maybe a year's after tax pay. I estimate now that net worth in 2029 would be only 5% lower than it would otherwise be. It's beginning to look like a no-brainer. Next step would be meeting with my director.

P.S. 8:50pm

I sent the email to my director about discussing the VSS and other options. Apparently, there is also a retirement scheme they are progressing with the ATO and the FAQ discusses working part time etc. I ran the numbers on the payout calculator they provided. Including annual leave and long-service leave, my estimated pay out is AUD 269k. There would be an estimated AUD 40k of tax on that.

Friday, February 21, 2025

1997

I feel that 1997 might be a good analogy to 2025. After an aborted recession in 1994 (2022) the stock market went up strongly in both 1995 (2023) and 1996 (2024). But when I left the US in 1996 for Australia the mood was that the economy was struggling and maybe another recession was coming. There was also a feeling that the stockmarket was overvalued. Alan Greenspan first mentioned "irrational exuberance" in December 1996. But the stockmarket, or at least tech stocks, went up for three more years to crazy heights in 1999 (2027) before the tech wreck. Then the boom was mainly internet related stocks, now AI and maybe quantum computing. Oscar Carboni, who is very slightly older than me, often says: "This boom is just getting started."

So, does that mean we should go all-in on tech stocks? There are no guarantees, and so I always diversify. My largest exposures to tech are through my venture capital exposures. If I am right, venture capital should do well for a while and maybe we can get some exits. And then I have WCM Global (WCMQ.AX), Generation Global, and Hearts and Minds (HM1.AX). Pershing Square Holdings (PSH.L) has investments in Google and Uber. Unisuper has some exposure through the Sustainable Balanced Option I am mainly invested in. But overall it would only add up to around 15% of net worth (and less of gross assets). On the other hand I have 18% of net worth in crypto-related assets that tend to move with tech stocks. Given that, perhaps my exposure is big enough?

Thursday, February 20, 2025

Voluntary Redundancy

So my employer announced a couple of days ago in the weekly newsletter that there will be a voluntary redundancy scheme. The details won't be announced until next week. Up till now they said that redundancies would be based entirely on determining work needs and budgets going forward and there would be no voluntary redundancies. Moominmama might also be made redundant mid-year, as her employer is also cutting and she is under-employed in her organization currently.

So, I did a simulation of what would happen if we both quit mid-year,* I got an AUD 75k payout (1 week's pay per year of service + 25k for long service leave etc.) and retired putting my transfer balance cap into pension mode. At the end of 2025 there is no real difference, as my pay is largely replaced by the payout. At the end of 2029 our net worth is 7% lower than it would otherwise be if I followed my original plan to work half time from next year until then.**

At first, when I told Moominmama this result she said: "Why are we working anyway then?" When I mentioned that I needed to stress test the result for different rates of return etc. she began to say it was too scary that we wouldn't have a salary coming in and I shouldn't take voluntary redundancy. But with that attitude I wouldn't retire till our youngest child completes grade school in 2037 when I will be 73!

In any case, I might yet be made compulsorily redundant. Our school (group of departments) has been given a salary budget for this year that is around 10% lower than the salaries we are paying...

* To get a rough estimate you don't need a simulation. Just work out the after tax salary and superannuation you are giving up by retiring now net of the redundancy payment and divide it by current net worth. That tells you how much more % you would have in net worth at the end of the period of foregone salary.

** Net worth in 2029 would still be AUD 1 million higher in real terms than at the end of 2025 despite being retired. This is because our current spending is only 2.9% of our net worth (not including housing equity), which is well below the classic 4% rule.

P.S. 21 February 2025

Heard today that the window for applying for voluntary redundancy will only be three weeks from 25 February when the details will be released.