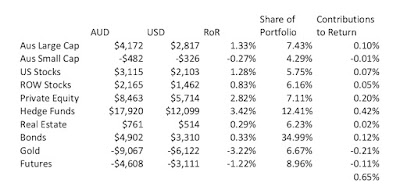

Here are my taxes for another year:

On the income side, Australian dividends, capital gains, and foreign source income are all up strongly. I finally ran out of past capital gains tax losses and so recorded a net capital gain for the first time in a decade. Foreign source income is mostly from futures trading and bond interest. My salary still dominates my income sources. As far as replacing salary with other income goes, you need to consider the joint picture with Moominmama's tax return below and the earnings of our superannuation accounts...

Increased deductions are mostly due to increased margin loan interest.

Franking credits (from Australian dividends), foreign tax paid, and the Early Stage Venture Capital (ESVCLP) offset are all deducted from gross tax to arrive at the tax assessment. Unlike in the past, I expect to pay a lot of extra tax.

Gross cash income deducts franking credits and adds the long-term capital gains discount to gross income. The former aren't paid out as cash and the latter are but aren't included in taxable income.

Net after tax cash income then deducts tax and deductions from gross cash income.

Moominmama's (formerly Snork Maiden) taxes follow:

Here there is more dramatic change. Salary was up further in the bounce back from maternity leave and in preparation for the second maternity leave now in progress. Foreign source income was up dramatically due to futures trading. We do more of our trading in this lower taxed account.

Work related travel expenses were down to almost nothing, as the tax year started during our last big trip to conferences etc. I haven't yet managed to do the mortgage inversion that should increase deductions and so deductions are down.

As a result, income and taxes were up dramatically and we will owe a lot of tax. I expect we will have to start making quarterly tax payments from now on.