In January, the Australian Dollar rose slightly from USD 0.6196 to USD 0.6237 meaning that USD investment returns are a little better than AUD investment returns. It was our second best month ever in absolute Australian Dollar terms (after November 2024). Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 3.38%

S&P 500: 2.78%

HFRI Hedge Fund Index: 1.35% (forecast)

Australian Dollar Indices

ASX 200: 4.57%

Target Portfolio: 2.82% (forecast)

Australian 60/40 benchmark: 2.19%

We gained 4.59% in Australian Dollar terms or 5.12% in US Dollar terms. So we outperformed all benchmarks.

The SMSF returned 6.11%, compared to Unisuper at 2.16% and PSS(AP) at 1.72%.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and do not include investment expenses such as margin interest, and so the total differs from the Australian Dollar returns on net assets mentioned above. RoW stocks (mostly Defi Technologies) gained 8.4% and made the largest contribution to returns followed by gold. Several asset classes lost money, futures including bitcoin lost the most and made the most negative contribution to returns.

Things that worked well this month:

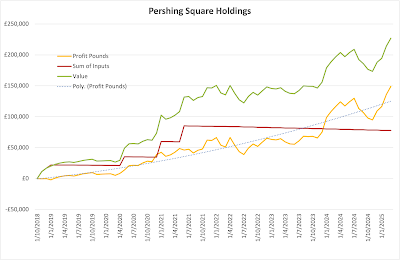

- Bitcoin (AUD 65k), Defi Technologies (DEFI.NE, 53k), gold (44k), Pershing Square Holdings (PSH.L, 39k), 3i (III.L, 26k), Unisuper (14k), US Residential Masters (URF.AX, 11k).

What really didn't work:

- WAM Alternatives (WMA.AX) was the worst performer but only lost 3k.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give the same statistics for three indices. The middle block gives our performance relative to the indices. Our rate of return is now higher than the ASX200 and we have much lower volatility, resulting in a Sharpe ratio of 1.01 vs. 0.53. Our alpha relative to the ASX200 increased to 4.95% with a beta of only 0.46. We capture much less of the downside moves than the upside moves in the market. But as we optimize for Australian Dollar performance, our USD statistics are much worse. We do beat the HFRI hedge fund index in terms of return, but at the expense of much higher volatility. Our USD volatility is at least less than that of the MSCI index, but our return is more than two percentage points lower.

We moved further away from our target allocation this month as "futures" and rest of the world stocks allocations continued to grow. We are now most overweight rest of the world stocks followed by futures, which includes bitcoin. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer superannuation contributions every two weeks. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. I am now receiving TTR pension payments from both Unisuper and our SMSF and contributing more than the total of these to the SMSF (around AUD 4k net contribution per month). I made the following additional moves this month:

- I sold out of our remaining position in Cadence Capital (CDM.AX). I got tired of waiting for something to happen in this fund. We still have a position (about 2.5% of net worth) in Cadence Opportunities (CDO.AX), which sometimes performs better than CDM.

- I bought 200 shares of the Fidelity bitcoin ETF (FBTC).

- I sold 1,000 shares of the Perth Mint gold ETF (PMGOLD.AX).

- I bought 3,000 shares of the WCM Global Quality active ETF (WCMQ.AX).