This month I decided to stop short-term trading again. I think you can make money doing what I was doing, but trading at a size that makes a real difference generates too much anxiety for me. I didn't hear from HSBC on refinancing our mortgage. I sent them one email. Will need to chase them more in January.

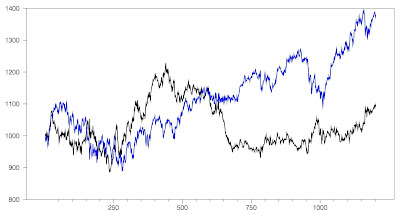

The Australian stockmarket fell a bit in December and the Australian Dollar rose, but overseas markets rose. The Australian Dollar rose from USD 0.6764. to USD 0.7023. The MSCI World Index rose 3.56% and the S&P 500 3.02%. On the other hand, the ASX 200 lost 2.08%. All these are total returns including dividends. We gained 0.28% in Australian Dollar terms and 4.11% in US Dollar terms due to the rise in the Australian Dollar. The target portfolio is expected to have lost 0.82% in Australian Dollar terms and the HFRI hedge fund index is expected to have gained 1.07% in US Dollar terms. So, we out-performed all our benchmarks, which is rather unusual. Updating the monthly AUD returns chart:

MSCI is negative here in December because of the rise in the Australian Dollar. We haven't lost money on a monthly basis in Australian Dollar terms since November 2018... The Australian stockmarket fell a bit in December and the Australian Dollar rose, but overseas markets rose. The Australian Dollar rose from USD 0.6764. to USD 0.7023. The MSCI World Index rose 3.56% and the S&P 500 3.02%. On the other hand, the ASX 200 lost 2.08%. All these are total returns including dividends. We gained 0.28% in Australian Dollar terms and 4.11% in US Dollar terms due to the rise in the Australian Dollar. The target portfolio is expected to have lost 0.82% in Australian Dollar terms and the HFRI hedge fund index is expected to have gained 1.07% in US Dollar terms. So, we out-performed all our benchmarks, which is rather unusual. Updating the monthly AUD returns chart:

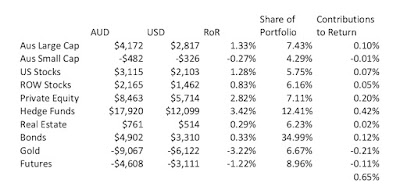

Here is a report on the performance of investments by asset class (futures includes managed futures and futures trading):

Hedge funds and gold did very well, which is the opposite of last month. Trading detracted most from returns. The largest positive contribution to the rate of return came from hedge funds. The returns reported here are in currency neutral terms.

Things that worked well this month:

- Hedge funds Platinum Capital/International Fund and Tribeca did very well. Tribeca (TGF.AX) is no longer our worst ever investment in dollar terms, though it is still hugely drawn down.

- Gold did well, almost reaching this year's highs again.

- Bitcoin lost heavily and we stopped trading it.

This is what the target portfolio would look like:

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- USD15k of Ford bonds were called and we didn't buy any new bonds.

- We bought AUD 40k by selling US Dollars.

- We traded very badly...

- We bought 500 shares of a Commonwealth Bank hybrid (CBAPI).