The biggest development this year at Moomin Valley is that we set up the SMSF. We also finished investing the money we inherited in late 2018. I also reviewed all our existing investments to decide which to drop. Investment returns were again very strong. We exceeded the net worth projection in last year's report, which at the time I thought was crazy. In my academic career, I didn't feel very productive. Mainly I worked on completing research projects started in previous years, though there was one project that started right at the end of last year that we have already submitted for publication. I was frustrated with online teaching in the first half of the year and then with the second lockdown in Canberra in the second half of the year. Luckily, we could send our younger child to daycare throughout the lockdown this time. The estimated value of our house rose sharply in line with market trends and we closed some of the lag to the general housing market that we have experienced since buying here. At the end of the year, we went for our first trip outside our local region since the pandemic started, to South Durras, NSW:

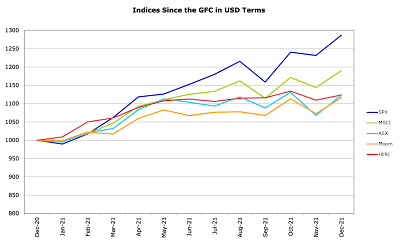

In Australian Dollar terms we gained 18.8% for the year and in USD terms we gained 11.7% because of the decline in the Australian Dollar over the year. The MSCI gained 19.0% in USD terms and the ASX 200 only 19.5% in AUD terms. The HFRI hedge fund index gained 12.4% in USD terms. Our target portfolio gained 17.4% in AUD terms. So, we only beat the target portfolio benchmark this year. This is expected in a strong bull market.

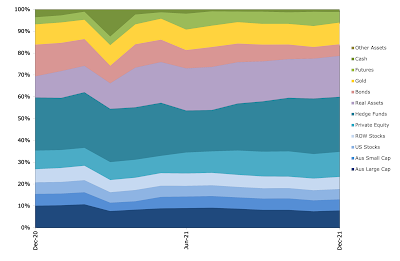

The main changes in allocation over the year were that we continued to reduce our bonds allocation while increasing real assets and private equity mostly:

The blip in the early part of the year is when we transferred funds from Colonial First State to the SMSF. The CFS funds were all converted to cash.

Accounts

Here are our annual accounts in Australian Dollars:

Percentage changes are for the total numbers. There are lots of quirks in the way I compute the accounts, which have gradually evolved over time. There is an explanation at the end of this post.

We earned $166k after tax in salary, business related refunds, medical payment refunds, tax refunds etc. This was up 17% on 2020 because Moominmama went back to work. We earned (pre-tax including unrealized capital gains) $485k on non-retirement account investments. A small amount of the gains were due to the fall in the Australian Dollar (forex). We gained $278k on retirement accounts with $37k in employer retirement contributions (more details below). The big difference to last year, is that instead of the value of our house falling, I estimate it rose by $246k. As a result, investment income totalled $1.008 million and total income $1.211 million.

$19k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. We transferred $374k into retirement accounts (ultimately the SMSF) from existing savings.

The change in current net worth, was therefore $1234k. Looking at just saving from non-investment income, we dissaved $344k. So, before the transfer to retirement accounts we saved about $31k (19%) from salaries etc.

We made $37k in pre-tax contributions to retirement accounts (after the 15% contribution tax) and made an estimated $278k in pre-tax returns. $20k in "tax credits" is an adjustment needed to get from the number I calculate as a pre-tax return to the after tax number. Taxes on returns are just estimated because apart from the SMSF all we get to see are the after tax returns. I do this exercise to make retirement and non-retirement returns comparable. Net worth of retirement accounts increased by $668k.

How Does This Compare to My Projection for This Year?

Last year my baseline projection for 2021 was for a very high 19% rate of return, a 6% increase in spending, and flat other income, leading to an $800k increase in net worth to around $5.7 million. This just seemed like too much to me so I also made a "more sensible projection" of an increase of $400k to around $5.3 million. Investment returns matched the baseline projections very closely. The additional gain in net worth is mainly due to the estimated increase in the value of our house. Using the same methodology, the baseline projection for 2022 is for a 16% rate of return, no increase in the value of our home, flat other income, and 6% growth in spending. This results in net worth increasing by $800k to around $6.7 million. Again, anything could happen.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then the other two are fairly self-explanatory. However, property taxes etc. are included in the current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells in the spreadsheet that might again be used in the future.