A less frenetic month financially but somehow I didn't get to make any blogposts since October's monthly report. We started on refinancing our mortgage at a lower interest rate, but the transaction is not yet complete.

The Australian Dollar fell from USD 0.6894 to USD 0.6764. The MSCI World Index rose 2.48% and the S&P 500 3.63%. The ASX 200 gained 3.51%. All these are total returns including dividends. We gained 2.17% in Australian Dollar terms but only 0.25% in US Dollar terms. The target portfolio is expected to have gained 1.53% in Australian Dollar terms and the HFRI hedge fund index is expected to have gained 0.75% in US Dollar terms. So, we out-performed our target portfolio but lagged other benchmarks. Updating the monthly AUD returns chart:

The Australian Dollar fell from USD 0.6894 to USD 0.6764. The MSCI World Index rose 2.48% and the S&P 500 3.63%. The ASX 200 gained 3.51%. All these are total returns including dividends. We gained 2.17% in Australian Dollar terms but only 0.25% in US Dollar terms. The target portfolio is expected to have gained 1.53% in Australian Dollar terms and the HFRI hedge fund index is expected to have gained 0.75% in US Dollar terms. So, we out-performed our target portfolio but lagged other benchmarks. Updating the monthly AUD returns chart:

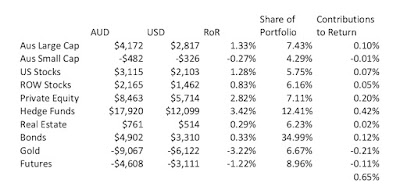

Stocks and real estate did well while hedge funds, private equity, and gold did poorly. The largest positive contribution to the rate of return came from large cap Australian stocks and the greatest detractor was gold. The returns reported here are in currency neutral terms.

Things that worked well this month:

- The Unisuper superannuation fund gained more than any other investment in dollar terms.

- Soybeans and Bitcoin were the next best performers.

- Crude oil and gold lost heavily.

- Regal Funds (RF1.AX) fell sharply after it was reported that the firm was under investigation by the regulator, ASIC.

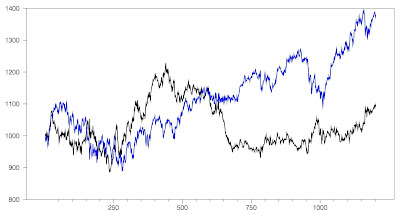

Using a narrower definition including only futures and CFDs we made 3.55% on capital used in trading or USD 6.5k. Including ETFs we lost just 0.01% or AUD 46. Using the narrow definition, we are catching up to last year's returns. This graph shows cumulative trading gains using the narrower definition year to date:

I think I should increase the risk allocations to soybeans and palladium to USD 5,000 each from USD 2,500 and AUD 1,250 currently. These would be roughly the allocations suggested by the portfolio optimization given current allocations to Bitcoin and oil (USD 3,670 and 2,500). Risk allocation is the maximum potential loss on a single trade.

We moved further towards our new long-run asset allocation.

Futures, bonds, and gold fell and all other asset classes increased their shares.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- I rebought 100,000 shares of Domacom (DCL.AX).

- I bought 10,000 shares of Regal Funds (RF1.AX) after the price fell sharply following an ASIC investigation of the firm.

- USD 100k of bonds (Virgin Australia & Viacom) matured. I bought USD 25k of Dell, 16k of Nustar, and 25k of Tupperware bonds. So our direct exposure to corporate bonds fell by USD 34k.

- I transferred AUD 45k to my Colonial First State superannuation account, investing in the Conservative Fund.

- I bought around AUD 43k and GBP 7k, selling US dollars.

- I bought 750 shares of 3i.