Stock markets fell, with the MSCI World Index (USD gross) falling by 4.89%, the S&P 500 by 5.17%, and the ASX 200 by 5.80%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7266 to USD 0.7063 reducing Australian Dollar losses and increasing USD losses. We lost 2.28% in Australian Dollar terms or 4.94% in US Dollar terms. The target portfolio is expected to lose 2.53% in Australian Dollar terms and the HFRI hedge fund index is expected to fall 2.16% in US Dollar terms. So, we out-performed the ASX200, the S&P 500, and the target portfolio, and underperformed the other two benchmarks. Of course, we are trying to optimize AUD returns. This means USD returns will be a lot more volatile. The currency neutral return for the month – where we just look at the gains on each investment in its own currency and ignore appreciation or depreciation of assets due to exchange rate changes was 2.82%. This tends to be close to the Australian Dollar return because we hold a lot of foreign investments in Australian Dollar denominated funds.

It was a busy month with a lot of trading. Quite a bit of this was for tax loss harvesting, selling in one of our names and buying in the other.

The record-breaking run of winning months in Australian Dollar (and

currency neutral) terms finally ended. We hadn't had a losing month since

March

2020. This was a 21 months run. We had several monthly US Dollar

losses in that time.

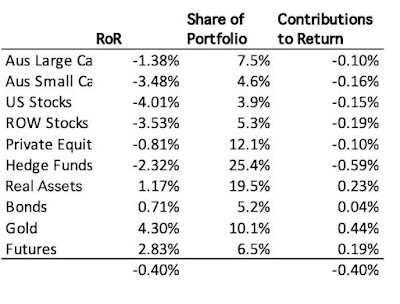

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Futures performed best. Gold made the largest contribution, but that was only because we hold it in an Australian ETF (PMGOLD.AX). The price of gold in Australian Dollars was boosted by the fall in the exchange rate. Aus small cap and US stocks were the worst performers while hedge funds detracted most from performance.

Things that worked well this month:

- Gold gained AUD 11k. Other gainers included Winton Global Alpha (AUD 7k), Aspect Futures (AUD 5k), Cadence Capital (CDM.AX), Fortescue Metals (FMG.AX), Pengana Private Equity (PE1.AX)...

What really didn't work:

- Hearts and Minds (HM1.AX) lost AUD 37k, while Pershing Square Holdings (PSH.L), Regal

Funds (RF1.AX), and Unisuper each lost AUD 24-25k constituting the majority of our total loss. This is the downside to

benefiting from the upside in the latter two. I'm beginning to question

whether HM1 is a good investment and am thinking of reducing our

position. In theory, it is attractive to invest in fund managers "best ideas", but when those are all overvalued growth stocks, there is a problem.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the other two benchmarks, which are measured in USD terms.

Our asset allocation got a little closer to our long-run asset allocation. Private equity is the most underweight asset class and real assets the most overweight. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month:

- I sold and bought Pengana Private Equity (PE1.AX) shares, which were trading a lot above NAV and then near NAV. I ended up increasing the position by around 6k shares.

- I bought 3k Hearts and Minds (HM1.AX) shares, which was a mistake so far.

- I sold 1,000 Fortescue Metals (FMG.AX) shares, to trim my position a bit. Then I bought back at a lower price.

- I bought a net 11k Regal Funds (RF1.AX) shares.

- I sold 2k Ruffer shares (RICA.L) to get liquidity.

- I net added around 1k of Cadence Opportunities (CDO.AX).

- I net added about 0.5k (WAM Strategic Value) WAR.AX shares.

- I closed our position in MCP Income Opportunities (MOT.AX).

- I did a couple of small futures trades.

- I started opening a second brokerage account for the SMSF with CommSec. The idea is to hold our listed trusts (RF1.AX, PE1.AX, URF.AX) in this account in order to get proper tax statements from the share registries. The tax data that Interactive Brokers provides for these is incorrect but I discovered that they are now sharing it with the ATO who challenged Moominmama's tax return from a couple of years back... So ATO believes the incorrect data...