A relatively uneventful month. Even though I went into the branch, I still have no news from HSBC on refinancing our mortgage...

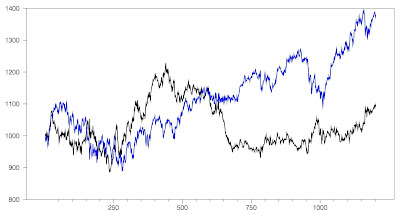

The Australian stock market rose sharply in January as the Australian Dollar fell, but overseas markets fell. The Australian Dollar fell from USD 0.7023 to USD 0.6695. The MSCI World Index fell 1.08% and the S&P 500 0.04%. On the other hand, the ASX 200 gained 4.98%. All these are total returns including dividends. We gained 3.46% in Australian Dollar terms and lost 1.38% in US Dollar terms. This was the biggest monthly investment return ever in terms of absolute Australian Dollars gained (AUD 124k). The target portfolio is expected to have gained 4.00% in Australian Dollar terms and the HFRI hedge fund index lost 0.19% in US Dollar terms. So, we under-performed all our benchmarks. Updating the monthly AUD returns chart:

MSCI is positive here in January because of the fall in the Australian Dollar.

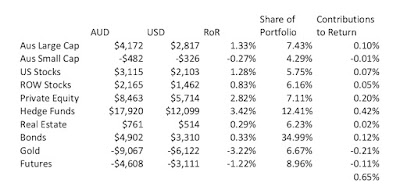

Here is a report on the performance of investments by asset class:

Gold and Australian stocks did well. The returns reported here are in currency neutral terms. Our gains in gold in Australian Dollar terms were near 10% (AUD 27k increase in value).

Things that worked well this month:

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

The Australian stock market rose sharply in January as the Australian Dollar fell, but overseas markets fell. The Australian Dollar fell from USD 0.7023 to USD 0.6695. The MSCI World Index fell 1.08% and the S&P 500 0.04%. On the other hand, the ASX 200 gained 4.98%. All these are total returns including dividends. We gained 3.46% in Australian Dollar terms and lost 1.38% in US Dollar terms. This was the biggest monthly investment return ever in terms of absolute Australian Dollars gained (AUD 124k). The target portfolio is expected to have gained 4.00% in Australian Dollar terms and the HFRI hedge fund index lost 0.19% in US Dollar terms. So, we under-performed all our benchmarks. Updating the monthly AUD returns chart:

MSCI is positive here in January because of the fall in the Australian Dollar.

Here is a report on the performance of investments by asset class:

Things that worked well this month:

- Gold did very well.

- Diversified portfolios at Unisuper, PSSAP, and CFS Diversified Fund all performed well.

- Hedge fund Regal Funds (RF1.AX).

- Hedge funds Platinum International and Tribeca Global Resources did poorly

- Our futures position betting on a steepening of the yield curve lost heavily as the curve moved back towards inversion.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- USD10k of Genworth and USD 16k of Dell bonds were called, USD 50k of Tomari bonds matured, and bought USD 25k of Ready Capital baby bonds (RCP). So, our corporate bond holdings fell by USD 51k.

- We bought AUD 40k by selling US Dollars.

- We sold out of our position in URF.AX (10k shares) when they announced a write-down of their US real estate portfolio. We made a small loss, but since then the stock has fallen a lot more.

- We sold 25k of Pengana Private Equity (PE1.AX) shares after they hit AUD 1.70 (NAV of 1.33) and announced a 2 for 1 rights issue at NAV. We still hold 25k shares and plan to buy our full allocation of shares in the placement, ending up with a 50% bigger position than we started with. We need to increase our allocation to private equity to reach our target allocation.

- I bought 500 CHN shares in the wake of the coronavirus scare. This looks like being premature. We do need to allocate more to non-US stocks.