Back at the beginning of 2021 I opened an HSBC account for Moominmama because Plus 500 refused to send money to an account in our joint names. Moominmama has just been using it for shopping getting 2% cashback some months. I just realised that it can hold foreign currencies. So, instead of using OFX to convert and transfer money to the US to invest in Unpopular Ventures and Masterworks I could convert the money at Interactive Brokers at the best exchange rate, transfer it to HSBC and then transfer it to the recipient from there for an AUD 30 fee. OFX have about a 1.4% exchange rate cost plus an AUD 15 fee for small orders. And one day when there are distributions from Unpopular Ventures we could transfer the money back to HSBC without converting it.

Saturday, August 13, 2022

HSBC Everyday Global Account

Superannuation Performance Update

I just calculated the return on my TIAA-CREF 403b in Australian Dollar terms to compare to our Australian superannuation funds. While the SMSF has done a lot better than Unisuper and PSS(AP) since inception, TIAA has really shone. This is mainly due to our investment in the TIAA Real Estate Fund and partly due to the fall in the Australian Dollar. Now, I am wondering whether to switch out of that fund.

Pre-tax returns for the 2021-22 financial year were: SMSF 2.6%, Unisuper -5.0%, PSS(AP) -2.9%, TIAA-CREF 28.5%. I am very generous in estimating the tax paid by Unisuper and PSS(AP). This boosts estimated pre-tax returns on the way up a little but detracts a bit on the way down.

Saturday, August 06, 2022

June 2022 Report

With the final private asset valuations complete, I am ready to present the June accounts. I needn't have waited, as the share price of Aura VF1 only rose by one cent and Aura VF2's share price was constant.

World markets fell sharply with the MSCI World Index (USD gross) falling by 8.39% and the S&P 500 by 8.25%. The ASX 200 fell 7.72%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7177 to USD 0.6900 increasing Australian Dollar returns and reducing USD returns. We lost 5.82% in Australian Dollar terms or 9.46% in US Dollar terms. The target portfolio lost 2.42% in Australian Dollar terms and the HFRI hedge fund index lost 3.08% in US Dollar terms. So, we under-performed all benchmarks apart from the ASX.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Hedge funds were the worst drag on performance followed by leverage. Only gold and the Australian Dollar contributed positive returns. The total benefit of the fall in the Australian Dollar was greater as many foreign assets are denominated in Australian Dollars. This includes gold which we invest in through an Australian ETF PMGOLD.AX.Things that worked well this month:

- Gold was the top performer (AUD 13k) followed by the China Fund (CHN) (9k), Winton Global Alpha (5k), and Aspect Diversified Futures (4k).

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost an incredible AUD 86k :(. Regal Funds followed with -36k and PSSAP rounded out the bottom three with -18k.

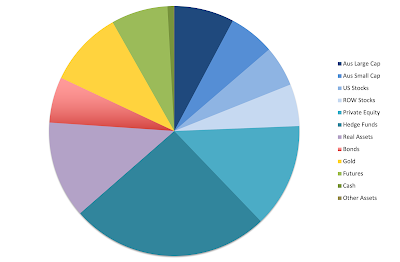

We moved a bit nearer to our target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I bought 5,000 shares of Regal Partners (RPL.AX). So far, this looks like a mistake.

- I bought 20,000 shares of Pengana Private Equity (PE1.AX).

- I bought 2,000 shares of Regal Funds (RF1.AX).

- I sold 2,000 shares of PMGOLD.AX, a gold ETF. I'm beginning to feel over-stretched. This move reduced our leverage a bit and reduced our most expensive debt (CommSec margin loan). It also pushed our gold allocation back to 10% of gross assets.

- I sold a net 988 shares of WAR. I moved the rest of the position from one account to another to avoid a margin call.

Wednesday, August 03, 2022

July 2022 Report

July was a reversal of June. The S&P500 gained more than it lost in the previous month and gold fell more than it rose in the previous month. Investors seem to think that the Federal Reserve will raise interest rates by less than originally expected. The MSCI World Index (USD gross) rose by 7.02%, the S&P 500 by 9.22%, and the ASX 200 by 5.77%. All these are total returns including dividends. The Australian Dollar rose from USD 0.6900 to USD 0.6968 increasing Australian Dollar returns and reducing USD returns. We gained 4.11% in Australian Dollar terms or 5.13% in US Dollar terms. The target portfolio gained 3.75% in Australian Dollar terms and the HFRI hedge fund index was up only 1.65% in US Dollar terms. So, we out-performed the latter two benchmarks but under-performed the stock indices. The AUD return for the month is more than what would be expected historically given the ASX 200 performance for the month.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have for the first time added in the contributions of leverage and the Australian Dollar to the AUD net worth return.

Hedge funds were the biggest contributor to performance while Australian small cap had the best return. Gold was the worst performer and a significant detractor. Rest of the World stocks had a relatively poor performance because of our weighting to the China Fund.

Things that worked well this month:

- Regal Funds was the best performer (AUD 25k) followed by Pershing Square Holdings (18k), Tribeca Global Resources (18k), and another seven investments that gained more than AUD 10k.

What really didn't work:

- Gold was the worst performer (-24k) followed by the China Fund (-9k) and Winton Global Alpha (-5k). Only six investments lost money while 29 gained.

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. This month, I have added another three rows to report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the hedge fund index and not really against the MSCI. Compared to the ASX200 our rate of return has only been 0.6% lower but our volatility has been 5% lower.

We are performing 2% per annum worse than the average hedge fund levered 1.7 times. I'm not sure why this alpha has deteriorated sharply recently. July 2017, which was dropped from the estimation this month, was a good month for hedge funds but both June and July 2017 were particularly good months for us in USD terms as the Australian Dollar rose sharply.

We moved a bit away from our target allocation. This was mainly because of the redemption of Pershing Square Tontine Holdings that reduced our private equity allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I sold 4,000 shares of WAM Leaders to get some cash.

- I made an AUD 20k concessional superannuation contribution for Moominmama.

- We combined these to start an account at Colonial First State for the SMSF investing in Aspect Diversified Futures with an initial AUD 25k (the minimum investment for Class A shares).

- As mentioned above, PSTH returned the cash to shareholders. There is a placeholder position still in our account which might turn into SPAR warrants at some point.

- I bought a net AUD 75k, mainly with the US Dollars from PSTH.

- I invested around AUD 10k in 64 Devonshire Road, Rossmore, NSW.

- I bought 1,250 PMGOLD shares (12.5 ounces of gold).

- I bought 3,000 more shares in Pendal (PDL.AX), when it was announced that merger talks were back on.

Friday, July 29, 2022

How I Made AUD 2,900 Instantly

A couple of days ago, I went on the Domacom platform just to see if anything was new. I found an offer to sell about 10,000 units in a semi-rural property near Sydney for AUD 1.0156 placed on 30th May. But the property was revalued on 18th July by around 30%!. Almost instantly I bought the units. One downside is that I already own about AUD 10k of units in the neighboring property. Of course, I can't realize this profit, so it is just on paper. The market is very illiquid, which is why I managed to get this bargain in the first place. Both properties have a vote next March on whether to sell the properties and wind up the funds or whether to continue to hold. Recently, my first investment at Domacom held a vote and sold for a big profit.

To get the funds, I had to cancel my pledge to a campaign to buy rural property. My money has been tied up in the campaign for a year while they have made almost no progress on raising money. I think that in future I won't make pledges to campaigns and only engage in the secondary market. The additional advantage of that is that I avoid paying big fees for the purchase of the property and the often huge upfront cut (c. 10%) taken by the promoters of the campaign. It would be much better if they were paid by performance fees instead...

Career Update

A year on, the career plan needs updating. I agreed with the School Director to take long service leave in 2022 and delay my leadership position to 2023-24. Instead, another person would take that leadership role for one year. Two months into the year, the director became a head of school at another university. The person temporarily filling the leadership position took over as interim director and a third person filled the leadership role. When I raised the issue recently, the person in the leadership role said they knew nothing of the plan to put me into the position in 2023-24 and it would depend on the new permanent school director who will be starting in January 2023. I don't think that the new director would be enthusiastic about me in that role.

Yesterday, I met with my immediate Department Head. He said that he thinks the leadership position is now off the table and doesn't think there will be pressure for me to take that kind of role now... He also wants me to again teach one of the courses I dropped.* The advantage, of course, is that teaching this course won't require any preparation. This new course has taken more preparation that anything I've taught before, I think. I am still working on that as the course began this week, but the end of prep is near... I'm not happy about teaching more again... Anyway, I told him that I would want to teach both courses in the same semester rather than spreading them out over the year. I find switching between teaching and research to be hard and end up wasting a lot of time doing that.

I also told him that I had thought about going to part-time status instead. Yesterday, I sent an email to HR asking about that. But I think that depending partly on investment income is a bit scary given the current economic and market uncertainty. On the other hand, the question is whether I will ever feel like I have enough money to retire....

I'll probably end up teaching the old course again together with the new one this time next year.

* He is teaching it this year (he also taught it before). Next year, he wants to revive another course that we have both taught before....

Thursday, July 21, 2022

Sam Dogen Interview

Sam Dogen of Financial Samurai has first video interview. Finally, you can get to see him, even if you still don't know his real name 😀

.jpg)