Seems like April is the time for me to think about trading. I developed a very simple mechanistic trend-following model for trading Bitcoin futures. I have placed orders in the market but they haven't triggered yet. Initially, I tried to be too clever, but quickly decided that just using mechanical rules will work better...

Now I am returning to thinking about more sophisticated models as well. Here are the results from a very simple mean reversion model – it goes short when stocks are strong and vice versa, with daily trades on the NASDAQ index:

This assumes perfect trades with no fees. It worked great until the end of 2008. Then it did nothing for three years and then started working again. But in the last five years it again went nowhere. Strangely, it looks a lot like the returns from trend-following over this period. Still, from 2005 to the present it returned 19% per year. I might be wrong, but I'm thinking that this is a benchmark for more sophisticated forecasts. If we can predict that we should trend follow rather than mean revert for a few of the worst days here, returns would improve a lot. But it has to be a very simple method that won't result in overfitting.

On the other hand, the NASDAQ 100 index itself returned 14.18% and go long with a stop if the market falls 1% or more intraday returned 19.85% a year.

Sunday, April 21, 2019

Friday, April 05, 2019

March 2019 Report

In March the Australian Dollar fell from USD 0.7106 to USD 0.7096. The MSCI World Index rose 1.32% and the S&P 500 1.94%. The ASX 200 rose 0.97%. All these are total returns including dividends. We gained 0.53% in Australian Dollar terms and 0.40% in US Dollar terms. Our currency neutral rate of return was 0.39%. The target portfolio gained 1.10% in Australian Dollar terms and the HFRI hedge fund index 0.97% in US Dollar terms. So, we underperformed our benchmarks.

Here again is a detailed report on the performance of all investments:

The table also shows the shares of these investments in net worth. At the bottom of the table I also included the Australian Dollars return from foreign currency movements and other net investment gains and losses - net interest and fees. This time I also combined all individual corporate bonds into a single investment. Their individual returns are not very informative. At the asset class level only Australian small cap stocks and hedge funds lost money this month. U.S. stocks were the best performing asset classs.

Things that worked very well this month:

The main driver is continued movement of cash from my US bank account to Interactive Brokers where I am buying bonds before eventually transferring some of the money to our Australian bank accounts when the broker allows..... We are now quite underweight in Australian shares.

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

Here again is a detailed report on the performance of all investments:

Things that worked very well this month:

- Pendal Property Investments an Australian fund of REITs did surprisingly well. Pershing Square Holdings continued to gain as Bill Ackman turned round his recent poor performance.

- The Tribeca Global Natural Resources listed hedge fund performed very badly this month.

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- USD 135k of corporate bonds matured (Santander UK and Welltower) and I bought USD 284k of bonds (HCA, Virgin Australia, Viacom, WGL, Goldman Sachs, and Kinder Morgan).

- I bought 755 Commonwealth Bank hybrid securities (preferred stock).

- I sold 10,000 shares of PIXX.AX and bought 30,000 shares of PMC.AX after the premium to NAV of the latter fell substantially.

- I bought another 1089 OCP.AX shares.

- We completed the deleveraging this month, just in time for the US yield curve to invert out to the 10 year maturity. I sold all of Moominmama's units in the CFS Geared Share Fund and bought units in the Imputation Fund instead. I also sold all her units in the CFS Geared Global Share Fund and bought units in the Generation Global and Platinum International Fund (same as PIXX.AX) instead. Yes, we still have a margin loan, but we have the cash to pay it off, just not yet in the right country...

- I applied for the Pengana Private Equity IPO.

CommBank App Not Working

More financial frustrations today... Recently I set my phone up to pay cardlessly using the CommBank App. But today, I went to buy lunch and it wouldn't work. This was the first day I didn't bring a credit card so I have less stuff to carry around. I couldn't log into the app either. I got a message that I didn't have an internet connection, despite everything else on my phone working fine. I phoned Commonwealth Bank and their solution: Delete the app and reinstall it. Apparently the cardless world hasn't arrived quite yet.

One thing positive I can say about CBA is that their phone service is excellent. Wait times are always very low and the representatives have the solutions to the problems immediately. I can't say that about some other Australia companies. Telstra for example.

One thing positive I can say about CBA is that their phone service is excellent. Wait times are always very low and the representatives have the solutions to the problems immediately. I can't say that about some other Australia companies. Telstra for example.

Restrictions on Withdrawing Cash at Interactive Brokers

If you move money to Interactive Brokers through the American banking system, they put a hold on your money so that you can't withdraw it to another bank for 44 days. This works in a very strange way. If you have more than the amount on hold in US dollars you can obviously withdraw that excess money in US Dollars. But if you want to withdraw money in Australian Dollars you also have to have more than that amount in Australian Dollar cash! Well, this is what an IB representative just told me to explain why I can't withdraw any money in Australian Dollars despite having cash in that account, including cash I received from dividends that absolutely wasn't transferred from a US bank.

This will slow down my financial restructuring plan. I don't want to buy that many Australian Dollars all at once, though I could use futures contracts to retain exposure to the US dollar... but for psychological reasons I find that harder to do. And I would have to sell the US corporate bonds I bought to do it. The only thing that I really want to do that is time bound is to make a non-concessional contribution to superannuation before the end of the financial year. I guess I will sell some Australian managed funds to come up with the money.

This will slow down my financial restructuring plan. I don't want to buy that many Australian Dollars all at once, though I could use futures contracts to retain exposure to the US dollar... but for psychological reasons I find that harder to do. And I would have to sell the US corporate bonds I bought to do it. The only thing that I really want to do that is time bound is to make a non-concessional contribution to superannuation before the end of the financial year. I guess I will sell some Australian managed funds to come up with the money.

Wednesday, April 03, 2019

Bitcoin

I thought it was time to buy Bitcoin when I heard that CBOE was dropping Bitcoin futures contracts. Supposedly, when everyone hates something, it's the time to buy it. I have also seen research, which argues for a big rise in Bitcoin. I set up a simple trading model and it confirmed that I should go long now. I got approval to trade CME Bitcoin futures on Monday. Looking at the stochastic oscillator on the chart above, I thought there would be a bit of a pullback and put in an order yesterday to buy at $4000 when the futures were trading at $4140 with a stop at $3845. I went to a meeting and when I came out I saw Bitcoin was at $4700. So, trying to be too clever, I missed the boat. The problem is that the stop is still the same according to my trading model. One contract is 5 Bitcoins. I don't want to risk USD5000+ on this trade. So, I will need to wait, probably a couple of weeks before the stop will change and I can place a trade with acceptable risk. The alternative risk is that Bitcoin continues to go higher from here. But after yesterday, I really want to stick to the model and not try to be clever.

This is one of three more "macro" trades that I am thinking of doing. At the moment, I don't have the time to do the research to fix my shorter term trading model.

Wednesday, March 27, 2019

Reduced Incentive to Access Superannuation as Early as Possible

Currently, Australian superannuation earnings are taxed at 15% and 10% for capital gains while you are in the "accumulation" phase (before you retire). When you retire you can switch up to $1.6 million of assets into pension mode and then the earnings are taxed at 0%.* The downside is that then there is a minimum payout ratio every year which increases with age. Unlike the U.S., there is actually no requirement to make any withdrawals from super. But making withdrawals is incentivized by the reduction in tax rate.

But if you have shares that pay franking credits, you can use these franking credits to offset the 10-15% tax. You might not pay any net tax on your super fund in the accumulation phase. When you switch to pension mode you will get cash refunds of the franking credits.**

Labor plans to abolish these refunds of franking credits. This means that there may actually be no net change in tax due when switching from accumulation to pension mode. The incentive to switch disappears. This means that if you have assets outside super you probably should spend them first in retirement as they are relatively highly taxed. Only if you run out of such assets, should you access your super.

* Any excess remains in accumulation mode.

** You might even get some cash refunds in accumulation mode if you have enough shares paying franked dividends.

Planning Permission Refused

I got an email today from the city planning office that the development in our neighbourhood that I had objected to was refused planning permission. The plan violated many individual rules, but basically the developers were trying to cram too much development into a small space. They planned on 56 town houses and commercial space and 12 apartments in a 5 storey building. The development occupies the two greenish blocks on the map:

You can see the size of townhouses and houses in the neighboring development (yes, we live there) to get an idea of how crammed this development was planned to be.

I objected to the height of the 5 storey building, which we would see from the front of our house, largely blocking our existing view to a wooded hill. Only 7 members of the public had filed written objections to the original plan despite wide advertising by the government of the application and consultation sessions in the neighborhood. I was the only person who wrote an objection against the revised plan the developers submitted.

I have been surprised how much work the developers have been doing on site. Apart from demolishing the existing office buildings, they have done most the excavation for underground car parks and then started building individual underground garages for the townhouses on the east of the site. They also recently installed a big yellow tower crane on site. How could they submit a plan that violated so many rules and then invest so much money on the basis of such a flawed plan. Will they have to change the work they have already done or will they get away with it? They have a month to appeal the decision, or they will need to submit a new plan.

Saturday, March 23, 2019

Leave Liability

Here in Australia, employers nowadays seem to be very concerned about people not taking their annual leave entitlements. If your balance gets above a certain amount you are likely to get a message from HR telling you take vacation days before some deadline. I got one of these recently and promptly ignored it. It's not that I haven't taken some breaks. Maybe formally though I was only on leave for a couple of weeks this financial year. I think they might just put me on forced vacation from 1 July which is OK with me (see below why)...

I supervise one other academic. I was told to make a plan with him to reduce his leave liability. He has ended up scheduling a bunch of mini-vacations when he plans to work anyway.

My wife also got a request from her employer to schedule a lot of leave before 1 July. She contacted HR and told them that she couldn't take leave as she has a lot of work to get done. She only works 3 days a week. Their solution? She should switch to full time and take leave on the days she wouldn't be working! This is a win-win solution :)

It might be an even bigger win for us. Moominmama will be going on maternity leave from the end of May. Yes, we are going to have a second child. She plans to be on leave for at least a year.

I think this means that the 18 (?) weeks of maternity pay from her employer will be paid at the full time rate. Also, last time, they made employer superannuation contributions (15.4% of base salary) for the whole year. These too look like they'll be at the full time rate now.

This seems really crazy from the employer's perspective. I don't understand why employers are so concerned about having this "leave liability" on their balance sheet. At her employer apparently you can cash out the leave instead of taking time off. So that is a real liability. My employer allows only allows it in cases of "financial hardship". There is an "annual leave loading" of 17.5% extra pay for the vacation days. The surplus is paid out on termination. But if you do take leave now, it is paid out now and elementary economics say that the employer should want to get it paid out later rather than earlier! It's the employee who is missing out on getting the money earlier. That said, I should take more leave earlier :)

Sunday, March 17, 2019

Pengana Private Equity

Pengana Capital is launching a listed investment trust that will invest in global (but mostly North American) private equity funds. I am participating in the IPO. I have been looking for an investment to replace IPE, which was taken over by Mercantile Capital. It's not an exact match as IPE invested in mostly Australian private equity. But now I am investing in Australian venture capital, so geographical diversification is good.

The fund will effectively be managed by Grosvenor Capital Management. I attended the "roadshow" where there were presentations from the CEO, Russel Pillemer and from a representative of Grosvenor, Aris Hatch. These were very helpful in understanding the potential value of this IPO. For U.S. regulatory reasons, the prospectus is missing any information on GCM's track record. However, there are two research reports on the IPO website, which are very informative, though technically they are only meant to be accessed by financial professionals.

The fund has really high fees. The base fees are about 2.4% p.a. If the investments exceed the 8% hurdle rate then three (!) levels of performance fees kick in. I estimate that the performance of the fund is related to that of the underlying investments as shown in this graph:

That's right, if the underlying performance reaches 25% the fees will be around 9%! Based on all the information I have, I still think the fund could return around 10% p.a. and so I think it is worth investing in.

An additional feature is that each $1.25 share will be stapled with $0.0625 worth of shares in Pengana Capital (PCG.AX). These shares will be distributed to investors after two years. Pengana will also absorb the costs of the float. Therefore, the initial NAV will be $1.3125 for a $1.25 investment. Pillemer justified PCG's 20% performance fee, for effectively doing nothing but choosing GCM as manager, on the basis of these giveaways. It seems that they won't get to keep much of the base management fee. Therefore, the fund will have to do well for Pengana to get paid.

The fund will take 4 years to get fully invested. In the short run they will invest in debt instead of equity. If there is a recession in the US in the near future, the fund can hopefully make some investments at good prices. So, the timing could be good.

Finally, it's interesting that the fund will not be a listed investment company but a trust. This means all earnings are passed on to investors in the form they are received rather than being converted to franked dividends. This is partly to make the investment more attractive to self managed super funds etc. if franking credit refunds are abolished.

Saturday, March 09, 2019

Benchmarking

As we move further away from an equities oriented portfolio, I think that benchmarking against equity indices makes increasing less sense. We are also in a multi-year process of investing inherited cash, which means our portfolio is more cash and bonds heavy than it will be in the long run. As we near "financial independence" I am also becoming more risk-averse. This is the opposite of the usual textbook economics prediction that risk-aversion decreases with wealth. Part of it is that I feel like I should take less risk with the inherited money than with the money I saved myself. My goal is to pass on to my children at least as much as I inherited myself.

So, I am increasingly thinking that an index of hedge fund returns makes more sense as a benchmark. Hedge funds in general aim for lower volatility than equity indices. And hedge fund returns are after fees and so are a more realistic goal to aim at. This is why I have been researching hedge fund performance.

The returns of the typical hedge fund have declined over time and the typical hedge fund no longer produces alpha relative to the MSCI world stock index. Hedge fund returns are increasingly correlated with stock returns. Our own returns are converging towards those of hedge funds:

The graph shows rolling regression estimates of our alpha and beta relative to the HFRI fund weighted index. Our alpha is now around 0% and beta is 2. For a 1% change in hedge fund returns our returns typically change 2%. Mostly in the past we had a negative alpha to hedge fund returns. Comparing our actual returns (in USD terms) to those of the HFRI index, at times we have underperformed and at times outperformed the index:

The graph shows how many percent per year extra you would have earned by investing with me instead of in hte HFRI index starting in each month on the graph. So, if you invested with me in October 1996 you would have received about 2% per year less since then than investing in HFRI. But from November 2002 you would have been 2% per year better off by investing with me instead. By contrast, there have been few months in the last couple of decades where my subsequent cumulative return has been better than the MSCI World Index:

May and June 2003 was one such short period. I have outperformed the index since then. August 2015 and May 2017 were two other recent cases. But there are long periods where my subsequent performance was more than 3% p.a. worse than the index. On the other hand, perhaps the hedge fund index is too easy a benchmark to beat:

So, I am increasingly thinking that an index of hedge fund returns makes more sense as a benchmark. Hedge funds in general aim for lower volatility than equity indices. And hedge fund returns are after fees and so are a more realistic goal to aim at. This is why I have been researching hedge fund performance.

The returns of the typical hedge fund have declined over time and the typical hedge fund no longer produces alpha relative to the MSCI world stock index. Hedge fund returns are increasingly correlated with stock returns. Our own returns are converging towards those of hedge funds:

The graph shows rolling regression estimates of our alpha and beta relative to the HFRI fund weighted index. Our alpha is now around 0% and beta is 2. For a 1% change in hedge fund returns our returns typically change 2%. Mostly in the past we had a negative alpha to hedge fund returns. Comparing our actual returns (in USD terms) to those of the HFRI index, at times we have underperformed and at times outperformed the index:

The graph shows how many percent per year extra you would have earned by investing with me instead of in hte HFRI index starting in each month on the graph. So, if you invested with me in October 1996 you would have received about 2% per year less since then than investing in HFRI. But from November 2002 you would have been 2% per year better off by investing with me instead. By contrast, there have been few months in the last couple of decades where my subsequent cumulative return has been better than the MSCI World Index:

May and June 2003 was one such short period. I have outperformed the index since then. August 2015 and May 2017 were two other recent cases. But there are long periods where my subsequent performance was more than 3% p.a. worse than the index. On the other hand, perhaps the hedge fund index is too easy a benchmark to beat:

Saturday, March 02, 2019

February 2019 Report

In February stock markets continued their rebound. The Australian market rose especially strongly. The Australian Dollar fell from USD 0.7274 to USD 0.7106. The MSCI World Index rose 2.72% and the S&P 500 3.21%. The ASX 200 rose 6.32%. All these are total returns including dividends. We gained 3.18% in Australian Dollar terms and 0.90% in US Dollar terms. So, we underperformed the markets. This is not surprising given the weight of cash and bonds in our portfolio. Our currency neutral rate of return was 1.94%. I estimate that the target portfolio gained 3.08% in Australian Dollar terms.

Here again is a detailed report on the performance of all investments:

The table also shows the shares of these investments in net worth. At the bottom of the table I also included the Australian Dollars return from foreign currency movements and other net investment gains and losses - net interest and fees.

Things that worked very well this month:

We moved towards the new long-run asset allocation:*

The main driver is continued movement of cash from my US bank account to Interactive Brokers where I am buying bonds before eventually transferring some of the money to our Australian bank accounts when the broker allows. The increase in rest of the world stocks is mostly due to updating the allocations of various managed funds for their current allocations. We are near the long term allocations for each of the stock categories and real estate. We are overweight cash and bonds and underweight commodities, private equity, and hedge funds.

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

* Total leverage includes borrowing inside leveraged (geared) mutual (managed) funds. The allocation is according to total assets including the true exposure in leveraged funds.

Here again is a detailed report on the performance of all investments:

Things that worked very well this month:

- CFS funds - they all did well. Future Leaders continues to outperform Developing Companies.

- Our two UK listed stocks - 3i and Pershing Square Holdings.

- Medibank. It continues to bounce back nicely though we only have a very small posiiton.

- Unisuper made the largest gain in dollar terms, though we are still below the peak value last year.

- Many investments hit new profit highs including PSS(AP), Generation, and Hearts and Minds.

- Yellowbrickroad... I exited this investment at 6.5-6.6 cents per share following the release of the Royal Commission report. I should have gotten out much earlier. The shares are now suspended as the company has not filed its interim financial report. They are still working on writing down their assets... The last price they traded at was 5.4 cents.

We moved towards the new long-run asset allocation:*

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- I bought USD 300k of corporate bonds and USD 100k of treasury bills matured. Our monthly bond ladder now extends to September.

- We sold 569 China Fund (CHN) shares back to the company at 99% of NAV in the tender and then bought 669 in the market for a lower price.

- We sold out of Yellowbrickroad (YBR.AX) at a big loss.

- I made a quick (losing) trade in gold futures (Included in gold above).

- We switched our choice of option in the PSS(AP) superannuation fund to "balanced" from a mix of "balanced" and "aggressive".

- I switched from Geared Shares to Imputation (leveraged and unleveraged Australian shares) in my CFS superannuation fund.

- At the end of the month I also switched to the balanced option in the Unisuper superannuation fund.

* Total leverage includes borrowing inside leveraged (geared) mutual (managed) funds. The allocation is according to total assets including the true exposure in leveraged funds.

Thursday, February 14, 2019

Retiring in Australia and Spending Dividends Only

Big ERN has a new blogpost about the safe rate of withdrawal in retirement. He takes on people who say that you can avoid the problem of selling assets when their price is low by investing in high-yielding assets and only spending the dividends or interest. The highest yielding portfolio he looks at has yielded an average of 3.6% p.a. and it looks like it ends up selling capital in the great recession of 2008-9.

Australian shares have a high dividend yield. They yielded 4.25% last year not counting franking credits. If as ERN assumes you withdraw 4% of the portfolio in the first year and then increase that withdrawal by the rate of inflation can you avoid selling shares? The short answer is: yes!

These are my assumptions: We invest in the ASX 200 index without fees (could be replicated by a portfolio of 20 stocks maybe?) and we don't pay taxes (it's a superannuation account in pension phase) and so we get the grossed up value of the dividends (Labor plans to eliminate these refunds if they win the next election). I start with $900k in shares and $100k in cash and get the Reserve Bank interest rate as interest on the cash. Then all dividends and interest are paid into the cash account.

My first simulation assumes we retire at the end of March 2000. This was not a good time to retire as it was just before the dotcom/tech crash. But the ASX200 index started in April 2000 and so data before then is not very reliable. This is what happens:

Starting in 2000 we would now have almost $1.7 million in shares and $900k in cash. If we'd reinvested some of the dividends we probably would have been even better off.

To stress test the model, I also do a simulation that assumes you retire at the end of December 2007 just before the great recession/global financial crisis. This is what happens then:

Obviously, it's not as good and you would have $970k now, more than 10 years later. In real terms the value of the portfolio will have fallen substantially. But so far, you won't have had to sell a single share with $138k in cash currently. Over the last couple of decades this strategy has worked well.

This suggests that investing in stocks in countries with traditionally high dividend yields like Australia and only spending the dividends is a viable investment strategy. If you need to pay taxes on withdrawals as in the case of a U.S. 401k account then you will need to start with more money invested to fund the same level of spending.

Australian shares have a high dividend yield. They yielded 4.25% last year not counting franking credits. If as ERN assumes you withdraw 4% of the portfolio in the first year and then increase that withdrawal by the rate of inflation can you avoid selling shares? The short answer is: yes!

These are my assumptions: We invest in the ASX 200 index without fees (could be replicated by a portfolio of 20 stocks maybe?) and we don't pay taxes (it's a superannuation account in pension phase) and so we get the grossed up value of the dividends (Labor plans to eliminate these refunds if they win the next election). I start with $900k in shares and $100k in cash and get the Reserve Bank interest rate as interest on the cash. Then all dividends and interest are paid into the cash account.

My first simulation assumes we retire at the end of March 2000. This was not a good time to retire as it was just before the dotcom/tech crash. But the ASX200 index started in April 2000 and so data before then is not very reliable. This is what happens:

Starting in 2000 we would now have almost $1.7 million in shares and $900k in cash. If we'd reinvested some of the dividends we probably would have been even better off.

To stress test the model, I also do a simulation that assumes you retire at the end of December 2007 just before the great recession/global financial crisis. This is what happens then:

Obviously, it's not as good and you would have $970k now, more than 10 years later. In real terms the value of the portfolio will have fallen substantially. But so far, you won't have had to sell a single share with $138k in cash currently. Over the last couple of decades this strategy has worked well.

This suggests that investing in stocks in countries with traditionally high dividend yields like Australia and only spending the dividends is a viable investment strategy. If you need to pay taxes on withdrawals as in the case of a U.S. 401k account then you will need to start with more money invested to fund the same level of spending.

Wednesday, February 06, 2019

Today's Moves

I bought more corporate bonds. This time in Royal Bank of Canada and Welltower. These were the highest yielding investment grade bonds that I could actually buy that mature in April. $US25k in one and $US35k in the other. Not ideal, as the commission is higher for the first $10k but those were the amounts on offer. I was looking to buy bonds of Siam Bank Corporation, but the minimum purchase turned out to be $US200k for some reason. I also tried to buy Glencore bonds, but when I put my bid in the market, the offer disappeared from the screen. I waited a while and I didn't get the bonds. Very weird. Probably it makes sense to wait until I have enough cash to buy $US100k and buy Treasury bills unless there is a sufficient amount of corporate bond with a high enough yield to make it worthwhile. After commissions these two purchases probably end up breakeven with a Treasury bill. As I begin to buy bonds at longer maturities though, the commission will be spread out over a longer period. I use the bond scanner provided by Interactive Brokers to find available bonds with the right characteristics.

I also am looking at shifting our allocation in the PSS(AP) superannuation fund from 50/50 "balanced" and "aggressive" to 100% balanced as part of our general de-risking. I am again reminded of how shocking the lack of transparency about investments is for Australian funds compared to US funds. All the information they provide in the annual report is the percentage of the fund allocated to "equities", "alternatives" etc. with no further details. PSS(AP) actually used to provide more, but not a lot more, information than this. An interesting fact from the annual report is that employer contributions totaled $A1.154 billion and employee contributions $A55 million in the 2017-18 financial year. Not many people are making additional contributions or they are not making very large contributions. This makes sense as the employer (the Public Service) contributes 15.4% on top of the official salary to the fund. It's only interesting because for the defined benefit fund at Australian universities – not part of the public service, though they are in the public sector – employees are required to contribute 7% on top of the employer 17% in order to get full benefits. I opted out of the defined benefit fund. Our employee contributions at PSS(AP) are actually as big as the employer contribution at the moment.

P.S.

Basec on reading the Unisuper report, employee contributions might only include non-concessional or "after tax" contributions and not salary-sacrificed or "pre-tax" contributions. This is because the stated contributions tax in the report is 15% of the employer contributions. By contrast with PSSAP though, Unisuper defined contribution members make massive non-concessional contributions (see p52 of the report), even though the employer makes 17% contributions to the fund.

I also am looking at shifting our allocation in the PSS(AP) superannuation fund from 50/50 "balanced" and "aggressive" to 100% balanced as part of our general de-risking. I am again reminded of how shocking the lack of transparency about investments is for Australian funds compared to US funds. All the information they provide in the annual report is the percentage of the fund allocated to "equities", "alternatives" etc. with no further details. PSS(AP) actually used to provide more, but not a lot more, information than this. An interesting fact from the annual report is that employer contributions totaled $A1.154 billion and employee contributions $A55 million in the 2017-18 financial year. Not many people are making additional contributions or they are not making very large contributions. This makes sense as the employer (the Public Service) contributes 15.4% on top of the official salary to the fund. It's only interesting because for the defined benefit fund at Australian universities – not part of the public service, though they are in the public sector – employees are required to contribute 7% on top of the employer 17% in order to get full benefits. I opted out of the defined benefit fund. Our employee contributions at PSS(AP) are actually as big as the employer contribution at the moment.

P.S.

Basec on reading the Unisuper report, employee contributions might only include non-concessional or "after tax" contributions and not salary-sacrificed or "pre-tax" contributions. This is because the stated contributions tax in the report is 15% of the employer contributions. By contrast with PSSAP though, Unisuper defined contribution members make massive non-concessional contributions (see p52 of the report), even though the employer makes 17% contributions to the fund.

Monday, February 04, 2019

Do You Feel You are in a Lower Wealth Percentile Than What the Official Data Say?

People tend to think they are less relatively wealthy than they are. You can check out your perceptions against reality for a number of countries here. I'm not surprised. According to the official statistics we are in the top 4% of households in Australia by wealth. But looking around, it certainly doesn't feel like that could be true.

Our house is only valued a few percent above the median for our city. Our car is a 15 year old Ford when it feels like the roads are full of luxury vehicles. But it's not like we are saving like crazy. In 2018, we spent almost all of what we earned from salaries. Apparently, a lot of people feel the same way.

Friday, February 01, 2019

January 2019 Report

In January stock markets rebounded but because the Australian Dollar rose, we didn't gain a lot in Australian Dollar terms. The Australian Dollar rose from USD 0.7049 to USD 0.7274 The MSCI World Index rose 7.93% and the S&P 500 8.01%. The ASX 200 rose 3.87%. All these are total returns including dividends. We gained 0.49% in Australian Dollar terms and 3.79% in US Dollar terms. So, we underperformed the markets. This is not surprising given the weight of cash and bonds in our portfolio. Our currency neutral rate of return was 1.89%. I estimate that the target portfolio gained 1.57% in Australian Dollar terms.

Here again is a detailed report on the performance of all investments:

The table also shows the shares of these investments in net worth. At the bottom of the table I also included the Australian Dollars return from foreign currency movements and other net investment gains and losses - net interest and fees. The loss on the apartment is the estimated sale costs.

Things that worked very well this month:

The main driver is continued movement of cash from my US bank account to Interactive Brokers where I am buying bonds before eventually transferring some of the money to our Australian bank accounts when the broker allows. Also, we sold the apartment we inherited.

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

Here again is a detailed report on the performance of all investments:

Things that worked very well this month:

- The China Fund - the fund has announced a tender for 30% of outstanding shares at 99% of NAV. The share price is rising towards NAV as a result. I tendered my shares into the buyback. At least it will probably realise a small capital loss.

- Pershing Square Holdings. This bounced back nicely from December losses and we are now up in this investment.

- Unisuper. This is after a steep fall in previous months. I continue to be surprised how much higher the beta of Unisuper is compared to PSS(AP). Both are public sector superannuation funds and we supposedly have a similarly aggressive stance in each.

- US Dollars - The Australian Dollar rose, especially after the statement from Jerome Powell.

- Cadence Capital - It continues to lose money and is now our third worst investment ever in terms of dollars lost. The fund manager explained that they focus heavily on value stocks and those got trashed.

- Yellowbrickroad...

On a regular basis, we also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- I moved AUD 30k from the CFS Geared Share Fund back to the CFS Conservative Fund in my CFS superannuation account. I originally moved this money in October to CFS Geared Share Fund. I made a small profit on the roundtrip trade, but the main motivation for closing the trade was to reduce risk.

- I bought 1558 shares in OCP.AX at AUD 2.07 a share just because they were being offered so low.

- I sold 15,000 shares in PMC.AX and bought 5000 shares in PIXX.AX as the PMC premium to NAV was still high.

- I bought AUD 24k during the "flash crash" and sold them after the Australian Dollar recovered a few cents.

- I bought 1000 shares of PERLS XI as I can't move the Australian Dollars I bought in December to our Australian bank account yet.

- I bought USD 100k of treasury bills maturing in February.

- I bought USD 100k of Santander UK bonds maturing in March.

- I bought 1000 shares of the gold ETF, IAU.

Wednesday, January 30, 2019

Understanding Increase in Spending Better

I wanted to understand why spending in the 2018 calendar year was up 28% on 2017. The first step was computing a spending breakdown for the 2017-18 financial year. The period is different and the definitions of income and spending are different than in my usual accounts to make it more comparable with other income and spending breakdowns on the web. I now computed the spending breakdown for the second half of 2018 and we can compare monthly spending in this period to that in 2017-18:

Spending was up by 7.5%. So not as dramatic a growth rate. The biggest difference between the two periods, is that in the first period we spent a lot on travel and in the second on health. In fact, the travel spending was mainly in the second half of 2017-18 - i.e. in the first half of 2018. So, 2018 had high spending because of both travel and health spending being up strongly on 2017. The way I usually compute spending and income is to include any refunds for medical spending as income rather than reducing spending by the amount of the refund, which I am doing here. So, that pushed up spending even more. I'm glad I now understand why our spending increased so much.

Another major change is that cash spending was down in the second half of 2018. That was because I had access to the statement for my Qantas Cash card – only the last 13 months is online. In the previous period, I treated all spending on the card as cash spending.

Going forward, I expect medical expenses to be lower this half year and travel expenses to be much lower than in the first half of 2018. Given that, 2019 calendar year spending might be lower than 2018 spending.

Spending was up by 7.5%. So not as dramatic a growth rate. The biggest difference between the two periods, is that in the first period we spent a lot on travel and in the second on health. In fact, the travel spending was mainly in the second half of 2017-18 - i.e. in the first half of 2018. So, 2018 had high spending because of both travel and health spending being up strongly on 2017. The way I usually compute spending and income is to include any refunds for medical spending as income rather than reducing spending by the amount of the refund, which I am doing here. So, that pushed up spending even more. I'm glad I now understand why our spending increased so much.

Another major change is that cash spending was down in the second half of 2018. That was because I had access to the statement for my Qantas Cash card – only the last 13 months is online. In the previous period, I treated all spending on the card as cash spending.

Going forward, I expect medical expenses to be lower this half year and travel expenses to be much lower than in the first half of 2018. Given that, 2019 calendar year spending might be lower than 2018 spending.

Tuesday, January 29, 2019

Gold

Put my toes into the water by buying a small 0.5% position using the IAU ETF. I've posted about gold previously and it is in our long-term allocation to allocate 6% to gold.

Saturday, January 26, 2019

Spending Breakdown

After a discussion with friends at lunch yesterday and some blogposts I read recently, I decided to try to find out what we are spending on. I haven't done this in more than two decades I think. I looked at the 2017-18 financial year so that I can also easily include official income and tax figures in the total. It's all in Australian Dollars of course:

Income is gross income from our tax returns plus employer superannuation contributions which which don't enter taxable income. Income includes salaries and investment income etc.

Next we deduct taxes. As franking credits – tax credits for corporation tax paid by Australian companies are included in taxable income, they need to be deducted as we don't actually get the cash. Then there is 15% tax on superannuation (retirement) contributions. In total tax is 26% of gross income. Next I deduct some financial costs that are deducted from gross income to get to taxable income. There are more of these deductions actually, but some I have included in our spending.

Of the AUD 216k of net income half was spent and half saved.

The big spending items are mortgage interest, supermarkets etc, cash spending, mail order, childcare etc, and travel (flights, accomodation etc). Cash spending includes both spending actual cash and spending using our Qantas cash cards. I haven't gone into the accounts for the latter, though maybe I should. Some of the other spending categories very low compared to the actual amount spent on these because a lot of the spending is in cash. Possibly the most important of these is restaurants. Yes, there is a lot of fuzziness in these numbers because we don't budget and spend a lot in cash.

Am happy to get feedback on how we can save money, though I'm not really into "frugality" for it's own sake. Or maybe you would just like to compare the differences with other posted spending breakdowns.

P.S.

Qantas only provide online statements for the last 13 months. So, I can't now do a breakdown of those accounts for 2017-18. Maybe next year.

Income is gross income from our tax returns plus employer superannuation contributions which which don't enter taxable income. Income includes salaries and investment income etc.

Next we deduct taxes. As franking credits – tax credits for corporation tax paid by Australian companies are included in taxable income, they need to be deducted as we don't actually get the cash. Then there is 15% tax on superannuation (retirement) contributions. In total tax is 26% of gross income. Next I deduct some financial costs that are deducted from gross income to get to taxable income. There are more of these deductions actually, but some I have included in our spending.

Of the AUD 216k of net income half was spent and half saved.

The big spending items are mortgage interest, supermarkets etc, cash spending, mail order, childcare etc, and travel (flights, accomodation etc). Cash spending includes both spending actual cash and spending using our Qantas cash cards. I haven't gone into the accounts for the latter, though maybe I should. Some of the other spending categories very low compared to the actual amount spent on these because a lot of the spending is in cash. Possibly the most important of these is restaurants. Yes, there is a lot of fuzziness in these numbers because we don't budget and spend a lot in cash.

Am happy to get feedback on how we can save money, though I'm not really into "frugality" for it's own sake. Or maybe you would just like to compare the differences with other posted spending breakdowns.

P.S.

Qantas only provide online statements for the last 13 months. So, I can't now do a breakdown of those accounts for 2017-18. Maybe next year.

Friday, January 25, 2019

New Investment: Santander UK

Bought my first US corporate bond - a Santander UK bond maturing on 14 March. This supposedly gives a yield per annum of about 2.85%, which is more than treasuries of the same maturity. The original coupon on the bond is 4.2575%, so it is trading at a price of above 100. It pays quarterly interest. Fees for trading corporate bonds are higher than for treasury bonds at Interactive Brokers, but I still figured it was worth it.

Santander UK is the result of the merger of three former UK "building societies" - a bit like credit unions. It is owned by Spain's Banco Santander group but is managed separately. The maturity date is before the scheduled Brexit date on 29 March, so I figure Brexit shouldn't affect getting paid when the bond matures. The bonds are denominated in US Dollars not Sterling.

Tuesday, January 22, 2019

Interesting Paper from GMO on Bursting Stock Market Bubbles and Anti-Bubbles

Here is the paper. Yes, they think that we were in a bubble in 2017 and much of 2018 and the last quarter of 2018 was the beginning of the bursting of the bubble. The problem with the CAPE measure of valuation they use is that it is so backward-looking. If profits are growing fast, CAPE will be high because it uses the average profits of the last 10 years. It has the built-in assumption that profits growth is very strongly mean-reverting.

Monday, January 21, 2019

Likely Political and Economic Scenario for Australia

A couple of days ago I posted a list of all 12 of Labor's proposed tax increases. How likely is it that these will actually be enacted? Labor is unlikely to gain control of the Senate. So, they will need the support of minor parties and independents to push through their program. A quite likely scenario is that there will be a recession in 2020 and the minor parties will be very resistant to raising taxes in those conditions, especially on housing. Or Labor will decide to postpone some of the proposals in reaction to a recession. Then Labor is likely to not be re-elected in 3 years if unemployment is rising etc. So, at this point I would put even odds on most of this agenda being enacted.

Sunday, January 20, 2019

How Has Yale Done Since the Financial Crisis?

Just following up on Financial Independence's comment on my post linking David Svensen's 2008 lecture. How has Yale done since Svensen's lecture? It is easy to find out by checking the endowment's annual reports. Yale's financial year is from July 1st to June 30th. The graph shows Yale's total return index against the MSCI, S&P 500, and HFRI, where the others are all calculated on a July to June basis too.

Yale has performed quite well, eventually outperforming the MSCI World Index, but underperforming the S&P 500. Yale's diversification didn't help in the financial crisis. Their returns were just as negative as those of the MSCI and the S&P 500 in 2008-9. By contrast, the HFRI suffered only small losses in 2008-9. The bottom line is that Yale's returns are quite similar to an equity index.

Here is their asset allocation over the years:

Prior to 2013 they didn't report venture capital separately from buyout funds and so "Leveraged Buyouts" represents all private equity in the earlier years. Also, prior to 2009 they didn't report real estate and natural resources separately and so "natural resources" covers both. Over the years they have increased private equity and foreign stocks and reduced real estate and domestic stocks.

Yale has performed quite well, eventually outperforming the MSCI World Index, but underperforming the S&P 500. Yale's diversification didn't help in the financial crisis. Their returns were just as negative as those of the MSCI and the S&P 500 in 2008-9. By contrast, the HFRI suffered only small losses in 2008-9. The bottom line is that Yale's returns are quite similar to an equity index.

Here is their asset allocation over the years:

Prior to 2013 they didn't report venture capital separately from buyout funds and so "Leveraged Buyouts" represents all private equity in the earlier years. Also, prior to 2009 they didn't report real estate and natural resources separately and so "natural resources" covers both. Over the years they have increased private equity and foreign stocks and reduced real estate and domestic stocks.

The Average Hedge Fund No Longer Produces Alpha

I regressed the excess (above risk free rate) monthly returns of the HFRI fund-weighted hedge fund index on the excess returns of the MSCI All Country World Index (gross returns):

Back at the turn of the century, the hedge fund index had alpha between 5 and 10%. But it collapsed going into the financial crisis and in the most recent 5 year period alpha is -0.17% p.a. Beta is 0.34. The r-squared between the MSCI and HFRI excess returns is 0.86, which is high. So, you might as well invest 34% of your money in global stocks and the rest in cash to replicate the index. Interestingly, a linear trend line rather than an exponential trend line fits the index:

So, it doesn't make sense to invest in hedge funds recently unless you can select an above average fund.

Back at the turn of the century, the hedge fund index had alpha between 5 and 10%. But it collapsed going into the financial crisis and in the most recent 5 year period alpha is -0.17% p.a. Beta is 0.34. The r-squared between the MSCI and HFRI excess returns is 0.86, which is high. So, you might as well invest 34% of your money in global stocks and the rest in cash to replicate the index. Interestingly, a linear trend line rather than an exponential trend line fits the index:

So, it doesn't make sense to invest in hedge funds recently unless you can select an above average fund.

Friday, January 18, 2019

All of Labor's Tax Increases

The Labor party is at the moment likely to win the next federal election in Australia in May. Labor has become increasingly left wing in recent years and has a long list of policies to raise taxes. This is, I think, a comprehensive list:

- Abolish Liberal plan to raise the top tax threshold to $200k: This was supposed to happen in 2024. The top tax bracket will still cut in at $180k (about USD130k) where it has been for many years. Bracket creep is pushing more and more taxpayers into the top bracket. This will affect us if I am still working then. If I'm not, probably my taxable income will be lower.

- Raise the top tax rate: Add 2% to the top rate to raise it to 47%. With Medicare that is 49%. This will immediately raise our taxes.

- Abolish plan to eliminate 37% tax bracket: This also was supposed to happen in 2024, so may not affect us except to the extent of how many franking credits will get used up offsetting our taxes, if I retire by then.

- Repeal already-legislated tax cuts for companies with turnovers of between $10 million and $50 million: Small businesses pay 27.5% corporation tax and larger companies 30%. The government wanted to extend the low rate to larger companies. This is unlikely to directly affect us.

- Reduce the long-term capital gains tax discount to 25%: The discount is now 50%. This will have an immediate impact on us as we have run out of accumulated tax losses. OTOH existing investments will be grandfathered. It makes it more attractive to incorporate and pay CGT of 27.5% instead of 37.5%.

- Abolish refundability of franking credits: Since 2000, if you have excess tax credits from Australian companies beyond those that offset the taxes you need to pay you can get a cash refund. I did benefit from this once or twice soon after we moved to Australia and my income was low. This will have a big impact on superannuation funds in pension phase that have zero tax to pay and possibly even in accumulation phase if they have a lot of franked dividends. It will affect lower income self-funded retirees with money outside superannuation too. Some listed investment companies (closed end funds) are already paying out special dividends to get franking credits out of the fund and to investors before the end of the financial year. On the other hand, I don't think these funds will radically restructure due to this proposal. I don't think it will have a big impact on us as I've planned to put the least tax advantaged investments like managed futures into our planned SMSF. And I expect we would be in the 32.5% tax bracket when retired. If I retire at 60 say and start a superannuation pension we could use franking credits inside our SMSF to offset Moominmama's superannuation earnings tax liability as she is 10 years younger. And then maybe we could add Moomin to the superannuation fund :)

- Abolish negative gearing: This is the ability to deduct investment costs beyond the earnings of an investment from other income. This mainly applies to property investors who mostly lose money in Australia in the short run, hoping for a long-run capital gain. We don't negative gear so it shouldn't affect us. Wealthier property investors who also own shares or other investments will be able to offset their losses in property against dividend and other income. So, like many of the Labor measures they mainly hit lower income investors...

- Tax discretionary trusts as companies: These are trusts that have multiple beneficiaries and can alter what earnings they stream to which beneficiary on a year by year basis. Actually, they are proposing to tax trust distributions at a minimum of 30%. So, it's not like a company which pays 27.5% tax in the case of a small business and then distributes franking credits. I don't see any justification for allowing this kind of tax dodging. However, I think they should just require all trusts to be unit trusts with defined shares and everyone sharing in all income. These operate just like unlisted managed funds (mutual funds). I think most discretionary trusts will just do this if it's allowed.

- Reduce annual non-concessional superannuation contributions to $75k: This would mean it would take us more years to make all the non-concessional contributions we want to make and means I probably should already get one in this financial year.

- Reduce the threshold for 30% superannuation contributions tax to $200k: Currently the threshold is $250k. The threshold includes employer superannuation contributions, so this will definitely affect me.

- Remove the right, already legislated by the government, of

superannuants to make catch-up contributions when their super balance is

less than $500,000: I don't think this is probably a big deal. It will mean stretching contributions over more years.

- Reduce ability to take tax deductions for additional concessional superannuation contributions: People will need to have 90% of their income or more from sources other than employment to do this. I don't understand why concessional contributions for employees are limited to salary-sacrificed contributions and you can't make more concessional contributions unless you really aren't an employee. The Liberals tried to fix this anomaly.

- Limit tax free pensions to $75k per year: Currently you can transfer up to $1.6 million into an account to fund a tax free superannuation pension. At a 4% initial withdrawal rate (required rate for under 65s) that is $64k per year. At 5% (65-74 y.o.) it is $80k per year. So, Labor's proposal is not that restrictive. However, if the $1.6 million earns a lot more than that a year, it will be taxed a lot more than at present.

- Limit deductions for tax advice to $3,000 per year: I am assuming that this won't apply to companies or superannuation funds, just to individuals. In which case, it isn't a big deal.

Thursday, January 17, 2019

David Svensen Lecture at Yale

Svensen is the manager of Yale's endowment. He also gives occasional lectures at Yale.

My investment strategy is strongly influenced by endowment investors like Svensen.

My investment strategy is strongly influenced by endowment investors like Svensen.

Wednesday, January 16, 2019

Moomin Needs a Tax File Number

That's what the bank in Falafelland says... So, I will look today at applying for one for him. I think they should just give them out when you apply for a birth certificate. I don't know if the bank wants it because they just want a permanent ID for him or because it will affect the tax he pays as a foreign beneficiary of a local trust account. Up till now we have been using his passport number as an ID number. But passport numbers aren't permanent. You get assigned a new one every time you renew your passport, which is every 5 years for children.

Saturday, January 12, 2019

Portfolio Charts

Portfolio Charts is a really interesting website where you can do simulations of safe and permanent withdrawal rates and many other things for a range of investment portfolios. These include predefined portfolios and you can also build your own portfolio using a range of ETFs. Here for example is Tony Robbins' version of Ray Dalio's All Weather portfolio:

The orange line gives the withdrawal rate which means that you wouldn't have run out of money if you retired in any year since 1970 and retired for the length of time on the x-axis. The green line is the withdrawal rate that means that you will have at least as much money as you started with in real terms. It's interesting how these go in opposite directions as the length of retirement increases. If you retired for 30 years the permanent withdrawal rate is 3.8%. This portfolio had an average real return of 5.5%. The best performing portfolio in terms of withdrawal rates is the site creator's own "Golden Butterfly" which has 40% stocks, 40% bonds, and 20% gold:

This portfolio had a real return of 6.5%.

An interesting point is that safe and permanent withdrawal rates vary a lot by country. The site allows you to choose the US, UK, Canada, and Germany as home countries. The linked article also includes Australia, but unfortunately the site itself doesn't allow you to do analysis for Australia. A big caveat is, of course, that all this depends on historical returns. If bonds, for example, don't do as well going forward as they did from 1980 till recently then, withdrawal rates are going to be lower. Choice of alternative investments is also limited to gold, a commodities ETF, and a REIT ETF.

The orange line gives the withdrawal rate which means that you wouldn't have run out of money if you retired in any year since 1970 and retired for the length of time on the x-axis. The green line is the withdrawal rate that means that you will have at least as much money as you started with in real terms. It's interesting how these go in opposite directions as the length of retirement increases. If you retired for 30 years the permanent withdrawal rate is 3.8%. This portfolio had an average real return of 5.5%. The best performing portfolio in terms of withdrawal rates is the site creator's own "Golden Butterfly" which has 40% stocks, 40% bonds, and 20% gold:

This portfolio had a real return of 6.5%.

An interesting point is that safe and permanent withdrawal rates vary a lot by country. The site allows you to choose the US, UK, Canada, and Germany as home countries. The linked article also includes Australia, but unfortunately the site itself doesn't allow you to do analysis for Australia. A big caveat is, of course, that all this depends on historical returns. If bonds, for example, don't do as well going forward as they did from 1980 till recently then, withdrawal rates are going to be lower. Choice of alternative investments is also limited to gold, a commodities ETF, and a REIT ETF.

Annual Report 2018

Investment Returns

In Australian Dollar terms we gained 2.3% for the year while the MSCI gained 0.9% and the ASX200 lost 1.1% (all pre-tax including dividends). In USD terms we lost 7.7%, while the MSCI lost 8.9% and the S&P500 lost 4.4%. So we beat Australian and international markets but not the US market. In the longer term perspective, our returns and market returns were closely aligned this year:

Here are returns over various standard periods (not annualized):

We have done well compared to the ASX 200 over the last 5 years. Not as great over 10 years. In USD terms we have done well compared to the MSCI over the last three years and underperformed over longer time periods.

Investment Allocation

The main change in allocation over the year is the large increase in cash and real estate when we received the inheritance:

I also reduced my allocation to Australian large cap stocks around the same time, in early October. Earlier in the year, the allocation to cash falls as we increased trading and invested more in the Winton Global Alpha Fund (commodities) and subscribed to some IPOs. Private equity also increased with investment in Aura and IPE and then decreased with the takeover of IPE.

Accounts

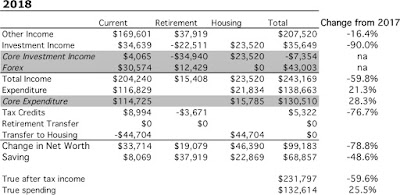

I stopped reporting monthly accounts this year, but I've still been computing them. Here are our annual accounts in Australian Dollars without including the inheritance:

We earned $170k after tax in salary, business related refunds, medical payment refunds, tax refunds etc. We earned (pre-tax including unrealised capital gains) $35k on non-retirement account investments. Both of those numbers were down strongly from last year. I stepped down from an admin role that paid extra salary and earned less in consulting etc. The investment numbers would have been worse without trading and the fall in the Australian Dollar ($31k in "forex" gain). Total current after tax income was $204k. Not including mortgage interest we spent $117k – Total actual spending including mortgage interest was $133k.

$9k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it. Finally, we transferred $45k in mortgage payments (and virtual saved interest) to the housing account. The change in current net worth, was therefore $34k. Looking at just saving from non-investment income, we saved $8k. Both these numbers are down steeply from last year.

The retirement account is a bit simpler. We made $38k in contributions (after the 15% contribution tax) and the value fell by an estimated $23k in pre tax returns. $4k in "tax credits" is an adjustment needed to get from the number I calculate as a pre-tax return to the after tax number. Taxe on returns are just estimated because all we get to see is the after tax returns. I do this exercise to make retirement and non-retirement returns comparable. Net worth of retirement accounts increased by $19k.

Finally, the housing account. We spent $16k on mortgage interest. We would have paid $24k in mortgage interest if we didn't have an offset account. I estimate our house is worth $24k more than I did last year based on recent sales in our neighbourhood. After counting the transfer of $45k into the housing account housing equity increased $46k of which $23k was due to paying off principal on our mortgage.

Total net worth increased by $99k, $69k of which was saving from non-investment sources. Comparing 2018's accounts with 2017's, we saved 49% less and net worth increased by 79% less. Total after tax income was almost $230k, down 60% on last year. This number feels a lot more "reasonable" than last year.

Though our saving is down sharply on last year, we still saved in total 33% of our after tax non-investment income. Of course, this is less than last year's 50%. Including investment income our savings rate was 43%.

Here are the same accounts expressed in US Dollars:

How Does This Compare to My Projection for This Year?

At the beginning of the year, I projected a gain in net worth of $250k based on an 8% return on investments and a 6% increase in spending. As you can see, spending rose 25% and return on investments was only 2%. As a result net worth increased by only $99k.

Looking to 2019, I think we will be lucky if our investment return is 0%, as I am quite bearish about the world economy and stockmarket. If I pencil in a 6% rise in spending, then we would only increase net worth by $60k.

In Australian Dollar terms we gained 2.3% for the year while the MSCI gained 0.9% and the ASX200 lost 1.1% (all pre-tax including dividends). In USD terms we lost 7.7%, while the MSCI lost 8.9% and the S&P500 lost 4.4%. So we beat Australian and international markets but not the US market. In the longer term perspective, our returns and market returns were closely aligned this year:

Australian Dollar Returns

Here are returns over various standard periods (not annualized):

We have done well compared to the ASX 200 over the last 5 years. Not as great over 10 years. In USD terms we have done well compared to the MSCI over the last three years and underperformed over longer time periods.

Investment Allocation

The main change in allocation over the year is the large increase in cash and real estate when we received the inheritance:

I also reduced my allocation to Australian large cap stocks around the same time, in early October. Earlier in the year, the allocation to cash falls as we increased trading and invested more in the Winton Global Alpha Fund (commodities) and subscribed to some IPOs. Private equity also increased with investment in Aura and IPE and then decreased with the takeover of IPE.

Accounts

I stopped reporting monthly accounts this year, but I've still been computing them. Here are our annual accounts in Australian Dollars without including the inheritance:

Annual Accounts

There are lots of quirks in the way I compute the accounts, which have gradually evolved over time. Here is an explanation:

Current account is all

non-retirement accounts and housing account income and spending. Then

the other two are fairly self-explanatory. But housing spending only

includes mortgage interest. Property taxes etc. are included in the

current account. There is not a lot of logic to this except the

"transfer to housing" is measured using the transfer from our checking

account to our mortgage account. Current other income is reported after

tax, while investment income is reported pre-tax. Net tax on investment

income then gets subtracted from current income as our annual tax refund

or extra payment gets included there. Retirement investment income gets

reported pre-tax too while retirement contributions are after tax. For

retirement accounts, "tax credits" is the imputed tax on investment

earnings which is used to compute pre-tax earnings from the actual

received amounts. For non-retirement accounts, "tax credits" are actual franking credits

received on Australian dividends and the tax withheld on foreign

investment income. Both of these are included in the pre-tax earning but

are not actually received month to month as cash.... Finally, "core

expenditure" for housing is the actual mortgage interest we paid.

"Expenditure" adds back how much interest we saved by keeping money in

our offset account.

We include that saved interest in the current account as the earnings

of that pile of cash. That virtual earning needs to be spent somewhere

to balance the accounts... It is also included in the "transfer to

housing". Our actual mortgage payments were less than the number

reported by the $6k in saved interest. For current accounts "core

expenditure" takes out business expenses that will be refunded by our

employers and some one-off expenditures. This year, I think there are

none of those one-off expenditures. "Saving" is the difference

between "other income" net of transfers to other columns and spending in

that column, while "change in net worth" also includes the investment

income.

We earned $170k after tax in salary, business related refunds, medical payment refunds, tax refunds etc. We earned (pre-tax including unrealised capital gains) $35k on non-retirement account investments. Both of those numbers were down strongly from last year. I stepped down from an admin role that paid extra salary and earned less in consulting etc. The investment numbers would have been worse without trading and the fall in the Australian Dollar ($31k in "forex" gain). Total current after tax income was $204k. Not including mortgage interest we spent $117k – Total actual spending including mortgage interest was $133k.

$9k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it. Finally, we transferred $45k in mortgage payments (and virtual saved interest) to the housing account. The change in current net worth, was therefore $34k. Looking at just saving from non-investment income, we saved $8k. Both these numbers are down steeply from last year.

The retirement account is a bit simpler. We made $38k in contributions (after the 15% contribution tax) and the value fell by an estimated $23k in pre tax returns. $4k in "tax credits" is an adjustment needed to get from the number I calculate as a pre-tax return to the after tax number. Taxe on returns are just estimated because all we get to see is the after tax returns. I do this exercise to make retirement and non-retirement returns comparable. Net worth of retirement accounts increased by $19k.

Finally, the housing account. We spent $16k on mortgage interest. We would have paid $24k in mortgage interest if we didn't have an offset account. I estimate our house is worth $24k more than I did last year based on recent sales in our neighbourhood. After counting the transfer of $45k into the housing account housing equity increased $46k of which $23k was due to paying off principal on our mortgage.

Total net worth increased by $99k, $69k of which was saving from non-investment sources. Comparing 2018's accounts with 2017's, we saved 49% less and net worth increased by 79% less. Total after tax income was almost $230k, down 60% on last year. This number feels a lot more "reasonable" than last year.

Though our saving is down sharply on last year, we still saved in total 33% of our after tax non-investment income. Of course, this is less than last year's 50%. Including investment income our savings rate was 43%.

Here are the same accounts expressed in US Dollars:

How Does This Compare to My Projection for This Year?

At the beginning of the year, I projected a gain in net worth of $250k based on an 8% return on investments and a 6% increase in spending. As you can see, spending rose 25% and return on investments was only 2%. As a result net worth increased by only $99k.

Looking to 2019, I think we will be lucky if our investment return is 0%, as I am quite bearish about the world economy and stockmarket. If I pencil in a 6% rise in spending, then we would only increase net worth by $60k.

New Investment: U.S. Treasury Bills

Interactive Brokers currently pays 1.7% interest on U.S. Dollars. But U.S. government bonds pay more than that and are supposedly risk free, so I thought I would give it a try. I am concerned that U.S. interest rates could still rise and so I don't want longer term bonds. So, I just bought a U.S. Treasury Bill expiring on 12 February. My idea is when that matures, I'll put part of the proceeds towards buying Australian Dollars. I plan to build a ladder of these and so force myself to buy Australian Dollars slowly.

At IB the commission for buying bonds is $5 and it turns out that the minimum trade size for treasuries is $100k. This isn't stated anywhere, but when I tried buying $50k last week, I got a message that my trade size was too small, whereas this trade went through. I'm gradually moving U.S. Dollars to my IB account - I can move up to $100k every 7 business days using the ACH method.

I've thought about municipal and corporate bonds too, but these can be illiquid. For example, for the nearest term Berkshire Hathaway bond, only $1000 is currently being offered.

At IB the commission for buying bonds is $5 and it turns out that the minimum trade size for treasuries is $100k. This isn't stated anywhere, but when I tried buying $50k last week, I got a message that my trade size was too small, whereas this trade went through. I'm gradually moving U.S. Dollars to my IB account - I can move up to $100k every 7 business days using the ACH method.

I've thought about municipal and corporate bonds too, but these can be illiquid. For example, for the nearest term Berkshire Hathaway bond, only $1000 is currently being offered.

Wednesday, January 09, 2019

Investment Policy for Trust Accounts

My brother is opening the trust accounts. They will be invested in local mutual funds. Unlike Australian or US managed or mutual funds these do not make distributions but like an Australian listed investment company (closed end fund) they pay tax on their earnings. The tax though is the relevant investment rate not the corporation tax. This is 25% of the inflation adjusted gain. Also, if you sell a mutual fund in Falafelland 25% capital gains tax is withheld. Looks like we can't really avoid this tax. Foreign tax paid is not refundable as cash in Australia – it can only be deducted against Australian tax liable.* Because my son's earnings would be way below the tax free threshold (initially each of these accounts will have about AUD 44k in them) he wouldn't need to pay tax if the investment funds were based in Australia.

My brother suggested investing 70% in bonds and 30% in stocks. As a long-term investment policy – we will be investing for the next 20 years for my son – I think this is too conservative.

This is both because in the long run stocks have performed better than bonds in most countries but also because interest rates are now low. This chart shows the real returns on US investments over the last century:

Since 1980, bonds did well as interest rates fell from historic highs. But in the 40 years up to 1980 bonds lost money in real terms as interest rates rose. So, I told him if we are adopting a "set and forget" investment policy then we should go for 60% stocks and 40% bonds. The mix between local and international investments should be 50/50. The local market is one of the cheaper ones globally.

OTOH the local currency is quite strong currently. If we can revisit investment policy periodically then 70% bonds is OK for now. If there is a future larger decline in stock markets we would then switch to a more aggressive stance.

My brother's children are much older and so their trust accounts will exist for less time. If they intend to spend the money when they get it then I guess a more conservative stance might make sense. The youngest though will still need to wait 9 years to get her money so I think she can be more aggressive.

* Labor wants to make franking credits from Australian companies non-refundable as well. This would bring back symmetry in the way these credits are treated. Of course, I think we should go in the other direction and make foreign tax refundable :)

My brother suggested investing 70% in bonds and 30% in stocks. As a long-term investment policy – we will be investing for the next 20 years for my son – I think this is too conservative.

This is both because in the long run stocks have performed better than bonds in most countries but also because interest rates are now low. This chart shows the real returns on US investments over the last century:

Since 1980, bonds did well as interest rates fell from historic highs. But in the 40 years up to 1980 bonds lost money in real terms as interest rates rose. So, I told him if we are adopting a "set and forget" investment policy then we should go for 60% stocks and 40% bonds. The mix between local and international investments should be 50/50. The local market is one of the cheaper ones globally.

OTOH the local currency is quite strong currently. If we can revisit investment policy periodically then 70% bonds is OK for now. If there is a future larger decline in stock markets we would then switch to a more aggressive stance.