I invested in the APSEC hedge fund back in 2020 just after they outperformed strongly in the COVID19 crash. They have managed to about match the ASX 200 over time with somewhat lower volatility:

They tend to outperform in bear markets and under-perform in bull markets. Since investing, I have only gotten a 5.9% internal rate of return, which is below average. The median IRR of my current investments is 9%. I would have done better by investing more in the Aspect Diversified Futures Fund instead, which has similar hedging properties, where I have had a 22% IRR. We have 2.47% of net worth in the fund all of it within the SMSF. I submitted a redemption notice for all of our holding today.Friday, April 12, 2024

Tuesday, February 20, 2024

When Does Our Investment Strategy Add Value?

EnoughWealth wonders if our investment strategy only adds value under certain market conditions. As a first step let's look at when the out-performance relative to the 60/40 portfolio happened:

The graph simply takes away the monthly return on the Vanguard 60/40 portfolio from Moom's actual results. We see there are periods of out- and under-performance throughout the period. Not surprisingly, it was weaker in 2023 in particular. I didn't do well in implementing the target portfolio strategy last year. Here is a graph comparing the performance of this theoretical portfolio and the Vanguard portfolio:

This looks more consistent. This portfolio is theoretical because it consists of a mix of actual investible funds and non-investible indices.

Bottom line, is I think it is a good idea to add things like managed futures, gold, real estate etc to your portfolio. It makes a real difference.

Saturday, February 10, 2024

Updating Target Asset Allocation

Not sure when I last posted about our target asset allocation, as I have tweaked it since this 2021 post. I am tweaking it again to reflect continuing new allocations to private equity (venture capital, buyout funds, and SPACs).

Overall we still have a 60% equity allocation. Now 20% of that will be the target for private equity, 20% hedge funds, and 20% long equity. Among the latter, 11% allocated to Australia and 9% to foreign shares. Within Australia, 6% is allocated to large cap and 5% to small cap. Within foreign equity, 5% to the US and 4% to the rest of the world.

Among the 40% allocated to other assets, 15% is allocated to real assets including real estate, art, water rights etc., 5% to bonds (including private credit), 10% to managed futures, 10% to gold.

The benchmark target portfolio splits the private equity component 50/50 between venture capital and buyout. It also allocates all the Australian exposure to the ASX200 and all the real asset allocation to a specific (mainly US) real estate fund. All the managed futures is allocated to Winton in the benchmark. Maybe I should try harder on this benchmark, but this seems good enough for my purposes.

Monday, January 08, 2024

Contributions to Annual Return

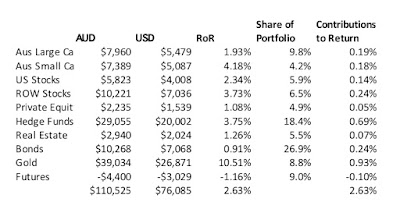

I haven't formally finalized the accounts for 2023 yet. I will need to wait to get investment returns on illiquid investments that report with a long time lag. But I do have a preliminary estimate of 6.38% in AUD terms (6.64% in USD terms). This is rather disappointing as the MSCI returned 22.81%, the S&P 500 26.27%, and the ASX 200 14.45%. Our target portfolio returned 10.84%. So, why did we underperform the target by so much? The following tables analyze the returns of each portfolio:

RoR is the rate of return of the asset class and contribution is the rate of return multiplied by the share of the portfolio. The sum of contributions gives the portfolio return. The returns for the Moom portfolio are in currency neutral and unlevered terms and, so, differ slightly from the Australian Dollar return for the portfolio. The asset classes don't quite match, but it's close enough.

The target portfolio got 2.48% returns from international stocks. The return I got from US stocks at 15.8% was less than the MSCI index at 22.5% but more importantly, my allocation to other countries resulted in a negative return and so the total contribution from international stocks was only 0.89%.

The target portfolio got 1.73% returns from Australian stocks. Again, my return from Australian large caps was a bit lower than that of the ASX 200 but my allocation to small cap stocks had a negative return and so the overall contribution was only 0.49%.

The target portfolio represents managed futures using the Winton Global Alpha Fund. This gave a contribution of 0.59%. I also allocated to the Aspect Diversified Futures Fund and Australian Dollar futures. These dragged down returns resulting in a contribution of only 0.18%.

The target portfolio obtained a 1.61% contribution from hedge funds (based on the HFRI index), while I only got 0.25%. Though some funds like Pershing Square did very well, other Australian hedge funds under-performed.

Real Assets is the area where I outperformed. I represent this in the target portfolio using the TIAA Real Estate Fund. My allocations to other real assets resulted here in a small gain rather than a large loss.

Bonds and gold made a similar contribution to each portfolio. Finally, venture capital made an outsized contribution to the target portfolio of 4.38%. My venture capital investments lost money overall in 2023. I did much better than the target portfolio in buyout investments like 3i. But this wasn't sufficient to match the target portfolio's overall private equity contribution.

I think there is some luck here. In a different year, non-US stocks or Australian small caps might perform well. On the other hand, I also need to eventually reduce some of my allocations to Australian hedge funds that have under-delivered.

Sunday, April 09, 2023

March 2023 Report

In March, stock markets rebounded. The MSCI World Index (USD gross) rose 3.15% and the S&P 500 3.67% in USD terms, while the ASX 200 only gained 0.25% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6740 to USD 0.6695. We gained 0.55% in Australian Dollar terms but lost 0.15% in US Dollar terms. The target portfolio gained 1.84% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 1.47% in US Dollar terms. So, we only out-performed the ASX200.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I then add in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return. We underperformed the target portfolio benchmark because of negative returns on international stocks and hedge funds as well as negative returns on Australian small caps. We lost on US stocks because of a very negative return from Hearts and Minds (HM1.AX) offsetting positive returns on other US holdings.Gold was the main positive contributor to returns and the highest returning asset class while futures were the largest detractor and worst performing asset class. The trend-following managed futures funds got caught in the sudden movement in US bonds during the month associated with the banking crisis.

Things that worked well this month:

- Gold gained AUD 54k - the biggest monthly gain in a single investment since I started investing.

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost AUD 11k. Followers up were: Pershing Square Holdings (PSH.L, -10k), Aspect Diversified Futures (-9k), Hearts and Minds (HM1.AX, -9k), and Winton Global Alpha (-8k).

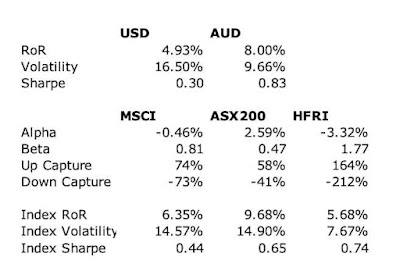

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture, positive alpha, and higher Sharpe Ratio against the ASX200 but not the USD benchmarks. We are performing about 3.6% per annum worse than the average hedge fund levered 1.76 times. Hedge funds have been doing well in recently.We are now very close to our target allocation but we mived away from it quite sharply during the month. In particular, real assets increased as we added to URF.AX and it rose, while private equity fell as we took profits in PE1.AX. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I sold 100 China Fund (CHN) shares.

- I sold 3,500 WAM Leaders (WLE.AX) shares.

- I sold 10k MCP Income Opportunities (MOT.AX) when the price spiked back up to AUD 2.10.

- I bought 12k shares net of Cordish-Dixon Private Equity Fund 3 (CD3.AX).

- I did a losing trade in bond futures.

Sunday, March 05, 2023

February 2022 Report

In February, stock markets fell again. The MSCI World Index (USD gross) fell 2.83% and the S&P 500 2.44% in USD terms, while the ASX 200 lost 2.25% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.7113 to USD 0.6740. We also lost money: 0.47% in Australian Dollar terms or 5.69% in US Dollar terms. The target portfolio gained 0.72% in Australian Dollar terms and the HFRI hedge fund index is expected to lose about 0.83% in US Dollar terms. So, we out-performed the ASX200 but under-performed all the other benchmarks.

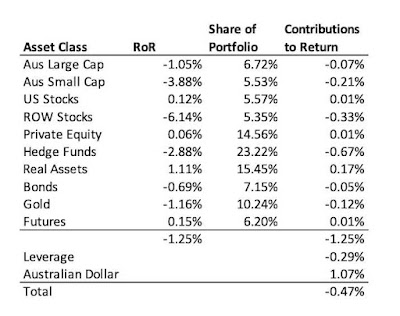

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I then add in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return. One reason that we underperformed the target portfolio benchmark is the very negative returns we got for rest of world stocks and to a lesser degree hedge funds. The Australian Dollar cash price of gold was breakeven for the month, so I also don't understand why PMGOLD.AX lost value, especially as I bought some extra shares during the month at a price that was lower than the end of month price...Real assets were the main positive contributor to returns and the highest returning asset class while hedge funds were the largest detractor.

Things that worked well this month:

- URF.AX (US residential real estate) was the biggest gainer adding AUD 11k, followed by two managed futures funds: Winton Global Alpha (9k) and Aspect Diversified Futures (6k).

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost AUD 30k. The next worse were the China Fund (CHN, -19k) and Australian Dollar Futures (-15k).

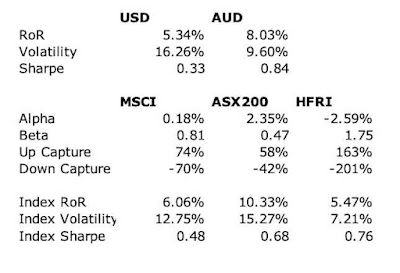

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture, positive alpha, and higher Sharpe Ratio against the ASX200 but not the USD benchmarks. We are performing about 3.3% per annum worse than the average hedge fund levered 1.77 times. Hedge funds have been doing well in recently.We are now very close to our target allocation but we mived away from it quite sharply during the month. In particular, real assets increased as we added to URF.AX and it rose, while private equity fell as we took profits in PE1.AX. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I bought 1,000 shares of the gold ETF, PMGOLD.AX.

- I sold 4,000 shares of WAM Leaders (WLE.AX).

- I sold 59,976 shares of Pengana Private Equity (PE1.AX).

- I bought 29,638 shares of the Cordish-Dixon private equity fund CD3.AX.

- I bought 25,000 shares of MCP Income Opportunities private credit fund (MOT.AX).

- I bought 65,000 shares of URF.AX (US residential real estate).

Wednesday, March 01, 2023

January 2022 Report

In January, stock markets rebounded. The MSCI World Index (USD gross) gained 7.19% and the S&P 500 6.28% in USD terms, and the ASX 200 gained 6.23% in AUD terms. All these are total returns including dividends. The Australian Dollar rose from USD 0.6816 to USD 0.7113. We gained 2.21% in Australian Dollar terms or 6.66% in US Dollar terms. The target portfolio rose 1.45% in Australian Dollar terms and the HFRI hedge fund index around 2.8% in US Dollar terms. So, we out-performed the S&P 500, the HFRI, and our target portfolio and under-performed the others.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have added in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return.

All asset classes had positive returns. Private equity was the largest contributor to returns Followed by hedge funds, while RoW stocks had the highest return.

Things that worked well this month:

- 3i (III.L) rose strongly, gaining AUD 22k. Tribeca (TGF.AX 18k), Unisuper (15k), PSSAP (14k), China Fund (CHN, 13k), and Hearts and Minds (HM1, 10k) all contributed more than AUD 10k.

What really didn't work:

- Three managed futures funds all lost money, with Winton Global Alpha losing the most (AUD 4k).

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The MSCI is reported in USD terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We have a higher Sharpe Index than the ASX200 but lower than the MSCI in USD terms. We are performing about 2.6% per annum worse than the average hedge fund levered 1.75 times. Hedge funds have been doing well in recently.

We are now very close to our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition, we made the following investment moves this month:

- I bought 1,000 shares of the China Fund, CHN.

- I bought 3,000 shares of Ruffer Investment Company, RICA.L.

Friday, September 30, 2022

Classic Case of Bad Market Timing

At the beginning of the 2020-21 financial year the Macquarie Winton Global Alpha Fund (managed futures) had AUD 1.27 billion in assets. It only returned AUD 1 million that year and had been performing weakly for a while. In the 2020-21 financial year there were net redemptions of AUD 829 million. Then in 2021-22 it made AUD 80 million. There were still net redemptions of AUD 194 million this year and the fund is down to AUD 324 million in assets.

Saturday, August 27, 2022

Moominpapa's 2021-22 Taxes

This year, I've prepared our tax returns earlier than usual as I have already received all the required information. Here is a summary of my taxes. Last year's taxes are here. To make things clearer, I reclassify a few items compared to the actual tax form. Of course, everything is in Australian Dollars.

On the income side, Australian dividends and franked distributions from managed funds are again up strongly. My salary still dominates my income sources but only increased by 3%.

A big chunk of foreign source income is from the distribution from Aspect Diversified Futures Fund. As a result, I am moving that holding into the SMSF. Net capital gain is zero due mainly to some strategic sales ton generate losses. I am carrying forward $99k in capital losses, which is double what was brought forward from last year.

In total, gross income grew 8%.

Deductions fell 47% because last year they included the loss on Virgin Australia bonds. Most deductions are interest including the $14k in other deductions.

Net income rose as a result by 26%.

Gross tax is computed by applying the rates in the tax table to the net income. In Australia, you don't enter the tax due in your tax return, but I like to compute it so that I know how big or small my refund will be.

Franking credits (from Australian dividends), foreign tax paid, and the

Early Stage Venture Capital (ESVCLP) offset (none this year as there were no capital calls from Aura) are all deducted from gross

tax to arrive at the tax assessment.

Estimated assessed tax rose 47%.

I estimate that I will pay 28% of net income in tax. Tax was withheld on my salary at an average rate of 31%. I already paid $6,546 in tax installments and so estimate that I need to pay an additional $2,829 in tax.

Monday, June 14, 2021

Investments Review: Part 8, Managed Futures

Managed futures have not performed well in recent years, but I am betting that they will make a bit of a comeback.

Macquarie Winton Global Alpha Fund. Share of net worth: 3.53%. IRR: -0.3%. This is a Macquarie Bank fund that provides access to the Winton fund management firm. Winton, Aspect, and Man AHL are all offshoots of the same original Adam, Harding, and Lueck team. Our profits in this fund peaked in August 2019 at AUD 29k and then fell to a minimum of AUD -19k in November 2020. Since then they have recovered to near break even.

Aspect Diversified Futures. Share of net worth: 2.04%. IRR: n.a. We hold this recent investment via the Colonial First State platform. It has performed better than Winton recently:

Sunday, May 16, 2021

Third Point and AlphaSimplex

I don't write much on the blog about investments I evaluated but rejected. There are quite a lot of these, of course. Recently, I evaluated and rejected Third Point and AlphaSimplex. Third Point is a well-known hedge fund managed by Daniel Loeb. Retail investors can invest in it through TPOU.L a closed-end fund on the London stock exchange. AlphaSimplex is a managed futures manager based in Boston that developed out of MIT. U.S. retail investors can invest with them through mutual funds issued by Natixis Funds. ASFYX has a USD 100k minimum and a lower expense ratio than AMFAX which has a low minimum investment. Non-U.S. investors can access them via Luxembourg based funds. There are institutional (USD 100k minimum and lower management fee) and retail classes (USD 1k minimum and higher management fee) and the funds are available in various currencies. Even the Australian Dollar! Kathryn Kaminski, their chief research strategist, was just on Meb Faber's podcast.

So, is this fund any good? And what about Third Point? Both these investments were interesting enough for me to do some proper analysis on them. These are some results using annual returns:

The period of analysis is the length of the track record provided by AlphaSimplex. All returns are in U.S. Dollars. None of this analysis deducts the risk-free-rate from returns. My returns in U.S. Dollars are not very good over the last ten years. In Australian Dollar terms they are much better.

So, it turns out that using annual data AlphaSimplex has a beta of 0.34 to the MSCI World Index and no alpha. Its correlation with the market is 0.4. Its average return was just 3.4% with a Sharpe ratio of 0.3. The Winton Global Alpha Fund has had similarly poor returns but actually has a negative beta and positive alpha. Before the 2020 debacle, Winton was a lot better than AlphaSimplex. I'm definitely not sold on AlphaSimplex.

Third Point is more attractive. However, it acts more or less like a good quality long-only fund. It's correlation with the MSCI is 0.92. It has an alpha of 1.4%. I added Pershing Square Holdings as a comparison. It has a much lower correlation to the market though it has a beta of 1.04. With an alpha of 4.3% it adds much more uncorrelated return. So, I haven't found Third Point convincing enough to add to the portfolio.

Monday, May 03, 2021

April 2021 Report

This month we completed the initial investments in our self-managed superannuation fund (SMSF). I stopped systematic trading for the moment. We also reached a big round net worth number in Australian Dollar terms. But once I raised the value of our house to reflect a recent sale in our neighborhood, I realised we would have actually reached that number in February.

The Australian Dollar rose from USD 0.7612 to USD 0.7725. It was another month of increases in world stock markets. The MSCI World Index rose 4.41%, the S&P 500 by 5.34%, and the ASX 200 rose 3.48%. All these are total returns including dividends. We gained 2.54% in Australian Dollar terms or 4.06% in US Dollar terms. The target portfolio is expected to have gained 1.76% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 2.07% in US Dollar terms. So, we outperformed these benchmarks and did OK vs. the MSCI. Here is a report on the performance of investments by asset class (currency neutral terms):

Hedge funds added the most to performance and only Australian small cap had a negative return. Things that worked well this month:- Tribeca Global Resources was the largest contributor in dollar terms contributing AUD 21k. Gold bounced back, contributing AUD 15k. Unisuper, Cadence Capital, and Pershing Square Holdings all also contributed more than AUD 10k. Other notable strong performers were URF.AX (NY/NJ residential real estate), 3i (UK private equity), and soybeans.

- The worst performers were Hearts and Minds (HM1.AX) and Domacom (DCL.AX).

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and

Australian Dollar terms. The following four lines compare performance

against each of the three indices. We show the desired asymmetric capture and positive alpha against the ASX200 index. Against the MSCI World Index we could be doing better and we are doing a little worse than the median hedge fund levered 1.6 times.

We moved decisively towards our desired long-run asset allocation again as I implemented our SMSF investments. In October 2018, when we received the inheritance we were 48 percentage points away from our target allocation at the time. Now we are less than 6 percentage points away. We compute this by calculating the Euclidean distance between the target and actual allocation vectors. This is the square root of the sum of squared differences between the actual and target allocations for each asset. Real assets is the asset class that is now furthest from its target allocation (4.6% of total assets too little):

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. This was a very busy month. I'm only recording net changes here:- Australian large cap: I invested in Argo Investments again.

- Hearts and Minds (HM1.AX): I bought back 20k shares I had sold a while ago at higher prices. This is a long only global equities fund.

- Hedge funds: I increased our holding of Regal Funds (RF1.AX). This wasn't intentional, but I didn't get the price I wanted in exiting part of our holding in a regular brokerage account while also establishing a position in the SMSF.

- Private equity: I increased our holding of the Pengana private equity fund (PE1.AX).

- Bonds: Our Medallion Financial baby bond matured and we bought shares in Scorpio Tankers, Star Bulk Carriers, and Ready Capital baby bonds, increasing our net holdings of US corporate bonds by USD 50k. We also bought shares in the Australian MCP Income Opportunities Trust (MOT.AX).

- Art: I invested in another painting at Masterworks.

- Real estate: I invested in the Domacom and Australian Unity Diversified Funds. I also doubled our holding of URF.AX (NY/NJ residential property).

- Futures: I successfully closed a calendar spread trade in soybeans and stopped systematic trading of ASX futures.

Friday, April 02, 2021

March 2021 Report

This month we took some big steps towards fully setting up our self-managed super fund. Trading didn't go well, but I persisted, following the rules exactly. We also reached a big round net worth number in Australian Dollar terms.

The Australian Dollar fell from USD 0.7737 to USD 0.7612. The MSCI World Index rose 2.72%, the S&P 500 by 4.38%, and the ASX 200 rose 2.74%. All these are total returns including dividends. We gained 1.46% in Australian Dollar terms but lost 0.17% in US Dollar terms. The target portfolio is expected to have gained 2.00% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 1.30% in US Dollar terms. So, we strongly underperformed all our benchmarks. Here is a report on the performance of investments by asset class (currency neutral terms):

Hedge funds added the most to performance and gold detracted the most. Things that worked well this month:- Three hedge funds: Cadence Capital (AUD 20k), Regal Funds, and Platinum had the largest gains this month in absolute terms. Cadence benefited from its investment in Deepgreen metals. Domacom gained 21% or AUD 7.5k.

- Gold lost the most in dollar terms (AUD 11k) with Hearts and Minds (HM1.AX) and the China Fund (CHN) following up. Trading the ASX200 lost the fourth largest amount AUD 6k.

I thought it'd be interesting to look at the twelve month performance since the end of March 2020 when the stock market bottomed:

Portfolio shares are as at the end of March and gains are the dollar gain since March divided by the value at the end of March. Hedge funds are again the star performer, but Aussie small caps did surprisingly well.The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices. We show the desired asymmetric capture and positive alpha against the ASX200 index.We moved sharply away from our desired long-run asset allocation. Rolling over my retail superannuation funds to the SMSF resulted in a big rise in cash. Cash is the asset class that is furthest from its target allocation (12% of total assets too much) followed by real assets (7% too little):

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also

retirement contributions. Other moves this month:

- Our SMSF received all approvals, and I rolled over my Colonial First State super funds to the SMSF, made an AUD 15k contribution to the fund, and applied for a brokerage account.

- Ready Capital called their baby bonds early, reducing our bond exposure by another USD 25k.

- I continued systematically daytrading ASX200 CFDs and futures.... Daytrading experienced a strong drawdown. I lost as much (including slippage) as the algorithm did (not including slippage) despite using a smaller position size, mainly because of one bad trade where Plus500 got me into the opposite direction trade than I should have been in. The trade in the wrong direction triggered near the open, when in the futures market you would have got into a trade in the right direction later in the day.

- I started a calendar spread in soybeans futures. Soybeans are very strongly backwardated when usually they should be in contango. I am betting that the November and May prices will converge. They went the wrong way in March but on 1st April moved very sharply in my favor.

- I invested USD 10k in another painting at Masterworks. I now have USD 70k invested in 7 paintings.

- I bought 15,000 Cadence Capital shares (CDM.AX) @ $1.045 per share when they announced that their pre-IPO investment in DeepGreen Metals was being acquired by a SPAC and would list on the NYSE. The current share price of Cadence gives you this investment for free.

- I sold 10,000 shares of Hearts and Minds (HM1.AX) @ $4.78 a share. The shares are trading at a large premium to the NAV and I felt that some of their recent picks of growth and tech stocks perhaps peaked. I still hold 25k shares.

- I sold half our Treasury Wine (TWE.AX) position @ $11.15 a share. Now it is down to 1% of the portfolio again, which is the default allocation for an investment in a single company.

- I bought 2000 shares of Perth Mint Gold (PMGOLD.AX) @ $22.44 and 22.56 per share. Our allocation to gold fell below the long-term weight. It is now almost exactly at 10% of gross assets.

Tuesday, March 02, 2021

February 2021 Report

The month ended quite turbulently, but stock markets were still up for the month. The Australian Dollar rose from USD 0.7663 to USD 0.7737. The

MSCI World Index rose 2.35%, the S&P 500 by 2.76%, and the ASX 200

rose 1.65%. All these are total returns including dividends. We gained 1.65% in Australian Dollar terms or 2.68% in US Dollar terms.

The target portfolio is expected to have gained only 0.23% in Australian

Dollar terms and the HFRI hedge fund index is expected to gain 1.05% in

US Dollar terms. So, we outperformed or matched all our benchmarks. The S&P 500 isn't a benchmark.

- Tribeca Global Resources (TGF.AX), Regal Funds (RF1.AX), and Hearts and Minds (HM1.AX) were the top three performers gaining AUD 20k, 18k, and 11k, respectively. In other notable gains, we gained AUD 5k in Treasury Wine (now a 2% of net worth position) and Winton Global Alpha gained for a change, up AUD 3k.

- Gold was the worst performer, giving back AUD 30k of gains.

We moved further towards our long-run asset allocation. Real assets (real estate and art) are the asset class that is furthest from their target allocation (7.2% of total assets too little) followed by bonds (2.9% too much):

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also

retirement contributions. Other moves this month:

- I sold my USD 25k of Virgin Australia bonds for 8.125 cents on the dollar. With Australian borders closed longer than we would have expected at the beginning of the year, I guess the company's financial situation will be worse than they expected when they told us we would likely get 9 cents.

- Prospect Capital called its baby bonds (PBB) early, resulting in another USD 25k reduction in our bond exposure.

- I started systematically daytrading ASX200 CFDs and futures.... I made a little money, just under AUD 600. I also started trading soybean futures using my version of the turtle model. This system doesn't trade that often. It made one trade which was stopped out for a loss.

- Two days before the earnings release, I sold 2000 of our Treasury Wine shares (TWE.AX) as I was anticipating some turbulence. The next day the price fell sharply and I bought them back almost a dollar lower. By the end of the day the price recovered. On the earnings day not much happened. Then the day after earnings the stock price rose 17% on a broker upgrade and a positive article in the Fin Review. After that there was more turbulence and I adjusted the positions a little

- I invested USD 10k in another painting at Masterworks. I now have USD 60k invested in 6 paintings.

Monday, February 01, 2021

Trading Once Again

Just over a year ago, I decided to stop systematic trading. This wasn't the first time. The problem with my trading systems was that they were overfitted to the data. They worked well for a while but then didn't. I did try one similar approach that is not tuned to the data. Yes, I said that this wasn't for me. But then over this weekend, I thought: "Maybe it is?" :) So, I downloaded a bunch more data and did backtests. It would have done especially well during the COVID-19 crash and OK in other months in the last year. So, I decided to try it today again. I used the Plus500 account, which I had decided to shutdown but hadn't managed to do yet. At least this allowed me to trade a smaller position - only AUD 10 per SPI point. The full size futures contract is AUD 25 per point. Well, I was stopped out for a AUD 960 loss... In the backtesting, getting stopped out is fairly unusual. Initially, the market fell and the short trade was profitable. Then it reversed and had a steep rally.

Most losing trades have to be manually closed at the end of the day. So bad luck on my first trade. I'll try a few more and see how I go...

Saturday, October 03, 2020

September 2020 Report

- Bluesky Alternatives (soon to be Wilson Alternative Assets) gained AUD 13.5k followed by Regal Funds (AUD 10.4k) and Cadence Capital (AUD 7.4k).

- Gold fell the most (- AUD 16.6k).

- I bought 100k of Australian Dollars by selling US Dollars.

- Woolworths (USD 25k) and Nustar (16k) bonds matured.

- I invested USD 10k in a painting at Masterworks.

- I bought 22,136 Domacom shares (DCL.AX) at 6.6 cents each. The company announced a deal that might get them about halfway from here to profitability.

- I bought 25,000 Bluesky Alternatives shares (BAF.AX).

- I bought another 1,000 shares of the IAU gold ETF.

- I was stopped out of the short 10 year treasuries futures position.

- We reduced our Commonwealth Securities margin loan by another AUD 90k to AUD 92k. Ultimately, I plan to borrow mainly from Interactive Brokers who have a much lower interest rate and only use the Commsec margin loan or our home mortgage facility when there are particularly good opportunities.

Friday, September 04, 2020

August 2020 Report

Things that worked well this month:

- Regal Funds (RF1.AX) was the top performer, up AUD30k, closely followed by Bluesky Alternatives (BAF.AX, 22k), and Hearts and Minds (HM1.AX, 19k).

- Domacom (DCL.AX) doubled in price from 4 to 8 cents. Half my position was bought at 2 cents a share. But then the company voluntarily suspended its quotation pending an announcement about a major transaction. The trading halt started on 19 August and there is still no news, though the company did release its annual report.

- The Aura Venture Fund reported that it performed very well in the June quarter. In retrospect, it was easily the best performing investment that month.

- Winton Global Alpha Fund continued to lose money. The fund announced that a special meeting of unitholders will consider broadening the strategy and lowering the fees.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- I bought small positions in URF.AX, CDM.AX, RF1.AX, TGF, AX, and PE1.AX in my Commsec account (for a total of 1% of net worth roughly) with the aim of getting better tax information on distributions than provided by Interactive Brokers.

- I bought 13,719 shares of Platinum Capital.

- I bought 25,000 shares of Bluesky Alternatives and 1000 shares of 3i to increase our private equity position a little.

- I opened an account with Masterworks and bought 500 shares in my first painting for USD 10k.

- USD25k of Goodyear bonds, USD25k of Safeway bonds, and USD28k of Xerox bonds matured.

- I bought net AUD 60k and GBP 14k and sold net USD 61k.

- I closed the 2 year-10 year US treasuries September futures spread and shorted 1 contract of December 10 year bonds futures.

Monday, August 17, 2020

Adjusting the Target Portfolio

Given the continued underperformance of managed futures, I think I am going to again lower my allocation to this asset class to 5% from 10%. I've never gotten above 5% in managed futures funds anyway. In place of this, I could raise the allocation to real estate to 15% or raise both real estate and gold to 12.5%. Or is there something else I should allocate capital to?

Wednesday, August 05, 2020

July 2020 Report

The returns reported here are in currency neutral terms. Gold performed best and futures worst. Gold contributed most to the total return.

Things that worked well this month:

- Gold gained AUD 39k as the metal hit a record high. It is now our fourth best investment ever in dollar terms. Only the CFS Geared Share Fund and the Unisuper and PSS(AP) superannuation funds have made us more money.

- Tribeca was the next best performer gaining AUD 15k.

- Pengana Private Equity lost AUD 4k.

- My Virgin Australia bonds lost AUD 3k. In the coming month we'll find out how much they are really worth.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- We participated in the Pengana Private Equity (PE1.AX) rights issue buying 18,000 shares.

- I bought AUD 50k of Australian Dollars and used 40k to reduce my margin loan at CommSec.

Thursday, July 02, 2020

June 2020 Report

The Australian Dollar rose from USD 0.6647 to 0.6884. The MSCI World Index rose 3.24%, the S&P 500 1.99%, and the ASX 200 2.66%. All these are total returns including dividends. We lost 0.65% in Australian Dollar terms and gained 2.91% in US Dollar terms. The target portfolio is expected to have gained 0.59% in Australian Dollar terms and the HFRI hedge fund index 1.26% in US Dollar terms. So, we came close to the MSCI return and outperformed HFRI but underperformed the Australian Dolar benchmarks. Despite my attempts to diversify, returns during this crisis have closely matched the MSCI World Index:

Here is a report on the performance of investments by asset class:

Things that worked well this month:

- Regal Funds gained AUD 17k. We are now back in the black on this investment.

- Gold gained AUD 12k.

- Tribeca Global Resources lost AUD 20k, though it's still above the March low...

- Pengana Private Equity lost AUD 10k. It was at an unsustainable high level and then a rights issue at a much lower level was announced. So, this is actually OK I think.

On a regular basis, we invest AUD 2k monthly in a set of managed funds, and there are also retirement contributions. Other moves this month:

- I sold USD 5k of Tupperware bonds. I probably acted too quickly on that one.

- I bought 12,000 shares of Tribeca Global Resources. Probably a mistake too.

- I bought AUD 35k of Australian Dollars.

- I sold 20,000 shares of Pengana Private Equity (PE1.AX) and then bought back 40,000 shares at lower prices. I also subscribed to the rights issue.