July was a reversal of June. The S&P500 gained more than it lost in the previous month and gold fell more than it rose in the previous month. Investors seem to think that the Federal Reserve will raise interest rates by less than originally expected. The MSCI World Index (USD gross) rose by 7.02%, the S&P 500 by 9.22%, and the ASX 200 by 5.77%. All these are total returns including dividends. The Australian Dollar rose from USD 0.6900 to USD 0.6968 increasing Australian Dollar returns and reducing USD returns. We gained 4.11% in Australian Dollar terms or 5.13% in US Dollar terms. The target portfolio gained 3.75% in Australian Dollar terms and the HFRI hedge fund index was up only 1.65% in US Dollar terms. So, we out-performed the latter two benchmarks but under-performed the stock indices. The AUD return for the month is more than what would be expected historically given the ASX 200 performance for the month.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have for the first time added in the contributions of leverage and the Australian Dollar to the AUD net worth return.

Hedge funds were the biggest contributor to performance while Australian small cap had the best return. Gold was the worst performer and a significant detractor. Rest of the World stocks had a relatively poor performance because of our weighting to the China Fund.

Things that worked well this month:

- Regal Funds was the best performer (AUD 25k) followed by Pershing Square Holdings (18k), Tribeca Global Resources (18k), and another seven investments that gained more than AUD 10k.

What really didn't work:

- Gold was the worst performer (-24k) followed by the China Fund (-9k) and Winton Global Alpha (-5k). Only six investments lost money while 29 gained.

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. This month, I have added another three rows to report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the hedge fund index and not really against the MSCI. Compared to the ASX200 our rate of return has only been 0.6% lower but our volatility has been 5% lower.

We are performing 2% per annum worse than the average hedge fund levered 1.7 times. I'm not sure why this alpha has deteriorated sharply recently. July 2017, which was dropped from the estimation this month, was a good month for hedge funds but both June and July 2017 were particularly good months for us in USD terms as the Australian Dollar rose sharply.

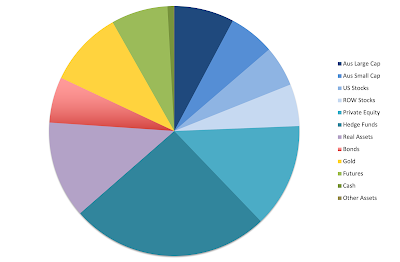

We moved a bit away from our target allocation. This was mainly because of the redemption of Pershing Square Tontine Holdings that reduced our private equity allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I sold 4,000 shares of WAM Leaders to get some cash.

- I made an AUD 20k concessional superannuation contribution for Moominmama.

- We combined these to start an account at Colonial First State for the SMSF investing in Aspect Diversified Futures with an initial AUD 25k (the minimum investment for Class A shares).

- As mentioned above, PSTH returned the cash to shareholders. There is a placeholder position still in our account which might turn into SPAR warrants at some point.

- I bought a net AUD 75k, mainly with the US Dollars from PSTH.

- I invested around AUD 10k in 64 Devonshire Road, Rossmore, NSW.

- I bought 1,250 PMGOLD shares (12.5 ounces of gold).

- I bought 3,000 more shares in Pendal (PDL.AX), when it was announced that merger talks were back on.