Expected that some or even many companies will go bust in this space. This is the first individual venture investment of ours that went bust. Luckily I only invested USD 2,500 so it is about a 0.1% loss to our portfolio. One of my main criteria for making an individual investment rather than through a fund is that there is a clear pathway to profitability or breakeven laid out. So, surprising this went under relatively quickly. I was going to mention the company involved but see that the email is marked confidential so can't give you more details. I think it should be OK to mention the company when they are no longer going to be in business but I'm paranoid about getting removed from AngelList so won't do so...

Saturday, March 02, 2024

One of Our Venture Investments Goes Bust

Saturday, February 24, 2024

Checking in on the SMSF

We have now been running an SMSF for almost three years. How is it doing?

The obvious benchmarks are our employer superannuation funds - Unisuper and PSS(AP). All these numbers are pre-tax. I probably over-estimate the tax paid by the funds, while I know the exact amount of tax paid by the SMSF. So the funds have a bit of an advantage here.

The SMSF got a good start after which it gradually trudged higher. The two industry funds both declined substantially in 2022 and then recovered. PSS(AP) is almost catching up with the SMSF now.

The SMSF has had lower volatility than the two industry funds, though, at 1.85% per month, its standard deviation is only marginally lower than PSS(AP) at 1.87%. Up and down moves are both penalized using this metric. Unisuper's standard deviation is 2.23%.

Using Unisuper as the benchmark, the SMSF has a beta of 0.42 and an annualized alpha of 4.75%.* Another way of expressing this is that the SMSF captures 64% of the Unisuper's upside but only 24% of its downside. Reducing downside risk is one of our main goals.

* This is treating the risk free rate as zero. The official CAPM alpha using the RBA cash rate will be a bit lower.

Friday, February 23, 2024

Closed Two Investments

I sold our holding in WAM Leaders (WLE.AX). It was down to only 0.1% of the portfolio. Once we held a lot more but gradually sold it off over time to fund other things. I think it is a good investment and maybe we will come back to it in the future. We got a 7.8% internal rate of return on this investment.

The other was Ruffer Investment Company (RICA.L) a diversified listed investment company on the London Stock Exchange. This has not been doing well in the last couple of years and I am tired of losing money. I think the managers got too clever for their own good in being bearish. We got a -3.9% internal rate of return on this investment.

I also sold the holding of Hearts and Minds (HM1.AX) in the SMSF to tidy things up. We still hold more than 40,000 shares of that. Hearts and Minds is currently at an IRR of 3.7%. Our median investment is at 8.5% (PSSAP).

I started a new investment/trade with some of the proceeds, which I'll talk about in due course.

Wednesday, February 21, 2024

My Aunt's Legacy

My aunt died in 2020. She was single all her life. My father and her did not get on well. They fought each other in court over their mother's will. We wondered who she left her money to. Turns out she set up a foundation with about £5 million in assets. Most of the value came from her house and a company that seems to rent properties. The charities commission in the UK is already investigating the foundation for donating money to things that she didn't specify and maybe benefiting the trustees.... I wonder what happened to the art she inherited that they fought over? Either she had already sold it or she must have given it to someone else.

One of my cousin's children found out about this charity when they were looking for grants for education, which did fall within one of the approved purposes of the foundation.

Tuesday, February 20, 2024

When Does Our Investment Strategy Add Value?

EnoughWealth wonders if our investment strategy only adds value under certain market conditions. As a first step let's look at when the out-performance relative to the 60/40 portfolio happened:

The graph simply takes away the monthly return on the Vanguard 60/40 portfolio from Moom's actual results. We see there are periods of out- and under-performance throughout the period. Not surprisingly, it was weaker in 2023 in particular. I didn't do well in implementing the target portfolio strategy last year. Here is a graph comparing the performance of this theoretical portfolio and the Vanguard portfolio:

This looks more consistent. This portfolio is theoretical because it consists of a mix of actual investible funds and non-investible indices.

Bottom line, is I think it is a good idea to add things like managed futures, gold, real estate etc to your portfolio. It makes a real difference.

Monday, February 19, 2024

Lost Money Found

Got an email from Commonwealth Bank that mentions their "Benefits Finder" button in the CommBank App. This can help you find missing money. Turns out I have about $650 with ASIC in liquidator dividends from the collapse of HIH Insurance. I owned 7,500 shares when it collapsed. Need to have a document with my name and address on at that time. I even have the ASX holding statement for my shares! Get a certified copy, a certified copy of my passport, and a statutory declaration and send it all to ASIC.... Will be paying a visit to the Post Office tomorrow to do all this...

Sunday, February 18, 2024

A 60/40 Australia-Oriented Passive Benchmark

If we create a portfolio invested 50% in VDBA and 50% in VDGR we can simulate a 60/40 passive benchmark:

This requires monthly rebalancing of the portfolio. We ignore the costs of this rebalancing. Over this period, the benchmark portfolio had a compound annual return of 5.60% with a monthly standard deviation of 2.55% compared to Moom's compound return of 7.77% with a monthly standard deviation of 2.32%. Moom's beta to this portfolio was 0.8 with an annual alpha of 2.9%.

Note that our portfolio goes through three different "regimes" during this period. Up to October 2018 we had a portfolio that was about 60% long public equity. Then we received a large amount of cash, which we converted to bonds and then gradually invested in other assets. This phase lasted up to the end of 2020. Since then we have been close to the target portfolio.

VDGR

First, here is how $1000 would have evolved if invested either with me or in VDGR since the end of November 2017:

Put another way, the average annual return over this period was 6.97% for VDGR and 8.65% for Moom.VDGR is less conservative, but still underperformed. The monthly standard deviation of returns for VDGR is 2.84%, while it is 2.28% for Moom. So, we had higher returns with lower risk.

I again did a CAPM style analysis using the RBA cash rate as the risk free rate and treating VDGR as the index. Moom has a 0.72 beta to VDGR and an annual alpha of 2.58%.

Again, I conclude that the additional diversification in our portfolio really does add value.

Does My Investment Strategy Add Value?

EnoughWealth commented on my recent post on our target allocation:

"Have you tried benchmarking your actual and target asset allocation performance against something a lot simpler - like a basic Bond:Shares allocation with similar risk level, with appropriate split of AU vs Global within each and a basic index fund proxy for each? I just suspect you may not be adding a lot of performance by the degree of complexity and number of individual holdings. I did a quick comparison of your NW monthly figures to mine (after converting my figures using the relevant monthly avg AUD:USD exchange rate), and aside from the jump in my nW in Feb '23 when I updated my estimated valuations for non-home real estate values, the monthly and three year trend is visually almost identical -- if anything yours seem to have more volatility than mine. Since most of the individual investments in your portfolio have internal diversification, I'm not sure your role as an active fund manager of your own investment portfolio is actually adding much 'alpha' ;) Then again, your spare time is 'free' so at least you aren't charging yourself a fee as fund manager (on top of whatever fees are embedded in some of those funds you've chosen)."

My response was that I had a beta of less than one to the ASX 200 and had positive alpha... But I have now done an analysis that I think is close to what EnoughWealth is suggesting here. I picked the Vanguard managed ETF VDBA.AX, which is diversified across Australian and global stocks and bonds. So, this is a potential alternative to our current investments. It is 50/50 stocks and bonds, whereas I am targeting 60% equities. But we could lever it up a little bit if we wanted.

Vanguard nicely provide all the data needed. Most of the work is in

calculating dividend reinvestment. I assumed dividends were reinvested

on the ex-date increasing the number of shares. Then I multiplied the

daily price by number of shares to get the total value. I carried out my

analysis using month end values since inception of VDBA.

The results might surprise Bogleheads :)

First, here is how $1000 would have evolved if invested either with me or in VDBA since the end of November 2017:

Put another way, the average annual return over this period was 5.06% for VDBA and 8.65% for Moom.Is this because VDBA is a bit more conservative? As you can see from the graph, volatility is about the same for the two investments. Formally, the monthly standard deviation of returns for VDBA is 2.32%, while it is 2.28% for Moom. So, it's not because of that.

So, I also did a CAPM style analysis using the RBA cash rate as the risk free rate and treating VDBA as the index. Moom has a 0.88 beta to VDBA and an annual alpha of 3.33%. 1% of extra return on a $5 million portfolio is $50,000...

In conclusion, the additional diversification in our portfolio really does add value.

January 2024 Report

Monthly reports are back! In January, The MSCI World Index (USD gross) rose 0.61% while the S&P 500 rose 1.68%, and the HFRI hedge fund index gained 0.44% in USD terms. The ASX 200 rose 1.19% and the target portfolio 2.87% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6806 to USD 0.6595. We gained 1.92% in Australian Dollar terms or lost 1.24% in US Dollar terms. So, we under-performed all benchmarks apart from the ASX200.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. US Stocks experienced the highest rate of return, while hedge funds made the largest contribution to returns. On the other hand, Australian small cap and rest of world stocks had negative returns in January.Things that worked well this month:

- Pershing Square Holdings (PSH.L, AUD 19k), gold (AUD 13k), and Hearts and Minds (HM1.AX, AUD 11k) all had more than AUD 10k gains.

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost AUD 23k and Australian Dollar Futures lost AUD 10k.

Here are the investment performance statistics for the last five years:

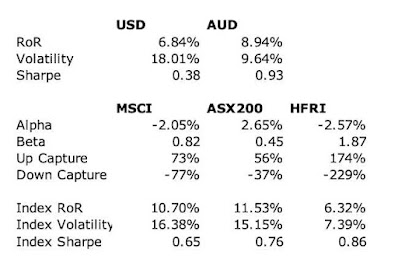

The top three lines give our performance in USD and AUD terms, while the last three line give results for the indices. Compared to the ASX200 we have a lower average return but also much lower volatility, resulting in a higher Sharpe ratio of 0.93 vs. 0.76. But as we optimize for Australian Dollar performance our USD statistics are much worse and worse than either the MSCI world index or the HFRI hedge fund index. Well, we do beat the HFRI in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 with a beta of only 0.45.We are quite close to our target allocation. We are underweight private equity and overweight real assets. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. It was a very quiet month. I made one change to our investments:

- I sold around USD 35k of the CREF Social Choice Fund and bought the same amount of the TIAA Real Estate Fund in my US 403b retirement account.

Saturday, February 10, 2024

Updating Target Asset Allocation

Not sure when I last posted about our target asset allocation, as I have tweaked it since this 2021 post. I am tweaking it again to reflect continuing new allocations to private equity (venture capital, buyout funds, and SPACs).

Overall we still have a 60% equity allocation. Now 20% of that will be the target for private equity, 20% hedge funds, and 20% long equity. Among the latter, 11% allocated to Australia and 9% to foreign shares. Within Australia, 6% is allocated to large cap and 5% to small cap. Within foreign equity, 5% to the US and 4% to the rest of the world.

Among the 40% allocated to other assets, 15% is allocated to real assets including real estate, art, water rights etc., 5% to bonds (including private credit), 10% to managed futures, 10% to gold.

The benchmark target portfolio splits the private equity component 50/50 between venture capital and buyout. It also allocates all the Australian exposure to the ASX200 and all the real asset allocation to a specific (mainly US) real estate fund. All the managed futures is allocated to Winton in the benchmark. Maybe I should try harder on this benchmark, but this seems good enough for my purposes.

Friday, February 09, 2024

Insurance Inflation

This year's home contents insurance bill is 70% higher than last year's! How does that make sense? The number I am comparing to is one that the company provides that they say is adjusted for any change in policy. This seems particularly egregious but part of a general trend of rising insurance costs.

.png)