The latest episode. I met the director on Thursday. They didn't try to discourage me from doing it (I didn't expect they would). They even noted that they have at least a couple of other people who teach and research in my exact field. We are the top place for this in Australia. We also discussed other options included a transition to retirement plan, where you work part-time till a set retirement date at a maximum 3 years in the future. The director saw this plan as tied to a specific "project", which isn't something in the plan as described by the university. The key aspect in the university description is that the university keeps paying employer contributions to Unisuper at the full time rate even though the worker is now working part time. This is critical for people on the defined benefit scheme who otherwise lose a lot of money if they switch to part-time work.

The other option we discussed is simply working part-time. The director wouldn't commit to a specific reduction in salary that I need to take in order to reduce my teaching load. Instead, they said I should talk to my department head (HoD).* But they did say that all expectations needed to be adjusted and not just the teaching expectation. What does this mean? Academic staff are allocated a nominal percentage workload. In my case it is 40% teaching, 40% research, and 20% service. So, the director is saying that each of those percentages need to go down, not just the teaching one. This is totally expected. Having been a HoD myself, I knew that they couldn't make this decision by themselves. But what they can do is look at their teaching plans and see how it would work.

So, on Friday I talked to the HoD on the phone, who was very positive about the part-time plan and said there are two people who would be interested in teaching one of my courses. The HoD will now go back to the director to negotiate the percentage cut in FTE. The HoD is going to argue for a 30% cut. I think the director wants 50% but wouldn't say so. Maybe I'll end up at a 40% cut?

On Tuesday, there is an information session on the VSS, which I'll attend.

I have discussed this a lot with Moominmama. At one extreme we talked about taking the VSS and moving somewhere cheaper and doing homeschooling. In Australia, the lower the cost of living the worse the quality of public schools and there might not be a suitable private option.** At the other extreme we are looking at doing the part-time option.

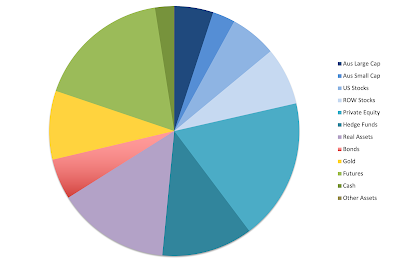

I've debugged my simulations more and the VSS is equivalent financially to working part time to the end of 2028. After that, one year of part-time work adds 1.1% to net worth. Full time work adds 0.8% per year on top of the part-time option. The differential is because of progressive taxation.

So, why not just take the VSS? The main reason comes down to going cold turkey from an AUD 200k plus salary to depending entirely on investment returns.*** This month has been our worst in investment returns since June 2022. I have been very stressed out by the combination of that and the need to make this career decision. Moominmama thinks I will be very stressed out and maybe make bad decisions if I take the VSS. So, the lowest stress path is to ease into retirement gradually. In theory, the VSS gives you a pile of cash, so that you don't need to depend on investment returns for more than a year. But the temptation is to chase yield on that too...

* The director heads a "school" that comprises 4 academic departments.

** In particular, coastal areas outside the big cities are notoriously areas of low socio-economic status and high unemployment. Here are the socio-economic profiles of our nearest public high school in Canberra:

and Bateman's Bay High School, on the coast near Canberra:

These numbers are relative to Australia as a whole. The main private school tbere only has 28% of its students from the top quartile and its performance is similar to the average school in Australia. At our children's school 80% of students are from the top-quartile! I think that is likely too far in the opposite direction 😀

*** Around AUD 245k pre-tax including employer superannuation contributions.