After looking at another couple of houses at the weekend and not agreeing on which we preferred we have changed direction and are now looking to rent a house or townhouse as a midway step to buying a house. Snork Maiden's mom is probably coming to visit for a while (months) and though we previously reorganized this apartment to accommodate her and her now deceased husband we aren't prepared to do that this time. We are much better off now and so have other alternatives. One option would be to rent her a furnished apartment nearby, but she's not keen on that... So we have four houses lined up to look at in the next three days. Rents range from $A570 to $A650 per week compared to $A490 in our current apartment. One ($A650) is actually nearer to the city centre, the others a little further out. One house is almost identical to another we looked at to buy a few doors down. Snork Maiden didn't like the small garden or lack of trees in the (new) neighborhood. But if we're not buying permanently...

I also just put in four orders to buy shares in listed funds here in Australia. Two have already executed (OCP.AX and AOD.AX). My margin loan was down to only $A15k. But if we are not likely to buy a house very soon then I don't need the extra borrowing capacity. We are still keeping a huge amount of cash on hand. You never know when the ideal property would show up. If we rent a house though it would be a 12 month lease. You can get out of that but it could be costly. With high occupancy rates still, it shouldn't be too hard to find someone else to rent in these locations.

The financial year here in Australia ends 30th of June so we are again in the run-up to filing tax returns (deadline 31 October). I've done a preliminary assessment and both of us probably owe more tax. For me it is over $1,000. This is going to mean that I will need to pay quarterly taxes in future :( The reason it is so high is that as we still don't have private health insurance I need to pay 1% of my income as the Medicare surcharge. On top of that my interest earnings are more than $3k due to our house-buying cash stockpile. On Friday I'm meeting a health insurance salesperson (sorry, consultant) who is offering a lower corporate health insurance rate. So, hopefully in future I can avoid the quarterly tax payments. It's also an incentive to increasing the margin loan again. I tried to do Snork Maiden's taxes using the ATO's E-Tax software now that they have a Mac version. It was a frustrating experience and I gave up. Crazily, you can't download a pdf of the main tax form! Only a sample copy. You have to get a hardcopy from the ATO in the mail or from their "shopfront". What I would really like is a web-based tax form that I can just fill numbers into without dealing with all the silly questions in E-Tax, or a typable pdf. I am going to get a hardcopy and again submit paper tax returns until they get the system more user friendly.

Monday, July 22, 2013

Sunday, July 14, 2013

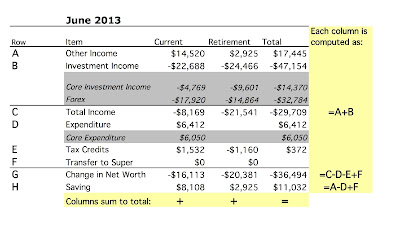

Moominvalley June 2013 Report

Finally back in Australia after another long trip to Europe, Asia, and Africa. This month's accounts in US Dollars, as usual:

Unlike last month we managed to save some money this month ($8,108 from current non-investment income) but still spent $6,412, which isn't too bad given all the travelling. There will probably be a similar level of spending in July too.

The Australian Dollar fell sharply this month resulting in investment returns in US Dollar terms of -5.46% but in Australian Dollar terms of -0.94%. As a result net worth fell $US36k but rose $3k in Australian Dollar terms to $A901k.

Unlike last month we managed to save some money this month ($8,108 from current non-investment income) but still spent $6,412, which isn't too bad given all the travelling. There will probably be a similar level of spending in July too.

The Australian Dollar fell sharply this month resulting in investment returns in US Dollar terms of -5.46% but in Australian Dollar terms of -0.94%. As a result net worth fell $US36k but rose $3k in Australian Dollar terms to $A901k.

Monday, June 03, 2013

Moominvalley May 2013 Report

Short report this month. I am travelling, currently in Charlottesville VA and about to go out to do some shopping.... Long trip from Australia via Canada yesterday... Here are the monthly accounts:

The Australian Dollar fell sharply resulting in steep losses in USD terms. US Dollar net worth is down $70k. This way underperformed the MSCI World Index. Australian Dollar net worth was flat as investment returns were -1.42% in currency neutral terms. The Australian Dollar is still overvalued of course (will report back from my shopping trip maybe on that)... We spent a record amount, actually dissaving a little bit this month. Most of the expenditure is on planned travel. $3,500 at least was reimbursed but still is recorded as expenditure. A big chunk though is associated private travel.

The Australian Dollar fell sharply resulting in steep losses in USD terms. US Dollar net worth is down $70k. This way underperformed the MSCI World Index. Australian Dollar net worth was flat as investment returns were -1.42% in currency neutral terms. The Australian Dollar is still overvalued of course (will report back from my shopping trip maybe on that)... We spent a record amount, actually dissaving a little bit this month. Most of the expenditure is on planned travel. $3,500 at least was reimbursed but still is recorded as expenditure. A big chunk though is associated private travel.

Wednesday, May 01, 2013

April 2013 Moominvalley Report

Yes, I haven't posted anything since last month's report, but I didn't post much on my professional blog either. It's been a busy time - teaching and everything else... Now starting to plan trips for June and July. I've booked a trip to Canada and the US. Will be in Ontario and Virginia in the first week of June. I'll be back in Australia for 10 days and then heading for Spain and Middle East/Africa. It will be my first trip to sub-Saharan Africa - I have been to Tunisia before - with two new countries to add to the visited list. I have a guidebook with a picture of giraffes on the cover right next to me as I am typing this.

Another up month... In USD terms it is the 11th up month. In AUD and currency neural terms we were down a little last month though. We yet again hit new net worth highs in both Australian and US Dollar terms of $A8889k (+$A31k) and $US923k (+$US28k).

Our rate of return was 1.97% in USD terms versus 2.92% for the MSCI and 1.93% for the S&P500. US stock markets were very strong and the Australian stock market relatively weak. In Australian Dollar terms we gained 2.52%. All asset classes gained apart from small cap Australian stocks (-2.62%). The best performing asset class was large cap Australian stocks (+3.32%). The monthly accounts (in US Dollars) look like this:

Non-investment income was a bit above normal and spending was the high side. Snork Maiden was traveling in North America. Total investment returns were $17k with USD returns suffering from the rising US Dollar. Saving in the table is saving from non-investment income.We saved almost $8k from our salaries not counting the retirement contributions of $4k. The latter were inflated, by a third payment this month from Snork Maiden's employer - all salary and other payments are paid every two weeks in Australia.

Another up month... In USD terms it is the 11th up month. In AUD and currency neural terms we were down a little last month though. We yet again hit new net worth highs in both Australian and US Dollar terms of $A8889k (+$A31k) and $US923k (+$US28k).

Our rate of return was 1.97% in USD terms versus 2.92% for the MSCI and 1.93% for the S&P500. US stock markets were very strong and the Australian stock market relatively weak. In Australian Dollar terms we gained 2.52%. All asset classes gained apart from small cap Australian stocks (-2.62%). The best performing asset class was large cap Australian stocks (+3.32%). The monthly accounts (in US Dollars) look like this:

Non-investment income was a bit above normal and spending was the high side. Snork Maiden was traveling in North America. Total investment returns were $17k with USD returns suffering from the rising US Dollar. Saving in the table is saving from non-investment income.We saved almost $8k from our salaries not counting the retirement contributions of $4k. The latter were inflated, by a third payment this month from Snork Maiden's employer - all salary and other payments are paid every two weeks in Australia.

Tuesday, April 02, 2013

Moominvalley March 2013 Report

Finally, we had a slightly down month in investment returns in Australian Dollar terms though the streak of gains extended to the 10th month in USD terms. We yet again hit new net worth highs in both Australian and US Dollar terms of $A858k (+$A9k) and $US895k (+$US25k). The Australian Dollar rose to $US 1.0426.

Our rate of return was 1.38% in USD terms versus 1.88% for the MSCI and 3.75% for the S&P500. US stock markets were very strong and the Australian stock market relatively weak. In Australian Dollar terms we lost 0.43%. Real estate was the best performing asset class and Australian small cap stocks the worst. The monthly accounts (in US Dollars) look like this:

Non-investment income was normal as was spending. We spent $A220 on a lawyer looking over the contract for the house that we didn't buy. Total investment returns were $12k with USD returns suffering from the rising US Dollar. Saving in the table is saving from non-investment income.We saved almost $10k from our salaries not counting the retirement contributions of $3k.

Our rate of return was 1.38% in USD terms versus 1.88% for the MSCI and 3.75% for the S&P500. US stock markets were very strong and the Australian stock market relatively weak. In Australian Dollar terms we lost 0.43%. Real estate was the best performing asset class and Australian small cap stocks the worst. The monthly accounts (in US Dollars) look like this:

Non-investment income was normal as was spending. We spent $A220 on a lawyer looking over the contract for the house that we didn't buy. Total investment returns were $12k with USD returns suffering from the rising US Dollar. Saving in the table is saving from non-investment income.We saved almost $10k from our salaries not counting the retirement contributions of $3k.

Monday, March 11, 2013

Money Burning a Hole in Your Pocket

Snork Maiden's stepfather died. He was 80 years old. Her mother is much younger. Snork Maiden has gone to China to be with her mother for a while. Her mother wants to visit Australia later this year, maybe starting in late October for a while and think about spending more time here in the future. She wants to transfer some money to our account here to help pay her expenses in Australia so that she can be more independent than when she and her husband visited last time. If we still are living in this apartment we could try to rent her a furnished unit somewhere nearby. We saw a couple of these last year when were looking for accommodation for a colleague (in the end they stayed on campus), but they weren't that near here.

But she wants to transfer the money today. One reason is so that Snork Maiden can help her with the transaction, which involves moving a "pile of cash" between two banks. Snork Maiden said as well that:

"She is in a hurry because she doesn't want to sit on a pile of money for long. She got a fixed-term pile of money that is ready to be harvested today, and she wants to decrease the number of transactions as much as possible. I suggested we could put the money in her saving account for the time being, but she said that was too complex and she has never had that much money sitting in her account. It was my stepfather who dealt with their money, so she has never touched so many cash before, and even the thought of having that much of money in her bank account somehow worries her. "

In the past I heard she would give money away to relatives rather than hold onto too much. It made me think of this story. A lot of people asked how it could be that a 68 year old full professor in a low cost of living location didn't have any savings. One answer is that some people just don't seem to be able to hold onto money for psychological reasons. Obviously, I don't have that problem. So, I'm going to look after her money for her.

But she wants to transfer the money today. One reason is so that Snork Maiden can help her with the transaction, which involves moving a "pile of cash" between two banks. Snork Maiden said as well that:

"She is in a hurry because she doesn't want to sit on a pile of money for long. She got a fixed-term pile of money that is ready to be harvested today, and she wants to decrease the number of transactions as much as possible. I suggested we could put the money in her saving account for the time being, but she said that was too complex and she has never had that much money sitting in her account. It was my stepfather who dealt with their money, so she has never touched so many cash before, and even the thought of having that much of money in her bank account somehow worries her. "

In the past I heard she would give money away to relatives rather than hold onto too much. It made me think of this story. A lot of people asked how it could be that a 68 year old full professor in a low cost of living location didn't have any savings. One answer is that some people just don't seem to be able to hold onto money for psychological reasons. Obviously, I don't have that problem. So, I'm going to look after her money for her.

Saturday, March 02, 2013

Auction

Our first auction where we were actually bidding. Some guy started the bidding at $700k and then it went up in increments of $25k. It stalled around $825k. Then I bid $830k. The next bid was $835k. But even $830k was above our predetermined limit. I only bid it because I knew the price was still below the reserve and if bidding really had dried up I wanted to be the top bidder to negotiate. But that seemed to unstick things and eventually the house sold for $877,500. Looks like the reserve was $875k. I was surprised that it actually sold at auction as the two previous houses that sold for $870k in that neighborhood would have standard valuations that would be higher. I guess the atmosphere on that block feels more like you are out in the bush and maybe that is what people wanted to pay for. It's what attracted us.

One of the agents would go around talking to bidders during the auction trying to get them to up their bids. When he asked me at around $875k I said: "That's the most we could possibly afford and it's way over the valuation we got, so no". He said: "They were wrong". I think it is highly likely that official land values for tax purposes will go up steeply in this neighborhood after these recent sales. But at the end of the auction, the agent shook my hand and said: "Congratulations". That was weird. Did he really think it wasn't worth $877.5k or did he know something else? A neighbor standing behind us then made some cryptic comments about the other neighbors. Snork Maiden thinks he was saying they were bad. I just couldn't understand what he was talking about.

Our attention now turns to a house in a neighborhood nearer us. It's land is valued $200k more than this one. It has a great view of the city and hills. The house is smaller and not in as good condition. Maybe a better chance to get a deal. There are lots of blocks in this value range that I really think are not worth paying for. This one maybe is.

A couple of colleagues came along to the auction. They hadn't been to a house auction before. One said: "These are like Santa Barbara prices". That's almost right.

One of the agents would go around talking to bidders during the auction trying to get them to up their bids. When he asked me at around $875k I said: "That's the most we could possibly afford and it's way over the valuation we got, so no". He said: "They were wrong". I think it is highly likely that official land values for tax purposes will go up steeply in this neighborhood after these recent sales. But at the end of the auction, the agent shook my hand and said: "Congratulations". That was weird. Did he really think it wasn't worth $877.5k or did he know something else? A neighbor standing behind us then made some cryptic comments about the other neighbors. Snork Maiden thinks he was saying they were bad. I just couldn't understand what he was talking about.

Our attention now turns to a house in a neighborhood nearer us. It's land is valued $200k more than this one. It has a great view of the city and hills. The house is smaller and not in as good condition. Maybe a better chance to get a deal. There are lots of blocks in this value range that I really think are not worth paying for. This one maybe is.

A couple of colleagues came along to the auction. They hadn't been to a house auction before. One said: "These are like Santa Barbara prices". That's almost right.

Friday, March 01, 2013

Moominvalley February 2013 Report

Yet another in 8 months of positive investment returns in Australian Dollar terms (9th in USD terms). We yet again hit new net worth highs in both Australian and US Dollar terms of $A848k (+$A40k) and $US869k (+26k). The US Dollar rose strongly, particularly against the Pound but also against the Euro and Australian Dollar. Many of our investments are at all time high profit levels. In US Dollar terms, total profits hit a new high of $US254k vs. $US250k in October 2007. So in nominal terms we have recovered from the financial crisis. In Australian Dollars though profits are at $A143k vs. $A209k at the peak in August 2007. So there is still some way to go.

Our rate of return was 2.43% in USD terms versus 0.03% for the MSCI and 1.36% for the S&P500. In Australian Dollar terms we made 4.31%. Almost all asset classes had positive returns with 5% plus gains in AUD terms in large cap Australian stocks and private equity. The monthly accounts (in US Dollars) look like this:

Non-investment income was normal while spending was high. We spent $A550 on getting the house valued. Car rego and a plane ticket to China added another $A2.5k or so. Total investment returns were $20k with USD returns suffering from the rising US Dollar. Saving in the table is saving from non-investment income.We still saved almost $5k from our current salaries in a high spending month like this.

Our rate of return was 2.43% in USD terms versus 0.03% for the MSCI and 1.36% for the S&P500. In Australian Dollar terms we made 4.31%. Almost all asset classes had positive returns with 5% plus gains in AUD terms in large cap Australian stocks and private equity. The monthly accounts (in US Dollars) look like this:

Non-investment income was normal while spending was high. We spent $A550 on getting the house valued. Car rego and a plane ticket to China added another $A2.5k or so. Total investment returns were $20k with USD returns suffering from the rising US Dollar. Saving in the table is saving from non-investment income.We still saved almost $5k from our current salaries in a high spending month like this.

Insurance

This afternoon I had the surreal experience of getting insurance on a house I don't own. We saw the lawyer this afternoon and she recommended that we get insurance already this afternoon rather than wait till Monday as we will still be liable to buy the house once we have a deposit down, even if it burns down or something between Saturday and Monday. This is called a "cover note". If we don't buy, we phone the insurer on Monday and cancel the policy. So we are all ready. The lawyer charged $220 for looking at the contract and going over things with us. No charge for looking at future contracts if we don't buy the house this time. Insurance for the house will be $966 per year.

Wednesday, February 27, 2013

Getting Ready

We are getting ready for the auction this weekend. If we end up buying we need to give the owner a cheque for 5% on the day. So I'm moving that money out of our savings account and into our checking account. There is a $20k a day limit on transfers which is kind of annoying. But I've now done two in a row and so am more or less at the 5%. Snork Maiden's job for today is phoning a lawyer and seeing if they need to see a copy of the contract before the auction. I'd much prefer to just be able to make an offer rather than this auction mechanism, but the best houses tend to go to auction here.

Wednesday, February 13, 2013

Things are Getting Serious

We went to see this house for the second time today. We took along a couple of friends/colleagues. One has some architecture background. They liked the house too. So, I just ordered an independent valuation. The standard way I value in houses here is to use the taxable value of the land and for a house in excellent condition $A2,000 per square metre. Using that this how comes in at $A775k. But houses seem to sell for more than that in this area. So, going into an auction I need a better sense of the fair price. Oh, yes, it's going to be auctioned in a few weeks time. I contacted the bank and they said I don't need to do anything else at the moment. The bank might accept the auction price or get their own valuation, it depends.

We went to see this house for the second time today. We took along a couple of friends/colleagues. One has some architecture background. They liked the house too. So, I just ordered an independent valuation. The standard way I value in houses here is to use the taxable value of the land and for a house in excellent condition $A2,000 per square metre. Using that this how comes in at $A775k. But houses seem to sell for more than that in this area. So, going into an auction I need a better sense of the fair price. Oh, yes, it's going to be auctioned in a few weeks time. I contacted the bank and they said I don't need to do anything else at the moment. The bank might accept the auction price or get their own valuation, it depends.

Friday, February 08, 2013

All Time Highs

The profits on a lot of our investments are currently at the maximum since we started investing in them. This is only remarkable because of the financial crisis and bear market we've been through in the last few years. Many of our investments have now fully recovered or more. They include:

CFS Developing Companies

CFS Future Leaders

Unisuper Superannuation Fund

CFS Diversified Fund

Clime Capital (CAM.AX)

PSSAP Superannuation Fund

TFS Market Neutral Fund (TFSMX)

CREF Global Equities Fund

IPE.AX (Aus private equity) BT Property Securities Fund

Aurora Sandringham Fund (AOD.AX)

Boulder Total Return (BTF)

CFS Geared Global Share Fund

Generation Global Shares

Celeste Small Australian Companies Fund

What isn't:

CFS Geared Share Fund

CFS Conservative Fund

CFS Global Resources Fund

Platinum Capital (PMC.AX)

TIAA Real Estate

Oceania Capital Partners (OCP.AX)

Cambria Global Tactical (GTAA)

Qantas (QAN.AX)

Man Eclipse 3 (Managed futures)

Bekaert

China Fund

3i (iii.l)

Legend International (lgdi)

Leucadia (LUK)

EAIT and EDIF (Funds of hedge funds)

Any pattern here? Australian and more generally small cap stocks and diversified portfolios are doing well. Larger cap stocks and non-Australian private equity resources/China themed stuff are not doing well.

CFS Developing Companies

CFS Future Leaders

Unisuper Superannuation Fund

CFS Diversified Fund

Clime Capital (CAM.AX)

PSSAP Superannuation Fund

TFS Market Neutral Fund (TFSMX)

CREF Global Equities Fund

IPE.AX (Aus private equity) BT Property Securities Fund

Aurora Sandringham Fund (AOD.AX)

Boulder Total Return (BTF)

CFS Geared Global Share Fund

Generation Global Shares

Celeste Small Australian Companies Fund

What isn't:

CFS Geared Share Fund

CFS Conservative Fund

CFS Global Resources Fund

Platinum Capital (PMC.AX)

TIAA Real Estate

Oceania Capital Partners (OCP.AX)

Cambria Global Tactical (GTAA)

Qantas (QAN.AX)

Man Eclipse 3 (Managed futures)

Bekaert

China Fund

3i (iii.l)

Legend International (lgdi)

Leucadia (LUK)

EAIT and EDIF (Funds of hedge funds)

Any pattern here? Australian and more generally small cap stocks and diversified portfolios are doing well. Larger cap stocks and non-Australian private equity resources/China themed stuff are not doing well.

Thursday, February 07, 2013

And Yet More Proposed Changes to Superannuation

Turns out the government has decided to abandon the idea of taxing distributions from larger superannuation accounts. The latest idea they are floating is taxing earnings of larger accounts. But the threshold would be much higher than $800k. This after destroying further the confidence of investors that superannuation payouts won't be taxed. And of course, this further complicates the system. Probably this won't happen because there is no chance I think that this government will be re-elected in September. Of course, none of these changes applies to the huge superannuation benefits that members of parliament receive. Those should definitely be abolished.

Wednesday, February 06, 2013

More Changes to Superannuation?

The Australian Labor government is floating the idea of taxing distributions from superannuation accounts (retirement accounts) if the balance is above $800k. Currently distributions are tax free but there are taxes on contributions and earnings though these are below the usual income tax rates. The tax free distributions were introduced by the Liberal government in 2006. That was a step towards moving the Australian system towards the Roth IRA model. The US Roth IRA taxes contributions at normal rates and then has no tax on earnings or distributions. The Australian government recently made changes to increase the contributions tax for earners above $300k and reduce it for those under $30k that seemed a further step towards the Roth IRA model. But this new move would just complicate things. It is the fact that earnings in the fund are taxed and that there have been so many changes to the system that has resulted in superannuation being so complicated in Australia. The US system is much simpler. There is a variety of different account types but none of them have earnings taxed - only contributions or distributions. Therefore, no tax return or audit is needed for a retirement account. As a result it is easy to set up an IRA, the US equivalent of a self managed superannuation fund, while it is complex in Australia and only worthwhile for large amounts of money because of the costs.

If the Australian government really wants to tax distributions I recommend they just move to the US 401k model where only distributions are taxed and contributions and earnings are not. I doubt they will do that. The Labor Party and the Treasury see any "tax concession" as equivalent to a government expenditure and they want to eliminate all of them if possible.

This has implications about whether to make "nonconcessional contributions" i.e. after tax contributions in the next decade. If distributions will be taxed there is little point in making after tax contributions of course, given that I don't pay tax on the earnings of my investments outside super at the moment (due to accumulated capital losses and deductions which result in surplus franking credits). Currently, I have $215k in my super accounts. In the next 12 years until I am 60 my contributions will be $300k assuming the current limit remains what it is. A 5% rate of return keeps me under $800. Assuming that the limit would be adjusted for inflation that's a reasonable rate of return. Of course, if I keep working and contributing past 60 then I will go over the limit. Snork Maiden would hit the limit in 2028 when she would be 53 me in 2024 when I'm 60.

If the Australian government really wants to tax distributions I recommend they just move to the US 401k model where only distributions are taxed and contributions and earnings are not. I doubt they will do that. The Labor Party and the Treasury see any "tax concession" as equivalent to a government expenditure and they want to eliminate all of them if possible.

This has implications about whether to make "nonconcessional contributions" i.e. after tax contributions in the next decade. If distributions will be taxed there is little point in making after tax contributions of course, given that I don't pay tax on the earnings of my investments outside super at the moment (due to accumulated capital losses and deductions which result in surplus franking credits). Currently, I have $215k in my super accounts. In the next 12 years until I am 60 my contributions will be $300k assuming the current limit remains what it is. A 5% rate of return keeps me under $800. Assuming that the limit would be adjusted for inflation that's a reasonable rate of return. Of course, if I keep working and contributing past 60 then I will go over the limit. Snork Maiden would hit the limit in 2028 when she would be 53 me in 2024 when I'm 60.

Friday, February 01, 2013

Moominvalley Monthly Report January 2013

This was the 7th month of positive investment returns in Australian Dollar terms (8th in USD terms). This long streak of gains is making me nervous... We yet again hit new net worth highs in both Australian and US Dollar terms of $A808k (+$A54k) and $US843k (+59k). The Australian Dollar was fairly stable. Many of our investments are at all time high profit levels but overall, profits are still down relative to the peak before the financial crisis:

Profits in retirement accounts are almost back to pre-crisis highs but in non-retirement accounts we are still at a negative net profit and only halfway back to the pre-crisis high from the trough.

Our rate of return was 5.81% in USD terms versus 4.64% for the MSCI and 5.18% for the S&P500. In Australian Dollar terms we made 5.44%. All asset classes had positive returns. The monthly accounts (in US Dollars) look like this:

We each received three paychecks this month boosting non-investment earnings. Spending was lower $7,700 ($A7,384) but $A3,000 of that was money we gave to Snork Maiden's mother. Without that we spent $A4,384 which is pretty reasonable given recent spending levels. Total investment returns were $41k with little contribution from exchange rate moves. Saving in the table is saving from non-investment income.

Profits in retirement accounts are almost back to pre-crisis highs but in non-retirement accounts we are still at a negative net profit and only halfway back to the pre-crisis high from the trough.

Our rate of return was 5.81% in USD terms versus 4.64% for the MSCI and 5.18% for the S&P500. In Australian Dollar terms we made 5.44%. All asset classes had positive returns. The monthly accounts (in US Dollars) look like this:

We each received three paychecks this month boosting non-investment earnings. Spending was lower $7,700 ($A7,384) but $A3,000 of that was money we gave to Snork Maiden's mother. Without that we spent $A4,384 which is pretty reasonable given recent spending levels. Total investment returns were $41k with little contribution from exchange rate moves. Saving in the table is saving from non-investment income.

Monday, January 28, 2013

Evolution of Yale's Portfolio

A topic I haven't covered for a while - endowments. The Yale portfolio is the most dissimilar to our own portfolios of those I track. They have very little foreign equity and lots of private equity and those trends have been accentuated over recent years. Their allocations to hedge funds and domestic (US) equity have also almost halved. I have an update on Harvard's rate of returns but they are vague on portfolio allocation.

Sunday, January 13, 2013

Update on Rates of Return

I just realized that I'd been computing the rate of return over the last 10 years incorrectly in earlier versions of this chart that I'd posted. The new calculation increases the variance a bit - so low and high returns are lower and higher than before. The graph only goes to the end of December. The rate of return over the last ten years was almost 10%. So far this month we are now over 10%. But these returns from the end of the tech crash market slump in 2002. Going forward, returns will fall again so that 6% seems like a more realistic long-term RoR. At the moment 2-3% is a realistic return for the S&P 500. Yes, that includes dividends. Of course, at some point this decadal bear market may end and a new bull market become apparent and RoR increase.

Wednesday, January 02, 2013

2013 Forecast

We came in near the top of 2012's predicted range for net worth. For this year, the optimistic forecast is $A975k or just over $USD 1 million. Buying a house would cost about $50k in costs and then around $2,500 a month in higher costs. So let's assume a $75k hit. A fall in the Australian Dollar to 75 cents would increase Australian Dollar net worth to over $A1 million and reduce US Dollar net worth to $US765k. While we are expecting a 10% investment return a 10% fall instead would mean net worth was $175k lower. So the expected range in Australian Dollars is $A700k-$A1 million and in US Dollars $500k to $1 million.

Annual Review 2012

This year was less eventful than last year, but I was very busy, mainly with my career and a few international and domestic trips. We also put a lot of effort into looking for a house, but didn't decide on anything. Snork Maiden got her job turned into a permanent position. She was recently shocked to find out that she is now earning $A93k per year. And that's not counting 15% superannuation contributions from her employer :)

The last couple of years' career events and a reasonable investment market meant that we hit new records in income and net worth. This is the annual accounts that sum each of my monthly reports for the year:

The numbers are on an after-tax basis but investments are shown pre-tax and any tax refunds or payments are reported under "other income" which otherwise is mainly from salary. Also the investment returns include tax credits, which reduce our tax bill but don't add to net worth directly. Therefore, these have to be deducted to get to net worth changes. It's an odd way of accounting, but it is the easiest one to put together and it works for me :)

The non-investment income after tax totalled $180k with an additional $40k in retirement contributions. Total investment income was $113k with almost all of it being "core income" and not just the result of exchange rate movements. Spending was actually a few hundred less than last year, so no new record there. That's despite giving $5,000 to Snork Maiden's parents which I counted as spending.

I closed my Roth IRA due to a bungle by Ameritrade. This results in the transfer of $9k from retirement to current accounts. So, we saved $A106k from non-investment income for the year, or $8,800 per month vs. $6,200 in spending per month. That's a record high savings rate, but only 1% higher than in 2006! I only spent $25.7k back then. I was single and lived in the US in a cheap area.

Investment rate of return for the year in USD terms was 18.76% vs. 16.8% for the MSCI. In Australian Dollar terms we made 17.14% (18.11% in currency neutral terms). After the last several years it's good to be making money and doing better than the market.

The last couple of years' career events and a reasonable investment market meant that we hit new records in income and net worth. This is the annual accounts that sum each of my monthly reports for the year:

The numbers are on an after-tax basis but investments are shown pre-tax and any tax refunds or payments are reported under "other income" which otherwise is mainly from salary. Also the investment returns include tax credits, which reduce our tax bill but don't add to net worth directly. Therefore, these have to be deducted to get to net worth changes. It's an odd way of accounting, but it is the easiest one to put together and it works for me :)

The non-investment income after tax totalled $180k with an additional $40k in retirement contributions. Total investment income was $113k with almost all of it being "core income" and not just the result of exchange rate movements. Spending was actually a few hundred less than last year, so no new record there. That's despite giving $5,000 to Snork Maiden's parents which I counted as spending.

I closed my Roth IRA due to a bungle by Ameritrade. This results in the transfer of $9k from retirement to current accounts. So, we saved $A106k from non-investment income for the year, or $8,800 per month vs. $6,200 in spending per month. That's a record high savings rate, but only 1% higher than in 2006! I only spent $25.7k back then. I was single and lived in the US in a cheap area.

Investment rate of return for the year in USD terms was 18.76% vs. 16.8% for the MSCI. In Australian Dollar terms we made 17.14% (18.11% in currency neutral terms). After the last several years it's good to be making money and doing better than the market.

Moominvalley December 2012 Report

This was the 6th month of positive investment returns in Australian Dollar terms (7th in USD terms). We yet again hit new net worth highs in both Australian and US Dollar terms of $A754k (+$A38k) and $US784k (+37k). The Australian Dollar was fairly stable.

Our rate of return was 3.74% in USD terms versus 2.31% for the MSCI and 0.91% for the S&P500. In Australian Dollar terms we made 4.01%. Performance has outstripped the MSCI for the last several months: The graph shows the annual rate of return above the MSCI All Country World Index for money invested in the month indicated. We have had periods of both under and over performance with the differences getting smaller as we go back in time.

This month's gains were mostly due to strong gains in Australian shares but all asset classes except commodities rose. The monthly accounts (in US Dollars) look like this: Spending was lower than it has been recently at $,4401($A4,235). The monthly accounts show that we earned $13.4k in salaries etc. Retirement contributions were $2.4k. My employer delayed making one payment due to Christmas. Total investment returns were $27.9k with little contribution from exchange rate moves. Saving in the table is saving from non-investment income.

The house-buying fund reached $A152k, so we have reached our goal.

Our rate of return was 3.74% in USD terms versus 2.31% for the MSCI and 0.91% for the S&P500. In Australian Dollar terms we made 4.01%. Performance has outstripped the MSCI for the last several months: The graph shows the annual rate of return above the MSCI All Country World Index for money invested in the month indicated. We have had periods of both under and over performance with the differences getting smaller as we go back in time.

This month's gains were mostly due to strong gains in Australian shares but all asset classes except commodities rose. The monthly accounts (in US Dollars) look like this: Spending was lower than it has been recently at $,4401($A4,235). The monthly accounts show that we earned $13.4k in salaries etc. Retirement contributions were $2.4k. My employer delayed making one payment due to Christmas. Total investment returns were $27.9k with little contribution from exchange rate moves. Saving in the table is saving from non-investment income.

The house-buying fund reached $A152k, so we have reached our goal.

Tuesday, January 01, 2013

Follow up on Aletheia

A couple of weeks ago I blogged about the trouble at Aletheia fund managers. Well they are going out of business and we are shifting the account to Boston Advisors Large Cap Growth.

I didn't have access to the account for almost a year as the portfolio information service provider changed and I didn't have the login details. I just checked the acount now and they really didn't perform well before going under. The account was 16% below where I had estimated it would be based on the last known value in January 2012 and the S&P 500 index. In other words they underperformed the index 16% in one year. In absolute terms down 0.03% for the year. By comparison the Thomas White account my mother also has was above where I expected based on the MSCI All World Index and up 18.6% for the year.

I didn't have access to the account for almost a year as the portfolio information service provider changed and I didn't have the login details. I just checked the acount now and they really didn't perform well before going under. The account was 16% below where I had estimated it would be based on the last known value in January 2012 and the S&P 500 index. In other words they underperformed the index 16% in one year. In absolute terms down 0.03% for the year. By comparison the Thomas White account my mother also has was above where I expected based on the MSCI All World Index and up 18.6% for the year.

Housing Search Roundup

December and annual reviews are coming up. One finance area I talked about quite a bit on the blog this year was looking for a house to buy. We looked at a lot of houses in the course of the year but have found it hard to find one we both like, that we can afford, in a good location. We got close a few times. The last one was the closest yet. I thought the living room was a bit small though and Snork Maiden didn't like the large amount of electricity transmission cables in the backyard:

There are electric cables in the middle of the block in all the older suburbs here. But sometimes they are not so noticeable as other times. But the house was in "move in" condition though we'd like to do some work on the kitchen and in our price range in a good location. Another recent one is a townhouse with the best garden with seen for a townhouse here. This is a quarter million less... Snork Maiden doesn't like the neighborhood and thinks the bedrooms are too close together if her mother came to stay with us. So, we'll be looking again this year...

There are electric cables in the middle of the block in all the older suburbs here. But sometimes they are not so noticeable as other times. But the house was in "move in" condition though we'd like to do some work on the kitchen and in our price range in a good location. Another recent one is a townhouse with the best garden with seen for a townhouse here. This is a quarter million less... Snork Maiden doesn't like the neighborhood and thinks the bedrooms are too close together if her mother came to stay with us. So, we'll be looking again this year...

Monday, December 24, 2012

Tuesday, December 18, 2012

Aletheia

This is not good news. My Mom has money invested with this firm via a local broker where she lives. The losing trades don't seem to affect separately managed accounts, but it can't be good news if the management firm is declaring backruptcy. I haven't been able to access the account for a while as the broker moved firms and is using a new platform which we haven't been able to get the passwords to work for properly. So I don't even know how much is in the account. I estimate $US180k.

I asked my brother to follow up urgently on this.

Sunday, December 09, 2012

Adjusting Savings Plan

We pretty much achieved our goal of accumulating $A150k in cash to buy a house:

Now it's time to adjust savings plans again. For the moment I'll use savings to pay down the margin loan of $A35k that we took to start the fund off. I also just withdrew Snork Maiden's investment in the Acadian Long Short Fund as it has been an underperformer and a quick evaluation of returns shows that despite owning seven different funds in her account there only seem to be three main sources of return: Australian stocks, international stocks, property. I'll submit a new regular savings plan for her managed funds (mutual funds) account soon to replace the current one.

Now it's time to adjust savings plans again. For the moment I'll use savings to pay down the margin loan of $A35k that we took to start the fund off. I also just withdrew Snork Maiden's investment in the Acadian Long Short Fund as it has been an underperformer and a quick evaluation of returns shows that despite owning seven different funds in her account there only seem to be three main sources of return: Australian stocks, international stocks, property. I'll submit a new regular savings plan for her managed funds (mutual funds) account soon to replace the current one.

Monday, December 03, 2012

Moominvalley November 2012 Report

This was the 5th month of positive investment returns. We hit new net worth highs in both Australian and US Dollar terms of $A716k (+$A15k) and $US747k (+20k). The Australian Dollar was fairly stable.

Our rate of return was 1.18% in USD terms versus 1.33% for the MSCI and 0.58% for the S&P500. In Australian Dollar terms we made 0.64%. This is mostly due to strong gains in large cap Australian shares, hedge funds, and private equity in that order. Private equity had the largest percentage gain due to the distribution from IPE. Looking at longer term performance we have about matched the market year to date - 14.54% vs. 14.16% for the MSCI. Over 1-5 years we have lagged the world stock markets. Over 10 years though we are doing very well. This chart shows the averaeg annual rate of return over a decade:

The monthly accounts (in US Dollars) look like this:

Spending was around recent averages - $5,466 ($A5,242). The monthly accounts show that we earned $13.6k in salaries etc. Retirement contributions were $3.3k. Total investment returns were $8.6k with about equal amounts from exchange rate moves and core investment returns. The house-buying fund reached $A144k. The goal of $A150k should be reached at the end of next month.

Our rate of return was 1.18% in USD terms versus 1.33% for the MSCI and 0.58% for the S&P500. In Australian Dollar terms we made 0.64%. This is mostly due to strong gains in large cap Australian shares, hedge funds, and private equity in that order. Private equity had the largest percentage gain due to the distribution from IPE. Looking at longer term performance we have about matched the market year to date - 14.54% vs. 14.16% for the MSCI. Over 1-5 years we have lagged the world stock markets. Over 10 years though we are doing very well. This chart shows the averaeg annual rate of return over a decade:

The monthly accounts (in US Dollars) look like this:

Spending was around recent averages - $5,466 ($A5,242). The monthly accounts show that we earned $13.6k in salaries etc. Retirement contributions were $3.3k. Total investment returns were $8.6k with about equal amounts from exchange rate moves and core investment returns. The house-buying fund reached $A144k. The goal of $A150k should be reached at the end of next month.

Sunday, December 02, 2012

Million Dollars

No, we haven't reached millionaire status yet but gross underlying assets do now exceed a million US Dollars:

This is gross assets before deducting loans counting both loans we owe and those owed by leveraged funds we own. I use this total asset data as the best way of tracking the composition of our portfolio.

Saturday, November 24, 2012

Income per Capita in Australian States

According to this nominal income per capita in Western Australia is double that in the US and in the ACT double that in the UK. This shows the overvaluation of the Australian Dollar but also the high incomes in these states. I find the numbers hard to believe though. Nominal gross income per capita has doubled in the last decade but only increased by 50% in the decade before. These also imply that academic salaries have fallen back a lot relative to averages in the last 15 years. Snork Maiden's salary (not counting superannuation (retirement) contributions is less than average gross income per capita now. My salary at the same rank was about 50% above it back in 1996 when I first worked in Australia. It's hard to believe that a professional salary is less than income per capita (which includes children, retirees etc in the denominator), but that is what the ABS claims.

Tuesday, November 06, 2012

Spain, Dubai, and Australia

I am now in Spain, where I arrived yesterday. I have never been here before but it feels very familiar as an amalgam of places I have been. It almost feels strange that I can't speak the language. Reading it is a lot easier of course. I know French quite well and am generally good at languages, especially reading them. Unemployment is 25% in Spain right now and supposedly it is a country in financial crisis. There are a few closed stores in town but generally you wouldn't know about the crisis. Maybe one sign was when I got on the Iberian flight at Madrid airport the plane felt very old, rundown, and cramped. Well, after flying on Emirates, the first leg of which was on an A380. My first flight on Emirates or an A380. But Madrid airport was huge and grandiose. Dubai airport at 5am is totally packed with crowds of people from all over the world buying duty free goods and scurrying around. It was a long trip around 33 hours door to door and 4 flights to the coast of the far west of Europe from inland south east Australia. Following up from a comment I just made on my last post in response to Financial Independence's comment that an income of $4,000 a month is sufficient. As, I said in Australia that is less than the average wage. A couple each earning the average wage will make $11,000 per month or $130k per year. The median price of a house in the major cities in Australia is around $500k which is about 4 times their annual income. So we are making about twice the average and looking at houses that cost 50% more than average which would be 3 times our annual income. This hopefully, gives some perspective on average numbers for Australia and our relative position. In much of the world these numbers will seem enormous, but you aren't facing Australian prices. Here in Spain, a beer from the mini-bar in the hotel room is about half the price of a beer in a typical pub or restaurant in Australia, for example.

Thursday, November 01, 2012

Moominvalley Financial Report October 2012

Financially, things went OK again this month. We hit new net worth highs in both Australian and US Dollar terms of $A701k (+$23k) and $US728k (+23k). The Australian Dollar was very stable.

Our rate of return was 1.84% in USD terms versus -0.64% for the MSCI and -1.85% for the S&P500. In Australian Dollar terms we made 2.04%. This is mostly due to strong gains in Australian shares for a change. We gained 2.59% in large cap Australian shares and 4.80% in small cap Australian shares. The monthly accounts (in US Dollars) look like this:

Spending was around recent averages - after removing work expenses $5,846 ($A5,638). The monthly accounts show that we earned $14.3k in salaries etc. Retirement contributions were $3.4k. But there is also a $9135 transfer from retirement to non-retirement, which is me cashing out my Roth IRA. My Roth transfer is finally spendable in my brokerage account and I put an order in to buy 500 BTF. I had 175 BTF in the old account as well as HSFGX.

Total investment returns were $13k. The house-buying fund reached $A132k, which was flat for the month. We don't look like going house-hunting again till December and so I transferred a little money back to a brokerage account to reduce margin debt.

Our rate of return was 1.84% in USD terms versus -0.64% for the MSCI and -1.85% for the S&P500. In Australian Dollar terms we made 2.04%. This is mostly due to strong gains in Australian shares for a change. We gained 2.59% in large cap Australian shares and 4.80% in small cap Australian shares. The monthly accounts (in US Dollars) look like this:

Spending was around recent averages - after removing work expenses $5,846 ($A5,638). The monthly accounts show that we earned $14.3k in salaries etc. Retirement contributions were $3.4k. But there is also a $9135 transfer from retirement to non-retirement, which is me cashing out my Roth IRA. My Roth transfer is finally spendable in my brokerage account and I put an order in to buy 500 BTF. I had 175 BTF in the old account as well as HSFGX.

Total investment returns were $13k. The house-buying fund reached $A132k, which was flat for the month. We don't look like going house-hunting again till December and so I transferred a little money back to a brokerage account to reduce margin debt.

Sunday, October 28, 2012

Update on Incompetent TD Ameritrade Moves

Finally, I got the money I withdrew from my TD Ameritrade Roth IRA over to Interactive Brokers. It took a while because my bank account with HSBC was transferred to First Niagara and I had to update the details and confirm the account etc.

Now today I get a new e-mail from Ameritrade:

"We previously communicated to you that your Retirement Account with TD Ameritrade would be impacted by a new business policy requiring the account to be closed due to your country of residence. Upon further review, it has been determined that your Retirement Account, ending in xxxx, will no longer be impacted by this policy. Trading ability has been restored to your account, and you are no longer required to transfer or liquidate the account. We are sorry for any inconvenience this may have caused you, and are sure that you have questions. Please feel free to contact us regarding any questions or concerns at 800-669-3900 or simply reply to this message.

Sincerely, xxxx"

That is crazy! They seem very incompetent. I e-mailed them back to make sure my account is closed as I have already sold everything (and paid brokerage fees for that! Selling a mutual fund cost $50) and moved my money to another broker! At least I don't need to pay capital gains tax as the account lost money. There was just under $10k in the account and officially in Australia I am meant to pay tax on it so I wasn't that upset to have to close it. IB couldn't open a new Roth and so the money is now in a regular brokerage account.

Now today I get a new e-mail from Ameritrade:

"We previously communicated to you that your Retirement Account with TD Ameritrade would be impacted by a new business policy requiring the account to be closed due to your country of residence. Upon further review, it has been determined that your Retirement Account, ending in xxxx, will no longer be impacted by this policy. Trading ability has been restored to your account, and you are no longer required to transfer or liquidate the account. We are sorry for any inconvenience this may have caused you, and are sure that you have questions. Please feel free to contact us regarding any questions or concerns at 800-669-3900 or simply reply to this message.

Sincerely, xxxx"

That is crazy! They seem very incompetent. I e-mailed them back to make sure my account is closed as I have already sold everything (and paid brokerage fees for that! Selling a mutual fund cost $50) and moved my money to another broker! At least I don't need to pay capital gains tax as the account lost money. There was just under $10k in the account and officially in Australia I am meant to pay tax on it so I wasn't that upset to have to close it. IB couldn't open a new Roth and so the money is now in a regular brokerage account.

Sunday, October 07, 2012

Saving More Each Month than I Earned as a Graduate Student in a Year

As a relatively old PF blogger :) I've occasionally mentioned that young people shouldn't worry too much about saving for retirement and should enjoy life. Of course, if you are earning a high salary when you are young then go ahead and save. But there is no sense in depriving yourself if your income is low and expected to increase.

I just realized that our average saving (not counting investment returns) per month is now more than I earned in a year as a graduate student twenty years ago. I earned between $9k and $10k a year back then (around 1992). Yes, prices have probably about doubled since then, and the Australian Dollar is extremely strong now which makes our current savings particularly high in US Dollar terms, but then let's say we save in 3 months what I earned in a year in real terms and we would not be wrong.

Back then I was spending more than I earned then but not dramatically so. I ended up with a negative net worth of about $11k. I expected to certainly earn more in the future than I was then and so thought this was entirely justified. On the other hand, my Dad told me I should be saving money. Of course, maybe that was because he was lending me money :) *

I think the investment in my graduate education has certainly paid off. Of course, it might not have but it was hard for me to imagine that I wouldn't be earning a lot more in some job in the future.

But, I think you'll find that most people save the most for retirement in the years leading up to retirement despite all the rhetoric from the financial management industry about starting early and compounding. There is a good reason for this - their income is highest here and for most people other life expenditures are maybe declining (buying a house, having children). The latter isn't the case for us, of course. We are still looking at buying our first house.

Tuesday, October 02, 2012

Moom's Taxes 2011-12 Edition

After doing Snork Maiden's taxes my final investment tax statement arrived and I could do my taxes:

It's a huge contrast to my 2010-2011 taxes (Follow through to earlier years and it is even more dramatic):

It's a huge contrast to my 2010-2011 taxes (Follow through to earlier years and it is even more dramatic):

- My salary has almost tripled.

- Interest is almost 10 times as high.

- Foreign source income is a fraction of what it was (2010-11 included foreign employment income).

- Deductions are similar though I am now attributing some expenses to my mutual funds which I previously attributed entirely to stock investments.

- Gross tax has quadrupled and net tax is about 6 times higher with almost three times the tax rate, now at 29.51%.

Monday, October 01, 2012

Moominvalley Monthly Report September 2012

Financially, things went OK again this month. We hit new net worth highs in both Australian and US Dollar terms of $A678k (+$19k) and $US705k (+23k). The Australian Dollar was pretty stable, up 0.5 US cents.

Our rate of return was 2.94% in USD terms versus 3.19% for the MSCI and 2.58% for the S&P500. In Australian Dollar terms we made 2.40%. The monthly accounts (in US Dollars) look like this:

This was a very high spending amount as Snork Maiden gave $A5,000 to her mother and also bought a ticket to China ($A1,400). I also bought a ticket for a trip next month, though my employer is paying most of it, I'm paying $A600. Taking all of this out we still spent $5,000, which I guess is the new normal. We did go to Western Australia and spent quite a bit there on car hire, restaurants etc.

The monthly accounts show that we earned $13.5k in salaries etc. . Retirement contributions were $2.8k. Total investment returns were $20.0k. There was very little change in the portfolio over the month as all asset classes made money. I did withdraw $A1000 from one of Snork Maiden's mutual funds to add to the house-buying fund. That fund reached $A131k up from $A126k despite transferring $A6k from this account to China ($A1000 is spending money for Snork Maiden there).

Our rate of return was 2.94% in USD terms versus 3.19% for the MSCI and 2.58% for the S&P500. In Australian Dollar terms we made 2.40%. The monthly accounts (in US Dollars) look like this:

This was a very high spending amount as Snork Maiden gave $A5,000 to her mother and also bought a ticket to China ($A1,400). I also bought a ticket for a trip next month, though my employer is paying most of it, I'm paying $A600. Taking all of this out we still spent $5,000, which I guess is the new normal. We did go to Western Australia and spent quite a bit there on car hire, restaurants etc.

The monthly accounts show that we earned $13.5k in salaries etc. . Retirement contributions were $2.8k. Total investment returns were $20.0k. There was very little change in the portfolio over the month as all asset classes made money. I did withdraw $A1000 from one of Snork Maiden's mutual funds to add to the house-buying fund. That fund reached $A131k up from $A126k despite transferring $A6k from this account to China ($A1000 is spending money for Snork Maiden there).

Sunday, September 30, 2012

Will Close Roth IRA

I blogged a few days ago about Ameritrade dropping support for foreign investors. I got a reply from Interactive Brokers - they can't open a Roth IRA account for me and, therefore, I can't transfer that account from Ameritrade to them. So I will have to sell my investments (one mutual fund and one closed end fund) and transfer the money to my US bank account and from there to my regular brokerage account at IB. I have to pay taxes anyway on my Roth IRA account in Australia so it makes no difference as long as I live here how the account is structured. And this will be one less account to deal with.

Saturday, September 29, 2012

Snork Maiden's Taxes 2011-12 Edition

I've more or less finished Snork Maiden's tax return for this year (Australian tax year ends on 30th June) but I can't submit it till I do my tax return. This is because they need to know my income in order to compute the correct Medicare Levy (tax that supposedly funds health care). For households earning more than $A160k per year without private health insurance the rate is 2.5%. That includes us. I've thought of getting private health insurance but it doesn't seem to save much money in net and just sounds like an extra hassle. Maybe it's because I've never really understood how the Australian medical system works. I am still waiting for one final investment statement for last year before I can do my taxes. The deadline is 15th October.

Anyway, so here is Snork Maiden's summary for this year:

Real net income takes out various tax credit and capital gains adjustments to get back to the real cash income rather than the taxable income.

Of course, not included here are all her superannuation (retirement) contributions, which add in another $22k pre tax. If we add that back in, income is above $96k and the tax rate is around 21.5%.

Anyway, so here is Snork Maiden's summary for this year:

For comparison, here are last year's taxes. There have been some changes in categories reported on this year's tax return and some big changes in her deductions but otherwise there has been fairly minor increase. Real cash income rose by 2.98% and the tax rate rose from 22.12% to 23.58%. As a result, after tax income rose by only 1.05%.

Of course, not included here are all her superannuation (retirement) contributions, which add in another $22k pre tax. If we add that back in, income is above $96k and the tax rate is around 21.5%.

Tuesday, September 25, 2012

Transferring Money to China

Snork Maiden wants to give money to her parents in China to help them out with medical bills. I've been telling her that all I need is bank account details and I can transfer the money there either using our regular bank account or a service like Ozforex. She is also going to open a new bank account in China because she thinks her mother's account is up to the task of handling transfers or they can't get the necessary details. A Chinese colleague recommended using a company called Superforex instead. The set up is pretty weird - first you transfer the money to their account - then send them an e-mail with a scan of your transfer receipt and then they'll allocate the money to you to transfer on. Ozforex's rate is only 6.4353 Yuan per AUD while Superforex claim to offer 6.5685. Anyone heard of them?

Ameritrade No Longer Supports Foreign Customers?

I got a letter from TD Ameritrade saying they will no longer support customers in my country from 30th October. Either I need to open a new Roth IRA account with another institution and ask the new institution to transfer my account or I will need to liquidate my account. I have a brokerage account with Interactive Brokers but I suppose that I won't be able to open a new Roth IRA account as I'm not resident in the US. Anyone who has better information on this let me know, please.

So, I'm guessing my best option is to just close the account. There are no net profits and there is no penalty for withdrawing your contributions. I have less than $10k in the account.

PS - I just sent a "ticket" to IB asking this question.

Sunday, September 16, 2012

Rich or Poor?

Interesting set of profiles in the Guardian. For a comparison, we make around £150,000 a year and have £230,000 in savings. Professor married to a researcher. Our monthly rent is £1300. I think we feel rich until we go to look at houses to buy :) The mortgage on the kind of property we are looking at would be £3,000 a month (we now got pre-approved to borrow up to $A780k). We don't live rich apart from living in exactly the location we want to live in and paying the rent that that means. We have an eight year old Ford car for example.

Thursday, September 13, 2012

$700,000

Yes, we are over $US700k in net worth after passing $US600k for the first time in February. Can't promise that it will hold up to the end of the month though!

Premier Banking

So, we've been looking at houses and find some of the sort we might be interested in are above our pre-approved borrowing limit. So, we tried to get the limit raised as we have been increasing the size of our deposit pretty rapidly. Turns out the guy we spoke with before is no longer working for the bank. So, we've now been referred to a relationship manager who works with the banks Premier Banking division. If you have more than $750k borrowed and/or in investments with the bank you qualify for this service. If and when we get a mortgage from the bank we will be in that category. So, I guess this makes sense. Anyway, one lesson is that it really matters who you bump into when you walk into the bank what kind of service you get directed to.

We just need to send the relationship manager our latest payslips and bank statement (from another bank) and he will see what he can do.

BTW it is 5 years to the day since we left the US and moved to Australia. We didn't arrive till the 15th.

We just need to send the relationship manager our latest payslips and bank statement (from another bank) and he will see what he can do.

BTW it is 5 years to the day since we left the US and moved to Australia. We didn't arrive till the 15th.

Sunday, September 09, 2012

Three Bikes for Three Hundred Dollars

We went shopping for bikes with a couple of friends who are visiting our city for a few months. When we were at the store I decided to buy a bike too. Each of us ended up buying a bike for exactly $100. All second-hand of course. Mine is a Nakamura Cougar mountain bike - 21 speeds, old fashioned cantilever brakes, big knobby tires. Plan is to ride it to work which is 2 1/2 km and so is a bit far to walk both ways each day and seems a bit near to take the bus that only actually covers about half the distance, though that's what I've been doing. I have a road bike but keep it in our apartment and it has the wrong pedals for ordinary shoes and just seems like a hassle. This bike, I'll keep in the underground parking beneath our apartment building. And won't worry about bumping over kerbs and stuff. I couldn't find any pictures that are much like this bike, even though I think it is just a classic mountain bike.

It's the first bike I've bought since 1985! Yeah, there aren't many original parts on my road bike and that includes the frame.

It's the first bike I've bought since 1985! Yeah, there aren't many original parts on my road bike and that includes the frame.

Monday, September 03, 2012

Moominvalley August 2012 Report

Financially, things went OK again this month. We hit new net worth highs in both Australian and US Dollar terms of $A659k (+$33k) and $US681k (+22k). The Australian Dollar fell a little.

Our rate of return was only 0.78% in USD terms versus 2.22% for the MSCI and 2.25% for the S&P500. In Australian Dollar terms we made 2.61%. The monthly accounts look like this:

The monthly accounts (in US Dollars) show that we earned $20.2k in salaries etc. as this was a three pay month. Retirement contributions were $3.3k. We spent $5.0k but around $500 of that was implicit depreciation on our car and so actual spending was relatively low compared to recent months. Total investment returns were $5.1k but earnings would have been $15.4k without the changes in exchange rates.

Our rate of return was only 0.78% in USD terms versus 2.22% for the MSCI and 2.25% for the S&P500. In Australian Dollar terms we made 2.61%. The monthly accounts look like this:

The monthly accounts (in US Dollars) show that we earned $20.2k in salaries etc. as this was a three pay month. Retirement contributions were $3.3k. We spent $5.0k but around $500 of that was implicit depreciation on our car and so actual spending was relatively low compared to recent months. Total investment returns were $5.1k but earnings would have been $15.4k without the changes in exchange rates.

Saturday, September 01, 2012

Moominhouse Fund Progress

The fund rose from $116k to $125k this month. Progress has been pretty steady since February:

This is actually just the cash in the bank account which we also pay our rent from. So that is why it also dips down. I think we need to get to $150k before we'll be in a position to bid for houses at auctions and have back up for contingencies. Well, at least for houses in the price range we seem to be targeting.

This is actually just the cash in the bank account which we also pay our rent from. So that is why it also dips down. I think we need to get to $150k before we'll be in a position to bid for houses at auctions and have back up for contingencies. Well, at least for houses in the price range we seem to be targeting.

Tuesday, August 21, 2012

Facebook Investor Peter Thiel Makes Thousand-fold Return

The fall in Facebook shares since the IPO isn't much of a worry for the earlier investors. Peter Thiel sells 80% of his Facebook shares for $400 million. He bought his stake in the company for $1/2 million. Another way to look at it is that he made a 137% p.a. return in the eight years since investing.

P.S. 22 August

Actually, he made more than a 2000-fold gain.

P.S. 22 August

Actually, he made more than a 2000-fold gain.

Friday, August 03, 2012

Bill Gross is Wrong

In this piece, Gross says that stocks have had a 6.6% real return historically and asks how that can continue if the GDP grows at only 3.5% per year.

The answer is simple - you get a dividend of 3% and the value of your stock goes up by 3.5% in real terms to reflect the growth of future dividends in line with the growth of the economy. If you don't pay any taxes and reinvest all your dividends, the value of your asset grows at 6.5% per year and you would own an increasing share of the stock market. But in the long-run no-one can do this. At least they haven't. Even endowments like Harvard spend some of their earnings all the time. The stock prices of companies that don't pay dividends but make normal profits would go up at 6.5% per year. Berkshire Hathaway is a company that hasn't paid dividends for more than 40 years and its stock price has gone up enormously. At some point the model of buying more and more companies will run out of steam. In fact, I expect that after Buffett dies the managers will end up breaking up the company.

The answer is simple - you get a dividend of 3% and the value of your stock goes up by 3.5% in real terms to reflect the growth of future dividends in line with the growth of the economy. If you don't pay any taxes and reinvest all your dividends, the value of your asset grows at 6.5% per year and you would own an increasing share of the stock market. But in the long-run no-one can do this. At least they haven't. Even endowments like Harvard spend some of their earnings all the time. The stock prices of companies that don't pay dividends but make normal profits would go up at 6.5% per year. Berkshire Hathaway is a company that hasn't paid dividends for more than 40 years and its stock price has gone up enormously. At some point the model of buying more and more companies will run out of steam. In fact, I expect that after Buffett dies the managers will end up breaking up the company.

Thursday, August 02, 2012

Moominvalley July 2012 Report

A whole month has gone by with no posts since the first day of the month... This seems to be the fate of a lot of personal finance blogs, eventually after a few years they die out. But I have been blogging on my professional blog quite a lot this month. I guess there isn't much nowadays that I feel like sharing with the rest of the world on personal finance. Things have been very busy at work and I have also had flu too.

Financially, things went well. We hit new net worth highs in both Australian and US Dollar terms of $A626k (+24k) and $US659k (+42k). As you can see the Australian Dollar is again rising.

Non-retirement assets are now substantially ahead of retirement accounts again. Our rate of return was 5.26% in USD terms versus 1.4% for the MSCI and S&P500, which is nice. Only 2.87% in Australian Dollar terms though. The monthly accounts look like this:

The monthly accounts show that we earned $14.5k in salaries etc. (this includes some reimbursements) and $3.3k in retirement contributions. We spent $6.3k but some of that was work related and will be reimbursed and so the core expenditure is $5.2k in line with recent behavior. Total investment returns were $32.4k but $14.7k of that was due to the rise in the Australian Dollar. All in, net worth rose $42.3k.

I have computed Snork Maiden's taxes for this year and it looks like she owes a little money. So I won't submit the return until October when I do mine. My taxes for the year are now in the region of $A42k. My tax reducing strategies are having little impact now given my large rise in income. I guess that is a good thing.

Also, after both our salaries went up my employer is contributing more than the $25k annual concessional limit to superannuation. This means that $500 of it will be taxed at the top marginal rate. There is no way to reduce this contribution. Snork Maiden is now just below the cap including her salary sacrifice contributions. In future, we will have to reduce those, assuming the super rules stay the way they are.

Financially, things went well. We hit new net worth highs in both Australian and US Dollar terms of $A626k (+24k) and $US659k (+42k). As you can see the Australian Dollar is again rising.

Non-retirement assets are now substantially ahead of retirement accounts again. Our rate of return was 5.26% in USD terms versus 1.4% for the MSCI and S&P500, which is nice. Only 2.87% in Australian Dollar terms though. The monthly accounts look like this:

The monthly accounts show that we earned $14.5k in salaries etc. (this includes some reimbursements) and $3.3k in retirement contributions. We spent $6.3k but some of that was work related and will be reimbursed and so the core expenditure is $5.2k in line with recent behavior. Total investment returns were $32.4k but $14.7k of that was due to the rise in the Australian Dollar. All in, net worth rose $42.3k.

I have computed Snork Maiden's taxes for this year and it looks like she owes a little money. So I won't submit the return until October when I do mine. My taxes for the year are now in the region of $A42k. My tax reducing strategies are having little impact now given my large rise in income. I guess that is a good thing.

Also, after both our salaries went up my employer is contributing more than the $25k annual concessional limit to superannuation. This means that $500 of it will be taxed at the top marginal rate. There is no way to reduce this contribution. Snork Maiden is now just below the cap including her salary sacrifice contributions. In future, we will have to reduce those, assuming the super rules stay the way they are.

Sunday, July 01, 2012

Moominvalley June 2012 Report

Accounts for June in US Dollars:

These accounts aren't totally final due to the slow reporting of tax credits etc. at the end of the Australian financial year which was on Saturday. Net worth rebounded strongly (by $33k) from May in USD terms as the Australian Dollar rose over parity again. Net worth is now $US617k or $A602k. We spent $US5754 but some of that was work related and without that we spent $5,319. $1,000 of that was a coffee machine that was supposed to be a present for Snork Maiden's dad. Or maybe not. He told us to use it ourselves so that we can teach him. Seems to require some skill still in the milk department despite being an "automatic" espresso machine.

The rate of return in USD terms was 3.96% vs. 4.99% for the MSCI World Index and 4.12% for the S&P 500. In Australian Dollar terms, though, we lost 1.37% (-0.46% in currency neutral terms).

These accounts aren't totally final due to the slow reporting of tax credits etc. at the end of the Australian financial year which was on Saturday. Net worth rebounded strongly (by $33k) from May in USD terms as the Australian Dollar rose over parity again. Net worth is now $US617k or $A602k. We spent $US5754 but some of that was work related and without that we spent $5,319. $1,000 of that was a coffee machine that was supposed to be a present for Snork Maiden's dad. Or maybe not. He told us to use it ourselves so that we can teach him. Seems to require some skill still in the milk department despite being an "automatic" espresso machine.

The rate of return in USD terms was 3.96% vs. 4.99% for the MSCI World Index and 4.12% for the S&P 500. In Australian Dollar terms, though, we lost 1.37% (-0.46% in currency neutral terms).

Lost Decade Update