As you probably know if you live in Australia, Labor plans to abolish the refundability of franking credits - the tax credits attached to dividends for company tax already paid. This will affect taxpayers with low marginal tax rates including self managed superfunds that are paying out a pension, which is tax free if they have less than AUD 1.6 million in assets for that member. This could significantly cut the retirement income of self-funded retirees who have a lot of Australian shares. OTOH, this was the policy prior to 2000 and most other offsets, like foreign tax credits, aren't refundable either.

I already plan to have relatively small amounts of Australian shares when I start an SMSF - this makes sense as I have lots of investments outside super and so it makes sense to put the least tax efficient investments like managed futures into super.

Listed investment companies (LICs) are closed-end funds that pay tax on their earnings and then distribute franked dividends to shareholders. I own shares in several of these like Platinum Capital, Cadence Capital, Hearts and Minds, and Tribeca Global Resources. Both Geoff Wilson and Cadence Capital's Karl Siegling have suggested that they will reorganize their funds if this happens. There are a couple of ways this could happen. One I had thought about, is to delist and turn the fund into a unlisted managed fund (mutual fund). For funds that trade at a premium to NAV, like several of Wilson's funds, this would cause investors to lose a lot of money as now their holdings would only be worth the NAV. For funds trading at a discount to NAV it could be attractive, as shareholders would gain wealth (but see below). To the extent that the funds receive franked dividends from companies, they would still have to distribute franking credits, but capital gains would no longer create franking credits.

Another option I didn't know about, is that they could instead convert to a listed investment trust like an ETF that doesn't pay taxes. This solves the problem of wealth destruction for funds trading at a premium to NAV.

But the article I linked says that this would result in realization of the portfolio for tax purposes. This could be a huge tax bill for companies like Argo that do little trading. The funds will need to pay out a massive special dividend to distribute the associated franking credit. According to Argo's website they will need to pay 72 cents in tax for liquidating the portfolio. That means they would have to pay a $1.68 cash dividend and so actually sell 23% of the portfolio to pay the dividend out. Some other funds have undistributed franking credits and so would also need to sell shares to generate the cash for such a dividend. They will need to do this soon, as there will probably be an election next May. So, I am a bit skeptical that many will.

Monday, December 17, 2018

Sunday, December 09, 2018

Was It a Good Decision to Switch to Defined Contribution Superannuation?

Back in 2009 when I started with my current employer, I carried out a cost-benefit analysis to see whether it made sense to stay in the default defined benefit scheme or to switch to the defined contribution scheme. As a result of the analysis I switched to defined contribution.

Was that a good decision. Using the info in the Unisuper PDS and my data I compute that if I retired at the end of this month I would get a lump sum of AUD 213k. My actual Unisuper account is at AUD 284k. So, so far it's been a good decision.

For context, in Britain, there have been strikes and demonstrations against the plan to switch academics from defined benefit to defined contribution. But I see defined benefit as a regressive form of socialism where people who are promoted near the end of their career suck the benefits from the system. This is because the lump sum benefit is proportional to the members salary in the last 5 years. I've seem quite a few people promoted to professor in their last few years and of course, deans and other senior administrators benefit heavily from the scheme. This is at the expense of successful researchers who are promoted early and stay in research at a more or less constant salary.

Saturday, December 08, 2018

Target Portfoilo Performance November 2018

The target portfolio gained 0.22% in AUD terms. Offsetting losses in Ausrtalian shares, gold, and unhedged foreign shares there were gains in particular in managed futures and buyout PE.

Tuesday, December 04, 2018

FIRE?

I just read what was a controversial blogpost at Financial Samurai:"Why $5 Million Is Barely Enough To Retire Early With A Family". The post analyses the income and expenditure of a family living in west Los Angeles. A lot of commenters are critical of the assumptions and spending behavior of this family and some people provide some alternative numbers. That got me thinking about the numbers for our family in a bit more detail than I had thought about previously. In the following, I assume we retire where we currently live in Canberra, Australia.

Our net worth is only a bit over half that in Ken's blogpost: AUD 4 million (USD 3 million). We spend about AUD 10k (USD 7k per month) including mortgage interest (but not taxes) compared to their USD 14k per month. If we retired, most of our spending would be unchanged. We don't wear fancy clothes to work and we don't commute long distances. Assuming we continue daycare for 3 days a week (a very good idea in my opinion) we would lose the government subsidy, increasing our spending by AUD8k per year. Anyway, we would progress to private pre-school and likely private school after that going forward so we will have schooling expenses of a similar level. Unlike the American case studies, our health insurance would be unchanged at AUD 6k per year. In fact, it would make sense in my opinion to drop the private health cover and rely on the government system as we will no longer need to pay the Medicare Levy Surcharge if we don't have private insurance. Moominmama will probably want to keep the coverage, though, because she thinks private everything is better (see schools above). Also, unlike the US, we don't need to worry about saving for college tuition because almost all Australian universities are public and students borrow the tuition costs from the government and pay it back as their post-graduation income allows.

Another thing that would be more expensive for us is international travel. This year we traveled as a family for a month to three Northern European countries and Japan. As I went to three international conferences, my fare was paid my employer. I also deducted two weeks accommodation for two conferences which were in the same city and half my wife's airfare from our taxes. She also attended one of the conferences. If we had to pay for everything ourselves, it would have cost us about AUD 5k more.

On the income side, if we stop working, our tax will fall to effectively zero. We will put as much as possible into superannuation and two tax-free thresholds and franking credits should mean no tax on the earnings of the "taxable" part of the portfolio. If I get back into trading successfully, we probably will have to pay tax again, but then our income will be higher too.

So AUD 130k or so per year is about 3.25% of the net worth, which is close to ERN's recommended withdrawal rate. So, in theory we could retire now. As, I'm in my mid-50s, this would still qualify as early retirement. However, I am a bit worried about rising expenditure and a looming economic downturn. Also, at the moment I am happy with my job and so it doesn't make sense to sacrifice the salary. So, at least for the next year we won't implement the RE part of FIRE.

Monday, December 03, 2018

November 2018 Report

Volatility in financial markets continued this month but I hardly traded at all and for us it was a fairly quiet month financially with mostly background prep work. The Australian Dollar rose from USD

0.7083 to USD 0.7302 The MSCI World Index rose 1.51% and the S&P 500 2.04%. The ASX 200 fell 1.96%. All these are total returns including dividends. We lost 1.88% in Australian Dollar terms and gained 1.15% in US Dollar terms. So, we outperformed the Australian market and underperformed international markets. Our Australian Dollar returns are now strongly driven by changes in the exchange rate as cash in US Dollars and other currencies are a large part of our portfolio. Our currency neutral rate of return was -0.14%.Here again is a detailed report on the performance of all investments:

- Bluesky Alternatives rose sharply after Geoff Wilson engineered the firing of most of the board and Pinnacle Investment withdrew their proposal to manage the fund. It now looks like Wilson Asset Management will end up managing the fund. Most Wilson LICs (closed end funds) trade above net asset value.

- The Hearts and Minds IPO started trading and performed well.

- International hedge funds: Tribeca and Pershing each did well in relative terms as did Winton.

- The China Fund had a decent bounce and Boulder Income Fund bounced back very nicely to almost return to it's September value.

- Cadence Capital, again fell sharply. It's performance in the last three months has been very disappointing.

- Perhaps relatedly, small cap Australian funds also performed badly.

- Medibank Private fell sharply after the Australian Defence Department didn't renew its contract with them.

- UK private equity firm, 3i, fell further, though it bounced from its lows.

We also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Other moves this month:

- As mentioned above, Hearts and Minds began to trade and I increased my holding up to the amount I originally requested in the IPO.

- I sold some Platinum Capital (PMC.AX) and bought the equivalent actively managed ETF PIXX.AX instead. The idea was that PMC was overvalued. So far this trade hasn't worked out.

- I bought more Pershing Holdings (PSH.L) and 3i (III.L). Though I increased each position by 50%, each is still only around 0.8% of net worth.

- I did a couple of trades in futures options and futures.

Thursday, November 29, 2018

Put Writing Strategy

ERN recently posted again about his put writing strategy. Despite the market falls in October he ended up for the month. This seems to be down to luck that after his contracts went into the money (which means a loss if you write options) around 12th October, they then recovered substantially before the expiry date.

I was curious about the performance of such a strategy in the long term. You can now buy an ETF that implements a similar strategy. It differs a little from ERN's strategy. In particular, the ETF sells options each month, rather than 3 times a week. It tries to match the performance of the CBOE S&P 500 put writing index. The index goes back to 1986! In the following I analyze the performance of the strategy since January 2007.

Looking at the chart of the index, it seems to track the fluctuations in the stock market quite closely over the last 10 years:

Most of the time there is lower volatility and then there are occasional spikes. When I regress monthly returns on the monthly returns of the S&P 500 total return index (i.e. including dividends) I get a beta of 0.64 and annualized alpha of 0.9%.* The R-squared is 0.74. After transaction costs that alpha will likely disappear. This is looking a lot like investing 64% of your money in an S&P 500 ETF and the rest in cash with occasional volatility spikes added in.

Of course, this might not be much like the return profile that ERN is getting as his performance in October shows.

* This isn't the classic CAPM regression where you deduct the risk free rate first, but that won't make much difference here.

Most of the time there is lower volatility and then there are occasional spikes. When I regress monthly returns on the monthly returns of the S&P 500 total return index (i.e. including dividends) I get a beta of 0.64 and annualized alpha of 0.9%.* The R-squared is 0.74. After transaction costs that alpha will likely disappear. This is looking a lot like investing 64% of your money in an S&P 500 ETF and the rest in cash with occasional volatility spikes added in.

Of course, this might not be much like the return profile that ERN is getting as his performance in October shows.

* This isn't the classic CAPM regression where you deduct the risk free rate first, but that won't make much difference here.

Saturday, November 24, 2018

Trust Accounts

As I mentioned before, my mother's will leaves money for each of her grandchildren – currently six of them including Moomin. They can't get this money until they are 23. The two eldest grandchildren are already 23 or over and so will get their money right away. We now have a clearer picture of what will happen with the other's money. My brother will set up trust accounts with his bank for each of them in his (and my mother's country). These accounts can then invest in any investments they like though probably only through managed funds/shares available in that country. The income will be taxed at source at 25%. I did some research and if we get Moomin a tax file number here in Australia and open a bank account for him, we can submit a tax return each year and get the foreign tax refunded as cash. I used the ATO's tax calculator to check that. As he is inheriting GBP 25k (no, the account isn't in Britain but somewhere to the southeast, let's call it Falafeland :)), the refund might be a few hundred dollars a year. Once he is old enough to understand money a bit he'll be able to decide whether to spend or save that money...

In the meantime, I'm going through the hassle of getting a copy of my passport notarized. This isn't the normal method of proving identity in Australia, which is to go the post office or a police station to get the postal clerk or police officer to stamp and sign the copy as true (actually there is a broad range of people who can do this, including tertiary teachers like me). But this standard certification in Australia isn't valid outside the country, but a "notary public" is needed to certify the document. It seems these people have to be lawyers. Anyway, the bank in Chocolateland (yet another country) wants to get this notarized copy before they will release the main chunk of inherited money to me. Actually, there seem to be four levels of certification available in Australia: regular certification, "justice of the peace" (including police officers), notarization, and an "apostille". Initially, my brother said the Chocolateland bank wanted an apostille...

In the meantime, I'm going through the hassle of getting a copy of my passport notarized. This isn't the normal method of proving identity in Australia, which is to go the post office or a police station to get the postal clerk or police officer to stamp and sign the copy as true (actually there is a broad range of people who can do this, including tertiary teachers like me). But this standard certification in Australia isn't valid outside the country, but a "notary public" is needed to certify the document. It seems these people have to be lawyers. Anyway, the bank in Chocolateland (yet another country) wants to get this notarized copy before they will release the main chunk of inherited money to me. Actually, there seem to be four levels of certification available in Australia: regular certification, "justice of the peace" (including police officers), notarization, and an "apostille". Initially, my brother said the Chocolateland bank wanted an apostille...

Self Managed Superannuation

I am exploring setting up a self managed superannuation fund (SMSF). I want to do this so that I can implement our target portfolio investment strategy and so I can put higher tax investments into the lower tax superannuation environment. Managed futures are a tax ineffective investment outside super when your marginal tax rate is 47%. Inside superannuation they will be taxed at 15%.

Setting up an SMSF is very complicated in Australia compared to the US where you can just open an IRA account with a broker like any other brokerage account and the only issue is limits on contributions and later on minimum withdrawals. For standard IRAs you pay tax on withdrawals only, on your regular tax return. The main reason Australian SMSFs are complex is taxation but some of the bureaucracy just seems to be for the sake of it... In Australia, pretax or concessional contributions are taxed at 15% (or 30% for high income levels) going in, and you can also make after tax contributions. Its necessary to keep track of which were taxed how. Then earnings are taxed at 15% (10% for capital gains) and can be offset by franking credits and foreign tax paid. When you finally withdraw your money, no tax is due and earnings of the account are untaxed if you set up a pension, though now there is a cap of $1.6 million on the amount of assets whose earnings are untaxed. So funds need to submit tax returns separate from their members. And they need to be audited annually and there are lots of ways they could become non-compliant with the rules. And an SMSF is a trust which is set up as a separate legal entity. You might also want to set up a company to act as trustee!

You could go to a lawyer to set up the trust and to a local accountant to help audit the fund and do everything else yourself. But there are many providers who streamline the set up and administration of SMSFs. You can get "year-end" administration which just helps get everything in order for the tax return and audit, or you can get a full daily service. Though I do our own tax returns, I have decided to go for the full daily service as I want to outsource this as much as possible (looks like I am going to have to do tax returns for my son too and am also looking at setting up a company...) and want to be confident that I am compliant with the rules, because the penalties for non-compliance are very severe.

This is a great site with information about different providers of services for self-managed superannuation funds. I visited the websites of all the providers that offer a daily service. Some sites have a lot information and some have next to none. The latter want you to phone them to give you the details. I have a strong preference for financial services that are as transparent as possible. I also investigated Commonwealth Securities and Dixon Advisory, which are not on this list.

Dixon are based in Canberra and I often go past their offices on Northbourne Avenue. Years ago, I used to read Daryl Dixon's column in the Canberra Times. Their service combines admin and investment advice and costs from $3,000 for a $333k account to a maximum of $6,000 for accounts above $666k. To make investments, you have to call their broker and the commissions for shares are 1.1%, which is capped at $400 for Australian shares and uncapped for foreign shares. I don't need investment advice and trading is way too expensive.

Commonwealth Securities is a more realistic option. Including audit fees, they charge a flat $3,000 a year. On a $900k account that is 1/3%, which is reasonable. Trading fees are 0.12% for Australian stocks, which is good though not the lowest, and 0.31% for US stocks and 0.41% for shares in the UK and many other countries, which is expensive but not as outrageous as Dixon. You can't trade CfDs (which are offered by CommSec for other accounts) or futures (which aren't offered by CommSec).

You can set up a trading account for an SMSF with Interactive Brokers, which can trade anything you like for low fees, and then find an administration provider who is prepared to work with them. Determining who can work with IB is what I need to do next. You can trade futures in an SMSF as long as it fits within the written investment strategy (yes, you are required to write one) and other risk related rules.

Two providers on my list, who have won awards and who I am going to investigate next, are Heffron and Super Guardian. I am impressed with the transparent information on Super Guardian's site. They also have an endorsement from Chris Cuffe. Super Guardian charge more the more investments you have. If we have up to 20 investments then they are a similar price to CommSec. Heffron charge a flat fee of $3,300 for their top level service.

Setting up an SMSF is very complicated in Australia compared to the US where you can just open an IRA account with a broker like any other brokerage account and the only issue is limits on contributions and later on minimum withdrawals. For standard IRAs you pay tax on withdrawals only, on your regular tax return. The main reason Australian SMSFs are complex is taxation but some of the bureaucracy just seems to be for the sake of it... In Australia, pretax or concessional contributions are taxed at 15% (or 30% for high income levels) going in, and you can also make after tax contributions. Its necessary to keep track of which were taxed how. Then earnings are taxed at 15% (10% for capital gains) and can be offset by franking credits and foreign tax paid. When you finally withdraw your money, no tax is due and earnings of the account are untaxed if you set up a pension, though now there is a cap of $1.6 million on the amount of assets whose earnings are untaxed. So funds need to submit tax returns separate from their members. And they need to be audited annually and there are lots of ways they could become non-compliant with the rules. And an SMSF is a trust which is set up as a separate legal entity. You might also want to set up a company to act as trustee!

You could go to a lawyer to set up the trust and to a local accountant to help audit the fund and do everything else yourself. But there are many providers who streamline the set up and administration of SMSFs. You can get "year-end" administration which just helps get everything in order for the tax return and audit, or you can get a full daily service. Though I do our own tax returns, I have decided to go for the full daily service as I want to outsource this as much as possible (looks like I am going to have to do tax returns for my son too and am also looking at setting up a company...) and want to be confident that I am compliant with the rules, because the penalties for non-compliance are very severe.

This is a great site with information about different providers of services for self-managed superannuation funds. I visited the websites of all the providers that offer a daily service. Some sites have a lot information and some have next to none. The latter want you to phone them to give you the details. I have a strong preference for financial services that are as transparent as possible. I also investigated Commonwealth Securities and Dixon Advisory, which are not on this list.

Dixon are based in Canberra and I often go past their offices on Northbourne Avenue. Years ago, I used to read Daryl Dixon's column in the Canberra Times. Their service combines admin and investment advice and costs from $3,000 for a $333k account to a maximum of $6,000 for accounts above $666k. To make investments, you have to call their broker and the commissions for shares are 1.1%, which is capped at $400 for Australian shares and uncapped for foreign shares. I don't need investment advice and trading is way too expensive.

Commonwealth Securities is a more realistic option. Including audit fees, they charge a flat $3,000 a year. On a $900k account that is 1/3%, which is reasonable. Trading fees are 0.12% for Australian stocks, which is good though not the lowest, and 0.31% for US stocks and 0.41% for shares in the UK and many other countries, which is expensive but not as outrageous as Dixon. You can't trade CfDs (which are offered by CommSec for other accounts) or futures (which aren't offered by CommSec).

You can set up a trading account for an SMSF with Interactive Brokers, which can trade anything you like for low fees, and then find an administration provider who is prepared to work with them. Determining who can work with IB is what I need to do next. You can trade futures in an SMSF as long as it fits within the written investment strategy (yes, you are required to write one) and other risk related rules.

Two providers on my list, who have won awards and who I am going to investigate next, are Heffron and Super Guardian. I am impressed with the transparent information on Super Guardian's site. They also have an endorsement from Chris Cuffe. Super Guardian charge more the more investments you have. If we have up to 20 investments then they are a similar price to CommSec. Heffron charge a flat fee of $3,300 for their top level service.

Wednesday, November 14, 2018

Regal to Float Hedge Fund LIC on ASX

Regal Funds Management plans to float a hedge fund LIC (closed end fund) on the ASX in March or April next year. Regal was on my future potential investments list but you need to be a certified wholesale investor to invest in their existing hedge funds. I might qualify next year, but investing via the stock exchange would be a lot less hassle assuming I could get in at a reasonable price.

The Hearts and Minds LIC started trading today and is trading above the IPO price. I topped up the allocation that I got in the IPO to the number of shares I originally wanted to invest in. I don't classify this as a hedge fund, as they are not planning to take short positions and there are no performance fees. Actually, there are no management fees. Instead 1.5% of NAV will be donated to charity each year.

The Hearts and Minds LIC started trading today and is trading above the IPO price. I topped up the allocation that I got in the IPO to the number of shares I originally wanted to invest in. I don't classify this as a hedge fund, as they are not planning to take short positions and there are no performance fees. Actually, there are no management fees. Instead 1.5% of NAV will be donated to charity each year.

Sunday, November 11, 2018

Got Online Access to My US Bank Account

I couldn't get online access to my account at Keybank because they required a US phone number as a security measure. This meant I also couldn't transfer money between Keybank and Interactive Brokers. So, I now bought a US phone number through Skype! I now have access to my account (my old password and username from First Niagara still work, and I managed to initiate a transfer of money to Interactive Brokers. Have to wait and see if it really works, though.

Saturday, November 10, 2018

Private Equity and Venture Capital Indices

I commented that I didn't have a good proxy for private equity and venture capital. So, I went and found one and came up with these indices from DSC Quantitative Group. What they do is regress a quarterly indices of private equity buyout and venture capital funds from Thomson Reuters on various sector indices of listed stocks. They update these weights each time Thomson Reuters produce a new number. Because they are using listed stock indices as proxies they can then produce a daily index for private equity. The fit of the proxy to the underlying index is not too bad. This is for venture capital:

The biggest deviation is during the financial crisis - unlisted private equity fell by more than the proxy index had predicted. When we compare the proxy to the NASDAQ total return index, it looks superficially like a leveraged version of the index:

When I regress it on monthly NASDAQ total return index data for 2008 to 2018, I get a beta of 1.15 and annual alpha of 6%. This suggests that venture capitalists add value by rotating the sectors that they invest in over time and it's not just about leverage:

Alpha is given by the intercept of 0.4% per month. I didn't do the proper CAPM regression where you are supposed to deduct risk free returns from the two returns series first. Given the volatility here and low risk free rates since 2008, I doubt it would make much difference.

Interestingly, the Cambridge VC index estimates much lower returns, close to the returns of the NASDAQ index itself.

You could do all this analysis for the buyout private equity index too. You'd want to regress that on the S&P 500 total return index instead.

The biggest deviation is during the financial crisis - unlisted private equity fell by more than the proxy index had predicted. When we compare the proxy to the NASDAQ total return index, it looks superficially like a leveraged version of the index:

When I regress it on monthly NASDAQ total return index data for 2008 to 2018, I get a beta of 1.15 and annual alpha of 6%. This suggests that venture capitalists add value by rotating the sectors that they invest in over time and it's not just about leverage:

Alpha is given by the intercept of 0.4% per month. I didn't do the proper CAPM regression where you are supposed to deduct risk free returns from the two returns series first. Given the volatility here and low risk free rates since 2008, I doubt it would make much difference.

Interestingly, the Cambridge VC index estimates much lower returns, close to the returns of the NASDAQ index itself.

You could do all this analysis for the buyout private equity index too. You'd want to regress that on the S&P 500 total return index instead.

Thursday, November 08, 2018

Target Portfoilo Performance

In October the target portfolio lost 2.83% in Australian Dollar terms. In USD terms the model portfolio lost 3.43%. This model portfolio doesn't include a proxy for private equity, as I don't know a good one. The ASX lost 6.04%. It was hard not to lose money last month. In the last 10 years the model portfolio returned 8.63% p.a. vs. 11.54% including franking credits for the ASX. In the longer term though the target portfolio ("composite") has about matched the returns on Australian shares with lower volatility:

So it's not that necessary to leverage the portfolio to get good returns. The chart shows returns in Australian Dollar terms though bond and real estate are US dollar returns to two TIAA funds invested in those sectors.

So it's not that necessary to leverage the portfolio to get good returns. The chart shows returns in Australian Dollar terms though bond and real estate are US dollar returns to two TIAA funds invested in those sectors.

Wednesday, November 07, 2018

Model Performed Badly Since I Stopped Trading

Since I decided to temporarily stop trading the model has performed badly losing about 9% while the NASDAQ 100 index is down about 4%. It still gained 5% for October overall while the index was down 8.7%. I gained 18% on capital invested due to leverage. It's good I stopped trading when I did.

Saturday, November 03, 2018

October 2018 Report

As I'm sure you know, this month was very volatile, which is good for trading but not for the performance of investments generally. This was a good test of our overall strategy, except that I abandoned trading after 17 October when I found the model was overfitted (and I also got ill with flu/pneumonia or something for the rest of the month). At the end of the month we received the grant of probate and so I am now adding in the inherited assets (cash and half an apartment) from the end of this month. This will suppress returns on both the upside and downside in the near future but doesn't affect the numbers for this month.

The Australian Dollar fell from USD 0.7228 to USD 0.7083. The MSCI World Index fell 7.47% and the S&P 500 fell 6.84%. The ASX 200 fell 6.04%. All these are total returns including dividends. We lost 5.30% in Australian Dollar terms and 7.20% in US Dollar terms. So, we outperformed both Australian and international markets.

Because of the high volatility this month here is a detailed report on the performance of all investments and asset classes:

The table also shows the shares of these investments in our post-inheritance portfolio. Futures contracts are at the bottom. It doesn't make sense to compute shares or rates of return for those. Yeas, we lost a total of AUD 117k, which is our worst ever monthly result in absolute dollars. Things that worked quite well in this market crash:

The following is table of investment performance statistics computed over the last 60 months (extended from 36 months previously) of data:

The first two rows gives the annual rate of return and Sharpe ratio for our investment performance in US dollars and Australian dollars. The other statistics are in comparison to the two indices. Based on beta, compared to the MSCI World Index we seem to be slightly geared, while compared to the Australian index we are less sensitive to market movements. We have a positive alpha compared to the Australian and a negative alpha compared to world markets. We capture more of the up movements and less of the down movements in the Australian market and the reverse in the international markets. The fall in the Australian Dollar over this period explains the poor performance compared to international benchmarks. The rate of return in USD terms is just horrible. US markets have been super strong over this period compared to the rest of the world.

We actually moved away from the new long-run asset allocation in quite a dramatic way with the infusion of cash:

Total leverage includes borrowing inside leveraged (geared) mutual (managed) funds. The allocation is according to total assets including the true exposure in leveraged funds. All asset classes apart from cash and real estate fell as I added the inherited assets. My share of the inherited apartment is about 6% of net worth. Australian large cap fell by more as I switched out of the CFS Geared Share Fund just before the market correction got going. Hedge funds were boosted by the addition of Tribeca (TGF.AX), which started trading on the ASX and Pershing Square Holdings, which I made a new investment in.

We also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends.

The Australian Dollar fell from USD 0.7228 to USD 0.7083. The MSCI World Index fell 7.47% and the S&P 500 fell 6.84%. The ASX 200 fell 6.04%. All these are total returns including dividends. We lost 5.30% in Australian Dollar terms and 7.20% in US Dollar terms. So, we outperformed both Australian and international markets.

Because of the high volatility this month here is a detailed report on the performance of all investments and asset classes:

The table also shows the shares of these investments in our post-inheritance portfolio. Futures contracts are at the bottom. It doesn't make sense to compute shares or rates of return for those. Yeas, we lost a total of AUD 117k, which is our worst ever monthly result in absolute dollars. Things that worked quite well in this market crash:

- PSSAP Superannuation fund - this fell very little, by contrast with Unisuper, which surprised me.

- International hedge funds: Platinum, Tribeca, and Pershing, each did fairly well in relative terms. We should invest fully in these (12.5% is allocated to them in the model portfolio and 10% to Australian hedge funds).

- Futures: Our own futures trading worked perfectly until I stopped and Winton's downside was not too bad (better than in February), but still not performing with zero or negative correlation to equity markets. Gold rose (will be a priority to invest in it). We need to get trading working, but it will take me a lot of time to do the needed research.

- Real estate, CFS Diversified Fund etc all had more limited downside as we'd expect (estimated return for CFS Conservative Fund was negatively affected by trading).

- Cadence Capital, which fits in the (mostly) Australian hedge fund category, fell sharply.

- China Fund - this isn't surprising given the supposed drivers of the market correction.

- Yellow Brick Road - I should have sold out of this when the Mercantile offer terminated

The following is table of investment performance statistics computed over the last 60 months (extended from 36 months previously) of data:

This month I made USD 6k trading futures. This is the second best result to date and occurred as the NDX declined for the month. As I stopped trading partway through the month, I won't post the usual comparison of market, model, and my own performance. There seems to be potential here, but we need a system that is robust to different market conditions.

We actually moved away from the new long-run asset allocation in quite a dramatic way with the infusion of cash:

We also invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends.

Wednesday, October 24, 2018

Hearts and Minds IPO Oversubscribed?

I just got an email with my allocation of shares in this IPO. It's 82% of what I requested and the settlement dates and first trading date have been brought forward. So looks like the IPO is oversubscribed and closing early.

Friday, October 19, 2018

Overfitted

When I started trying to backtest the model with my new program the performance was bad, worse than I expected and worse than backtests I'd done previously. Recent changes to the model seem to have overfit it to the recent data. Therefore, we can't rely on the model going forward. This will need thorough investigation and in the mean time I'll stop trading.

Wednesday, October 17, 2018

Hearts and Minds IPO

Another Australian IPO of a listed investment company (closed end fund). This one has a twist – there are no management fees and the directors have waived their fees too. Instead of receiving a fee, the managers will donate 1.5% of NAV each year to charity. The board of directors include local investing luminaries like Geoff Wilson and a long list of wealthy Australian families (such as the Lowy family) have agreed to make investments in the fund.

The fund is a long only fund investing in Australian and international stocks. Each year several Australian investment managers present at the Sohn Hearts and Minds conference their best investment picks for the coming year. 40% of the fund will be allocated to these picks. 60% will be allocated to "high conviction ideas" from a number of other "core" investment managers. In total the fund will invest in about 25 securities.

The picks from the last two conferences have done very well:

One of the core investment managers is Regal, whose hedge funds have done extremely well.

In summary, I think this looks like being another good investment opportunity.

The fund is a long only fund investing in Australian and international stocks. Each year several Australian investment managers present at the Sohn Hearts and Minds conference their best investment picks for the coming year. 40% of the fund will be allocated to these picks. 60% will be allocated to "high conviction ideas" from a number of other "core" investment managers. In total the fund will invest in about 25 securities.

The picks from the last two conferences have done very well:

One of the core investment managers is Regal, whose hedge funds have done extremely well.

In summary, I think this looks like being another good investment opportunity.

Results for the S&P 500

These are the results of the year to date for the S&P 500 model, again without stops. As volatility is lower than the NASDAQ index, returns are lower but are still very good:

Alpha 0.47948 Beta -0.22355 ror 0.46115 Sharpe 2.62376

Again these are annualized values. Annualized rate of return is 46% for this year.

P.S.

I've now written all the code including stops for NQ and ES. Stops only detract a little from performance for ES but quite a bit for NQ. This suggests that we should use wider initial stops, just to avoid catastrophe, rather than to get out of ordinary bad trades.

Alpha 0.47948 Beta -0.22355 ror 0.46115 Sharpe 2.62376

Again these are annualized values. Annualized rate of return is 46% for this year.

P.S.

I've now written all the code including stops for NQ and ES. Stops only detract a little from performance for ES but quite a bit for NQ. This suggests that we should use wider initial stops, just to avoid catastrophe, rather than to get out of ordinary bad trades.

Tuesday, October 16, 2018

More Progress on Programming the Trading Model

5082 7637.43018 1.00000 0.00000 D buy. Stay long

5083 7490.00000 0.00000 0.00000 K sell. Go short

5084 7399.00977 0.00000 0.00000 K sell. Stay short

5085 7352.81982 0.00000 0.00000 K sell. Stay short

5086 7371.62012 0.00000 0.00000 K sell. Stay short

5087 7044.50000 0.00000 0.00000 D sell. Stay short

5088 6964.02978 0.00000 1.00000 R buy not confirmed by pdD D sell. Stay short

5089 7157.20996 1.00000 1.00000 R Buy outside BB confirmed by pdD

5090 7068.67041 1.00000 1.00000 R Buy outside BB confirmed by pdD

5091 NA 1.00000 1.00000 R Buy outside BB confirmed by pdD

These are the most recent decisions, including today's decision to stay long. The "NA" indicates that we don't yet know the index value for today...

It also produces some performance statistics:

Alpha 1.76456 Beta -0.21425 ror 1.68344 Sharpe 5.47108

That means 176% p.a. of alpha... This is based on compounding the daily alpha over the year. Beta to the market is slightly negative and so compound rate of return for the year is a little less than alpha. I don't expect that high rates of return in other years. Conditions are ideal this year and probably the model is a bit overfitted. One of the reasons for doing this programming is to make it easier to test the model on larger samples.

Next I will add some refinements like using futures prices instead of index prices for performance results. Oh yes, and adding stops!

P.S.

When I ran the algorithm on the S&P 500, I found at least one bug which also needs ironing out.

Firetrail Cancels IPO

I looked at the prospectus but decided not to invest. Apparently they got more than the minimum funds raised but claim that there aren't enough different shareholders...

Dear Moom,

After careful consideration Firetrail Absolute Return Limited (Company) (in consultation with Firetrail Investments Pty Limited (Firetrail)) has made the decision, in the best interest of investors, to withdraw the initial public offering for ordinary shares in the Company (Offer) which was scheduled to close this Friday, 19 October 2018.

The Company made the decision to withdraw the Offer (in consultation with Firetrail) as it was in the best interests of investors to do so given liquidity concerns, in particular the concentration of the shareholder base. Listed Investment Companies (LICs) that do not have a well-diversified shareholder base are generally at a higher risk of the share price trading at a discount to the company’s net tangible assets. As such, we believe it was in the best interests of shareholders to withdraw the Offer, despite raising in excess of the minimum investment amount.

Investors that would like to gain access to the strategy are still able to do so through the Firetrail Absolute Return Fund which is still open to investors and has delivered strongly during the recent market volatility over the past week. Since Monday 8 October 2018, the share market has fallen over -4%1. The Firetrail Absolute Return Fund has delivered a positive return of approximately +1.3% over the same period, highlighting the benefit of the strategy which aims to deliver positive absolute returns above the RBA Cash Rate, independent of movements in the underlying share market.

Please contact us if you would like more information on investing in the Fund.

Kind regards,

Firetrail Investments

Firetrail Absolute Return Limited withdraws listed investment company IPO offer

Tuesday 16 October 2018Dear Moom,

After careful consideration Firetrail Absolute Return Limited (Company) (in consultation with Firetrail Investments Pty Limited (Firetrail)) has made the decision, in the best interest of investors, to withdraw the initial public offering for ordinary shares in the Company (Offer) which was scheduled to close this Friday, 19 October 2018.

The Company made the decision to withdraw the Offer (in consultation with Firetrail) as it was in the best interests of investors to do so given liquidity concerns, in particular the concentration of the shareholder base. Listed Investment Companies (LICs) that do not have a well-diversified shareholder base are generally at a higher risk of the share price trading at a discount to the company’s net tangible assets. As such, we believe it was in the best interests of shareholders to withdraw the Offer, despite raising in excess of the minimum investment amount.

Investors that would like to gain access to the strategy are still able to do so through the Firetrail Absolute Return Fund which is still open to investors and has delivered strongly during the recent market volatility over the past week. Since Monday 8 October 2018, the share market has fallen over -4%1. The Firetrail Absolute Return Fund has delivered a positive return of approximately +1.3% over the same period, highlighting the benefit of the strategy which aims to deliver positive absolute returns above the RBA Cash Rate, independent of movements in the underlying share market.

Please contact us if you would like more information on investing in the Fund.

Kind regards,

Firetrail Investments

Sunday, October 14, 2018

NQ Equity Curve

This is the equity curve trading NQ futures since the beginning of the trading experiment. It starts at about USD 4k because that was the cumulative profit for 2006-8. This isn't our total trading performance because I've also traded other things like ES futures and earned a little interest.

The little tick down at the end is the "bad trade", which wasn't so bad in the end, but that was mostly luck.

I've done a bit more programming and now the program produces a coherent list of trades, one for each day. But I've only written up part of the system yet, so you wouldn't want to actually trade them :) In fact, here is the fractional gain (i.e. 0.15 is 15% gain, not compounded) if you traded "the strategy" for this year:

In other words, it breaks even in the end, which is what you'd probably expect for a random set of trades. This kind of thing is now easy to produce, which is one of the main things this is all about.

To explain this curve, the model starts at long on 4th January and some of the code is written for what to do if you are long - it might tell you to switch to short, but not much code is written yet for what you should do if you are short. So there is little code to flip you back to long again. As a result the model is stuck on short for much of the time...

Saturday, October 13, 2018

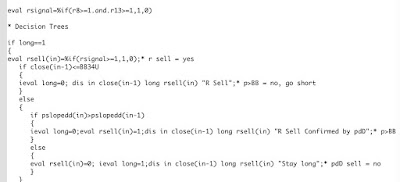

Started to Code the Decision Tree

After a couple of hours of coding and debugging I got the first little bit of the model decision tree to work and spit out buy and sell decisions. The output looks like this:

4895 6584.58008 1 0.00000 Stay long

4896 6653.29004 0 1.00000 R Sell Confirmed by pdD

4897 6676.62988 0 1.00000 Go long

4898 6677.93994 0 0.00000 Stay short

4899 6662.66016 0 0.00000 Stay short

4900 6708.49023 0 0.00000 Stay short

As the decision tree is far from complete, only the first two orders – long and then short – make any sense. The first number is a code for the date, the second is the closing value of the NASDAQ 100 index on the previous day (so that it's easier for me to work out where I am than the obscure date codes). Then there are codes for buy and sell and then a verbal description of the decision and why it was taken.

Luckily, writing computer code is a core practical skill for professional economists (or you should have these skills if you don't!) we took programming courses as part of our first year undergrad study.

Should Have Done the Long Trade

Market went up strongly. Model is still long for Monday. But I'm still not in. I needed to take a break from trading. This is why I need an automated system.

Friday, October 12, 2018

Rescued the Bad Trade

I stayed up and closed at 7119.75 the bad trade where I went long at NQ = 7145. So in the end I only lost USD 500 on that trade and am still up more than USD 6k for the month. If I exactly followed the model, though, I would be up USD 13k! The model is now switching to long for Friday, but this trade is based on the adjustment I made for the 1987 crash (picture below from 1987) and doesn't have a lot of statistical support. So, this is a high risk trade and I think I will wait it out. Yeah, I'm not doing what the model says to do but at least I am not trading against it!

In other news, the Tribeca fund (TGF) starts trading on the ASX today . They only sold 63 million shares in the IPO out of a maximum of 120 million, which is a bit disappointing. Maybe, my thesis that it would trade above NAV will take a while to work out. My entry point into Pershing Square was really bad - lost around 4% already on it. I also did a trade yesterday to switch back AUD 20k from CFS Conservative Fund to CFS Geared Share Fund. ASX SPI futures are off 47 points but CME NQ futures bounced after the New York close and the model is switching to long, so hopefully my timing wasn't too bad.

In other news, the Tribeca fund (TGF) starts trading on the ASX today . They only sold 63 million shares in the IPO out of a maximum of 120 million, which is a bit disappointing. Maybe, my thesis that it would trade above NAV will take a while to work out. My entry point into Pershing Square was really bad - lost around 4% already on it. I also did a trade yesterday to switch back AUD 20k from CFS Conservative Fund to CFS Geared Share Fund. ASX SPI futures are off 47 points but CME NQ futures bounced after the New York close and the model is switching to long, so hopefully my timing wasn't too bad.

Thursday, October 11, 2018

Great at Analysis No Good at Trading

I'm great at analysis and no good at trading. Just like this guy. This is why I need a computer to trade for me. That will now be the top priority.

Australian Corporation Tax

The Australian government has lowered the rate of corporation tax on small businesses and planned to lower the rate on larger businesses too. The latter was blocked by the Senate. The main reason put forward for reducing the tax seems to be increasing international competitiveness, though this is less important for small businesses that mainly don't have international investment in them. Today, the news is that the government wants to bring forward by several years the reduction to 25% for small businesses as a pre-election vote winner. Labor, by contrast, opposes this cut (they withdrew their policy to repeal the previous cut) and wants to raise all sorts of taxes on investment.

As an Australian investor in public companies I didn't used to care too much how high the corporation tax was. This is because when a company pays tax and then pays a dividend, Australian investors get a "franking" credit for the tax paid by the company, so there is no double taxation. Foreign investors usually can't use these credits, hence the argument to partly level the playing field by bringing down the rate of the tax. If a company doesn't distribute profits and the share price increases and I sell my shares and pay capital gains tax, then there is double taxation. But the long-term capital gains tax is only half the normal income tax rate and so this isn't too bad (Labor want to reduce this discount too). Additionally, the price paid for listed shares takes into account that profits are taxed, which helps mitigate the impact of the tax on the rate of return that investors receive. Australian investors, though, are willing to pay more for Australian shares than international investors are, given their differential tax treatment.

Actually, I like getting franking credits, because after I deduct investment costs like margin interest they reduce the tax on my salary.

But as I think about setting up a private company, I increasingly like the idea of lowering the corporation tax. Profits that are re-invested in the business, rather than paid out as dividends, are greater if the tax rate is lower. Of course, this applies to listed companies too, and cutting the tax rate should raise the price of shares in a one time move. The more that we have existing investments rather than are buying new investments the more we should like increases in share prices... On the other hand, ot all the extra profits from lowering the tax rate will actually be realized. Market equilibrium should mean that after the rate of return increases, firms invest more, lowering the pre-tax rate of return. This mechanism is much like how stock market investors will buy shares raising the price and reducing the expected rate of return again. But lower taxes on investment are economically more efficient.

As an Australian investor in public companies I didn't used to care too much how high the corporation tax was. This is because when a company pays tax and then pays a dividend, Australian investors get a "franking" credit for the tax paid by the company, so there is no double taxation. Foreign investors usually can't use these credits, hence the argument to partly level the playing field by bringing down the rate of the tax. If a company doesn't distribute profits and the share price increases and I sell my shares and pay capital gains tax, then there is double taxation. But the long-term capital gains tax is only half the normal income tax rate and so this isn't too bad (Labor want to reduce this discount too). Additionally, the price paid for listed shares takes into account that profits are taxed, which helps mitigate the impact of the tax on the rate of return that investors receive. Australian investors, though, are willing to pay more for Australian shares than international investors are, given their differential tax treatment.

Actually, I like getting franking credits, because after I deduct investment costs like margin interest they reduce the tax on my salary.

But as I think about setting up a private company, I increasingly like the idea of lowering the corporation tax. Profits that are re-invested in the business, rather than paid out as dividends, are greater if the tax rate is lower. Of course, this applies to listed companies too, and cutting the tax rate should raise the price of shares in a one time move. The more that we have existing investments rather than are buying new investments the more we should like increases in share prices... On the other hand, ot all the extra profits from lowering the tax rate will actually be realized. Market equilibrium should mean that after the rate of return increases, firms invest more, lowering the pre-tax rate of return. This mechanism is much like how stock market investors will buy shares raising the price and reducing the expected rate of return again. But lower taxes on investment are economically more efficient.

I Will Do What the Model Says to Do

Maybe today will finally knock my tendency to not follow the model out of me, but I kind of doubt it. I am getting better though. Today, I closed my short position early. That's not such a bad move. But then near the close I went long, because I thought the model was saying to go long tomorrow. But I had forgotten the correct way to read that rule and read it wrongly – I used today's value of the indicator instead of the forecast of it for tomorrow. The model in fact says to stay short into Thursday. The market continued to plummet and took away most of my gains for the day. Still, I am up for the month, for now.

I must fast-track model automation. First step is to convert the decision rules, which I now execute manually and record in an Excel spreadsheet into computer code (in my econometrics package) that can make decisions without errors. Then I need to get better at just doing the decisions at the right time while learning Python etc in order to build an automated system or getting someone else on board to do that. In the meantime, I will stick to trading a single contract to minimize risk.

Wednesday, October 10, 2018

New Investment: Pershing Square Holdings

I made a small (1% of net assets) investment in Pershing Square Holdings (PSH.L). This is a closed end fund trading on the London Stock Exchange that is managed by Pershing Square Capital Management, the fund founded and managed by William Ackman. Pershing Square funds did very well from 2004 to 2014, which is when they launched the closed end fund. They did very poorly in the next three years:

PSH lost 20.5%, 13.5%, and 4% in each of 2015, 2016, 2017. However, NAV has gained 15% or so year to date. The stock trades at a 27% discount to NAV. Given the past good performance, the return of good performance this year, and the substantial discount which the company is trying to reduce, I thought this was worth trying. Ackman and the firm are in the news for a $900 million investment in Starbucks, discussed here.

If you are wondering why a US hedge fund is listed in London, it's because it's not legal to offer hedge funds to retail investors in the US.

Thursday, October 04, 2018

Generation Global Share Fund Closed to New Investors

It turns out that the Generation Global Share Fund is closed to new investors and so I couldn't do the fund switch I tried to do yesterday. CFS's systems allowed me and the guy I phoned to select this option but then rejected the complete portfolio. So I recomputed the numbers and did the switch online now. New allocation is:

CFS Geared Share Fund: 7%

CFS Geared Growth Plus: 40%

CFS Conservative: 11%

Platinum International: 23%

CFS Developing Companies: 19%

Gearing in the Geared Growth Fund is lower than in the Geared Share Fund. Still it is quite aggressive and I will likely delever further at some stage.

CFS Geared Share Fund: 7%

CFS Geared Growth Plus: 40%

CFS Conservative: 11%

Platinum International: 23%

CFS Developing Companies: 19%

Gearing in the Geared Growth Fund is lower than in the Geared Share Fund. Still it is quite aggressive and I will likely delever further at some stage.

Moominmama Allocation

Following up from yesterday's post on delevering in my retail superannuation (retirement) account, here is the desired allocation compared to actual allocation in Moominmama's (formerly Snork Maiden - I mention this because I used to refer to my mother as Moominmama on the blog) Colonial First State managed funds account (in American: taxable mutual fund account). Desired allocation:

CFS Geared Share Fund: 19%

CFS Global Geared Share Fund: 9%

Platinum International: 27%

Generation Global Share: 13%

BT Property Investment: 13%

CFS Developing Companies: 19%

Actual:

CFS Geared Share Fund: 28.3%

CFS Global Geared Share Fund: 16.0%

Platinum International: 11.0%

Generation Global Share: 16.4%

BT Property Investment: 12.6%

CFS Developing Companies: 15.7%

The funds are in: geared (leveraged) Australian shares, geared global shares, global equity hedge fund, global shares, REITS, small cap Australian shares.

We are moving towards the desired allocation slowly by only adding each month to the underweight funds and by not reinvesting distributions. If things looked worse, maybe I would then actually switch funds, but then there will be a capital gains tax bill. Unlike the US, even at low income levels you have to pay capital gains tax (unless you earned less than AUD 18k a year and paid no income tax), though the long-term rate is half the normal income tax rate (for the moment).

This is how our asset allocation has evolved since the financial crisis:

This doesn't include our house. The main trend is a reduction in allocation to Australian large cap srtocks since the recovery bounce from the crisis and an increase in other asset classes.

CFS Geared Share Fund: 19%

CFS Global Geared Share Fund: 9%

Platinum International: 27%

Generation Global Share: 13%

BT Property Investment: 13%

CFS Developing Companies: 19%

Actual:

CFS Geared Share Fund: 28.3%

CFS Global Geared Share Fund: 16.0%

Platinum International: 11.0%

Generation Global Share: 16.4%

BT Property Investment: 12.6%

CFS Developing Companies: 15.7%

The funds are in: geared (leveraged) Australian shares, geared global shares, global equity hedge fund, global shares, REITS, small cap Australian shares.

We are moving towards the desired allocation slowly by only adding each month to the underweight funds and by not reinvesting distributions. If things looked worse, maybe I would then actually switch funds, but then there will be a capital gains tax bill. Unlike the US, even at low income levels you have to pay capital gains tax (unless you earned less than AUD 18k a year and paid no income tax), though the long-term rate is half the normal income tax rate (for the moment).

This is how our asset allocation has evolved since the financial crisis:

This doesn't include our house. The main trend is a reduction in allocation to Australian large cap srtocks since the recovery bounce from the crisis and an increase in other asset classes.

Wednesday, October 03, 2018

Delevering

I just made a big switch in my Colonial First State superannuation account to reduce risk. Stock markets still look bullish but the Fed shows no sign of stopping raising interest rates, risking an inversion of the yield curve. They have been saying that this time is different and that an inverted yield curve doesn't mean that there will be a recession. But though the sample size is very small, it has been a good predictor in the past. We are not yet at yield curve inversion but it still could make sense to reduce risk. My CFS superannuation account has been invested very aggressively. At the end of September this was the allocation:

CFS Geared Share Fund: 48.9%

CFS Geared Growth Plus: 20.2%

CFS Conservative: 10.2%

Platinum International: 10.2%

CFS Developing Companies: 10.5%

So about 70% was in geared (leveraged) funds. Geared Share Fund is large cap Australian shares. Geared Growth is diversified. The new allocation, which is much closer to our new long-term allocation is:

CFS Geared Share Fund: 15%

CFS Geared Growth Plus: 18%

CFS Conservative: 4%

Platinum International: 23%

CFS Developing Companies: 20%

Generation Global Share: 20%

Both Platinum, which is a hedge fund (long and short global equities) and Generation performed well in the Great Recession. Doing this transaction in a superannuation account is tax free - capital gains tax of 10% is paid on unrealised gains on a continuous basis. There is just the cost of the entry/exit spreads.

I changed the allocation for new investments in Moominmama's CFS account, which is not a superannuation account to only buy the non-geared funds going forward. If things look more bearish, we may yet do a switch there too.

CFS Geared Share Fund: 48.9%

CFS Geared Growth Plus: 20.2%

CFS Conservative: 10.2%

Platinum International: 10.2%

CFS Developing Companies: 10.5%

So about 70% was in geared (leveraged) funds. Geared Share Fund is large cap Australian shares. Geared Growth is diversified. The new allocation, which is much closer to our new long-term allocation is:

CFS Geared Share Fund: 15%

CFS Geared Growth Plus: 18%

CFS Conservative: 4%

Platinum International: 23%

CFS Developing Companies: 20%

Generation Global Share: 20%

Both Platinum, which is a hedge fund (long and short global equities) and Generation performed well in the Great Recession. Doing this transaction in a superannuation account is tax free - capital gains tax of 10% is paid on unrealised gains on a continuous basis. There is just the cost of the entry/exit spreads.

I changed the allocation for new investments in Moominmama's CFS account, which is not a superannuation account to only buy the non-geared funds going forward. If things look more bearish, we may yet do a switch there too.

Tuesday, October 02, 2018

September 2018 Report

The Australian Dollar rose from USD 0.7201 to USD 0.7228. The MSCI World Index rose 0.48% and the S&P 500 rose 0.57%. The ASX 200 fell 1.04%. All these are total returns including dividends. We lost 0.63% in Australian Dollar terms and 0.26% in US Dollar terms. So, we outperformed the Australian market and underperformed international markets.

The best performing investment in dollar terms was NASDAQ futures gaining AUD 2.6k – and the worst the CFS Geared Share Fund losing AUD 10.7k. The best performing asset class was private equity, gaining 1.28% followed by commodities (this includes trading), gaining 1.22%. The worst performing asset class was Australian large cap, losing 1.57%.

The following is table of investment performance statistics computed over the last 60 months (extended from 36 months previously) of data:

The first two rows gives the annual rate of return and Sharpe ratio for our investment performance in US dollars and Australian dollars. The other statistics are in comparison to the two indices. Based on beta, compared to the MSCI World Index we seem to be slightly geared, while compared to the Australian index we are less sensitive to market movements. We have a positive alpha compared to the Australian and a negative alpha compared to world markets. We capture more of the up movements and less of the down movements in the Australian market and the reverse in the international markets. The fall in the Australian Dollar over this period explains the poor performance compared to international benchmarks.

This month I made USD 2.5k trading futures. This is the second best result to date and ocurred as the NDX declined for the month. The table * compares my performance to the market and the model:

This month was the sixth month of the futures trading experiment. The first month was the model development phase, and since then I have been trying to get disciplined at trading and further incrementally improving the model. I didn't trade in the first half of the month as I was traveling to Europe and Singapore and the model was short and based on relatively low volatility I thought the profit potential was low. This was a mistake as the model did very well. Then when I got back into trading we were in a corrective phase with the market trading sideways. I traded long NQ short ES for the last few days of the month. The model outperformed the market this month, though its return was not that high. The model is bearish and under-performs when the market is strong and outperforms when the market is weak. It got stopped out a couple of times, which is unusual. As a result the model made 4 trades in 4 days. The second time the model was stopped out, the market ended up on the day and so the stop was too tight. The first time, the stop reduced losses.

What I want to do next on the trading front is write the model's decision algorithm in computer code. At the moment I estimate the indicators I use with an econometric model but I then make decisions manually and record the details in an Excel spreadsheet. It is quite quick to do to make daily decisions in a single market but it is quite hard to do backtesting of different ideas. This will be much easier once we have the decision algorithm coded in the same program as the estimation model. Also, in the long run I plan to automate trading or at least automate data acquisition and decision making for multiple markets. Coding the model in the language of my econometrics program is a first step towards that. Once the model is written in one computer language, converting it to another shouldn't be hard.

I did our tax returns this month. I should get a big refund and Moominmama had to pay a little under AUD 1,000 in extra tax. Otherwise, I am waiting for the probate process to play out before undergoing a big round of financial restructuring.

We made a little bit of progress towards the new long-run asset allocation:

Total leverage includes borrowing inside leveraged (geared) mutual (managed) funds. The allocation is according to total assets including the true exposure in leveraged funds.

We invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Major moves tbis month:

The best performing investment in dollar terms was NASDAQ futures gaining AUD 2.6k – and the worst the CFS Geared Share Fund losing AUD 10.7k. The best performing asset class was private equity, gaining 1.28% followed by commodities (this includes trading), gaining 1.22%. The worst performing asset class was Australian large cap, losing 1.57%.

The following is table of investment performance statistics computed over the last 60 months (extended from 36 months previously) of data:

The first two rows gives the annual rate of return and Sharpe ratio for our investment performance in US dollars and Australian dollars. The other statistics are in comparison to the two indices. Based on beta, compared to the MSCI World Index we seem to be slightly geared, while compared to the Australian index we are less sensitive to market movements. We have a positive alpha compared to the Australian and a negative alpha compared to world markets. We capture more of the up movements and less of the down movements in the Australian market and the reverse in the international markets. The fall in the Australian Dollar over this period explains the poor performance compared to international benchmarks.

This month I made USD 2.5k trading futures. This is the second best result to date and ocurred as the NDX declined for the month. The table * compares my performance to the market and the model:

This month was the sixth month of the futures trading experiment. The first month was the model development phase, and since then I have been trying to get disciplined at trading and further incrementally improving the model. I didn't trade in the first half of the month as I was traveling to Europe and Singapore and the model was short and based on relatively low volatility I thought the profit potential was low. This was a mistake as the model did very well. Then when I got back into trading we were in a corrective phase with the market trading sideways. I traded long NQ short ES for the last few days of the month. The model outperformed the market this month, though its return was not that high. The model is bearish and under-performs when the market is strong and outperforms when the market is weak. It got stopped out a couple of times, which is unusual. As a result the model made 4 trades in 4 days. The second time the model was stopped out, the market ended up on the day and so the stop was too tight. The first time, the stop reduced losses.

What I want to do next on the trading front is write the model's decision algorithm in computer code. At the moment I estimate the indicators I use with an econometric model but I then make decisions manually and record the details in an Excel spreadsheet. It is quite quick to do to make daily decisions in a single market but it is quite hard to do backtesting of different ideas. This will be much easier once we have the decision algorithm coded in the same program as the estimation model. Also, in the long run I plan to automate trading or at least automate data acquisition and decision making for multiple markets. Coding the model in the language of my econometrics program is a first step towards that. Once the model is written in one computer language, converting it to another shouldn't be hard.

I did our tax returns this month. I should get a big refund and Moominmama had to pay a little under AUD 1,000 in extra tax. Otherwise, I am waiting for the probate process to play out before undergoing a big round of financial restructuring.

We made a little bit of progress towards the new long-run asset allocation:

Total leverage includes borrowing inside leveraged (geared) mutual (managed) funds. The allocation is according to total assets including the true exposure in leveraged funds.

We invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Then there are distributions from funds and dividends. Major moves tbis month:

- I redeemed the Janus-Henderson Global Resources Fund, which reduced exposure to ROW stocks.

- I reduced cash and the margin loan in preparation for investing in the Tribeca IPO. As a result our allocation to hedge funds will increase substantially next month.

- I added to the Yellow Brick Road position which is now about 1% of net worth.

Tuesday, September 25, 2018

Internal Rate of Return and Private Equity

Private equity funds like to report the returns on their investment using the internal rate of return metric. The IRR is the discount rate which results in the net present value of the stream of cashflows from the investment being zero. This article points out that it is only the true compound rate of return if you can reinvest the payouts that you receive over time at the same rate of return (r.o.r.). This is correct. But it then goes on to say that IRR is meaningless if you can't reinvest the distributions at the same r.o.r. I don't think that is right. If the IRR is higher than the r.o.r. that you can invest the distributions at, then your r.o.r. from investing in the private equity investment and reinvesting your distributions is greater than the r.o.r. you'll receive by just investing in your alternative investment (and vice versa). Your actual r.o.r. won't be as high as the IRR but the IRR is still useful for making decisions. The main issue is that you need to deduct the funds fees to get the true IRR. Often they will report that they made a $1 million investment and sold for $2 million and give the IRR without deducting fees. Probably as a back of the envelope calculation you could deduct 1/4 of the stated IRR in these cases and then compare to your alternative r.o.r.

So, for example, in Aura's latest report to investors they reported IRR's to date on two investments of 59.5% and 29.2%. So, yes, these are very good. Of course, those are the investments whose carrying values they are marking up. They report a 21.3% IRR on an investment they are exiting. But then there are others that are just breaking even.

So, for example, in Aura's latest report to investors they reported IRR's to date on two investments of 59.5% and 29.2%. So, yes, these are very good. Of course, those are the investments whose carrying values they are marking up. They report a 21.3% IRR on an investment they are exiting. But then there are others that are just breaking even.

Firetrail IPO

Another hedge fund IPO in the coming month. This one is also managed by Commonwealth Securities and so I could participate via the broker firm offer. It is a market neutral hedge fund that can lever up to 200% of NAV in both the long and short sides. The investment team used to work at Macquarie where they got decent returns (22.1% p.a. from July 2015 to October 2017). I'm not so impressed by their performance this year since starting up on their own:

This is not the sign of a high Sharpe ratio investment – it seems there is a lot of risk in this investment relative to the returns. I think this is a fund that is worth tracking over time and seeing if it settles down and performs better. Based on the above, I don't think the shares will trade above the offer price immediately after the IPO, though that is just a guess.

This is not the sign of a high Sharpe ratio investment – it seems there is a lot of risk in this investment relative to the returns. I think this is a fund that is worth tracking over time and seeing if it settles down and performs better. Based on the above, I don't think the shares will trade above the offer price immediately after the IPO, though that is just a guess.

Sunday, September 23, 2018

2017-18 Taxes

Here are my taxes for another year:

A lot of items are down on last year. Foreign source income and unfranked distributions are up because the Winton Global Alpha Fund did well in this tax year. This also means that a chunk of the margin interest is directed to foreign source income and appears under "other deductions". Another new item this year is the Early Stage Venture Capital Limited Partnership offset due to my invest in the Aura Venture Capital Fund. Work-related travel expenses are up because the grants and other funding I had are winding down and so I need to spend more of my own money on travelling to conferences etc.

Franking credits (from Australian dividends), foreign tax paid, and the ESVCLP offset are all deducted from gross tax to arrive at the tax assessment. I expect to get a large refund.

Gross cash income deducts franking credits as these aren't paid out as cash and adds in net capital gains, which were around $60k to income before deductions. Net after tax cash income then deducts tax and deductions from gross cash income.

Looking forward to next year, net capital gains will likely become positive as I won't have any more past losses to deduct. Foreign source income will likely grow further as futures trading comes in.

Moominmama's (formerly Snork Maiden) taxes follow:

Saturday, September 22, 2018

Longer Term Planning

I was rejected for the two jobs I recent applied for. One in Australia after interview and one in the UK pre-interview. So, it looks like we stay in Australia in this city for the moment. It also looks like I will continue in my job next year, but I am seriously thinking about "retiring" at the end of 2019 when I will be 55.

Hopefully, the probate situation is finalized before the end of this year and we can start to restructure our finances. This is what I am thinking to do:

1. We will need to set up a trust account or something less formal for little Moomin for the relatively small amount of money he will inherit. Need to wait to hear what we need to do. According to the will, he won't get the money till he's 23 years old...