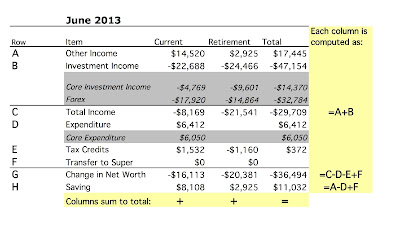

As I said in the annual report, the data in these monthly reports will be by default in Australian Dollars from now on. The Australian Dollar is now worth quite a bit less than a US Dollar and I think about our finances mainly in Australian Dollars of course, so it makes sense to report in Australian Dollars. The Australian Dollar fell further this month from $US0.8928 to $US0.8742. This depressed gains in net worth in US Dollar terms. Net worth fell $1k to $1.099 million in Australian Dollars and fell $US21k to $US961k. The monthly accounts (in AUD now) follow:

Other income is income not from investments or retirement contributions. It was normal this month at $15.4k. Spending was about average this month at $6.0k with $5.3k in core non-work related expenditure. In other words, not including stuff that we will get refunded. As a result, we saved $9.4k from regular income. Retirement contributions were also at the typical monthly rate.

We lost $15k on investments. There was a gain due to the fall in the AUD of $2.8k. Most of the loss was in retirement accounts. The rate of return for the month was -1.36% in AUD terms or -3.41% in US Dollar terms. The MSCI lost 3.98%, the S&P500 3.46%, and the ASX 200 lost 3.03% - the first two indices are in USD terms and the latter in AUD. So, we beat the market. Actually, I am recently seeing better performance on market declines than has been the case in the past.

I sold some shares in Platinum Capital as they are overvalued and some international share fund units. I bought some shares of Clime Capital and other Aussie stock funds. Overall this resulted in a bit of de-leveraging as cash continued to pile up and I reduced debt. Total leverage fell from 32.9% to 30.1%. Looking a the returns on asset classes, large cap Australian shares lost 2.43% and large cap US stocks 2.3%. By contrast, hedge funds (mainly Platinum Capital) gained 3.21%.

Other income is income not from investments or retirement contributions. It was normal this month at $15.4k. Spending was about average this month at $6.0k with $5.3k in core non-work related expenditure. In other words, not including stuff that we will get refunded. As a result, we saved $9.4k from regular income. Retirement contributions were also at the typical monthly rate.

We lost $15k on investments. There was a gain due to the fall in the AUD of $2.8k. Most of the loss was in retirement accounts. The rate of return for the month was -1.36% in AUD terms or -3.41% in US Dollar terms. The MSCI lost 3.98%, the S&P500 3.46%, and the ASX 200 lost 3.03% - the first two indices are in USD terms and the latter in AUD. So, we beat the market. Actually, I am recently seeing better performance on market declines than has been the case in the past.

I sold some shares in Platinum Capital as they are overvalued and some international share fund units. I bought some shares of Clime Capital and other Aussie stock funds. Overall this resulted in a bit of de-leveraging as cash continued to pile up and I reduced debt. Total leverage fell from 32.9% to 30.1%. Looking a the returns on asset classes, large cap Australian shares lost 2.43% and large cap US stocks 2.3%. By contrast, hedge funds (mainly Platinum Capital) gained 3.21%.