But setting stops is very tricky. If they are too close to the current price they will get hit all the time unnecessarily. Too far away and you lose too much money before the stop is triggered. For the moment I am sticking with 1.25% but adding two rules:

1. If the price comes back to the stop I should re-enter the trade. The 1.25% stop means that only powerful moves will trigger the stop. If those reverse sufficiently to return to the stop then the reversal is probably serious. This rule would have added a little less than 4% to returns in 2003 the one year I have tested fully.

2. If the next day's forecast suggests a trade in the opposite direction to the current trade then you should reverse to the opposite position at the stop. This adds more than 30% of compounded returns in 2003. I know it is hard to believe that - but it is true - it lets you get in on the beginnings of powerful new moves.

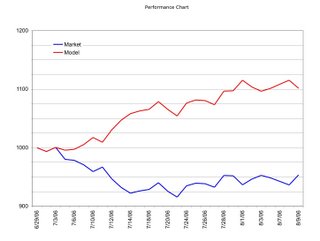

This chart shows the model's performance to date relative to the NASDAQ 100 index, assuming $1000 was invested in both at the close of trade on 29 June, and assuming no commissions, no spreads, and no leverage. Given the high rate of return a little leverage could offset the trading costs anyway:

2 comments:

mOOm,

how do trading costs effect you when you're stops are at 1.25%?

As I understand it, to put a stop in place with First Trade or another brokerage, aren't you essentially place a new order? That would cost me $6.95 per order (not sure if they charge if I cancel before execution).

How do the trading costs effect your models and need for returns?

Thanks.

makingourway

www.makingourwayblog.com

Thanks - the commission is $9.99 for me. I am trading 3000-4000 shares in my two Ameritrade accounts. So it is around 1/4 to 1/3 of a cent per share. So the brokerage is much less than the spread between bid and ask prices. It might not make sense to do this kind of strategy if you were trading only 100 shares.

Short-term trading on my Australian account is a whole other prospect as the minimum commission cost is 0.1%. In other words about 10 times higher than this.

Post a Comment