It's rare to see hedge funds beating the major stock indices to the upside these days, but that's what happened in December when the HFRI returned 4.47% and the S&P 500 3.84%. The MSCI World Index gained 4.68%. As a result our target portfolio actually returned 6.13% in US Dollar terms, though we still beat it, gaining 7.21%. In Australian Dollar terms it gained 1.26% rather than just breaking even as I reported a few days ago.

Saturday, January 09, 2021

Hedge Funds Beat the S&P 500 in December

Contributions of Individual Investments 2020

As promised, here are the contributions of each of 62 investments to our annual investment return. Of course, these numbers (in Australian Dollars) depend on the size of each investment and I don't make any attempt to work out or compile the annual rate of return on all these investments (I do compute it for some).

Compared to last year, gold again is a top contributor and Hearts and Minds and Pershing Square Holdings are gain near the top. Cadence Capital had a turn around this year for the positive and Platinum Capital for the negative. The large super funds did OK but last year they were the two top contributors.

There were two big disasters this year. Winton Global ALpha had a terrible performance losing 18% and Virgin Australia bonds were almost totally wiped out in the airline's bankruptcy.

The total number of investments was smaller this year as we gradually ran off our individual bond holdings and traded much less.

Tuesday, January 05, 2021

Annual Report 2020

The main financial themes of this year for us was continuing to invest the money we inherited in late 2018 and surprisingly strong investment returns for the year after the sharp fall in markets in March due to the COVID-19 pandemic. In my academic career I was also surprisingly productive in the second half of the year following the struggle of dealing with closed schools and our move to online teaching in the first half of the year. We spent less for the year overall because of a reduction in spending during the lockdown and no travel. Our house fell in value, which was against the trend in the Australian housing market.

Investment Returns

In Australian Dollar terms we gained 11.9% for the year and in USD terms we gained 23.2% because the Australian Dollar gained 10%. The MSCI gained 16.8% in USD terms and the ASX 200 only 2.6% in AUD terms. The HFRI hedge fund index gained 8.9% in USD terms. Our target portfolio is expected to gain 6.8%. So, we beat all benchmarks this year.

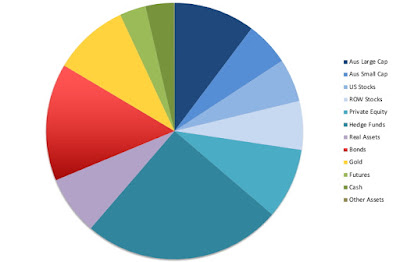

The main changes in allocation over the year was that we ran down our bonds allocation while increasing hedge funds, private equity, and gold mostly:

Accounts

Here are our annual accounts in Australian Dollars:

We earned $128k after tax in salary, business related refunds, medical payment refunds, tax refunds etc. This was down 13% on 2019 because Moominmama worked less and we had large tax bills due to investment income (investment income is reported pre-tax). We earned (pre-tax including unrealized capital gains) $370k on non-retirement account investments. The latter number was up on from last year. The former number continued its decline. The investment numbers suffered from the rise in the Australian Dollar ($67k in "forex" loss). Total current income was $498k. Not including mortgage interest we spent $121k. Total spending was down 18% on 2019 due to reclassifying mortgage interest as an investment cost since we paid off and redrew the mortgage and reduced spending due to the pandemic. Not counting mortgage interest, spending was down 9%.

$10k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. We transferred $45k into retirement accounts from existing savings in "non-concessional (after tax) contributions. I list $2.4k of "inheritance". This is mostly due to adding the value of a painting I inherited, which I already had but hadn't included in net worth. The only other "things" included in our net worth are our car, a gold coin, and our house.

The change in current net worth, was therefore $324k. Looking at just saving from non-investment income, we dissaved $37k. So, before the transfer to retirement accounts we saved about $8k from salaries etc.

The retirement account is a bit simpler. We made $44k in pre-tax contributions (after the 15% contribution tax) and made an estimated $65k in pre-tax returns, which was strongly down on 2019. $8k in "tax credits" is an adjustment needed to get from the number I calculate as a pre-tax return to the after tax number. Taxes on returns are just estimated because all we get to see are the after tax returns. I do this exercise to make retirement and non-retirement returns comparable. Net worth of retirement accounts increased by $146k.

Finally, the housing account. I estimate that our house lost $34k in value. As our mortgage is now included in the current investment account there are no other entries in the housing account now.

Total net worth increased by $436k, which was up 12% on last year. $51k of this was from saving from non-investment sources, up 7% on last year. Thanks to employer superannuation contributions this was 30% of our total after tax non-investment income. Including investment gains our savings rate was 78% of our comprehensive after-tax income.

How Does This Compare to My Projection for This Year?

At the beginning of the year, I projected a gain in net worth of $425k, which turned out to be almost exactly correct. The baseline projection in my spreadsheet for 2021 is for a very high 19% rate of return, a 6% increase in spending, and flat other income, leading to an $800k increase in net worth to around $5.7 million. A more sensible projection would be for another $400k increase to around $5.3 million. Of course, anything could happen.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then the other two are fairly self-explanatory. However, property taxes etc. are included in the current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells that might again be used in the future.

Closing Plus 500 Account

I opened a CFD trading account with Plus 500 in Moominmama's name in order to hedge Bitcoin trades over the weekend and do other trading experiments with small position sizes. I no longer need the account and they are charging monthly inactivity fees. So, I tried to withdraw the cash in the account. But they wouldn't transfer the money to our joint Commonwealth Bank account. They also refused to transfer the money to Moominmama's Interactive Brokers account, even though it has a BSB and bank account number. So, I opened a new bank account in her name at HSBC. But now we have to wait a month to get a statement that would be acceptable to Plus 500... To be continued

Aura Venture Fund II Still Accepting New Investors

Recently, I invested in the Aura Venture Fund II. There was a "first close" but the fund is still accepting new investors before a final close. From my experience with Aura Venture Fund I, these later investors will need to pay interest together with their initial investment to account for possibly benefiting from the funds initial investments that were made before they joined. You can get more information about the fund here. Usually, you will need to be qualified as a wholesale investor and the minimum investment is likely AUD 250k. Note that you will only need to invest a fraction of that at first with capital calls then spread over the life of the fund. My initial investment was AUD 62.5k.

My IRR on VF I is 27% so far, but of course there is no guarantee that the new fund will perform as well or that the final IRR will be that high for VF I when all investments are wound up. A big advantage is that the tax rate for Australian investors on early stage venture capital investments is negative. There is a 10% offset on your investments and zero capital gains or income tax. Also, investment in the fund may make a foreign investor eligible for an investor visa to immigrate to Australia.

Monday, January 04, 2021

December 2020 Report

- Our house - we might change the value based on local sales up to a year after the month end! We will stick with last year's value until there is another local sale. Our house isn't included in the calculation of the rate of return, though, only in our net worth calculation.

- Aura VF1 - reports every 2 months and more than a month after the end of the month, I am using the IRR so far to project the return.

- Aura VF2- reports every 2 months and more than a month after the end of the month. For the moment we will stick with the IPO price.

- Winton Global Alpha - lag is only 2-3 days.

- Cadence Opportunities - not sure how long the lag will be. I am using the historic alpha and beta to compute an expected return.

- APSEC - seems to be 2-3 weeks after month end. I am using the expected HFRI return to project the return.

- Masterworks - none of my paintings is yet tradable in the secondary market, so we are just using the IPO price.

- Pretty much everything! But gold was the strongest performer in dollar terms, gaining AUD 28k.

- URF.AX which invests in residential property in New York and New Jersey lost most – AUD 3.5k. Hearts and Minds (HM1.AX) had its first decline since March, losing AUD 1.3k. That's after gaining AUD 95k since the March low!

- I rebalanced my US 403b retirement account to 50% in the TIAA Real Estate Fund (direct real estate) and 50% in the CREF Social Choice Fund (balanced fund). I eliminated an allocation to the Money Market Fund and reduced the allocation to the Social Choice Fund.

- I bought 5,000 Treasury Wine Estates shares.

- I sold 1,000 CBAPI.AX Commonwealth Bank hybrid securities (convertible bonds).

- I bought 3,000 shares of the IAU gold ETF, taking our position to 20,000 shares and finally around 10% of gross assets.

- I bought AUD 160k by selling US Dollars to get our currency exposure to 50% Australian Dollars and I bought GBP 25k by selling AUD.

- I bought 1,000 Pershing Square Holdings (PSH.L) shares. This took me more overweight hedge funds, but I self-justified it by the fact that the shares are still trading at a big discount to NAV but the gap is narrowing. And anyway, the target portfolio weights are arbitrary, aren't they? I will look to trim the lower performing listed hedge funds once prices are nearer NAVs again.

Saturday, January 02, 2021

Restructuring Baby Moomin's Portfolio

About one and a half years ago I opened an account for baby Moomin with Generation Life to invest the money he inherited from my mother. For this calendar year, the account made about 6.6% on a pre-tax basis.*

This wasn't as good as our portfolio, which returned about 12% in Australian Dollar terms. So, I felt that it was time to make some changes. I decided to switch out of the Dimensional World Allocation 50/50 Fund and the PIMCO Australian and Global Bond Funds. I am switching into the Dimensional World Allocation 70/30 and Vanguard Growth Funds, 50% in each. This is my first time investing in a Vanguard fund! The Vanguard fund is better tax optimized, while Dimensional has more of a tilt to value stocks, which are maybe back in favor. This will result in a total portfolio that is 60% stocks, 20% bonds, 10% infrastructure, and 10% hedge funds.

* This assumes that 30% tax was deducted. Actually, the tax was lower due to franking credits and offsets for foreign taxes. The post-tax return was 4.65%.

Friday, January 01, 2021

2020 Performance of Interactive Brokers Accounts

Inspired by Financial Samurai's post, here are the track records of our two Interactive Brokers accounts over 2020.

Moominpapa (in USD and compared to the S&P500):

This is the kind of result we are trying to achieve with our investment strategy and why we don't just invest in index funds. The only ETF we invest in is IAU - a gold ETF.

Moominmama (in AUD):

On the IB platform, I can only compare this inappropriately to US Dollar indices. By comparison, the ASX200 gained only 1.27% for the year. At the end of March it was down 23% for the year and so probably fell about as much as this portfolio did at the worst point a few days earlier. This is a pleasing result, though less downside would be nice, but then this is just a relatively small part of our total portfolio.

Monday, December 21, 2020

2020 Update on the Yale Endowment

Inspired by Financial Samurai's latest post, I am updating my post on the Yale Endowment. They have released preliminary results for the 2019-20 financial year (ends 30 June) and so we can update with three years of data. They returned 6.8% for the 2019-20 financial year, which is just below the S&P500's 7.5%. On the other hand, HFRI lost 0.6% and I lost 0.1% in USD terms. In the long run, since the financial crisis they have tracked the MSCI index with a little extra return and a little less volatility:

Their asset allocation continues to evolve, with domestic equity now only 2.5% and private equity now 41% of the portfolio:

Natural resources are now down to 4.5%. This is much more extreme than the typical family office portfolio, which has 49% of assets in alternatives including rela estate and commodities vs. 78% of the Yale portfolio.

Sunday, December 06, 2020

Breakdown into Taxes, Spending, and Saving

Following up on yesterday's post on our spending over time in different categories, I made another pretty graph, this time of the breakdown of income into taxes, spending, and saving. Everything is in Australian Dollars:

Total income is our gross income on our tax returns plus superannuation contributions that are not on our tax returns. This means that it includes taxable investment income. As a result, current saving looks quite big, but saving from our salaries is much smaller than this, nearer to AUD 20k per year. Superannuation contributions include employer and salary sacrifice contributions and not "non-concessional contributions", which I treat as transfers from current savings totaling AUD 180k during this period.

Mortgage principal payments were low last year when I paid off and redrew the mortgage. Even though in my investment performance reports I now include mortgage interest as an investment cost, for the purposes of these posts on spending I include it in housing costs to make our numbers more comparable to other people's. Investment costs are mostly margin interest as well as other fees. Taxes include income and property tax.

Saturday, December 05, 2020

Spending Over the Last Four Years

This year's spending is predicted to be lower than last due partly to COVID-19 and a lack of major house maintenance expenditure this year. Travel and cash spending have gone from significant items in 2017-18 to almost nothing or nothing this year. I deliberately reduced cash spending when I started this tracking of our spending in order to make tracking easier. The category that seems to have increased the most is childcare and education, which is not surprising as we went from one child in daycare only a few days a week to two children for more days of the week. The childcare subsidies we got have also been reduced.

Also of interest are restaurants, which are the tiny sliver above supermarkets, which also declined a lot this year for obvious reasons (I think I got food delivered from a restaurant maybe a couple of times ever in my life). In 2017-18, restaurants were very low because I would usually pay with cash then. Really, restaurant spending was much higher than shown in the first two years. Last year it was AUD 3k and this year is estimated to be AUD 1k. Travel only includes flights and accommodation.

Currency Exposures

I took a more granular look at currency exposures:

So, actually I still have less than 50% exposure to the Australian Dollar. This probably still exaggerates Australian Dollar exposure. I couldn't find any information on the Australian vs. international bond exposure in any of four Australian balanced funds we are invested in. So I ascribed all their bond exposure to Australian bonds. I am always frustrated by the low level of disclosure regarding investments by most Australian funds in comparison to American funds.Thursday, December 03, 2020

November 2020 Report

- The following funds all gained more than AUD 20k: Tribeca Global Resources (TGF.AX), Hearts and Minds (HM1.AX), Platinum (PMC.AX), Pershing Square Holdings (PSH.L). Pershing and Tribeca both gained more than 18%. URF.AX (US residential real estate) gained 34%.

- Gold fell 5.9% or AUD 23k. Domacom (DCL.AX) drifted down, losing AUD 5.5k.

- I applied for AUD 100k of shares in the Cadence Opportunities Fund.

- The first capital call for the Aura VFII fund was made for AUD 62.5k.

- General Financial called 760 of our GNFSL baby bonds. We still have 240.

- I made a trade in E-Mini S&P call options around the US election. Got out for a small profit, but should have held much longer.

- I bought another 1,000 IAU gold ETF shares. Still not at 10% of gross assets in gold!

- I sold 5,000 Hearts and Minds (HM1.AX) shares, taking our position down to 40,000. This was because the stock was trading at a large premium to NTA.

- I bought AUD 25k by selling US Dollars. We are now at roughly 50/50 in terms of Australian Dollar linked and foreign currency linked investments and so will probably not buy more Australian Dollars for a while.

- I borrowed AUD 100k from Interactive Brokers and AUD 30k from CommSec to fund the new investments.

Tuesday, December 01, 2020

New Investment or Trade? Treasury Wine Estates

Today, I bought 5,000 shares of Treasury Wine @ AUD 8.42 a share. The stock has traded as high as AUD 20.20 in the last three years. The price has fallen since China put a huge tariff on Australian wine. The company's announcement seemed positive to me. This stock was also recommended at the recent Sohn Investment Conference by Jun Bei Liu of Tribeca Investment Partners. I don't think she was betting on such a high tariff.

Monday, November 23, 2020

Asset Allocation of Family Offices

Here is the average asset allocation of family offices a couple of years ago according to UBS:

It's odd that they count commodities separately from alternatives. Perhaps it was used in a study about commodity investing. Here is our current allocation that was partly inspired by university endowments:

It's quite close, though we have more in commodities (=gold) and less in cash. Alternatives here includes private equity, real estate, hedge funds, futures, and art. As usual, the value of our house is not included.Saturday, November 14, 2020

Two New Investments

The second Aura Venture Fund finally closed this month and the first capital call was made for 25% of the investment. One of the things I like about these venture funds is that they gradually trickle money into the market. The others are that they have negative tax (a 10% tax offset on investments and no tax on gains or income) and the first fund has so far performed well. As I am committed to invest AUD 250k, this first payment was AUD 62.5k.

The second investment is the Cadence Opportunities Fund, which is an active trading equity hedge fund structured as a private company. When this fund was first floated and failed to IPO (instead it became an unlisted hedge fund), the main Cadence Fund (CAM.AX) was performing badly and so I decided not to invest. That was a mistake. The fund has gained more than 100% since launching. Now they have a rights issue and the opportunity for outside investors to obtain shares that aren't subscribed to by existing investors - the "shortfall". I put in a bid for AUD 100k in Moominmama's name.

Monday, November 02, 2020

October 2020 Report

- Regal Funds was the top performer, gaining AUD 20.8k. Hearts and Minds gained AUD 14.4k.

- As well as gold (down AUD 1.8k), London listed stocks 3i (2.6k) and Pershing Square Holdings (1.9k) were the worst performers.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- I invested USD 20k in two new paintings at Masterworks. I now have USD 40k invested.

- I bought 278k Domacom shares (DCL.AX).

- I bought 25,000 Bluesky Alternatives shares (WMA.AX).

- I borrowed AUD 100k from IB and used it to reduce our CommSec margin loan and increase our offset account balance.

Friday, October 23, 2020

Masterworks Sells First Painting, Investors Make 32% in One Year

Masterworks sold a Banksy Mona Lisa for $1.5 million after holding it for one year. Investors gain 32% after all fees and costs. I don't think this would be typical but nice to see that this first deal worked out.

I've now invested in four paintings through Masterworks.Monday, October 12, 2020

Adjusting Home Price Down

In the last couple of years I have used the Corelogic house price indices to update the value of our house. But this price has gotten more and more out of touch with sales prices in our development. Well, there was only one this year and it was a lot lot lower. So, I have now redone a regression analysis of all the comparable sales since we bought here. The dependent variable is the percent premium over the original sale price when the development was new and the explanatory variables are dummy variables for each year (0,1 variables that take the value one in the relevant year). This re-values our house at AUD 810k down from 852k last year. We paid 740k at the beginning of 2015 and so this hasn't been great investment-wise as it has appreciated a lot less than the average home in this city supposedly has.

This graph shows how the premium over the original price has changed over time:

In the last year prices have fallen quite a bit. I am not sure why there has been this trend, which is out of step with the rest of the city. One possibility is that the ongoing construction of a new large denser neighboring housing development in place of low rise offices has reduced the value of our development.

Saturday, October 03, 2020

September 2020 Report

- Bluesky Alternatives (soon to be Wilson Alternative Assets) gained AUD 13.5k followed by Regal Funds (AUD 10.4k) and Cadence Capital (AUD 7.4k).

- Gold fell the most (- AUD 16.6k).

- I bought 100k of Australian Dollars by selling US Dollars.

- Woolworths (USD 25k) and Nustar (16k) bonds matured.

- I invested USD 10k in a painting at Masterworks.

- I bought 22,136 Domacom shares (DCL.AX) at 6.6 cents each. The company announced a deal that might get them about halfway from here to profitability.

- I bought 25,000 Bluesky Alternatives shares (BAF.AX).

- I bought another 1,000 shares of the IAU gold ETF.

- I was stopped out of the short 10 year treasuries futures position.

- We reduced our Commonwealth Securities margin loan by another AUD 90k to AUD 92k. Ultimately, I plan to borrow mainly from Interactive Brokers who have a much lower interest rate and only use the Commsec margin loan or our home mortgage facility when there are particularly good opportunities.

Tuesday, September 22, 2020

Income and Tax History

Reading one of ESI Money's millionaire interviews I was inspired to track our income from previous tax returns (all on this blog). While I was at it, I added the tax as well:

Sunday, September 20, 2020

2019-20 Taxes

I just completed our tax returns for this year. As usual they only took a few hours as I am very well-prepared with spreadsheets updated throughout the year. Preparing taxes is mainly a case of checking that all the spreadsheet links and calculations are correct and refreshing my memory about some of the details of what goes where on the tax form. Last year's taxes are here.

On the income side, Australian dividends, capital gains, and foreign source income are all up strongly. My salary still dominates my income sources but is not really growing and we have a pay freeze for next year.

Interest is Australian interest only and is up strongly due to interest on Macquarie, Woolworths, and Virgin Australia bonds.

Unfranked distributions from trusts is up strongly due to the huge distribution from the APSEC fund I invested in just before the end of the tax year. That was a bad move. Foreign source income is mostly dominated by foreign bond interest and losses on futures trading. Other income is gains on selling bonds. These aren't counted as capital gains.

After recording a net capital gain for the first time in a decade last year, I again have zero capital gains and I am carrying forward around $150k in losses to next year. Foreign source income is mostly from futures trading and bond interest.

In total, gross income rose 6%.

Increased deductions are mostly due to losses on selling bonds. Interest rates are historically low and most bonds that you will be able to buy have higher nominal interest rates. As a result, these bonds are priced above par. If you hold them to maturity you have a loss that is more than offset by the interest received.

Dividend, foreign source income, and trust deductions are all mostly interest on loans.

Total deductions rose strongly, and as a result, net income fell 2%.

Gross tax is computed by applying the rates in the tax table to the net income. In Australia, you don't enter the tax due in your tax return, but I like to compute it so that I know how big or small my refund will be.

Franking credits (from Australian dividends), foreign tax paid, and the

Early Stage Venture Capital (ESVCLP) offset are all deducted from gross

tax to arrive at the tax assessment. I again expect to pay extra tax.

I paid 30% of net income in tax. Tax was withheld on my salary at an average rate of 32%.

Moominmama's (formerly Snork Maiden) taxes follow:

Her salary was down a lot because of maternity leave. Dividends and capital gains were up strongly due to investment in various listed investment companies and Commonwealth Bank hybrid securities. Foreign source income was down strongly due to losing on trading this year rather than gaining last tax year. As a result, total income fell by 23%.

Deductions rose dramatically, because of recording trading losses as deductions and starting to deduct interest against dividends. As a result, net income fell 42%. Tax was 15% of net income. Tax withheld on her salary was really high for this income level.

Saturday, September 19, 2020

Completed Internal Rates of Return

I posted recently the internal rates of return for 66 of my investments. I've now completed the calculations for all 94 investments that were held for more than one year:

Shaded returns are investments that I currently hold. The median rate of return is 5.1%. Most of the larger investments are above the median as are the majority of current investments. The median return of current investments is 9.1%.

Powertel and Looksmart were some dotcom era investments that worked out. DeepSkyWeb one that didn't. I can't even remember what FTS was. I held it in 2007-8. Newcastle was a mortgage fund that blew up in the GFC. Legend was a Joe Gutnick mining company that went to zero and HIH an insurance company that was the worst bankruptcy in Australia's history.

Wednesday, September 09, 2020

August Investment Performance

As my performance statistics over the last 5 years are looking good again, I thought I would start posting them again :)

The first two rows give the average annual rate of return and the Sharpe statistic in the two currencies. These are the kind of numbers I would aim for... Until recently, I was performing better in Australian Dollar terms. Now it depends on which statistic you look at.

The remaining four lines compare performance to the MSCI (global stocks), ASX200 (Australian stocks), and HFRI (Hedge fund) indices. The first two have all dividends and tax credits included. My portfolio has a subdued reaction to the first two indices (beta < 1) but is more volatile than HFRI. Alpha is the annual return after deducting the part explained by the index. It helps increase the upside and reduce the downside moves.

The final two rows show the same thing in a different way. Down capture divides the average return of the portfolio by the average return of the index in the months that the index went down. Up capture does the same in the months that the index rose. I have a positive asymmetry against all three indices.

Saturday, September 05, 2020

Internal Rates of Return

I have now computed the internal rate of return for 66 investments including all current investments. I excluded all trading involving futures, shorting etc and all names held for less than a month. There are still around a hundred closed investments that need to still be evaluated. In the meantime, here are the results:

- The top performer was held for under a year. Probably, I should drop everything held for less than a year...

- At the bottom are two investments that went to zero.

- The median return is 6.25%, but most of our larger investments are above the median.

- I bought shares in Colonial in the demutualization and then it was taken over by Commonwealth Bank. This was my best investment in terms of rate of return.

- Pershing Square Holdings is looking very good at #3.

- AAPT was an Australian telecom that did very well and was acquired by Telecom NZ. I think I bought that in an IPO too.

- I only held Qualcom for a short time.

- Rounding out the top 10 are five recent investments that are strong performers.

- A lot of the entries in the right hand column are bonds.