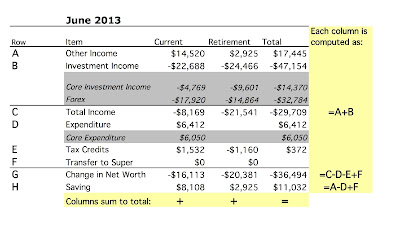

Turns out that I miscalculated and we didn't quite reach USD 1 million last month. This month due to the fall in the Australian Dollar we are further below it to $975k. In Australian Dollars we reached $1.069 million, up $A14k on last month. The monthly accounts (in USD) follow:

Spending was high this month. First, I had a bunch of business expenses for a trip early next year. Then I had to pay my employer a refund of half the price of an airline ticket for our trip to the Northern Hemisphere this past Northern summer. Otherwise, they decided retrospectively that they would have to pay fringe benefits tax and they don't want to do that... We still spent about $A6k after deducting these which seems to be the new normal. As a result we only saved $2.8k from regular income.

We lost money on investments - $28k - mainly due to the fall in the Australian Dollar of about 3 US cents. Rate of return for the month was -2.87% in USD terms or +0.83% in Australian Dollar terms. The MSCI gained 1.04%, the S&P500 3.05% (the unstoppable Energizer Bunny), and the ASX 200 lost 1.31% - the first two indices are in USD terms and the latter in AUD.

I made a major investment in managed futures as already mentioned in the blog. This month I will subscribe to the Platinum Capital rights issue for about $A7.5k. At the end of November our allocation of gross assets looked like this:

Of course, this isn't the same as the allocation of net worth due to leverage. Total leverage is about 34% i.e. 34 cents borrowed for each dollar of net worth. We retain that much cash while borrowing due to looking still to buy a house...

Spending was high this month. First, I had a bunch of business expenses for a trip early next year. Then I had to pay my employer a refund of half the price of an airline ticket for our trip to the Northern Hemisphere this past Northern summer. Otherwise, they decided retrospectively that they would have to pay fringe benefits tax and they don't want to do that... We still spent about $A6k after deducting these which seems to be the new normal. As a result we only saved $2.8k from regular income.

We lost money on investments - $28k - mainly due to the fall in the Australian Dollar of about 3 US cents. Rate of return for the month was -2.87% in USD terms or +0.83% in Australian Dollar terms. The MSCI gained 1.04%, the S&P500 3.05% (the unstoppable Energizer Bunny), and the ASX 200 lost 1.31% - the first two indices are in USD terms and the latter in AUD.

I made a major investment in managed futures as already mentioned in the blog. This month I will subscribe to the Platinum Capital rights issue for about $A7.5k. At the end of November our allocation of gross assets looked like this:

Of course, this isn't the same as the allocation of net worth due to leverage. Total leverage is about 34% i.e. 34 cents borrowed for each dollar of net worth. We retain that much cash while borrowing due to looking still to buy a house...