This is a hedge fund investment I am considering. The kind of thing that is not available to individual investors in the US but is available here in Australia. UK-based Man Group is probably the largest managed futures manager. This product is a structured investment that consists of four elements:

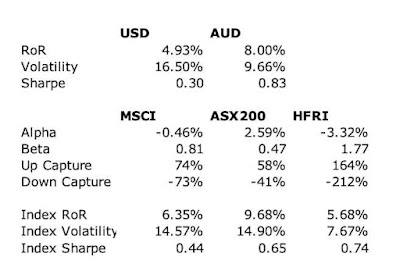

1. An 80%+ investment exposure in AHL, Man's main managed futures program. This is a system trading one hundred plus global futures markets. In the last 10 years it has returned 16.1% per annum (5 years, 12.3%, 1 year, 20.6% as at October 2007 - the MSCI returned: 8.8%, 20.2%, and 24.8% respectively - Moom: 10.8%, 26.1%, and 34.6%). So it outperforms stocks in bear markets and underperforms in bull markets. Examination of periods of drawdown in the Australian stock market, show that the program always made money in those periods.

2. A 20%+ investment exposure to the RMF Commodity Strategies program. This program invests with 30 hedge fund managers investing in commodities via futures and stocks. In the last three years it returned 18.4% p.a. (MSCI: 20.7%, Moom: 20.6%) and in the last year 13.2% as at October 2007.

3. A 20%+ investment exposure (yes there is moderate leverage in the scheme) to the RMF Asian Opportunities fund of managers. This program invests with 14 hedge fund managers specializing in Asian investments. In the last three years it returned 16.4% p.a. and in the last year 24.3% as at October 2007.

Though all three of these programs have quite high month to month volatility, their maximum drawdowns are lower than the stock market - they have a smoother equity curve in the long-run, year to year. Of course, this being a hedge fund, the fees are sky-high: 2% and 20% for AHL and 1.5% and 10% for RMF, plus brokerage of 3% per year plus an initial load of 5% (CommSec will rebate 80% of the 4% sales commission they will receive), plus another 0.5% overall to Man, plus 0.25% to Commonwealth Bank p.a and some other small fees. But all the returns quoted above are after fees (not the 5% load presumably).

4. A capital guarantee provided by Commonwealth Bank of Australia. When the investment matures in eight years they promise to pay back at least $A1.00 per initial $A1.00 investment. The most you can lose, therefore, is the interest on your money (assuming positive real interest rates) - which is quite a bit over eight years of course. They will also lock in each year half of any new net profits into the guarantee. So say the fund makes 10% in the first year. Then the guarantee will rise to $A1.05 per share and so forth.

Advantages Opportunity to invest in a high alpha (relative to the stock market) diversifying investment of a type that retail investors usually have limited access to. The managers are high quality.

Disadvantages The investment is relatively illiquid. Prices are quoted once a month and shares can be redeemed monthly. Until 2011 there is a 2% fee for exiting the fund. The capital guarantee only applies for shares redeemed in 2016 at maturity. Taxation is not so favorable either - according to the prospectus the long-term capital gains tax rate will apply to the capital guarantee but all gains above that will be taxed as an unfranked dividend - i.e. at ordinary income tax rates. There is also the potential for Australia's draconian foreign investment funds (FIF) legislation to apply. These rules require you to pay tax on unrealized gains in foreign investment funds annually - there are lots of exceptions but this isn't one of them. But if you have less than $A50,000 invested in such funds you are also exempt. So I think, from my reading of the rules, I should be exempt.

What do you think? Would you invest in this?

P.S.

How would this investment be funded? It can be funded using a Commonwealth Securities margin loan with a 70% lending ratio. After all my recent purchases I only have $5515 in cash available on my margin loan. But I could easily invest $10,000 in this fund and still have a buffer before I'd get a margin call as the 70% loan ratio means the cash available will only be reduced to $2515. Though that is beginning to cut things close. But, on 13th March I should receive $A16,400 from Primary Health Care for my Symbion shares. So there isn't going to be any problem in funding either $10k or $20k for this investment. Longer term I want to reduce the size of my margin loan as margin interest is expensive compared to other sources of leverage. We'll have to wait for some of my recent trades to payoff first though.