April was our third down month in a row, though the loss was less than in the previous two months. I also went through something of a mental health crisis involving insomnia. I am already beginning to feel better. As a result of the crisis I closed all our investments listed on North American markets. I also decided to continue in my job on a full-time basis for now rather than

quit or go part time. Also, because the information ratio of our SMSF is now lower than both Unisuper and PSS(AP), I am redirecting our non-concessional contributions to the latter funds instead of to the SMSF. On the other hand, the SMSF's rate of return since inception still beats the professionally managed funds (8.4% p.a. vs. 5.7% and 6.6%). But I got that extra return by taking on more risk. I now think that was too much risk for my health.

The Australian Dollar rose from USD 0.6240 to USD 0.6392 meaning that USD investment returns are better than AUD investment returns. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 0.98%

S&P 500: -0.68%

HFRI Hedge Fund Index: 0.18% (forecast)

Australian Dollar Benchmarks

ASX 200: 3.63%

Target Portfolio: 0.58% (forecast - depends on HFRI result)

Australian 60/40 benchmark: 0.48%

We lost 0.93% in Australian Dollar terms or gained 1.49% in US Dollar terms. So we outperformed the US Dollar indices and underperformed the Australian Dollar benchmarks.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and do not include investment expenses such as margin interest, and so the total differs from the Australian Dollar returns on net assets mentioned above. Performance was mixed, with rest of the world stocks having the worst rate of return and the most negative contribution to overall return followed by Australian small cap in terms of rate of return. Gold performed best, but private equity made the most positive contribution to total return (with gold in second place).

Things that worked well this month:

- 3i (III.L) was the star performer, gaining AUD 45k. Gold gained AUD 32k and Australian Dollar Futures 10k.

What really didn't work:

- Defi Technologies (DEFI.NE) was the biggest loser at AUD 52k. Bitcoin lost 33k, Pershing Square Holdings (PSH.L) 18k, Aspect Diversified Futures 11k, Regal Partners (RPL.AX) 12k, and Winton Global Alpha 10k.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give the same statistics for three indices. The middle block gives our performance relative to the indices.

These are now measured from the end of April 2020 and so are quite different to last month's data as they include one month of the post-pandemic rebound in the baseline value. Our alpha relative to the ASX200 fell to 3.15% with a beta of only 0.49. We still have much lower volatility, resulting in a Sharpe ratio of 1.12 vs. 0.93. We capture much less of the downside moves than the upside moves in the market. But as we optimize for Australian Dollar performance, our USD statistics are much worse. We do beat the HFRI hedge fund index in terms of return, but at the expense of much higher volatility. Our USD volatility is at least less than that of the MSCI index, but our return is almost three percentage points lower.

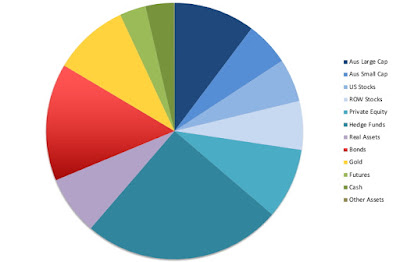

We moved away from our target allocation partly because we changed the allocation and partly because of our trades. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer superannuation contributions every two weeks. We make an annual concessional contribution to Moominmama's superannuation to reach the annual cap on contributions. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. I am now receiving TTR pension payments from both Unisuper and our SMSF and contributing more than the total of these back to our superannuation accounts. (around AUD 4k net contribution per month). I made the following additional moves this month:

- I sold all our position in Defi Technologies (DEFI.NE and DEFTF). We made a 90%+ IRR on the investment, which is some consolation, despite giving up the potential for more profit.

- We sold all our position in the Fidelity Bitcoin ETF (FBTC) (for a 17% IRR) and opened a much smaller position in Australia in the Monochrome Bitcoin ETF (IBTC.AX). Our allocation is now just 1.7% of net worth, which removed my anxiety entirely. My mistake was buying too much bitcoin at relatively high prices after first entering the investment at a reasonable price. This made me anxious about losing money and I sold out near a local low. Maybe we will do better next cycle. As a result of these two moves, we now have a huge pile of cash to re-invest - near AUD 700k.

- I bought 500 shares of IOZ.AX, an ASX200 ETF. This is to begin to match the new target allocation that has a larger allocation to long-only shares.

- I bought 40,000 shares of WAM Capital (WAM.AX), which is a small cap Australian stock fund managed by Wilson Asset Management. It has a very good track record. Another move to match the new target. We will gradually buy into these positions, which are both still very small.

- I did a quick trade of 5,000 RF1.AX shares (bought these by mistake in the wrong account!). I bought 15,000 RF1.AX shares in the SMSF.