Investment Returns

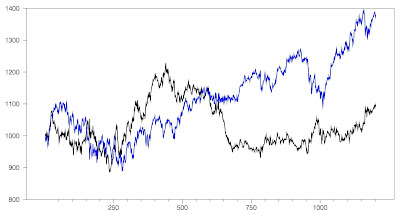

In Australian Dollar terms we gained 12.61% for the year and in USD terms we gained 12.16%. This is a lot less than stock markets gained, but I now prefer to compare our performance to the average hedge fund, which gained 10.35% in USD terms. The MSCI gained 27.3% in USD terms and the ASX 200, 25.6% in AUD terms. These are the US Dollar returns month by month compared to the MSCI and HFRI indices:We followed HFRI very tightly until September, when, apparently because of an increase in the volatility of the Australian Dollar, our performance became more volatile than the hedge fund index.

I posted equivalent Australian Dollar returns in the December monthly report. The next chart shows long term returns in Australian Dollar terms compared to the MSCI, ASX200, and the target portfolio:

Investment Allocation

The main change in allocation over the year was that we converted cash into bonds and gold and then began to run down the bond allocation mostly in favor of hedge funds:

Also, at the beginning of the year, I was still a part owner of my mother's apartment, which was then sold.

Accounts

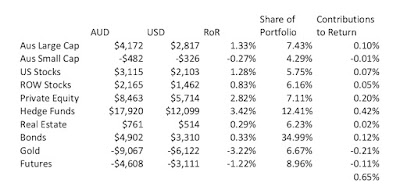

Here are our annual accounts in Australian Dollars:

There are lots of quirks in the way I compute the accounts, which have gradually evolved over time. There is an explanation at the end of this post.

We earned $152k after tax in salary, business related refunds, medical payment refunds, tax refunds etc. We earned (pre-tax including unrealized capital gains) $251k on non-retirement account investments. The latter number was up strongly from last year. The former number continued its decline. The investment numbers benefited from the fall in the Australian Dollar ($40k in "forex" gain). Total current income was $403k. Not including mortgage interest we spent $133k. Total actual spending including mortgage interest was $147k, which was up 12.3% on last year.

$9k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. We transferred $135k into retirement accounts from existing savings in "non-concessional (after tax) contributions. Near the end of the year we paid off the mortgage. Including mortgage payments during the year, that meant a total $520k transferred to our housing account.

The change in current net worth, was therefore -$394k. Looking at just saving from non-investment income, we dissaved $636k. Both these are crazy numbers...

The retirement account is a bit simpler. We made $46k in pre-tax contributions (after the 15% contribution tax) and made an estimated $204k in pre-tax returns. $23k in "tax credits" is an adjustment needed to get from the number I calculate as a pre-tax return to the after tax number. Taxes on returns are just estimated because all we get to see are the after tax returns. I do this exercise to make retirement and non-retirement returns comparable. Net worth of retirement accounts increased by $362k.

Finally, the housing account. I estimate that our house gained $24k in value. We spent $15k on mortgage interest. We would have paid $17k in mortgage interest if we didn't have an offset account. After counting the transfer of $520k into the housing account housing equity increased $527k of which $504k was due to paying off principal on our mortgage.

Total net worth increased by $495k, $48k of which was saving from non-investment sources. These numbers are steeply down from last year. The net worth increase last year mostly came from the inheritance.

Though our saving is down sharply on last year, we still saved in total 24% of our after tax non-investment income. Of course, this is less than last year's 33% and 2017's 54%! Including investment income our savings rate was 77%. This is based on our income calculated here at a ridiculously high $643k.

How Does This Compare to My Projection for This Year?

At the beginning of the year, I projected a gain in net worth of only $60k based on an 0% return on investments and a 6% increase in spending. As you can see, spending rose 12% and return on investments was also about 12%. As a result net worth increased by $495k. So, this was a big forecasting fail, as was last year's projection.

So, it's probably a mistake to try to make a projection for 2020 :) The baseline projection in my spreadsheet is for a 12% rate of return, a 6% increase in spending, and flat other income, leading to a $425k increase in net worth. I expect that forecast will fail big time again.

Notes to the Accounts

Current account is all

non-retirement accounts and housing account income and spending. Then

the other two are fairly self-explanatory. But housing spending only

includes mortgage interest. Property taxes etc. are included in the

current account. There is not a lot of logic to this except the

"transfer to housing" is measured using the transfer from our checking

account to our mortgage account. Current other income is reported after

tax, while investment income is reported pre-tax. Net tax on investment

income then gets subtracted from current income as our annual tax refund

or extra payment gets included there. Retirement investment income gets

reported pre-tax too while retirement contributions are after tax. For

retirement accounts, "tax credits" is the imputed tax on investment

earnings which is used to compute pre-tax earnings from the actual

received amounts. For non-retirement accounts, "tax credits" are actual franking credits

received on Australian dividends and the tax withheld on foreign

investment income. Both of these are included in the pre-tax earning but

are not actually received month to month as cash.... Finally, "core

expenditure" for housing is the actual mortgage interest we paid.

"Expenditure" adds back how much interest we saved by keeping money in

our offset account.

We include that saved interest in the current account as the earnings

of that pile of cash. That virtual earning needs to be spent somewhere

to balance the accounts... It is also included in the "transfer to

housing". Our actual mortgage payments were less than the number

reported by the $2k in saved interest. For current accounts "core

expenditure" takes out business expenses that will be refunded by our

employers and some one-off expenditures. This year, there are

none of those one-off expenditures. "Saving" is the difference

between "other income" net of transfers to other columns and spending in

that column, while "change in net worth" also includes the investment

income.