This month we "inverted" our mortgage, paying off the mortgage and then redrawing it for investment purposes. As a result the mortgage interest should now be tax deductible. I carried out quite a lot of trades and money shuffling to carry this out.

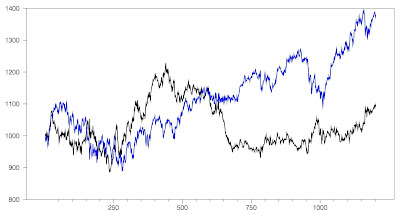

The Australian stockmarket fell a bit in October and the Australian Dollar rose, but overseas markets rose. The Australian Dollar rose from USD 0.6752 to USD 0.6894. The MSCI World Index rose 2.76% and the S&P 500 2.17%. The ASX 200 fell 0.35%. All these are total returns including dividends. We lost 0.20% in Australian Dollar terms but gained 1.90% in US Dollar terms. The target portfolio lost 1.03% in Australian Dollar terms and the HFRI hedge fund index is expected to have gained 0.83% in US Dollar terms. So, we out-performed our target portfolio, the HFRI, and the ASX, while underperforming compared to the MSCI World Index and the S&P 500 (a bit). Updating the monthly AUD returns chart:

Hmmm... It is looking like my performance is an average of the MSCI and the target portfolio in recent months.The Australian stockmarket fell a bit in October and the Australian Dollar rose, but overseas markets rose. The Australian Dollar rose from USD 0.6752 to USD 0.6894. The MSCI World Index rose 2.76% and the S&P 500 2.17%. The ASX 200 fell 0.35%. All these are total returns including dividends. We lost 0.20% in Australian Dollar terms but gained 1.90% in US Dollar terms. The target portfolio lost 1.03% in Australian Dollar terms and the HFRI hedge fund index is expected to have gained 0.83% in US Dollar terms. So, we out-performed our target portfolio, the HFRI, and the ASX, while underperforming compared to the MSCI World Index and the S&P 500 (a bit). Updating the monthly AUD returns chart:

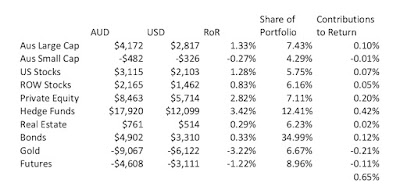

Here is a report on the performance of investments by asset class (futures includes managed futures and futures trading):

Private equity, real estate, and gold did well while hedge funds and futures did poorly. The largest positive contribution to the rate of return came from private equity and greatest detractors were futures and hedge funds. The returns reported here are in currency neutral terms.

Things that worked well this month:

- Pengana Private Equity and Bluesky Alternatives did very well, gaining AUD 8.7k and AUD 10k, respectively. Hearts and Minds gained AUD 5.3k.

- Gold gained (AUD 7.3k).

- Winton Global Alpha lost significantly, reversing recent gains.

- Pershing Square, Cadence Capital, and Tribeca Natural Resources all lost money.

We moved further towards our new long-run asset allocation.

The table shows how leverage increased this month as we moved the mortgage into the investment portfolio. Cash and bonds fell and all other asset classes increased their shares.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- USD 21K of Kraft-Heinz bonds were called early and we didn't buy any new bonds So, our direct bond holdings declined by USD 21k.

- We traded at a small loss, as discussed above.

- I sold 100k of Domacom (DCL.AX), 40k of Tribeca Global Natural Resources (TGF.AX), and 79k of Cadence Capital (CDM.AX) shares to harvest tax losses and obtain cash for the mortgage inversion. I subsequently bought back 40k of Tribeca and 80k of Cadence. I now have the funds which are marginable and/or are likely to pay large franking credits in my account and the non-marginable funds, which mostly also are likely to pay out fewer franking credits in Snork Maiden's account. As franking credits are applied to the tax bill it doesn't actually matter which account they are in, but I like to see my larger tax bill cut more :) I have a margin account with Commonwealth Securities, while Interactive Brokers don't offer margin loans to Australian customers.

- I bought 20k shares of Hearts and Minds (HM1.AX) before the upcoming annual Sohn Conference. The fund is currently winding down the investments in the stocks recommended at the last conference and will invest in new recommendations following this year's conference. The share price is very close to NAV and I think following the conference there could be a boost in price. The fund has done very well since inception.

- I went to Regal Fund's presentation here and was impressed and bought 20k more shares of RF1.AX.

- I sold 50k of Pengana Private Equity (PE1.AX) shares because the price seemed unsustainably high but then bought back 50k at lower prices. This is not looking like a good move given the tax implications

- We bought AUD 40k of Australian Dollars.

- We moved around AUD 1/4 million to our offset account and paid off the mortgage. We then redrew AUD 1/2 million and sent it to my CommSec account and Moominmama's Interactive Brokers account. This reduced my margin loan a lot and increased the cash in her account a lot. The latter is deemed to be "futures" in the pie chart above. Cash in our offset account fell to AUD 40k.