In the second half of 2023 I stopped writing monthly reports on this blog because each month's accounts had large errors.* But now I have got the errors down to not more than $500 in any one month and 0.01% of the portfolio for the year as a whole. Our private investments have all also reported their results for the year. So, now we can compute reasonably accurate annual and monthly accounts for the year.

Overview

Investment returns were positive and net worth again increased. But I was disappointed that we underperformed the target portfolio and were far behind the gains in stock indices. So, we also fell short of the net worth projection I made in the 2022 report. In the first half of the year, I spent quite a lot of time on my new hobby of researching my family tree. In the second half of the year I was working hard on teaching. I do all my teaching in the second semester now. In the second half of the year I also took on a new editorial role that will keep me busy over the next three years. We took a vacation at Coogee Beach in Sydney in January and I made a couple of short business trips to Melbourne in March and the end of November. Maybe in 2024 we will finally travel overseas again...

All $ signs in this report indicate Australian Dollars. I'll do a separate report on individual investments. I do a report breaking down spending after the end of the financial year.

Investment Return

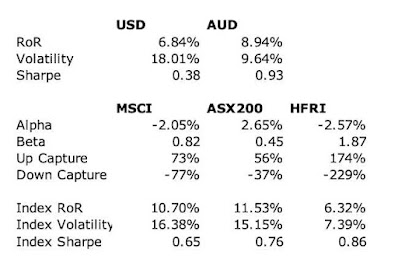

In Australian Dollar terms we gained 5.6% for the year while in USD terms we gained 5.9%. The Australian Dollar didn't move much over the year. The MSCI gained 22.8% and the S&P 500 26.3% in USD terms while the ASX 200 gained 14.4% in AUD terms. The HFRI hedge fund index gained 7.3% in USD terms. Our target portfolio gained 10.8% in AUD terms. So, we under-performed all benchmarks.

This chart compares our portfolio to the benchmarks in Australian Dollar terms over the year:

This is really not good. The following chart shows monthly returns in Australian Dollar terms:

We beat the target portfolio in four of the twelve months, but the eight months where we under-performed dragged down returns for the year.

Here are annualized returns over various standard periods:

We beat the HFRI over 5 to 20 year horizons but otherwise we under-perform, though we are quite close to the target portfolio over 3 and 5 year horizons.

Here are the investment returns and contributions of each asset class in 2023 in currency neutral and unlevered terms:

The contributions to return from each asset class sum to the total portfolio return. The portfolio shares are at the beginning of the year. Not surprisingly, US stocks did best followed by gold, Australian large cap, and private equity. The latter contributed the most to total return mainly due to the stellar performance of 3i (77.8% for the year). Australian small cap and rest of the world stocks had negative returns. Thankfully, they take up small shares of the portfolio. Returns from hedge funds were particularly disappointing despite a strong performance by Pershing Square Holdings (24.4% for the year), which is our largest hedge fund allocation.

Investment Allocation

There were no large changes in asset allocation over the year:

Mainly, relative exposure to hedge funds fell, as exposure to private equity and real assets rose.

Accounts

Here are our annual accounts in Australian Dollars:

Percentage changes are for the total numbers. There are lots of quirks in the way I compute the accounts, which have gradually evolved over time. There is an explanation at the end of this post.

We earned $178k after tax in salary etc. Total non-investment earnings including retirement contributions were $210k, up 14% on 2022. The result is likely driven by lower net tax. We gained

(pre-tax including unrealized capital gains) $154k on non-retirement

account investments. A small amount of the gains were due to the fall in the Australian Dollar (forex). We gained $130k on retirement accounts with $31k in employer retirement contributions. The value of our house is estimated to have risen by $33k. As a result, the investment gains totaled $317k and total income $527k.

Total spending (doesn't include mortgage payments) of $151k down 1.3% on last year. It looks like my efforts to cut spending are working. We saved $28k from

salaries etc. before making a concessional contribution of $20k to the SMSF. So, current net worth increased by $132k.

$31k of the current

pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. Taxes on superannuation returns are just estimated because, apart from tax paid by the SMSF, all we get to see are the after tax returns. I estimate this tax to make retirement and

non-retirement returns comparable. The total estimated tax on superannuation was $40k. Net worth of retirement accounts increased by $141k after the transfer from current savings. With the gain in the value of our house, total net worth increased by $306k.

Projections

Last year my baseline projection for 2023 (best case scenario) was for an 11.2% investment rate of return in AUD terms, an 11% nominal increase in spending, and about a 3% increase in other income, leading to an $550k increase in net worth to around $6.5 million or a 9% increase. Net worth only increased by just over half of this due to much lower than predicted investment returns. On the other hand, spending actually fell despite high inflation and non-investment income rose.

The best case scenario for 2024 is flat spending at $151k, an investment return of 10%, and probably a 3% increase in non-investment income, resulting in a 8% increase in net worth of $500k to $6.7 million.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then

the other two are fairly self-explanatory. However, property taxes etc. are included in the

current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells in the spreadsheet that might again be used in the future.

Current other income is reported after

tax, while investment income is reported pre-tax. Net tax on investment

income then gets subtracted from current income as our annual tax refund

or extra payment gets included there. Retirement investment income gets

reported pre-tax too while retirement contributions are after tax. For

retirement accounts, "tax credits" is the imputed tax on investment

earnings which is used to compute pre-tax earnings from the actual

received amounts. For non-retirement accounts, "tax credits" are actual franking credits

received on Australian dividends and the tax withheld on foreign

investment income. Both of these are included in the pre-tax earning but

are not actually received month to month as cash....

For current accounts "core

expenditure" takes out business expenses that will be refunded by our

employers and some one-off expenditures. This year, I didn't bother to note these, which amounted to about $1,000. "Saving" is the difference

between "other income" net of transfers to other columns and spending in

that column, while "change in net worth" also includes the investment

income.

* The error is the difference between two different ways of computing the profit or loss from changes in exchange rates for the month. The two methods should give the same result, but they don't when there are errors in the accounts.

.png)